When a beverage company decides to exchange equity for BONK dividends

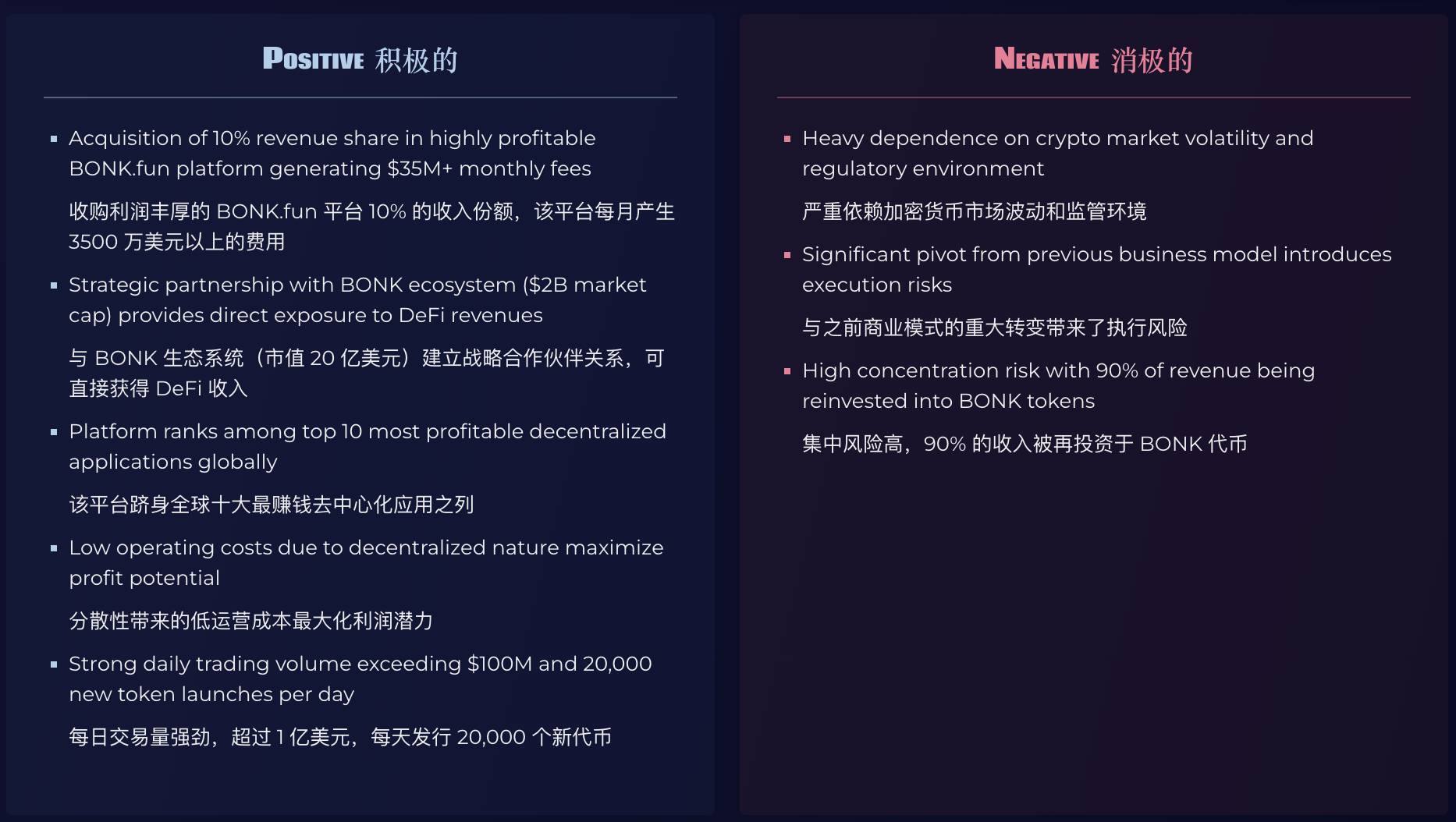

On August 11, 2025, Safety Shot, Inc. (NASDAQ: SHOT), a beverage company, announced a groundbreaking strategic partnership with founding contributors of BONK, establishing a close integration between the company and the BONK ecosystem.

Through a private placement, the Bonk founding team is providing $25 million worth of approximately 77 trillion BONK tokens, while Safety Shot is issuing $35 million in convertible preferred stock (which can be converted into common shares). This initiative aims to transform Safety Shot from a traditional beverage company into a DeFi-integrated enterprise, although it also brings the risk of diluting existing shareholders.

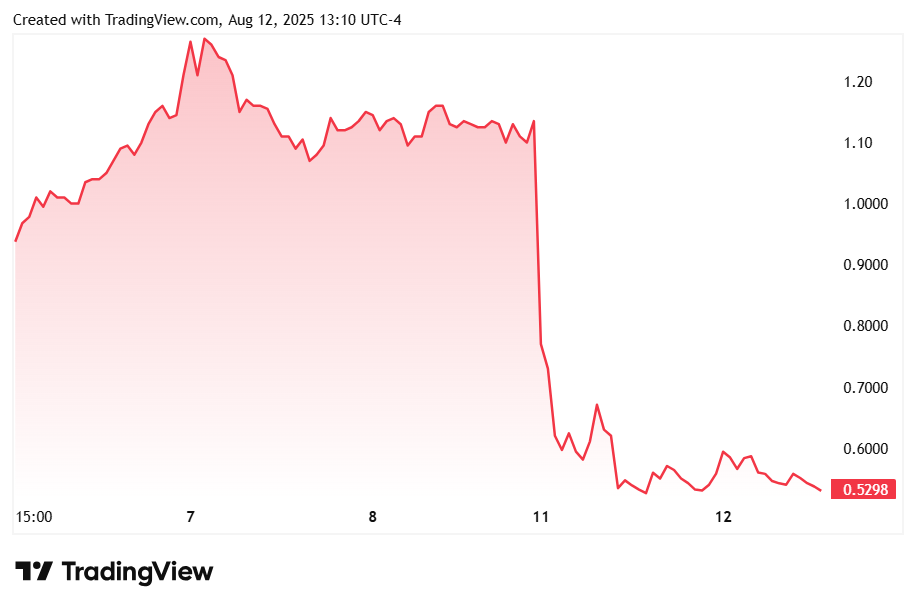

At first glance, this collaboration appeared to be another attempt by a public company to enter the cryptocurrency reserve strategy. The market responded negatively—Safety Shot’s stock plunged 55%, dropping by half immediately after the announcement.

Yet the reality is more nuanced: Safety Shot and BONK are charting an entirely new model of partnership.

On August 12, Safety Shot announced it had secured a 10% revenue-sharing interest in letsBONK.fun (BonkFun), the main platform of the BONK ecosystem. In addition, BONK’s founding members—such as Mitchell Rudy—were appointed to Safety Shot’s board of directors, controlling 50% of the board seats. Rudy will also serve as a strategic advisor on accumulation of BONK tokens and offer guidance on on-chain operations. The company has reserved the Nasdaq ticker “BNKK” for possible future strategic changes.

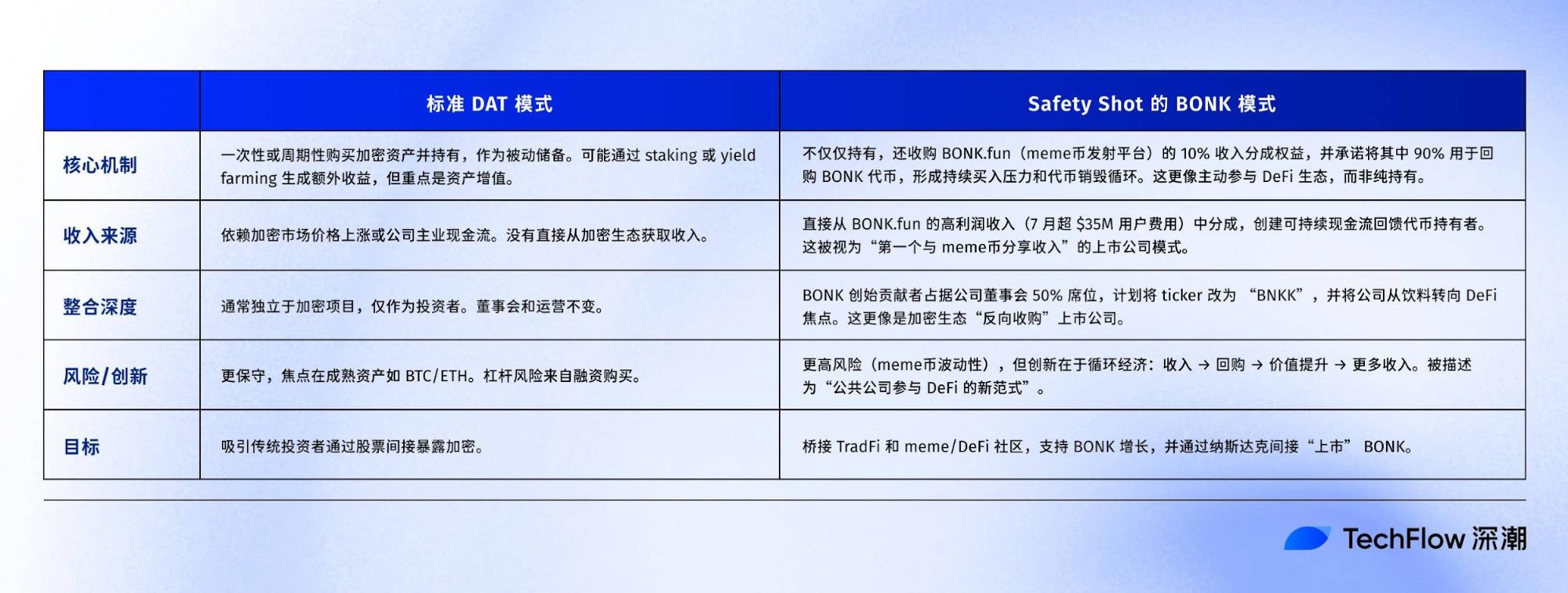

This cooperation clearly moves beyond the traditional playbook of established firms following the trend through token purchases to diversify their assets.

Safety Shot will receive 10% of BONK.fun’s revenue and has committed to using 90% of these proceeds to buy back BONK tokens and add them to its own treasury. This creates consistent demand for BONK and supports its value. Meanwhile, BONK.fun will itself repurchase and burn portions of BONK tokens in the open market, further decreasing supply and boosting the token’s price.

Differing from other cryptocurrency treasury management strategies, Safety Shot will generate income through active engagement in letsBONK.fun, not just from token trading revenue.

Rudy remarked, “Staking yields might be relatively steady, but they’re limited and always constrained by the underlying token price. In contrast, revenue sharing creates unlimited, exponential upside tied directly to the success of leading market players. It’s a bet on the broader industry’s growth, not just a single asset. For Safety Shot investors, this links company value to tangible, high-margin cash flows—much more powerful and exciting than simply holding tokens and hoping for price appreciation.”

Impact of the partnership on Safety Shot

Source: https://www.stocktitan.net/news/SHOT/safety-shot-acquires-10-revenue-sharing-interest-in-revenue-3axg64322ylq.html

This move marks the first time in Nasdaq history that a publicly traded company is sharing revenue with a meme coin in this manner. The collaboration also benefits token holders, with revenue ultimately flowing into the BONK ecosystem and supporting holders.

Jarrett Boon, CEO of Safety Shot, commented, “This strategic alliance marks the first step in a broader enterprise transformation for our company. By partnering with one of the most dynamic digital asset ecosystems, we are taking an ambitious first step forward.”

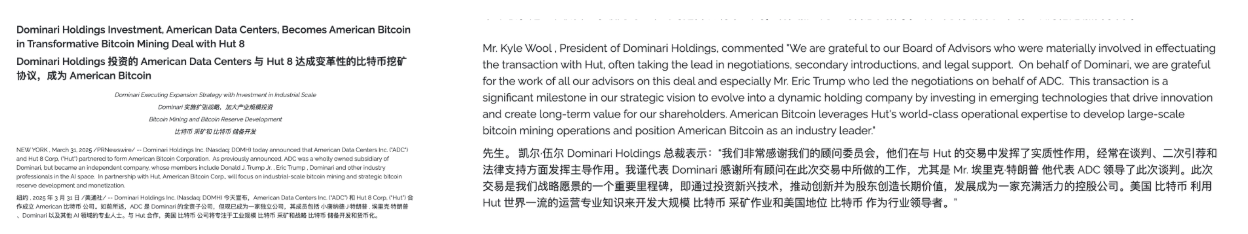

Notably, the investment advisor behind this bold partnership—Dominari Securities—isn’t just any firm. It’s a holding company tied to the Trump family, with its parent Dominari Holdings, Inc. (NASDAQ: DOMH) headquartered in Trump Tower.

As early as February 11, 2025, Dominari Holdings announced that Donald Trump Jr. and Eric Trump joined its advisory board, each investing roughly $1 million via private placement. FactSet data reveals the Trump brothers collectively hold 6.7% of the company’s shares, with each stake valued at over $6 million.

At present, the firm has become the Trump family’s preferred advisor on diverse transactions spanning crypto, data centers, and manufacturing. Dominari Holdings President Kyle Wool previously praised the advisory board—especially Eric Trump—for helping a subsidiary secure a bitcoin mining partnership, namely the deal between American Data Centers and Hut 8.

Returning to the audacious and risky Safety Shot–BONK deal: Dominari’s association with the Trump family places it firmly within the Trump business network. Although the Trump brothers weren’t directly involved, their connection adds a new risk dimension to this highly innovative partnership.

The “Trump effect” has drawn considerable attention to Safety Shot and BONK, fueling buzz in both crypto and traditional financial markets but also raising investor concerns about Trump-related speculative risk.

As of September 1, SHOT’s stock remains under pressure and has shown little sign of recovery following the initial announcement. The outlook for the partnership remains uncertain.

Disclaimer:

- This article is reproduced from [TechFlow]; copyright belongs to the original author [Yanz, Deep Tide TechFlow]. If you have concerns regarding this reproduction, please contact the Gate Learn team, which will address your request in accordance with proper procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice of any kind.

- Other language versions of this article have been translated by the Gate Learn team. Unless Gate is explicitly mentioned, unauthorized copying, distribution, or plagiarism of the translated article is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?