USDT BEP20

What Is Tether (USDT)?

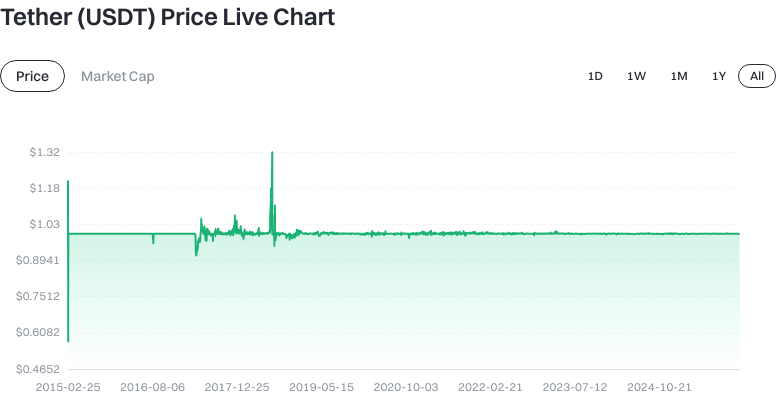

Tether (USDT) is a stablecoin pegged 1:1 to the US dollar, designed to facilitate near-instant “digital dollar” payments, settlements, and pricing on blockchain networks. The term “peg” refers to the issuer maintaining reserves of equivalent or highly liquid assets and dynamically adjusting token supply based on minting and redemption demands, ensuring USDT’s price fluctuates minimally around $1. USDT is issued across multiple blockchains; this article focuses on its BEP20 version (the token standard on BNB Smart Chain).

What Are the Current Price, Market Cap, and Circulating Supply of Tether (USDT)?

As of 2025-12-26 07:54 (UTC), the global price of USDT is approximately $0.999293. The circulating supply is about 186,890,051,108.87024 tokens, with a total supply of roughly 188,851,514,006.75452 tokens and no maximum cap. Circulating market capitalization stands at approximately $186,757,840,807.97, fully diluted market cap at $188,717,916,122.09, accounting for about 6.2712% of the total crypto market cap. Price changes: +0.0165% over the last hour, -0.0095% in 24 hours, -0.0039% over 7 days, -0.0413% over 30 days; 24-hour trading volume is around $70,599,611,867.63 with roughly 164,220 active trading pairs. (Source: provided market data; figures reflect total USDT across all chains—BEP20 is one subset.) The price’s slight fluctuation around $1 is typical behavior for stablecoins.

Click to view the latest USDT price

If you’re operating on the BEP20 network, select BEP20 for withdrawals and transfers and ensure you have some BNB in your wallet to cover gas fees.

Who Created Tether (USDT) and When?

USDT originated in 2014 under the name Realcoin before being rebranded as Tether. Since then, it has expanded across multiple blockchains to increase accessibility and liquidity. Its core purpose is to bring dollar-equivalent stability on-chain for settlement and as a trading pair benchmark. (Source: Tether official site and public records as of December 2025.)

How Does Tether (USDT) Work?

USDT maintains its peg through a “reserve + mint/burn” mechanism. When institutions or compliant users purchase USDT, they send dollars or equivalent assets to the issuer, who “mints” new USDT tokens. For redemptions, USDT is destroyed (“burned”) and fiat or equivalent assets are returned to the user. Token supply flexibly expands or contracts with demand; there’s no hard cap on total supply.

USDT is multi-chain; BEP20 refers to its version on the BNB Smart Chain, making USDT compatible with applications on this network. On-chain transfers require gas fees paid in BNB, so keep some BNB in your wallet.

The issuer periodically discloses reserve composition and audit attestations to reinforce trust in the peg. In secondary markets, trading and arbitrage help realign prices whenever USDT deviates from $1.

What Can You Do With Tether (USDT)?

USDT is widely used for quoting trading pairs and hedging risk. In volatile markets, converting assets to USDT lets you temporarily lock in value near that of the US dollar.

USDT also serves as a medium for cross-border and on-chain payments. On BEP20 (BNB Smart Chain), transactions are fast and fees are low—ideal for small everyday transfers and merchant settlements.

Within DeFi, USDT can be supplied as liquidity or lent out to earn interest or incentives. Users should understand protocol mechanisms and associated risks before participating.

For clearing and financial reconciliation, USDT functions as a “stable accounting unit,” simplifying multi-party settlements and bookkeeping for businesses or teams.

What Wallets and Extensions Exist in the USDT Ecosystem?

Users can choose between hot wallets and cold wallets. Hot wallets offer convenience for small, frequent transactions; cold wallets store private keys offline for higher security—ideal for large or long-term holdings. Non-custodial wallets put you in charge of your private keys and mnemonic phrases; losing them means permanent loss of access. Custodial accounts are managed by platforms and require strong security settings.

Common BEP20 network tools include:

- Block explorers for checking transactions and contract info; always verify the BEP20 contract address via the issuer’s official site before querying.

- Cross-chain bridges allow USDT transfers between networks; bridging involves extra smart contract and counterparty risks—use caution.

- Developers can integrate USDT via the BEP20 standard into payment, settlement, or DeFi applications.

What Are the Main Risks and Regulatory Issues With Tether (USDT)?

Peg deviation risk: During extreme market conditions or tight liquidity events, USDT’s price may temporarily move away from $1. Reserve and counterparty risk: The peg relies on the issuer’s reserve quality and transparency; monitor issuer disclosures and audit reports. Regulatory changes: Stablecoin regulations vary across jurisdictions; policy changes may impact issuance or redemption. Network costs: BEP20 transfers require BNB for gas; network congestion can affect fees and confirmation times. Cross-chain & smart contract risk: Bridges and third-party contracts may contain vulnerabilities or operational risks. Platform & key security: Custodial platforms have operational/compliance risks; for self-custody, securely back up mnemonic phrases and private keys, and watch out for phishing/malware threats.

How Do I Buy and Safely Store Tether (USDT) on Gate?

Step 1: Register and complete KYC. Create a Gate account using your phone number or email and finish identity verification to increase limits and security.

Step 2: Fund your account. Deposit via fiat quick-buy or supported bank cards; alternatively, transfer from your own blockchain wallet. When depositing or withdrawing, always select the BEP20 network to avoid cross-chain misdirected transfers.

Step 3: Select your trading option. On Gate’s buy or trade page, choose USDT as your target asset. If exchanging other crypto for USDT, select the relevant market and confirm price and amount.

Step 4: Place your order. Choose a market or limit order as needed; after submitting, check order status on your account page. Once filled, USDT will appear in your account balance.

Step 5: Withdraw to a BEP20 wallet (optional). For self-custody, prepare a non-custodial wallet supporting BEP20; record your mnemonic phrase offline for safety. When withdrawing, select BEP20 as the network and start with a small test amount to verify address accuracy; also keep some BNB ready for future gas fees.

Step 6: Secure your account/wallet. Enable two-factor authentication and withdrawal whitelists; when self-custodying, back up private keys properly—never save via screenshots or cloud drives; beware phishing links—always confirm contract addresses and download links via official websites.

How Does Tether (USDT) Differ From USDC?

Issuer & compliance: USDT is issued by Tether; USDC by Circle. Both release reserve reports but differ in corporate background, jurisdiction, disclosure cadence, and detail. Market cap & reach: USDT has broader historical liquidity and adoption in trading/payment scenarios; USDC is more deeply integrated into certain compliance and financial sectors. They complement each other depending on use case. Multi-chain support: Both support multiple chains. For BEP20 versions, verify contract addresses through official sources to avoid confusion or phishing contracts. Stability & deviation: Both target $1; short-term deviations depend on market liquidity/arbitrage efficiency. Long-term stability relies on reserve quality, transparency, and market trust. Fees & user experience: On-chain costs depend on network choice; BEP20 usually offers lower fees but requires BNB for gas. Cross-chain transfers and fiat onboarding vary by channel.

Tether (USDT) Summary

USDT is a dollar-pegged stablecoin designed for on-chain settlement and pricing, backed by reserves and managed via mint/burn mechanisms to maintain its $1 peg. This article highlights its BEP20 version—easy to use on BNB Smart Chain with low transaction fees but requiring contract verification and BNB for gas fees. As of December 26th 2025 data, USDT leads in scale and liquidity—well-suited for trading pairs, payments, and DeFi applications. Recommendations: complete compliant deposits/trades on Gate; select correct networks and test with small amounts when withdrawing; manage major assets with layered hot/cold solutions; track issuer reserve disclosures and regulatory changes; approach cross-chain/smart contract interactions with careful risk evaluation for enhanced security margins.

FAQ

What Is USDT BEP20?

USDT BEP20 is Tether issued on Binance Smart Chain (BSC), adhering to the BEP20 token standard. Compared to other chains’ USDT versions, BEP20 offers faster transactions and lower fees—ideal for frequent trades or small transfers. Note that USDT cannot be directly sent between chains; conversion requires exchanges or cross-chain bridge tools.

How Do I Transfer BEP20 USDT to Other Chains?

You cannot directly send BEP20 USDT to TRC20 or other networks. There are three ways to convert: withdraw via exchanges like Gate to your target chain wallet; use official bridges such as Tether Bridge; or employ third-party cross-chain protocols. Beginners are advised to use Gate for chain conversions—it’s simplest and safest.

Why Choose BEP20 USDT Over Other Chain Versions?

BEP20 USDT’s main advantages are low transaction costs and speed—BSC gas fees are typically just cents with second-level confirmation times versus several dollars on Ethereum. However, BEP20 liquidity is smaller than ERC20 or TRC20, making it best suited for everyday moderate-sized use; for large trades consider ERC20 or TRC20 where liquidity is highest.

How Do I Receive and Send BEP20 USDT on Gate?

To receive BEP20 USDT on Gate, go to the deposit page, select “USDT-BEP20,” then copy your generated BSC address to share with the sender. To send out USDT-BEP20, visit the withdrawal page, select “USDT-BEP20,” input recipient address/amount, then confirm—paying a small BSC fee completes the transaction. Always test with a small amount first to ensure address accuracy.

How Safe Is BEP20 USDT? What Risks Should I Be Aware Of?

BEP20 USDT is officially issued by Tether with strong security guarantees. Main risks include: loss of funds due to incorrect addresses (double-check chain type/address); phishing sites impersonating official withdrawal portals; smart contract vulnerabilities inherent to BSC itself. For large holdings use hardware wallets; access Gate only via official channels; avoid unknown links.

Key Terms for USDT (BEP20 Standard)

- Stablecoin: A cryptocurrency pegged to fiat currencies like USD, maintaining relatively stable value for trading and storage.

- BEP20: The token standard on Binance Smart Chain (BSC), defining token functions/interactions.

- Cross-chain bridge: Technology enabling assets like USDT to move between different blockchain networks.

- Gas fees: Transaction costs paid to incentivize validators processing transactions on blockchain networks.

- Liquidity: The ease with which an asset can be traded in the market—high liquidity means many trading pairs with minimal spread.

References & Further Reading

-

Official Site / Whitepaper:

-

Developer / Documentation:

-

Media / Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What Are Altcoins?