The Golden Age of Empty Bubbles

A good speculative bubble leaves behind railroads. Our bubbles leave behind screenshots. Not even a lousy tulip bulb. Bubbles of nothing but air. Out of reach of any regulators. And then there’s the addiction.

All this exists in a frenzied, influencer-fueled, action-junkie universe of wired chest pounders, proud of the fact the valueless crypto asset they champion makes the old school guys cringe.

Yet we seem to be happy to let the insiders earn risk-free returns, every time, while latecomers get return-free risk, on average. And a chance at the lottery.

When headline is the investment

Marshal McLuhan had it right; the medium is the message. A shooting hits the news, and within hours crypto kids with influencers on retainer ship a memecoin called RIPCharlieKirk. One of 10,000+ grifts with “Charlie/Kirk” in the name. This one starts near zero on Sept 10, finishes the day near $5,000,000, then bleeds to ~1/15th of the peak. That’s the product now: A ticker you can screenshot. No earnings. No value. Just a name and a JPEG.

Source: Pump.fun

A Florida trader, Evan Rademaker, tells Bloomberg he bought $30,000 of RIPCharlieKirk, sold at a $17,000 loss, chased the bounce, and lost again.

Launchers and paid shillers light the fuse, momentum and social feed do the rest. Most of these tokens are back to near zero; many will vanish. The ones that limp along are supported by hopium and sunk cost fallacy, while early insiders keep profits.

Sometimes uselessness is the whole point.

Useless Coin ran 40x in days and still sits near $320 million. It does literally nothing. That’s the definition of a memecoin: A crypto token with no use case.

Actually, there is one use case for Useless Coin: Enriching insiders.

But even though the life cycle of a memcoin has the speed and trajectory of a single fruit fly, there are thousands of Mr Rademakers waiting with their Robinhood accounts and crypto wallets, ready to take another flyer. Why?

Bubbles are not created equal

Soap bubbles are literally defined by being filled with nothing but the air we breathe. But bubbles in asset prices should mean something quite different.

We’ve told ourselves the comforting macro story: Dumb money funds real things. Canals. Railways. Electric utilities. Fiber across the Atlantic. Maybe AI is next. The rocket boosters during the pump are often the true believers. And those rocketships that don’t make it (think Global Crossing) can still provide a slingshot effect for society.

But lately it’s memecoins, and memestocks. Bubbles full of air that leave nothing behind. No infrastructure. No IP some other Silicon Valley garage-based startup can use. No future business to reorganize in Chapter 11. And Treasury Companies, that hold only one asset that you can buy yourself. For less.

Just wealth transferred from outsiders to insiders. The asset is the punchline; the exit is the business: issue to yourself and your friends for free. Then promote, and dump to greater fools.

Supply of these wealth-destroying machines is easy to explain. It has always been thus.

Reminiscences of the Stock Pumpers

History is a catalog of stock pumping. And dumping.

- Howe Street in the VSE days. Boiler rooms and Stratton Oakmont, the Wolf of Wall Street’s firm.

- The email spam era where “APPM TO A DOLLAR!!!” emails caused a worthless stock to double, triple, etc, and then half, all before lunch.

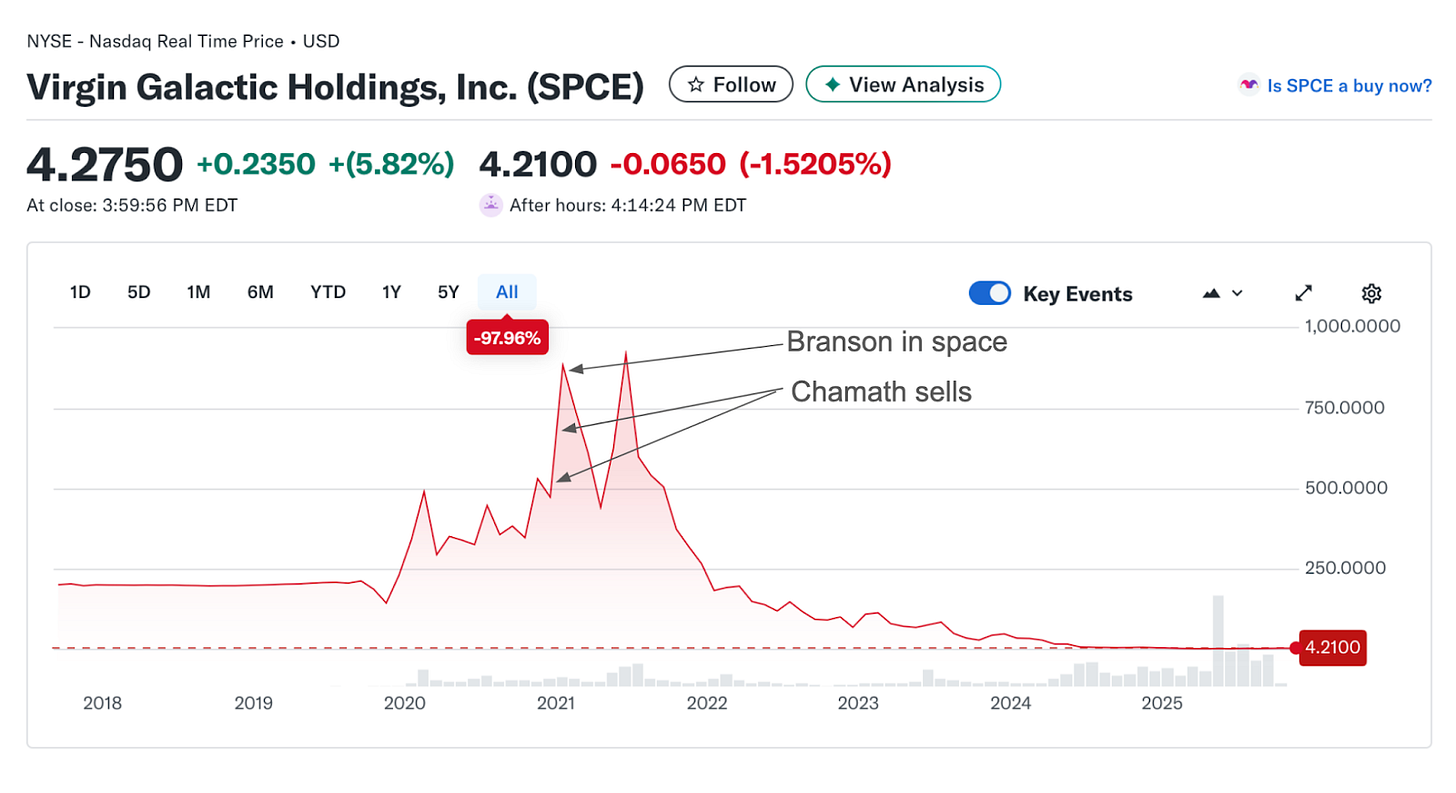

- SPAC sponsors pocketing eight figures while the stocks they promoted went down more than 99%. Virgin Galactic had its one moment when they shot Richard Branson into space. Chamath left with the $315 million ball. Check out the performance of the median shareholder:

Source: Yahoo Finance

The difference between all those thens and now is that the buyers were all suckers. They didn’t know what they didn’t know. They believed that the thing they bought was valuable. People went to jail. And retail generally learned a lesson. For a while.

They’re back. Where is Chamath?

So SPACs are back. And now Crypto Treasury Companies. Sometimes both at once (I’m looking at you, Cantor Equity Partners). Here’s one that traded at 25x its intrinsic value. Now it’s round-tripped back to the right price. Down 96% from the high. With Bitcoin, its major holding, at all time highs.

Source: Yahoo Finance

Meet the new memes. Same as the old memes? No

Memestocks are making a comeback as well. Meme 2.0. With some of the same operators. Keith Gill, aka Roaring Kitty, has returned three years after Memestock 1.0. But GameStop now has some fundamentals, which anchor price and make blatant manipulation harder.

So promoters adapted. Now “investments” are worthless by design so there’s no argument about intrinsic value.

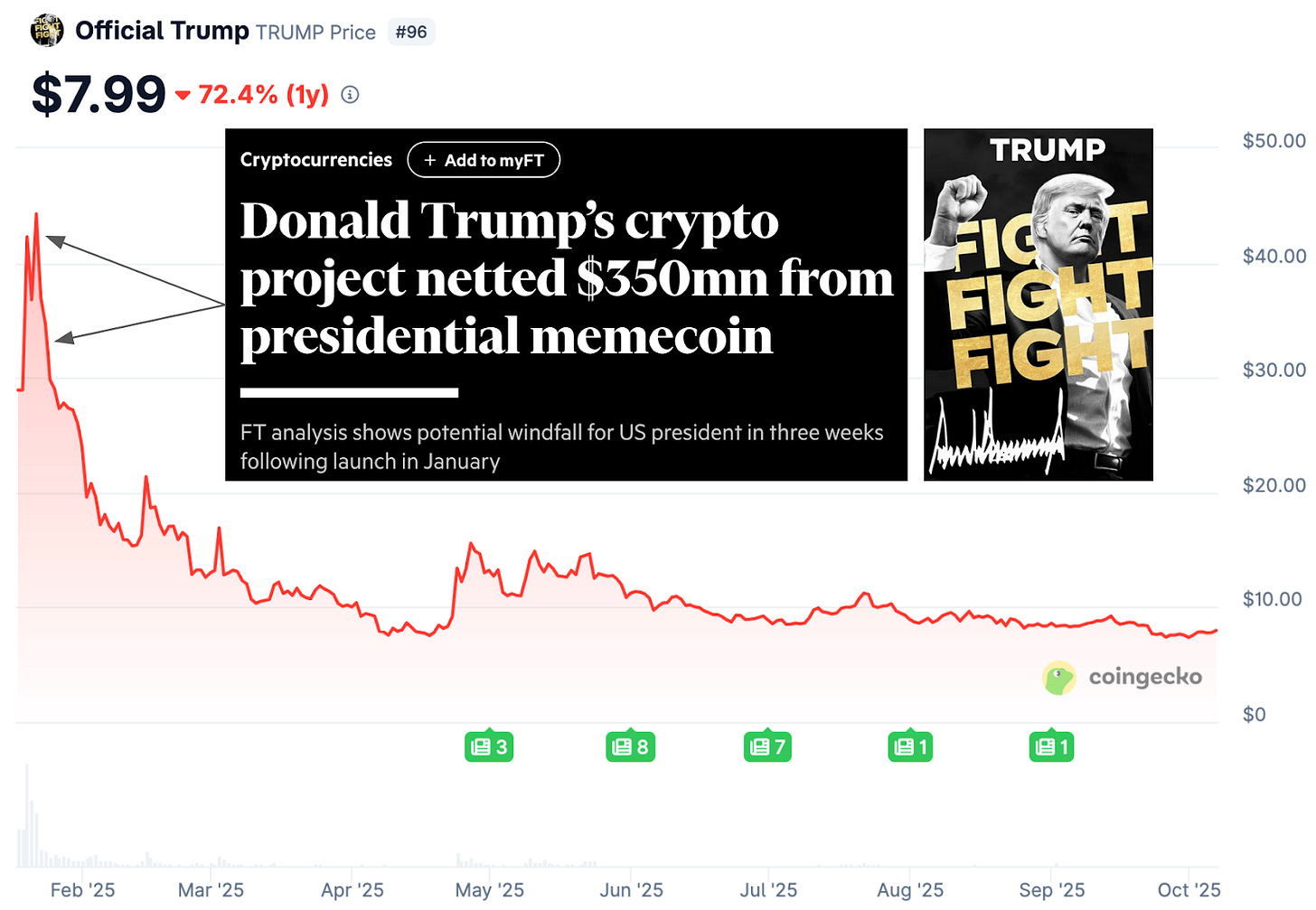

Every day there is a new crypto memecoin. Or 100. Or 1,000. Even the White House had gotten involved. $TRUMP coin distributed under $1, mooned to over $40, then fell back to earth. Insiders are still up around 8x. $350 million was taken off the table early by the Trumps. SPACs/Treasury Cos on steroids.

Source: Coingecko.com

This story has been repeated over and over again on the major launchpads in crypto. On Solana’s Pump.fun, multiple Dune analyses show that more than 60% of wallets are in loss, only 0.4% make more than $10,000 profit, and 81% of tokens drop more than 90% from ATH. That beats SPACs for wealth destruction. In numbers, if not in dollars.

But launch ethics are lacking. Solidus Labs revealed that 98.6% of Pump.fun launches and 93% of Raydium pools show indicators of fraudulent behaviour.

Few scams are as big as $TRUMP. There was (of course) MELANIA. And with LIBRA, 86% of traders lost a total of $251 million. And DOGE coin, SHIB and a few other multi-billion dollar memes are still alive and kicking. We’re into DOGE’s third pop, to $40 billion. Third time lucky? And $TRUMP is still valued at over one and a half billion.

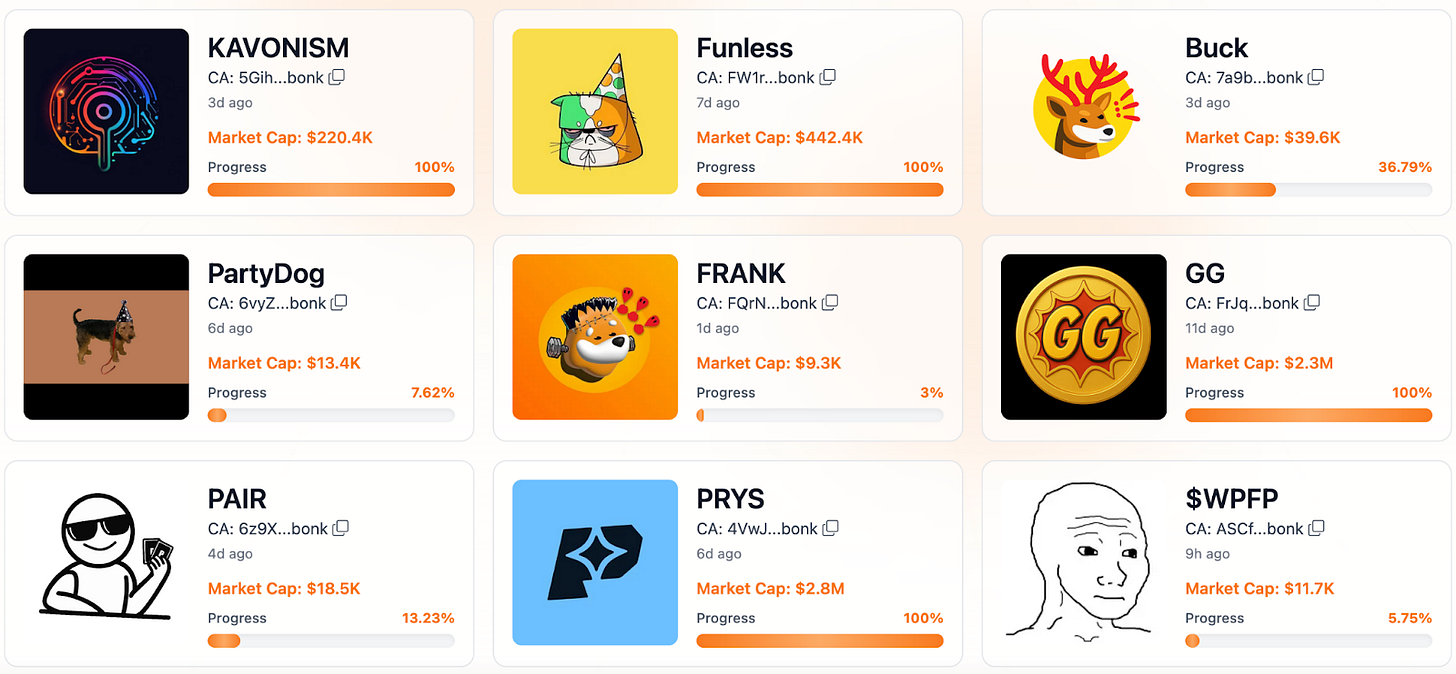

Many of these bubbles are tiny, though. And disappear fast. Like the fruit fly I mentioned earlier. Most tokens don’t get above a $1 million market cap. Here are a few recent examples from bonk.fun. $FUNLESS looks like it will give an investor as much fun as $USELESS coin had use cases. Talk about truth in advertising.

Source: Bonk.fun

But even small bubbles can be very lucrative. Case in point: A student I mentor skipped consulting this summer, to launch and “rug” (dump) Solana memecoins.

Greater fool, meet greater dopamine

Why buy from insiders during the pump? It’s not because everyone’s been duped. Many buyers know there’s no “there” there. Motivations include:

- Momentum/greater-fool: Catch the move and try to exit before the music stops. Sometimes works.

- Ignorance: Some actually believe the story. What?

But mostly it’s gambling addiction.

Small unit bets (unit bias on $0.0000030 tokens);

- Instant “payoff” (fruit-fly life cycles);

- Lottery skew (20-to-1 shots that occasionally hit 20x);

- Addictive, gamified UX (zero-commission, one-tap swaps, 24/7 dopamine);

- Social identity & FOMO (your group chats “made life-changing gains” in $MELANIA. Can you sit out the next one?).

Without the dump, there is no pump

So yes there can be “reasons” for these mini bubbles. But with so many losing so much money, why do they remain so pervasive?

The key is that we/they need the dump. Because it’s the near misses that light up the same brain circuits as slots. Intermittent rewards keep the handle cranking. And there are always just enough winners to restock the pond. Once one chance fades, another takes its place. The dump is the tinder for the next pump. If everybody wins (e.g. NVIDIA), there’s no need for new gambles.

Like sportsbooks, you’ll lose. Often. Sports gamblers are aware of this harsh reality. So are memecoiners.

But there’s always a new table, a new coin, a new ticker. Society pays the bill in dopamine debt and financial nihilism. If you need a housing down payment, lottery skew feels rational: $1,000 in index funds won’t move the needle for years; one 100x might do it tomorrow.

Lack of value is the feature

Modern bubbles require buyers who knowingly swing at air. Real businesses have ceilings and cash-flow gravity. Memes don’t. If the only “fundamental” is more buyers later, upside is bounded only by the reach of the influencers, and the half-life of a joke.

Insiders, market makers, and venues eat first. But the late buyers aren’t deluded. It’s not investing. It’s not about CAGR. It’s about one 10x. Or 100x. If it hits, there’s your down payment. If not, there’s another pump tomorrow.

Old gambling, meet new gambling

Casinos had chips, drinks, and carpet. Today the casino sits in your phone with a confetti UX and a social feed. The expected value didn’t improve, but the delivery did. We replaced velvet ropes with push notifications.

A casino needs more and more and more things to bet on. Wall Street insiders and crypto bros are good at providing them.

We’ve financialized memes. And thus meme-ified finance. Crypto, stocks, sportsbooks, betting on who will be the next President. It’s all the same. A gamble available every minute of every day. Quick results. Chase the next one.

There’s a reason why crypto/stock and soon sports-betting platform Robinhood entered the S&P500 the same day Caesars Entertainment left. On the day they passed like two ships in the night, Caesars was worth only $5.3 billion. Robinhood is now over $100 billion. And yesterday ICE, the world’s largest futures exchange, announced that it is investing in sportsbetting and prediction pioneer Polymarket.

That’s where the money is. Because every day and every trade screams “Vegas”. But “better”.

The moral (such as it is)

Bubbles used to misprice projects and accidentally build the future. Today’s meme-driven, thin-float, options-juiced manias mostly misprice claims and build exits. They transfer wealth with theatrical flair and leave behind a highlight reel. Insiders who get in at zero will always make money. Just like SPACs. Just like the bucket shops and boiler rooms of years gone by. Except now it’s legal.

Outsiders are just playing whack-a-mole.

It sounds OK. Until you realize it’s an addiction. With all the harms of other forms of betting. And an indicator that we are failing at finance.

Disclaimer:

This article is reprinted from [Mensmercatus]. All copyrights belong to the original author [Rasheed Saleuddin]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?