Uncovering the Hidden Risks Amid the Perp DEX Frenzy: Strategies for Overcoming the 5 Biggest Pitfalls

Hyperliquid has sparked a new wave of enthusiasm in the perpetual decentralized exchange (Perp DEX) sector, capturing 8.62% of the traffic typically associated with centralized exchanges (CEXs). However, it's essential to recognize the hidden challenges within this space and establish a robust framework to ensure that the shift toward decentralization remains truly irreversible.

TL;DR

- Liquidity Mirage: High trading volume does not necessarily indicate strong liquidity. Factors like bid-ask spreads, slippage, and taker fees can lead to price impact and execution losses. These metrics may also be artificially inflated by incentive mechanisms.

- Hidden Costs: The order book model requires substantial market maker subsidies, while liquidity providers (LPs) in automated market makers (AMMs) face scalability challenges. Both models encounter significant economic hurdles.

- Opaque Liquidation: Ensuring system safety must take precedence over user convenience, necessitating rigorous risk controls for open interest (OI), multi-source liquidation processes, and verifiable proofs. Risk is particularly acute in pre-market trading scenarios.

- Execution Order Trade-Offs: There is an inherent trade-off between prioritizing retail traders and high-frequency trading (HFT). Ultimately, this is a balance between fairness and efficiency.

- Inefficient Margin: A dynamic and efficient margin system—incorporating yield-bearing collateral, integrated lending, and hedged position recognition—is needed to match the capital efficiency of centralized exchanges.

Liquidity Mirage

While trading volume is a standard metric, token incentives can artificially inflate volumes and create misleading indicators. Even if headline volumes are equal, retail-driven trading is more valuable than "speculative trading" because it tends to be more stable and sustainable.

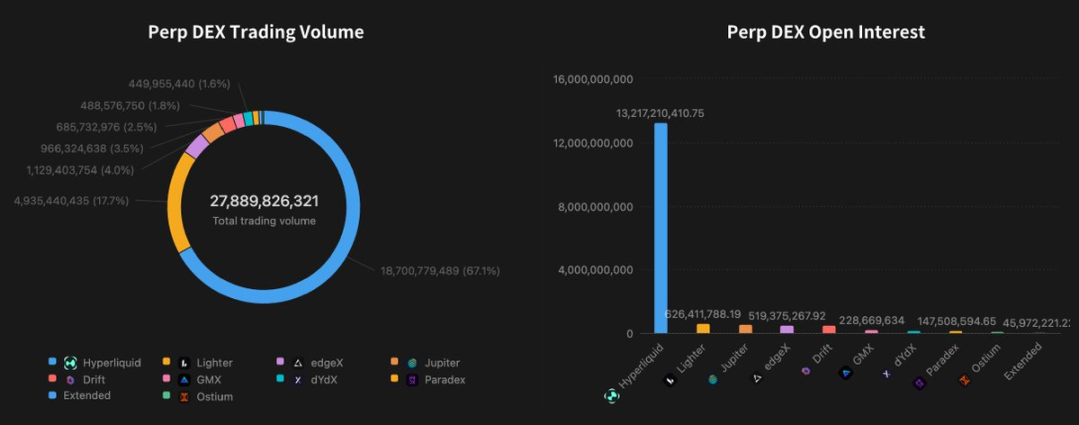

Perp DEX Trading Volume and Open Interest

The open interest to volume (OI-to-Volume) ratio reveals the true level of trading activity. CEXs without API access typically display ratios of 1:2 or 1:3. Hyperliquid's hourly fee structure and order cancellation priority mechanism push its ratio to a notably high 1:1, while other DEXs without live tokens often use token incentives to boost wash trading, resulting in lower ratios. Furthermore, fee income is critical for a platform's sustainability; it incentivizes participation and directly strengthens the platform’s risk buffer.

Liquidity is the ultimate benchmark for platform usability. Tight bid-ask spreads reduce trading costs, low slippage preserves price integrity for large orders, and deep markets minimize price volatility during trades. Comparative analysis indicates Hyperliquid performs exceptionally well for large position sizes over $20 million, while edgeX stands out for retail traders—offering the deepest liquidity within one basis point (bps), the lowest slippage, and the narrowest spreads across most trading sizes.

Order Book Comparison

Hidden Costs

Liquidity faces a classic "cold start problem": traders avoid platforms with few orders, and market makers are reluctant to provide liquidity to such markets.

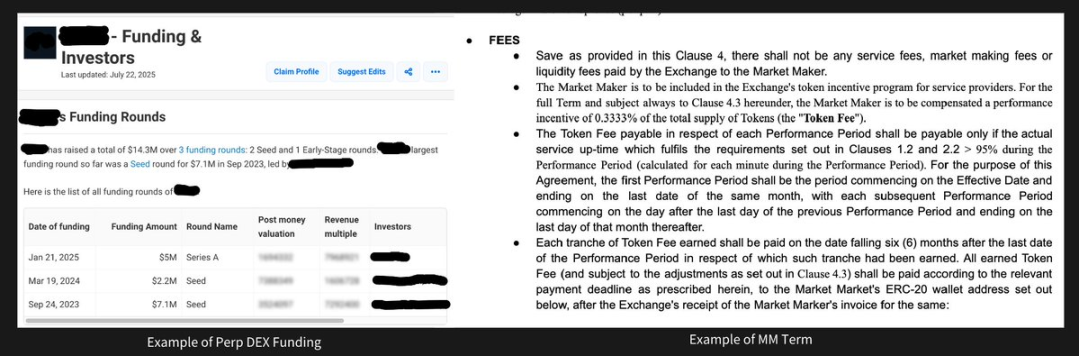

The order book model is more capital efficient, but requires significant upfront capital to support market making. The terms for market makers are often stringent: for example, a given Perp DEX may charge a 0.035% fee, but after paying market makers 0.01% and rebating users 0.01%, only 0.015% remains. With monthly operating expenses of $500,000, the platform would need at least $111 million in daily taker volume to break even. This simple calculation explains why most new entrants fail.

Perp DEX Funding and Market Maker Terms Example

The AMM model lowers capital requirements via LP pools and can leverage incentives to overcome cold start challenges (as demonstrated by GMX and Ostium). However, this model grants excessive advantage to the "house," making it unsuitable for handling large trades. Hyperliquid’s pivot to an order book model from LP pools represents a more sustainable growth path.

Opaque Liquidation

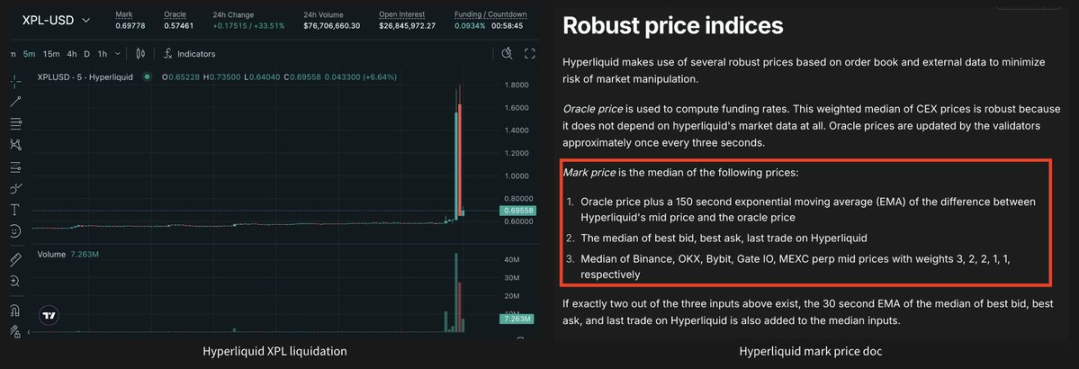

Single-source internal liquidation systems are vulnerable to manipulation. For example, on August 26, 2025 (UTC), a whale in Hyperliquid’s XPL market pushed the price from $0.60 to $1.80 in minutes, while other platforms maintained stable prices. (CEXs typically use pre-market circuit breakers to prevent such swings.) This led to the liquidation of 85% of short positions, with losses totaling $25 million. While multi-source mark pricing generally provides stronger resistance to manipulation—and Hyperliquid has now adopted it for most assets—pre-market trading scenarios pose distinct risks when external price feeds are unavailable.

Hyperliquid XPL Incident and Price Index

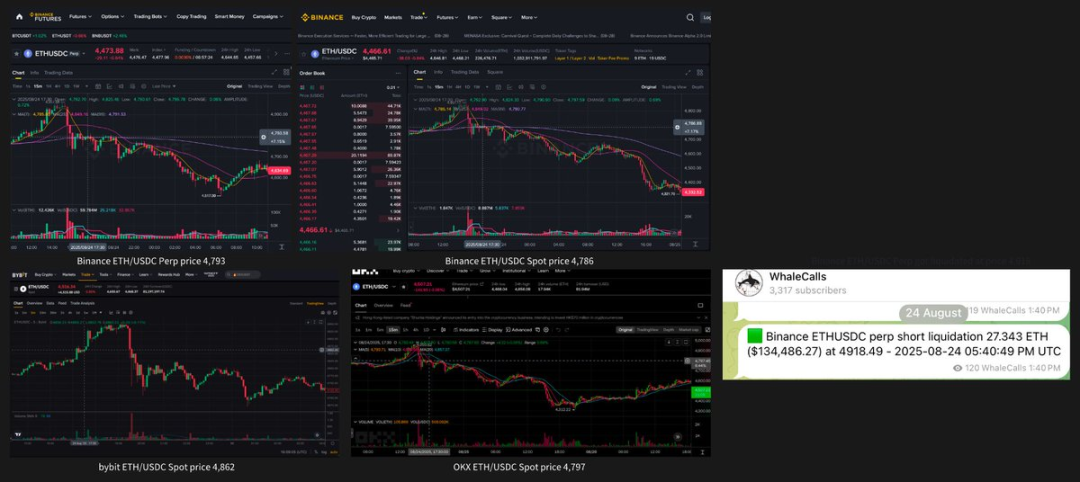

Liquidation processes remain opaque and unverifiable. Binance purports to use the median of three price feeds, but on August 25, 2025 (UTC), the ETH/USDC liquidation occurred at $4,918, well outside the visible range of $4,786–$4,862—a result that defies independent validation. The absence of timestamps on CEX liquidations renders them unpredictable and unaccountable. Hyperliquid has improved this by recording oracle prices on-chain, but its internal matching engine and CEX API linkage have yet to be independently audited.

Binance Forced Liquidation Example

The free market approach also has its limitations. Hyperliquid initially allowed traders to freely open positions, with order book liquidations retaining maintenance margin. However, during the "JELLY incident," the platform was forced to close the market and settle at a price advantageous to itself, setting a concerning precedent. Although isolated ADL and dynamic OI cap mechanisms were later added, the XPL event exposed similar vulnerabilities.

Building a liquidation system that is simultaneously fair and robust is inherently challenging. Hyperliquid’s pursuit of openness and efficiency is ambitious, but such freedoms may create vulnerabilities—colluding actors could exploit the system to the detriment of smaller traders. Implementing volatility caps could represent a more optimal safeguard.

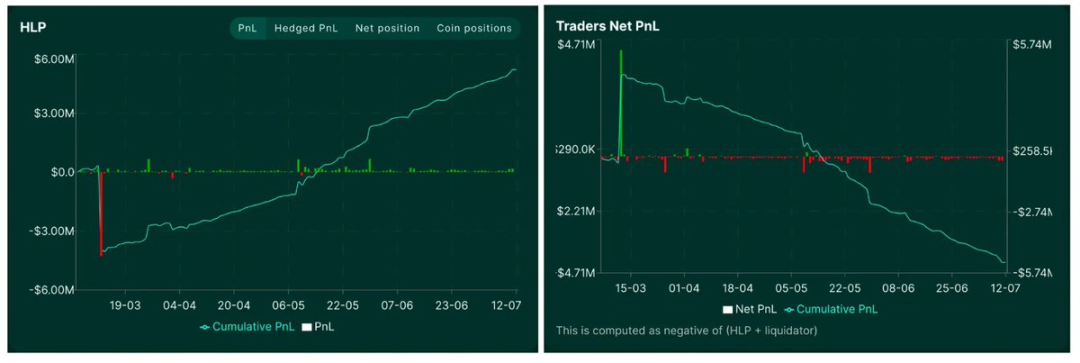

HLP pools remain profitable because traders are incurring losses.

Execution Order Trade-Offs

The main trade-off in trade ordering is between "fairness and accessibility" versus "efficiency and volume." Hyperliquid has favored fairness, adopting a "speed buffer" (three-block mempool buffering plus cancel order priority) that protects retail traders and small market makers from being outcompeted by complex HFT strategies. This fosters a more inclusive trading environment, enabling less-experienced participants to provide tight spreads without fear of adverse selection. However, this protection comes at the cost of overall liquidity and trading volume compared to Binance, as it dampens natural competition among market makers—a force critical to genuine price discovery. As Enzo has noted, a "barbell strategy" may help satisfy both retail and high-frequency trader needs.

Inefficient Margin

Centralized exchanges offer more flexible margin because balances exist as ledger entries until withdrawal. Decentralized exchanges, however, face greater constraints and cannot simply boost flexibility by lowering margin requirements. In addition to standard cross-margin systems, several strategies could enhance DEX margin efficiency:

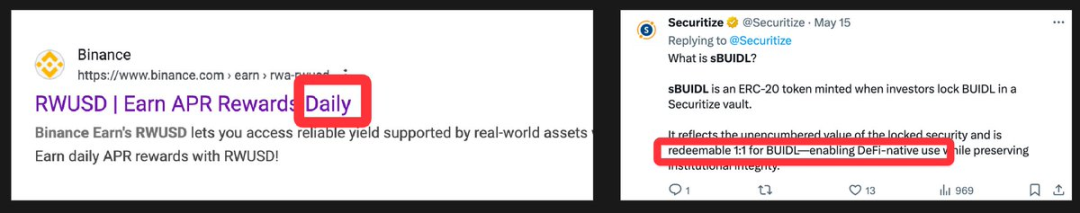

- Yield-Bearing Positions: Short-term government bonds present minimal risk but have trade-offs. BlackRock’s BUIDL requires KYC, while less restricted alternatives lack sufficient liquidity. On-chain products with monthly yield resets are operationally complex; by contrast, Binance’s daily-yield RWUSD showcases the advantages of CEX models. Yield-bearing stablecoins have great potential but typically lack the liquidity to support Perp DEX activity at scale.

- Decoupling Collateral and Margin via Lending: Native assets can be posted as collateral to borrow USDC for margin deposits, improving trading flexibility. For example, pledging 1 BTC as collateral to borrow USDC for use as margin. Drift allows assets like SOL to be posted as collateral, with trading and settlement in USDC based on loan-to-value (LTV) rules. However, the risk profiles for lending and perpetuals differ: failed liquidations in lending produce bad debt (due to the lack of auto-deleveraging), and there is little appetite among participants to recapitalize insurance pools. In this structure, lenders ultimately bear losses. Centralized exchanges can set risk limits and offset occasional losses with profits, while in DeFi, liquidation profits go to liquidators, leaving protocols with limited risk buffers.

- Hedged Position Recognition in Margin Systems: Smart margin frameworks should recognize "natural hedges" to reduce collateral requirements. For instance, using USDE as collateral while shorting ETH forms a negatively correlated exposure (ETH collateral plus ETH short)—bad debt would only occur if the perpetual diverges over 90% from its peg.

Conclusion

To build a sustainable trajectory, the next generation of Perp DEXs must feature highly capital-efficient margin systems, competitive spreads, minimal slippage, and strategically deployed incentive mechanisms.

Nevertheless, this space still faces fundamental trade-offs that stem from each platform’s core philosophy: how to manage unrestricted open interest, accommodate large traders, balance retail versus high-frequency execution preferences, and reconcile user protection with system security. These seemingly subtle differences will strongly shape user profiles and application scenarios.

“Decentralization” is often misunderstood in this sector; the majority of Perp DEXs merely shift centralized risk from "custody" to less visible "execution" and "liquidation" layers. Leading protocols must be grounded in core principles and maintain robust market integrity. With new infrastructure tools like LayerZero and Monad, innovative designs are rapidly emerging, signaling the arrival of a new generation of Perp DEXs.

Notice:

- This article is reprinted from [Foresight News] and remains the property of the original author [Rui]. If you have concerns about this reprint, please contact the Gate Learn team, who will address issues promptly in accordance with established procedures.

- Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Unless Gate is expressly credited, do not copy, distribute, or plagiarize translated content.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?