Why BTC & ETH Moon While Alts Sleep (Explained)

Why BTC & ETH Moon While Alts Sleep (Explained)

You’ve seen it again. Bitcoin rips 20%, ETH follows suit, and your altcoin bags? Dead money. You check Twitter, everyone’s celebrating new highs, but your portfolio looks like it’s stuck in 2023. What gives?

Here’s the truth nobody wants to hear: the market doesn’t owe your alts a pump just because BTC is printing. Understanding why requires killing one dangerous assumption.

Welcome back to Explained Series #4

The Misconception: “Beta Should Follow Immediately”

Most traders expect instant rotation. BTC pumps Monday, alts should explode Tuesday, right? Wrong.

The reality is that liquidity enters crypto in layers, not all at once. Majors can trend for weeks while alts stay range-bound. This isn’t broken market structure. It’s just how capital flows work. The sooner you accept this, the better positioned you’ll be when actual rotation arrives.

The Liquidity Stack: Where Money Actually Enters First

Stop watching altcoin charts. You’re watching the wrong liquidity. Capital enters crypto through three distinct doors, in order:

Door 1: Spot ETFs & Spot Majors (Cleanest access, biggest tickets) This is where institutions, family offices, and large allocators enter. They’re buying BTC and ETH spot through regulated products. Zero leverage, zero complexity, maximum size. This money isn’t “exploring” alts. It’s parking in the two assets with actual regulatory clarity.

Door 2: Derivatives (Fastest, but often not directional alt buying) Basis trades, funding arbitrage, perpetual OI. This activity can push BTC/ETH prices higher without creating broad risk appetite. More on this trap below.

Door 3: Retail & Onchain Risk (The last wave, and usually the alt wave) When regular traders finally feel confident enough to rotate out of majors and hunt for beta, that’s when alts move. But this is the last liquidity to arrive, not the first.

Understanding this stack changes everything. When BTC pumps and your alts don’t, it just means you’re still in Door 1 or 2. Door 3 hasn’t opened yet.

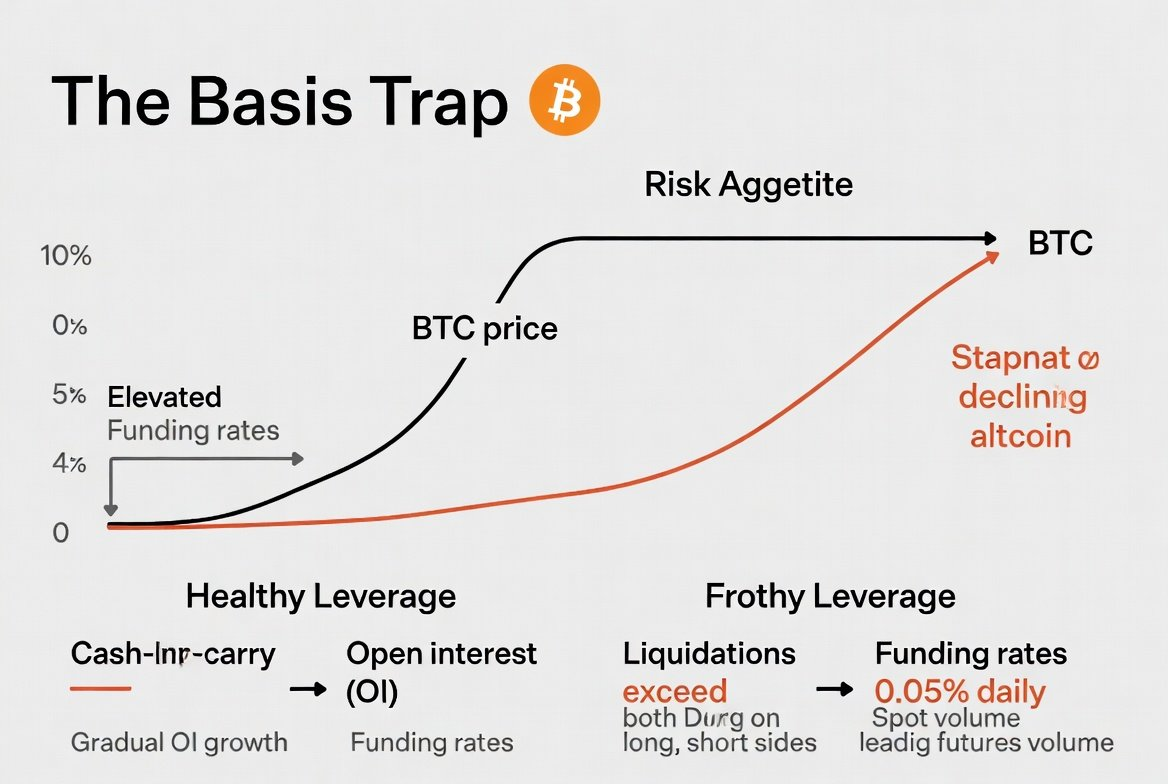

The Basis Trap: When Price Goes Up But Risk Appetite Doesn’t

Here’s a spicy reality check: BTC can rally hard while actual risk appetite stays frozen.

How? Cash-and-carry trades. Institutions buy spot BTC, short the futures, and collect the basis. This activity bids up BTC price without any intention of buying altcoins. Funding rates can stay elevated, open interest can climb, and price can grind higher while alts do absolutely nothing.

Healthy leverage looks like: gradual OI growth, moderate funding, spot volume leading. Frothy leverage looks like: OI spiking faster than price, funding >0.05% daily, liquidations piling up on both sides.

The basis trap explains why “BTC is pumping so alts should follow” often fails. The leverage pushing BTC higher isn’t the kind that buys alts.

BTC.D Regimes: Not Just “Up or Down”

Bitcoin dominance (BTC.D) isn’t a simple up-bad, down-good indicator. It operates in three regimes:

Risk-Off BTC.D Up: Capital flees alts into BTC. Alt holders get wrecked. This is brutal.

Risk-On BTC.D Up: BTC runs so hard it “steals oxygen” from everything else. Market is technically bullish, but BTC is hogging all the gains. Your alts might even bleed in USD terms.

Rotation (BTC.D Down): BTC consolidates or cools off. Traders finally hunt beta. Alts get attention. This is what you’re waiting for.

Watch for false BTC.D breakdowns. One red daily candle doesn’t confirm rotation. You need a clear trend with multiple lower highs.

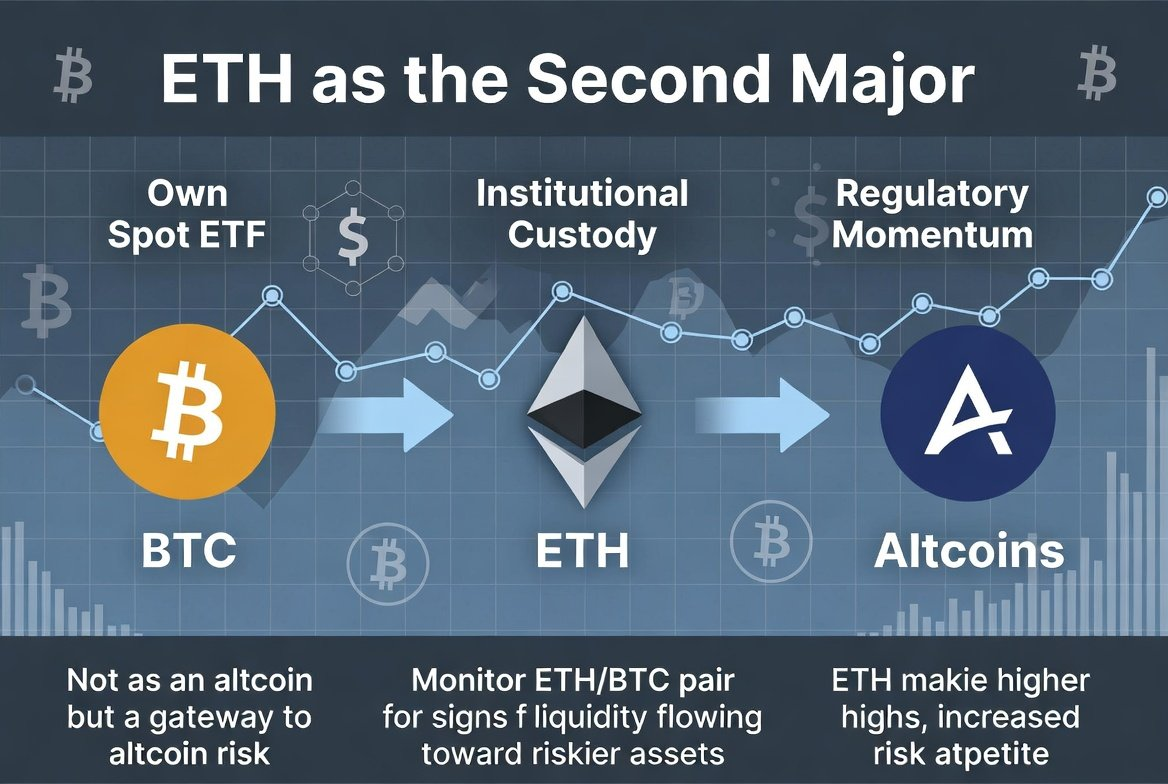

ETH Isn’t an Alt. It’s the “Second Major”

Stop grouping ETH with your Layer-1s. ETH is the bridge between majors and alt risk. When institutions want more beta than BTC but less risk than alts, they buy ETH.

ETH also has its own spot ETF, institutional custody, and regulatory momentum. It’s not an “altcoin.” It’s the gateway drug to altcoin risk. Watch ETH/BTC closely. When that pair starts making higher highs, liquidity is finally flowing toward riskier assets.

Why Alts Lag: The 5 Structural Headwinds Nobody Wants to Admit

Let’s get uncomfortable. Alts face structural problems that weren’t as severe in previous cycles:

Dilution & Unlock Overhang Supply keeps leaking. Every month, another billion-dollar unlock hits the market. Early investors and teams are selling. This creates constant selling pressure.

Fragmentation There are thousands of alts now. There’s no clear “altcoin index” that institutions can buy. Capital gets spread thin.

Narrative Dispersion AI coins, DePIN, memecoins, gaming, RWAs… every sector is competing for attention. In 2017, “Ethereum killers” were the narrative. Now? There are 47 narratives simultaneously. Capital gets confused.

Lack of Clear Use Cases Many projects still haven’t proven product-market fit. Speculation is fine, but without real users, tokens struggle.

Regulatory Uncertainty Most alts have zero regulatory clarity. Institutions can’t touch them even if they wanted to.

These aren’t temporary headwinds. They’re the new reality.

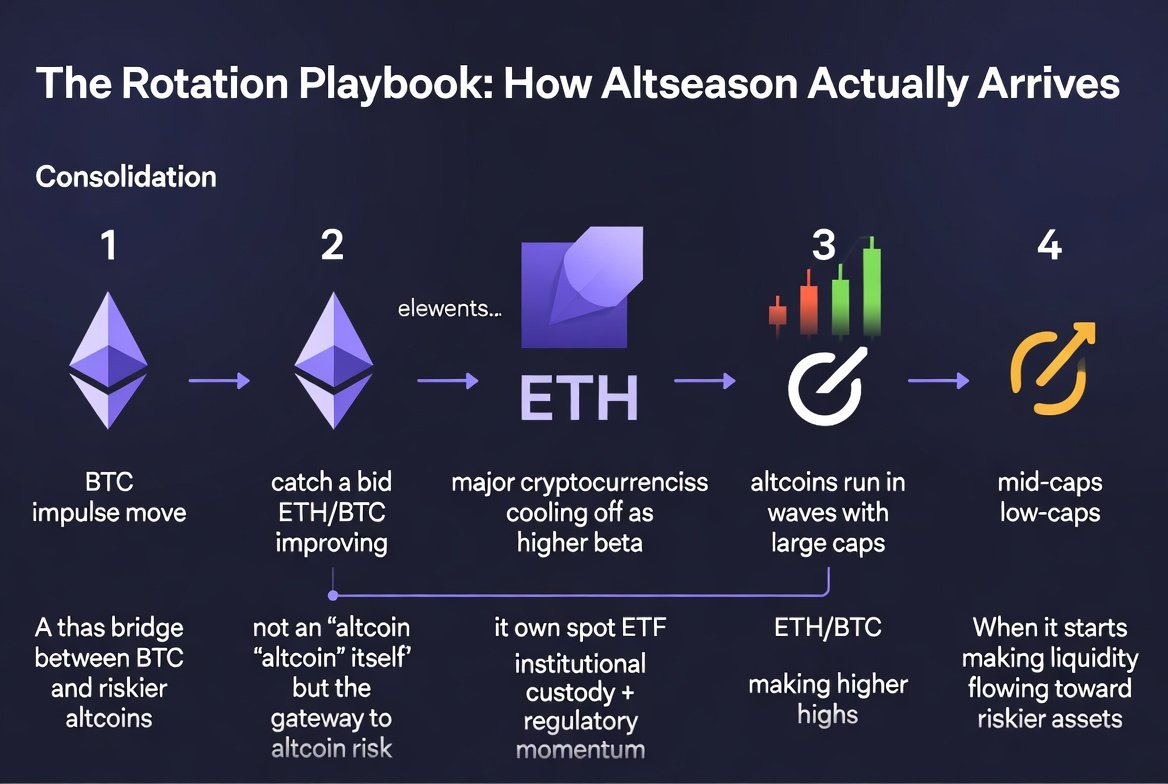

The Rotation Playbook: How Altseason Actually Arrives

Forget random pumps. Real rotation follows a sequence:

Step 1: BTC impulse move, then consolidation. Step 2: ETH catches bid. ETH/BTC starts improving. Step 3: Majors cool off. Traders get bored, hunt beta. Step 4: Alts run in waves. Large caps first, then mid-caps, then low-caps.

This sequence can take weeks or months. Patience pays.

The Altseason Trigger Board (Traffic Light Visual)

Here’s your checklist. You need multiple green lights, not just one:

Core Lights:

- BTC.D Trend: Confirmed downtrend, not one red candle

- ETH/BTC Trend: Higher highs, reclaiming key levels

- Stablecoin Supply Growth: Fresh capital entering the system

- Funding + OI Condition: Risk-on, but not overheated

- Alt Breadth: Many alts breaking out, not just 3 coins

Bonus Lights (Pro Mode):

- TOTAL2 vs BTC: Is altcoin market cap outperforming BTC?

- Perp Volume Share: Are traders actually trading alts or just majors?

- Memecoin Mania Index: Retail temperature check

When most of these lights turn green, rotation is real.

False Altseasons: The Trap Map

Not every pump is altseason. Watch for these fakes:

Trap 1: Narrow Pumps Two or three alts moon while breadth stays dead. This isn’t rotation. It’s rotation theater.

Trap 2: Memes Pump, Real Alts Don’t When dog coins and frog tokens rip but your Layer-1s and DeFi blue chips stay flat, that’s not sustainable. It’s retail gambling, not institutional rotation.

Trap 3: ETH Pumps Without ETH/BTC Confirmation If ETH rallies but ETH/BTC stays weak, it’s just BTC dragging everything up. Not real ETH strength.

False altseasons trap impatient traders. Wait for confirmation across multiple signals.

The Bottom Line

BTC and ETH moon first because that’s where liquidity enters. Alts lag because of structural headwinds, fragmented narratives, and the simple fact that risk appetite takes time to build.

Stop expecting instant rotation. Start watching the liquidity stack. When Door 3 finally opens, the signals will be obvious. Until then? Majors are the trade.

Altseason will come. But not on your timeline. On liquidity’s timeline.

Disclaimer:

- This article is reprinted from [DamiDefi]. All copyrights belong to the original author [DamiDefi]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025

What Is Dogecoin?

What is Neiro? All You Need to Know About NEIROETH in 2025

What is the Altcoin Season Index?