USDC Minting Activity Signals Rising Liquidity on Solana

Stablecoin Minting Activity Draws Market Attention

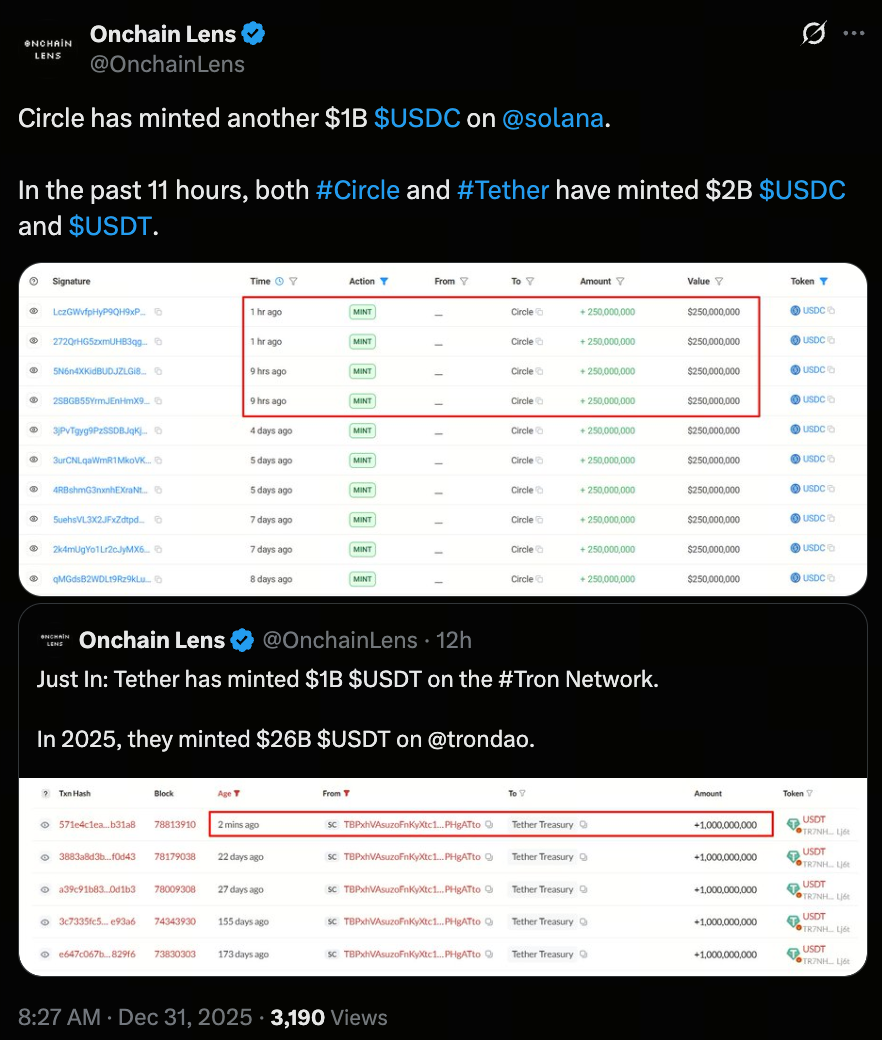

Onchain Lens, an on-chain analytics platform, reported that Circle minted an additional 1 billion USDC on the Solana blockchain on December 31, completing the process within just a few hours. Looking at a broader window, Circle and Tether together issued approximately $2 billion in USDC and USDT over the past 11 hours, underscoring the rapid expansion of stablecoin supply.

(Source: OnchainLens)

Solana On-Chain Liquidity Rises Sharply

The substantial influx of USDC has directly increased the available capital on Solana. As the primary medium of exchange in DeFi, a larger stablecoin supply empowers lending protocols, decentralized exchanges, and derivatives markets with deeper liquidity, setting the stage for more robust trading activity.

Stablecoins Power Ecosystem Growth

USDC issuance growth typically aligns with surging on-chain activity. As more capital enters the ecosystem, trading volumes and open interest often rise in tandem. This heightened activity can also bolster confidence in the Solana ecosystem, further increasing attention on associated assets.

Circle Signals Strategic Market Positioning

Circle’s issuance strategy continues to prioritize USDC on Solana, reflecting its ambition to cement a leading stablecoin position on the network. This approach not only strengthens USDC’s interoperability with other ecosystems like Ethereum and Base, but also reinforces its role as a core stablecoin in a multi-chain environment.

Growth Opportunities and Regulatory Challenges Ahead

The swift expansion of stablecoin supply demonstrates growing on-chain economic demand, while also signaling the likelihood of increased regulatory scrutiny. For issuers, maintaining the right balance between compliance and innovation will be critical for sustained growth.

If you want to learn more about Web3, click to register: https://www.gate.com/

Summary

The concentrated USDC minting on Solana is more than a single event—it reflects converging trends, including rising liquidity needs, shifting stablecoin competition, and issuers’ long-term infrastructure strategies. As stablecoins remain central to the Web3 economy, these on-chain developments will be essential indicators for tracking market direction.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution