UK Legally Recognizes Crypto as Personal Property: A New Era for Digital Asset Legal Status

Image: https://www.legislation.gov.uk/ukpga/2025/29/enacted

Why Did the UK Amend Its Laws: The Shift from Judicial Precedent to Statutory Law

As cryptocurrencies have rapidly gained popularity worldwide in recent years, their legal status has become a central point of debate. Traditionally, property law divides assets into two main types: tangible possessions, such as real estate, vehicles, or physical goods. Intangible claims or contractual rights include equity or debt claims. However, digital assets—including cryptocurrencies and NFTs—do not fit neatly into either category, as they are “neither physical objects nor contractual claims.” This has led to ongoing uncertainty regarding their legal standing.

What Are the Key Provisions of the New Law?

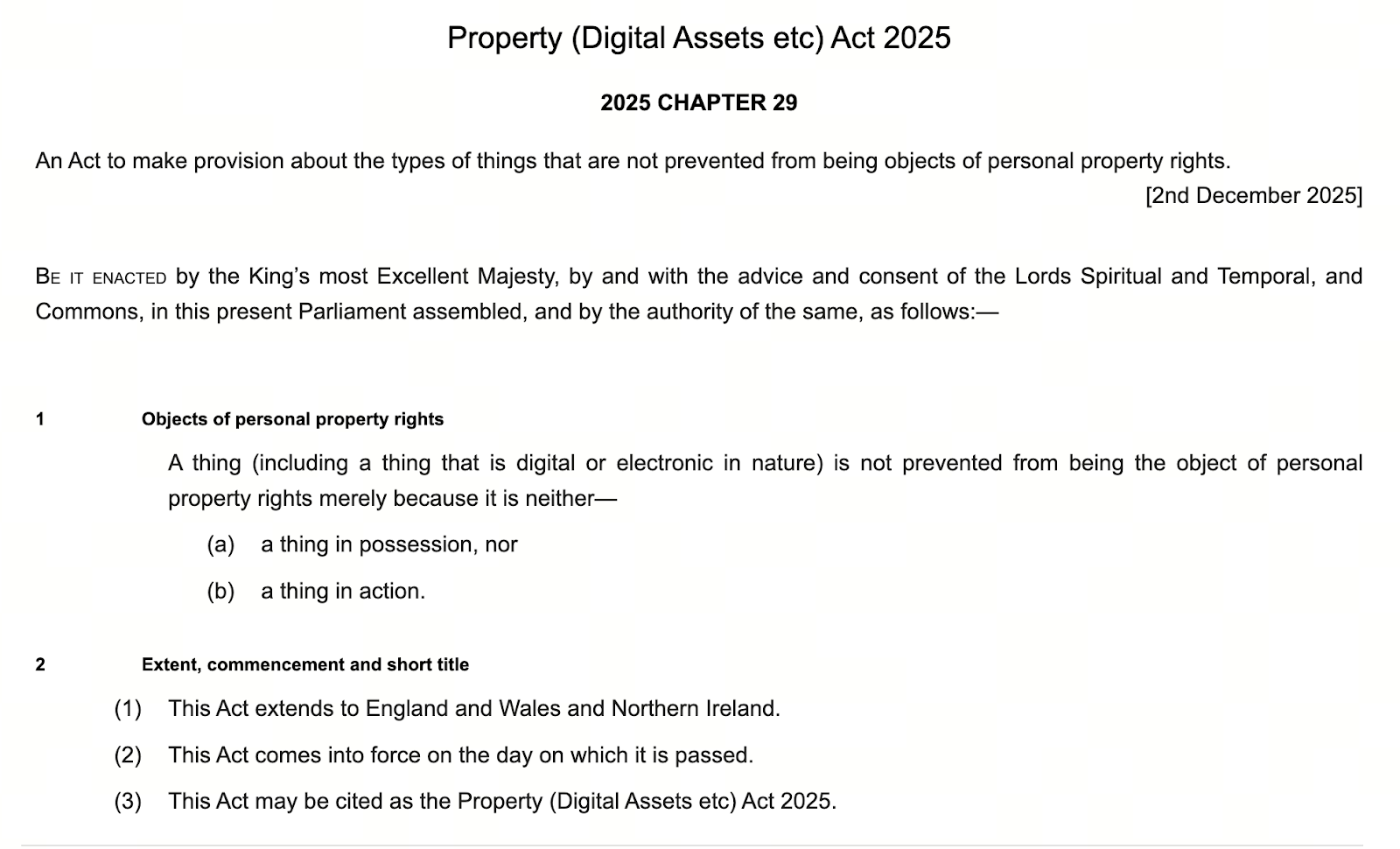

In December 2025, the UK Parliament enacted the Property (Digital Assets etc) Act 2025, which received Royal Assent. For the first time, the UK now recognizes digital assets as a distinct third category of personal property. The Act explicitly designates digital assets—including cryptocurrencies, stablecoins, and NFTs—as personal property, granting them the same legal protections as traditional assets.

The key provisions of the new law include:

- Digital assets are recognized as personal property, with legal ownership.

- Victims of theft, fraud, asset loss, or hacking can pursue the recovery of their digital assets through legal channels.

- In legal proceedings such as inheritance, bankruptcy, liquidation, or divorce, digital assets are now treated as legal property and handled according to law.

- The law establishes a clear legal framework for digital assets, moving beyond piecemeal court decisions to comprehensive statutory protection.

What Does This Mean for Crypto Asset Holders?

This represents a significant advancement for crypto asset holders. Previously, the uncertain legal status of digital assets made it extremely difficult—or even impossible—to recover assets lost to hacking, fraud, exchange bankruptcies, or inheritance disputes. Now, with these assets clearly recognized as legal property, holders benefit from robust legal protections. Security and legitimacy are significantly improved.

Potential Impact on the Crypto Industry and Market

From an industry and market perspective, this move signals the UK’s ambition to become a global digital asset hub. The new law not only boosts confidence among current crypto asset holders and investors. It also lays a solid legal foundation for future project launches, investments, institutional involvement, and estate planning. This clear legal structure will help attract digital asset businesses and talent from around the world. It will strengthen the UK’s leadership in Web3 and cryptocurrency regulation and development.

Summary and Outlook

By passing the Property (Digital Assets etc) Act 2025 and classifying digital assets as personal property, the UK has set a major milestone in digital economy development and legal modernization. For cryptocurrency users, this is more than just legal recognition—it means greater security, traceability, inheritance rights, and regulatory oversight. Digital assets are entering the mainstream as standards and maturity increase. Similar legislation may be adopted in additional countries, accelerating the global development of digital asset legal frameworks.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution