The Carnival and Concerns of U.S. Treasury Tokenization

Translator’s Note: As real-world asset (RWA) tokenization accelerates, U.S. government bonds stand out as the most dynamic and influential category, driven by their superior liquidity, stability, attractive yields, increasing institutional engagement, and their unique compatibility with tokenization mechanisms.

You might ask whether tokenizing these assets involves elaborate legal complexities. In practice, it does not. A transfer agent manages the official shareholder registry, and blockchain replaces legacy systems as the system of record.

To clarify the structure of major U.S. government bond tokens, this article applies three frameworks: a token overview (including protocol details and issuance data), regulatory and issuance structures, and on-chain use cases. Importantly, U.S. government bond tokens are digital securities subject to federal securities laws and related regulations. This regulatory status directly impacts issuance volume, number of holders, and on-chain utility, all of which interact dynamically. Moreover, contrary to popular assumptions, U.S. government bond tokens face notable limitations. Let’s dive into how this sector has evolved and where it’s heading.

Tokenization of Everything

“Every stock, every bond, every fund, every asset can be tokenized.”

— Larry Fink, BlackRock CEO

The passage of the U.S. GENIUS Act ignited global—and South Korean—interest in stablecoins. But are stablecoins the final frontier for blockchain finance?

Stablecoins are tokens on public blockchains pegged to fiat currencies. At their core, they are monetary instruments searching for real-world use cases. As the Hashed Open Research x 4Pillars Stablecoin Report discusses, stablecoins serve functions in remittances, payments, settlements, and more. Yet, the hottest narrative for “true stablecoin potential” is real-world assets (RWA).

RWAs are tangible, traditional assets—such as commodities, equities, bonds, or real estate. These assets are represented as digital tokens and traded on blockchains.

Why have RWAs become the next focal point after stablecoins? Because blockchain doesn’t just reinvent money—it has the power to fundamentally rebuild the infrastructure of traditional financial markets.

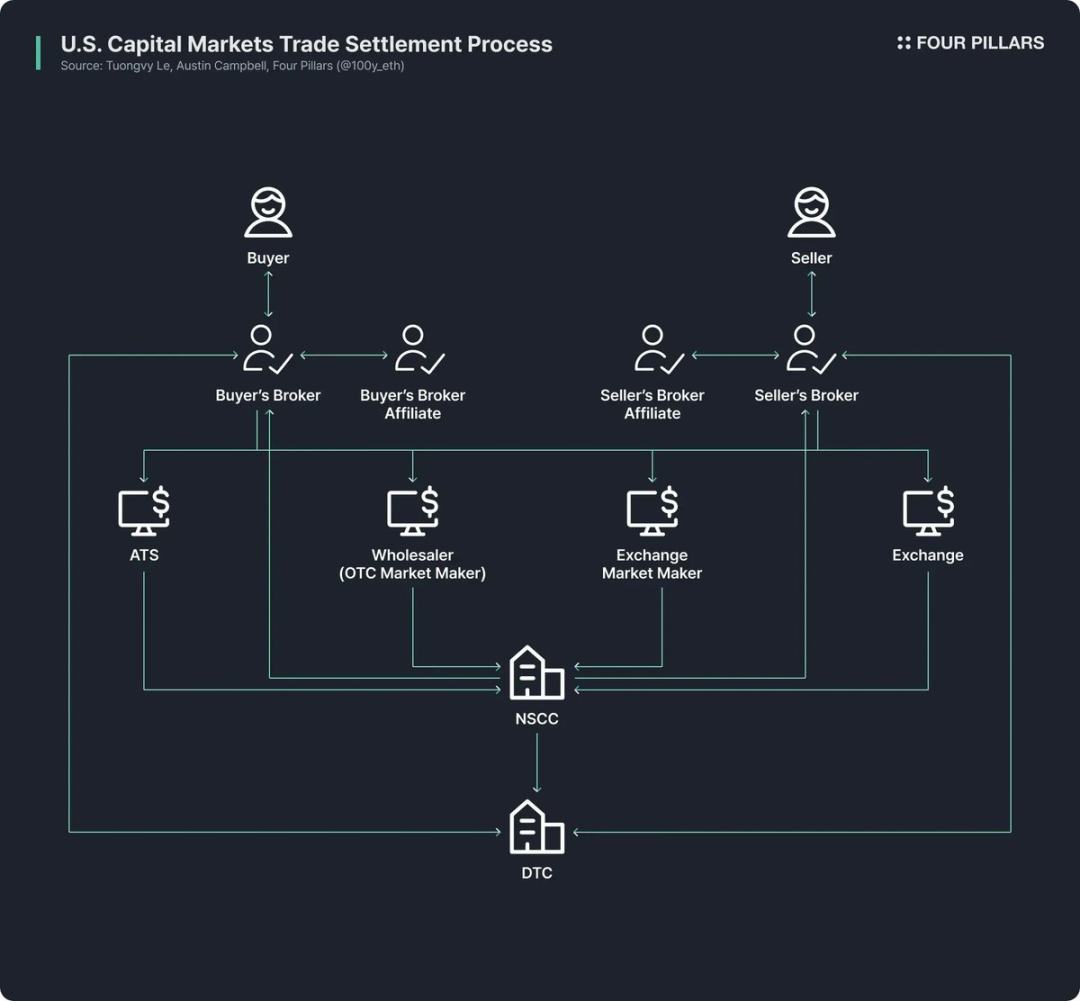

Despite fintech innovations enhancing retail access, core financial markets still operate on infrastructure created half a century ago.

The structure of U.S. equity and bond markets dates to reforms following the “paperwork crisis” in the late 1960s and the regulatory overhaul of the 1970s. This led to the creation of the Securities Investor Protection Act and amendments to securities laws, as well as institutions like the Depository Trust Company (DTC) and National Securities Clearing Corporation (NSCC). For over fifty years, this complex ecosystem has struggled with redundant intermediaries, settlement delays, opacity, and high compliance costs.

Blockchain can fundamentally transform these systems, making markets more efficient, transparent, and accessible. Blockchain upgrades can deliver immediate settlement, programmable finance via smart contracts, direct ownership without intermediaries, enhanced transparency, reduced cost, and fractional investing.

As a result, public agencies, financial institutions, and enterprises are moving aggressively to tokenize financial assets. For example:

- Robinhood is developing a native blockchain to support stock trading and has petitioned the SEC to establish a federal regulatory framework for RWA tokenization.

- BlackRock and Securitize launched BUIDL, a tokenized money market fund with $2.4 billion in assets.

- SEC Commissioner Paul Atkins has voiced public support for stock tokenization, while the SEC’s internal cryptocurrency working group has institutionalized regular RWA-focused meetings and roundtables.

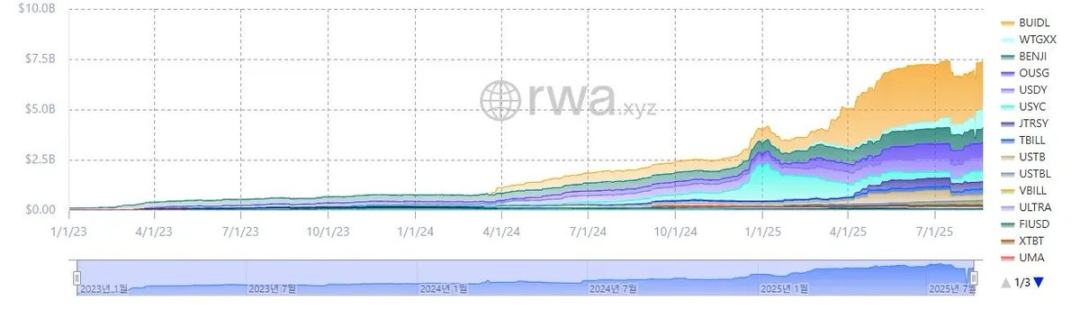

(Source: rwa.xyz)

Putting the hype aside, RWA market growth is real. As of August 23, 2025, total RWA issuance stood at $26.5 billion—up 112% year-over-year, 253% over two years, and 783% over three years. Tokenized assets span diverse categories, with U.S. government bonds and private credit leading, followed by commodities, institutional funds, and equities.

U.S. Government Bonds

(Source: rwa.xyz)

In the RWA landscape, U.S. government bond tokenization is by far the most active. As of August 23, 2025, the U.S. bond RWA market reached about $7.4 billion—an explosive 370% year-over-year increase.

Both global financial institutions and leading DeFi platforms are rapidly entering the space. BlackRock’s BUIDL fund tops the list with $2.4 billion in assets; DeFi protocols like Ondo build on BUIDL and WTGXX-backed RWA tokens to offer funds like OUSG, with assets around $700 million.

Why are U.S. Treasuries the most tokenized and largest segment within RWA? Reasons include:

- Unmatched liquidity and stability: U.S. Treasuries are the world’s most liquid assets, widely regarded as virtually risk-free, and command global trust.

- Global accessibility: Tokenization lowers barriers, enabling international investors easier access to U.S. Treasury markets.

- Strong institutional adoption: Major players—including BlackRock, Franklin Templeton, and WisdomTree—lead with tokenized funds and Treasury products, establishing market trust.

- Stable, attractive yields: U.S. Treasuries reliably yield around 4%.

- Low tokenization friction: While there’s no RWA-specific regulatory regime yet, current rules allow for basic Treasury tokenization.

How U.S. Government Bonds Are Tokenized

How are U.S. Treasuries represented on-chain? While the process may appear legally complex, it is straightforward under existing securities laws (issuance structures vary by token; the following example is illustrative).

Importantly, current “U.S. Treasury-based RWA tokens” do not tokenize the bonds themselves but rather tokenize funds or money market funds that invest in Treasuries.

Traditionally, U.S. Treasury funds—public asset management vehicles—must appoint an SEC-registered transfer agent. These financial institutions or service providers, designated by the issuer, maintain investor ownership records. The transfer agent is legally responsible for shareholder record-keeping and ownership management.

The fund directly issues tokens representing shares on-chain, and the transfer agent manages the official shareholder registry using a blockchain system.

Since the U.S. lacks a dedicated RWA regulatory framework, token holders do not yet enjoy full statutory ownership of fund shares. However, transfer agents typically manage shares based on on-chain token records. In the absence of hacks or exceptional incidents, token ownership usually confers indirect fund rights.

Leading Protocols & RWA Analysis Methodologies

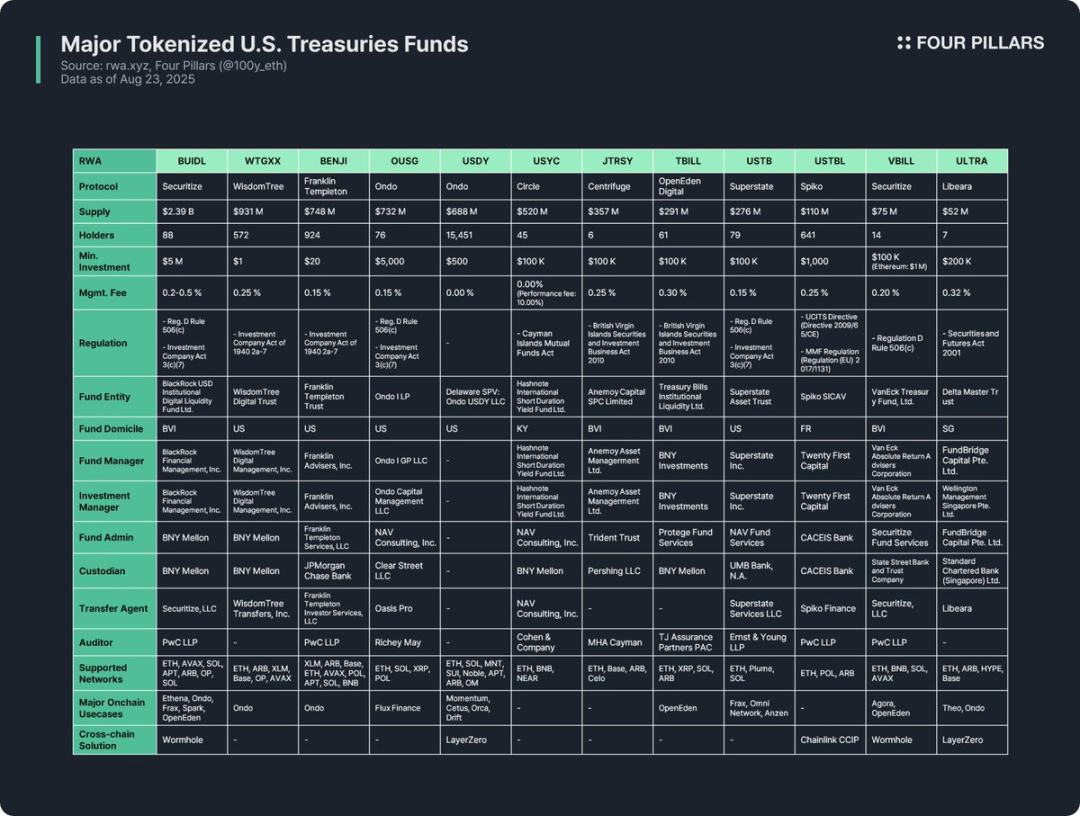

Tokenized U.S. Treasury funds dominate the RWA sector, prompting numerous protocols to issue such tokens. This analysis evaluates 12 leading tokens across three dimensions:

(1) Token Overview

Includes protocol background, issuance volume, holder count, minimum investment, and management fees. Protocols differ by fund structure, tokenization method, and on-chain utility; understanding the issuer provides rapid insight into token fundamentals.

- Issuance volume signals fund size and market demand.

- Holder count reflects legal and on-chain application context. Low numbers often result from regulatory requirements for accredited or qualified investors—such tokens are typically restricted to whitelisted wallets and rarely integrated into DeFi at scale.

(2) Regulatory Framework & Issuance Structure

Clarifies the legal rules and all core entities involved in fund management.

Analysis of 12 U.S. Treasury fund-based RWA tokens finds regulatory frameworks grouped by fund location and investor scope:

- Regulation D Rule 506(c) + Investment Company Act Section 3(c)(7):

The most prevalent model. Regulation D Rule 506(c) allows open solicitation, provided all investors are accredited, with strict verification. Section 3(c)(7) grants private funds an SEC registration exemption but requires all investors to be qualified purchasers and the fund to maintain private status. The combination expands eligible investor pools and avoids registration and disclosure burdens. Examples: BUIDL, OUSG, USTB, VBILL.

- Investment Company Act of 1940 Section 2a-7:

Applies to SEC-registered money market funds, which must maintain stable NAV, invest only in high-quality, short-term instruments, and ensure liquidity. Unlike private fund models, these can publicly issue shares to retail investors, with low minimums. Examples: WTGXX, BENJI.

- Cayman Islands Mutual Funds Act:

For open-ended mutual funds registered in the Cayman Islands, requiring a minimum initial investment of $100,000. Example: USYC.

- BVI Securities and Investment Business Act, 2010 (Professional Funds):

Regulates British Virgin Islands investment funds. Professional funds serve non-public investors with a $100,000 minimum. Funds soliciting U.S. investors must also comply with Regulation D Rule 506(c). Examples: JTRSY, TBILL.

- Other frameworks:

Funds adhere to domicile-specific regulatory frameworks. For example, USTBL from France’s Spiko complies with EU UCITS and Money Market Fund Regulation; ULTRA from Singapore’s Libeara adheres to the Securities and Futures Act of 2001.

Core participants in the fund structure include:

- Fund entity: pools investor capital (commonly U.S. trust, BVI, or Cayman offshore structures)

- Fund manager: responsible for overall operations

- Investment manager: manages investments and portfolios; may be separate from the fund manager

- Administrator: handles accounting, NAV calculation, investor reporting

- Custodian: safeguards bonds, cash, and other assets

- Transfer agent: maintains shareholder registry and legally records ownership

- Auditor: independent accounting firm protecting investor interests through external audits

(3) On-Chain Applications

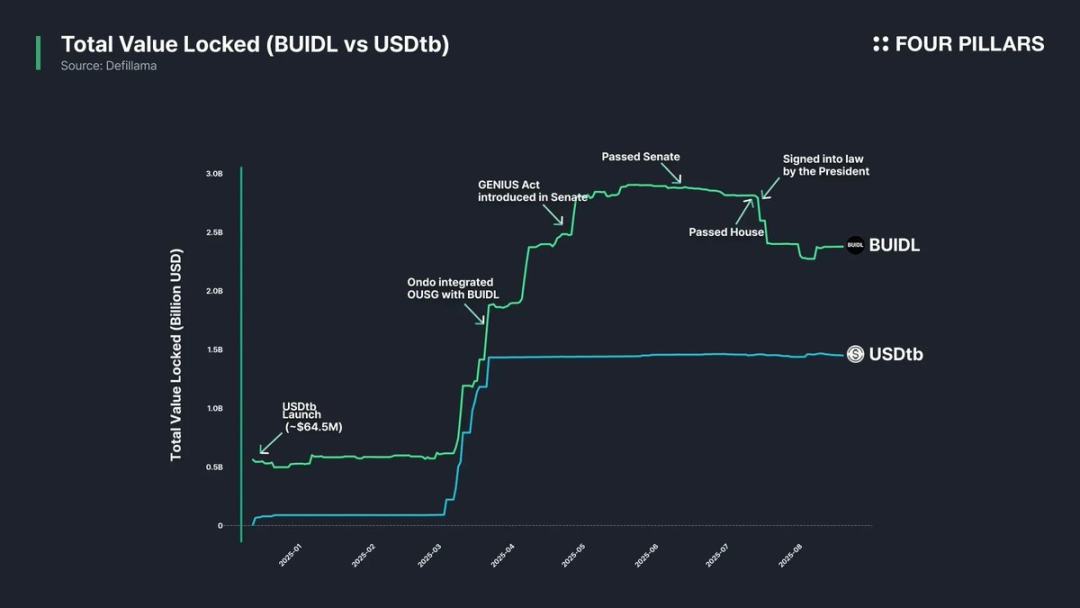

The core value of tokenized bond funds lies in their on-chain potential. Compliance and whitelist requirements currently hinder direct DeFi adoption, but some protocols have found indirect paths: DeFi platforms like Ethena and Ondo use BUIDL as collateral to issue stablecoins or as portfolio holdings for retail exposure. BUIDL has become the largest bond token precisely by integrating with major DeFi protocols.

Multi-chain interoperability is also crucial. Most bond fund tokens are issued on multiple networks, giving investors flexibility. While liquidity need not match stablecoin volumes, cross-chain capabilities enhance usability and seamless transfer.

Insights

After analyzing 12 top U.S. Treasury fund RWA tokens, here are the key insights and limitations:

- On-chain utility is restricted: RWA tokens remain digital securities, subject to real-world regulatory frameworks. All bond fund tokens are limited to KYC-completed, whitelisted wallets for holding, transfer, or trade. This creates barriers to permissionless DeFi.

- Holder numbers are low: Regulatory thresholds mean most bond fund tokens have few holders. Retail-focused money market funds like WTGXX and BENJI see higher numbers, but most funds require accredited, qualified, or professional investors—often have fewer than ten holders.

- B2B applications predominate: Given these constraints, bond fund tokens lack direct retail DeFi use and are instead adopted by large DeFi protocols. For example, Omni Network uses Superstate’s USTB for treasury management; Ethena leverages BUIDL as collateral for USDtb, indirectly benefiting retail users.

- Regulatory fragmentation: Issuers operate across jurisdictions, following divergent frameworks. Tokens like BUIDL, BENJI, TBILL, and USTBL each fall under different regimes, leading to significant differences in investor eligibility, minimum investment, and use cases. This fragmentation complicates investor education and obstructs standardized DeFi adoption, curtailing on-chain applications.

- No dedicated RWA regulation: There is no explicit legal regime for RWA. While transfer agents now maintain shareholder registers via blockchain, on-chain token ownership is not yet legally equivalent to real-world securities ownership. Clear regulatory rules are needed to bridge this gap.

- Limited multi-chain solutions: Despite almost all bond fund tokens supporting multi-chain issuance, very few practical cross-chain implementations exist. Further development is necessary to prevent liquidity fragmentation and ensure seamless user experiences.

Disclaimer:

- This article is republished from [Foresight News] and is copyright of the original author [@100y_eth]. For republication concerns, contact the Gate Learn team, who will process requests according to established procedures.

- Disclaimer: The opinions and views expressed are those of the author alone and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Copying, distribution, or plagiarism of translated content is not permitted unless proper reference to Gate is provided.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?