TradFi and DeFi Connecting: A New Era of Financial Integration and Market Opportunities

The Era of TradFi and DeFi Integration

Traditional Finance (TradFi) represents established banking systems, institutional investor networks, and complex regulatory frameworks. In contrast, Decentralized Finance (DeFi) uses blockchain technology to create open, transparent, and intermediary-free financial protocols. Historically, these two domains operated as “parallel universes,” but this distinction is rapidly fading.

By 2025, digital assets are shifting from speculative tools to strategic assets for institutions, with innovations like Bitcoin ETFs, regulated stablecoins, and asset tokenization becoming mainstream. Already, 88% of banks are involved in some form of blockchain service, signaling TradFi’s adoption of DeFi’s core technologies.

Latest Industry Developments and Market Trends

- Institutional Integration Signals: Industry leaders such as Nick van Eck underscore that TradFi and DeFi are not locked in a zero-sum competition, but are instead converging and integrating. This trend is drawing traders’ attention to liquidity across sectors and highlights the coming era of capital flowing freely across boundaries.

- Bridging Stablecoins and Regulated DeFi: Regulated stablecoins are emerging as crucial bridges between everyday payments and the banking system. Through programmable contracts and on-chain settlement, banks and decentralized networks are collaborating more efficiently in areas like cross-border payments and real-time settlements.

- Technical Standards and Interoperability: Technology providers such as Chainlink are advancing blockchain protocol standardization, reducing data and compliance friction between systems. These standards are lowering the technical barriers for integrating traditional financial systems with DeFi protocols.

Industry consensus points to a “symbiotic era” for TradFi and DeFi, where the future financial ecosystem will be hybrid and complementary—not a binary choice.

Price Performance and Market Data Insights

.

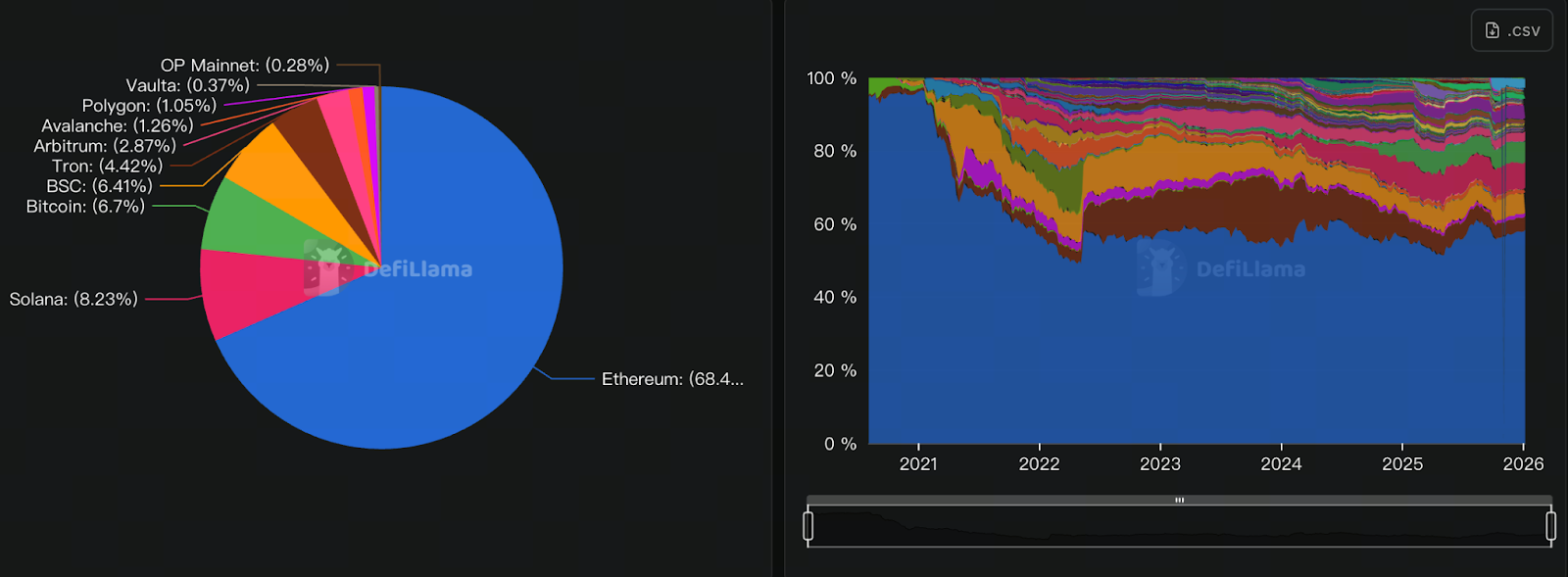

Chart: https://defillama.com/chains

As TradFi and DeFi converge, crypto market price trends reveal distinct market sentiment:

- In 2025, DeFi protocols’ total value locked (TVL) remains high, with the market continuing to expand.

- Regulated assets like XRP and regulated stablecoins are boosting institutional investor confidence.

While the broader market remains volatile, key assets propelled by this integration—such as tokens tied to real-world assets—are demonstrating stronger downside resilience and long-term potential.

Core Drivers of TradFi and DeFi Integration

Several key factors are driving the integration of TradFi and DeFi:

- Need for Greater Efficiency: Blockchain enables real-time or T+0 settlement, dramatically cutting transaction costs and intermediary friction.

- Institutional Capital Inflows: With the rise of ETFs and regulated financial products, institutional asset managers are increasingly allocating to digital assets.

- Shifting Client Demands

A new generation of investors is pushing traditional financial institutions to adopt DeFi tools to meet growing digital asset demand.

- Increasing Regulatory Clarity: Regulatory frameworks are maturing, providing a compliant foundation for TradFi and DeFi integration.

These drivers are building industry consensus and making hybrid financial ecosystems possible.

Case Study: Real-World Assets and Institutional Participation

Key examples fueling TradFi and DeFi integration include:

- Growth in real-world asset (RWA) tokenization, unlocking new liquidity pools for traditional assets.

- Stablecoins and regulated protocols enabling on-chain settlement for banks and payment systems.

- Rising institutional activity, with major banks demonstrating cross-chain transactions at events such as SmartCon and the RWA Summit.

These cases show that integration is not just theoretical—it is rapidly becoming commercial reality.

Potential Risks and Future Challenges

Despite promising prospects, integration also brings risks:

- Regulatory Uncertainty: Differing regulatory approaches worldwide may limit some innovations.

- Technical Risks: The complexity of cross-chain operations and smart contracts introduces vulnerabilities and security challenges.

- Systemic Risks: Interconnected TradFi and DeFi systems could make risk transmission more complex.

For successful integration, it is critical to address both opportunities and the importance of risk management and regulatory compliance.

Summary and Investment Recommendations

TradFi and DeFi integration is no longer just a vision for the future—it is an active, accelerating trend. Industry leaders and innovators are advancing the convergence of standards, systems, and technologies, aiming to build a financial era that balances stability with innovation.

Investors should focus on:

- Structural growth in regulated assets and stablecoin markets

- Protocols and infrastructure enabling TradFi-DeFi interoperability

- Application scenarios for asset tokenization products

With market trends and risks in mind, investors must carefully assess their strategies and risk tolerance.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution