What Is a Daily Leveraged Certificate (DLC)? Mechanism Explained and Latest Market Performance

What Are DLCs (Daily Leverage Certificates)?

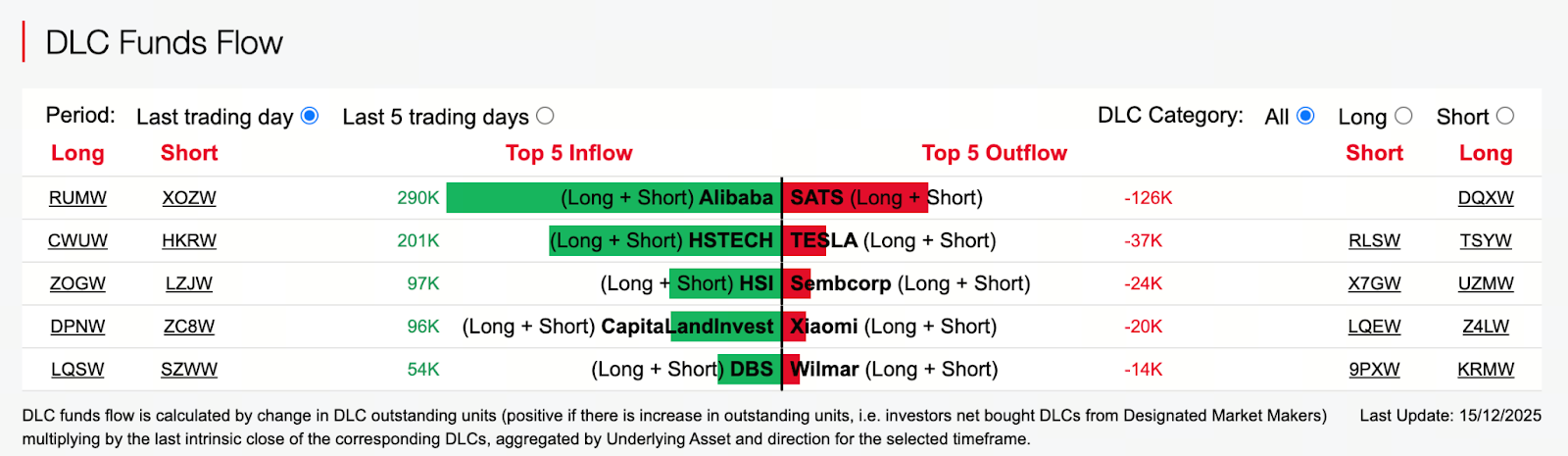

Source: https://dlc.socgen.com/

DLC stands for Daily Leverage Certificate. This is a structured financial product that enables investors to magnify the daily price movements of an underlying asset by a set multiple—commonly 3x, 5x, or 7x. Underlying assets can include individual stocks, such as Tesla, Meta, or Nvidia, as well as stock indices like the Nasdaq or Hang Seng Index.

Unlike traditional stocks or ETFs, DLCs focus on amplifying returns or losses based on daily price fluctuations. They are best suited for investors with short-term trading experience or those comfortable with higher risk exposure.

How Do DLCs Amplify Returns and Risks?

For example, if a stock rises 1% in a day:

- A 3x long DLC will increase approximately 3% in value;

- A 5x long DLC will rise about 5%;

- Conversely, short DLCs amplify profits when the underlying asset declines.

DLCs do not directly hold the underlying asset. Instead, they represent a “daily leverage strategy.” The product rebalances leverage every day to ensure the multiplier remains effective. Because of this daily reset, DLCs are not suitable for long-term holding. Over time, compounding effects may cause performance to diverge from the underlying asset’s actual trend.

Recent Market Trends and Price Examples

Recent public exchange data shows that many DLC products remain actively traded. For example:

- Tesla 3x Long DLC recently traded around 4.83 (currency units), gaining about 9.28% in a single day, while Tesla’s stock price rose approximately 2.70%.

- Nvidia 3x Long DLC traded between 4.34 and 4.36.

- There are also various long and short DLCs available for Meta, Microsoft, and other underlying assets.

This data illustrates that DLC prices do indeed amplify the movements of their underlying assets, but they can also drop sharply, especially when volatility is high.

Advantages and Target Users of DLCs

Key advantages include:

- High leverage for enhanced short-term gains: For traders who accurately anticipate price direction, DLCs can deliver amplified returns within a single trading day.

- Both long and short strategies: Investors can buy long DLCs to capture upward moves or short DLCs to profit from declines.

- Well-structured products with robust liquidity: Some major DLCs are listed and traded on exchanges, offering strong transparency.

Best suited for:

- Investors experienced in leveraged trading;

- Those who understand daily rebalancing and compounding effects;

- Active traders with high risk tolerance.

Key Risks to Consider When Investing in DLCs

While DLCs offer the potential for amplified returns, they also carry significant risks:

- High volatility risk: A single day’s movement in the underlying asset can result in steep losses or even a total loss of value.

- Airbag mechanism impact: Some DLCs feature an “airbag” that suspends trading and resets observation levels during extreme volatility, which may increase losses or reduce gains.

- Not suitable for long-term holding: Daily rebalancing can cause long-term returns to diverge from expectations.

- Qualification and fee requirements: Certain markets require investors to meet specific criteria and pay management fees, funding costs, and other charges.

Summary: DLC Key Takeaways

- DLCs are leveraged certificates that multiply the daily performance of the underlying asset by a fixed factor;

- They are generally suited for short-term traders and investors with a high risk appetite;

- The latest market data shows several popular DLC products remain actively traded;

- Before investing, it’s crucial to fully understand the product’s structure, leverage risks, and associated costs.

By understanding these key points, you can make a more informed evaluation of whether DLCs align with your investment strategy.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution