Prediction market information overload, aggregator track becomes the new "traffic entrance"

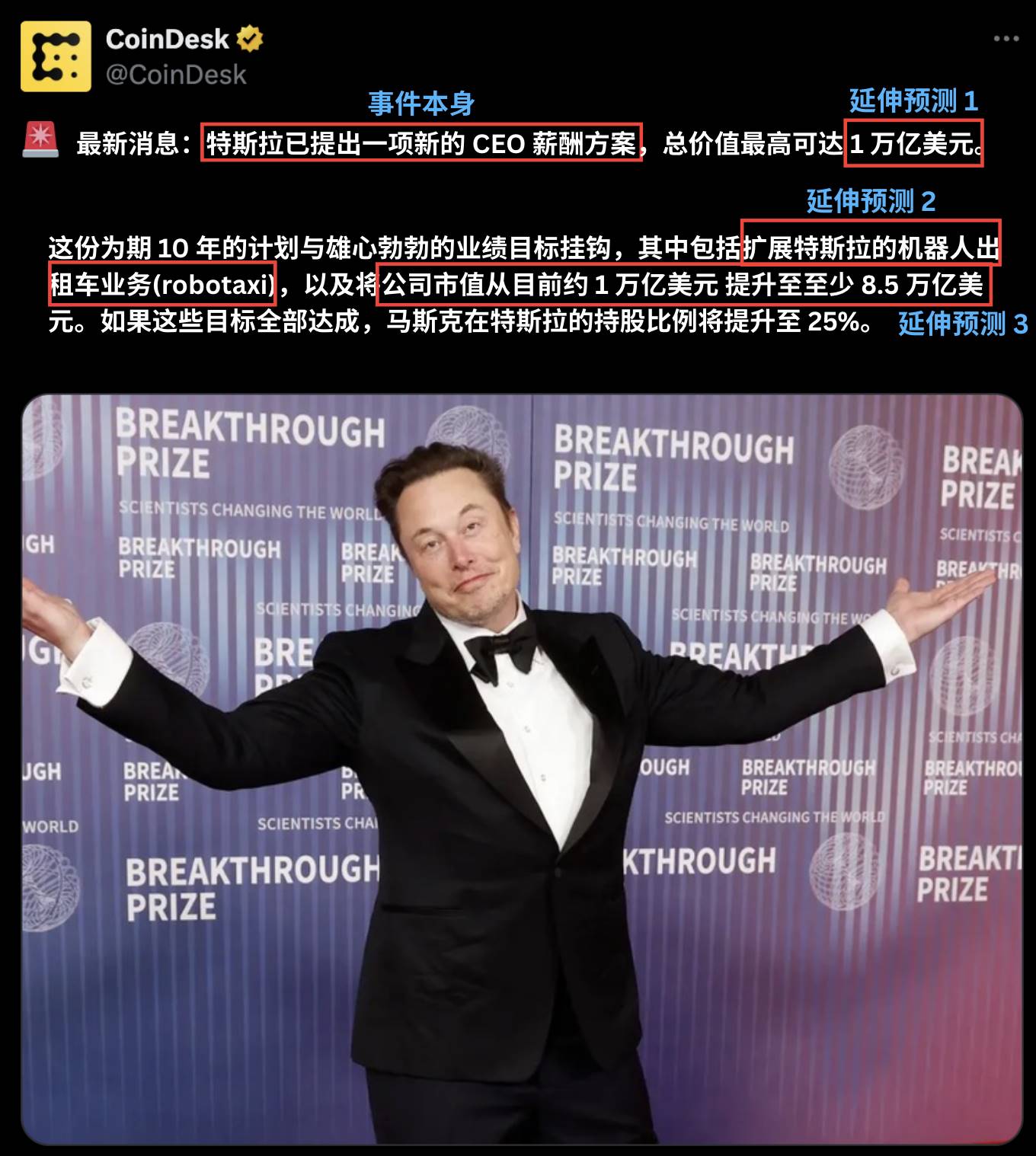

Elon Musk’s compensation plan was just announced, and traders are actively searching for related questions on prediction markets—not to buy Tesla shares, but to find relevant topics.

For these traders, one headline instantly spawns a range of forecasting themes: Who is likely to become the world’s first trillionaire? When will Musk break the trillion-dollar mark? Where is Tesla’s market cap headed this quarter? Which city will see the first Robotaxi rollout?

This is the daily reality for prediction market traders: each news story often leads to multiple topics and opportunities across several prediction platforms.

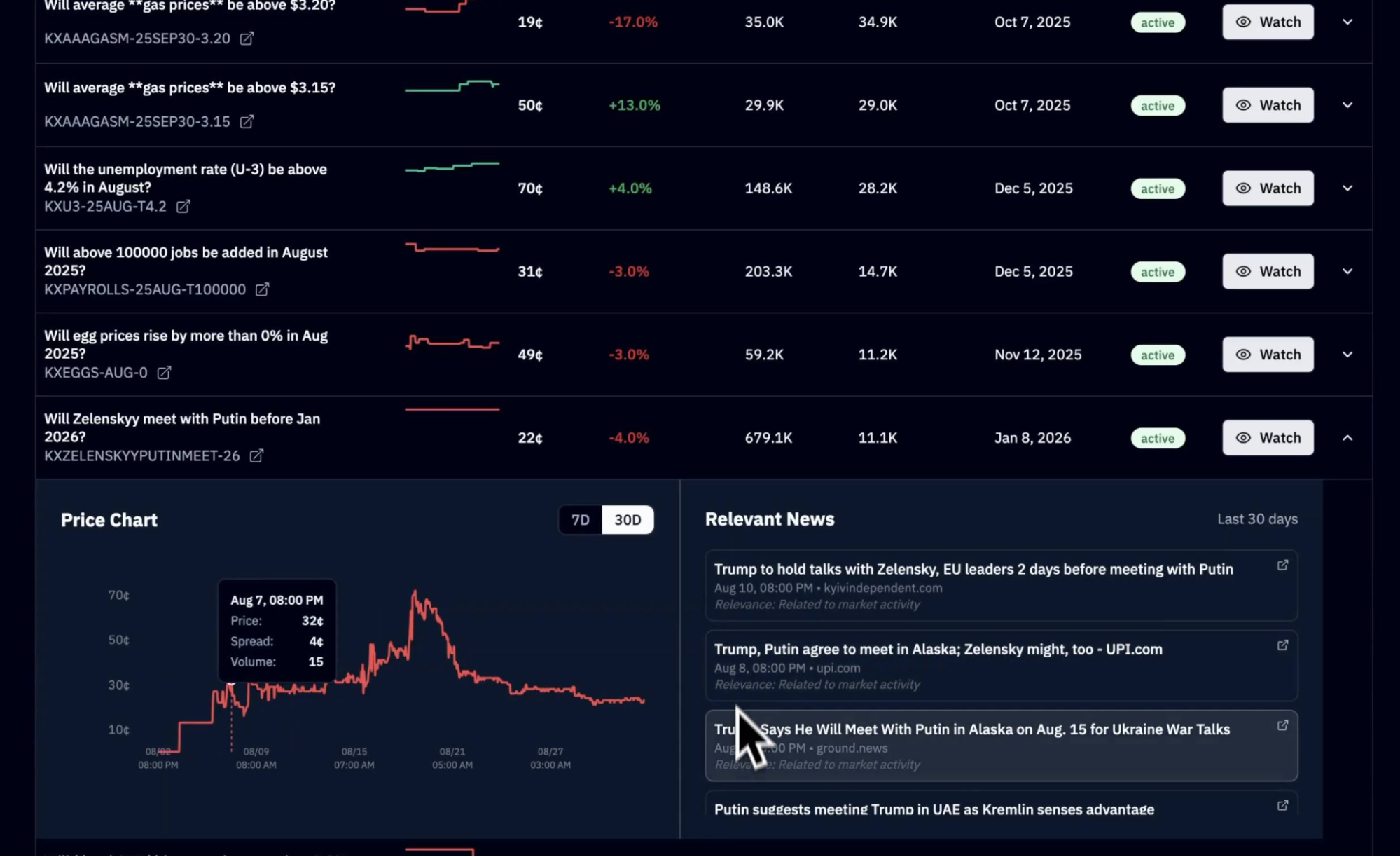

Currently, traders need to search multiple venues—Polymarket, Kalshi, Limitless, and others—to find relevant markets, compare odds, and monitor price changes.

This single news event exposes the shortcomings of current prediction markets.

If news could be matched automatically to relevant prediction markets, trading efficiency would increase significantly. Conversely, swiftly identifying the key points after publication would improve win rates.

Having many platforms simultaneously creates unprecedented challenges for traders: finding the best odds requires switching between sites, capturing arbitrage opportunities demands monitoring price differences across venues, and obtaining comprehensive information means continuously tracking market developments.

This fragmented information not only consumes time and energy but also prevents traders from making optimal decisions.

Trading Volumes Chase Meme Coins, but the Information Noise Is Greater

Recall the meme coin boom earlier this year?

In 2024, the Pumpfun launchpad quickly rose to prominence.

New coins flooded the market at a rapid pace. With such a large and fast-growing market, manual tracking of each new project became highly unrealistic, and traders were quickly overwhelmed. In this chaos, trading bots and aggregation platforms emerged. They helped users filter information, identify opportunities, and simplify complex trading workflows.

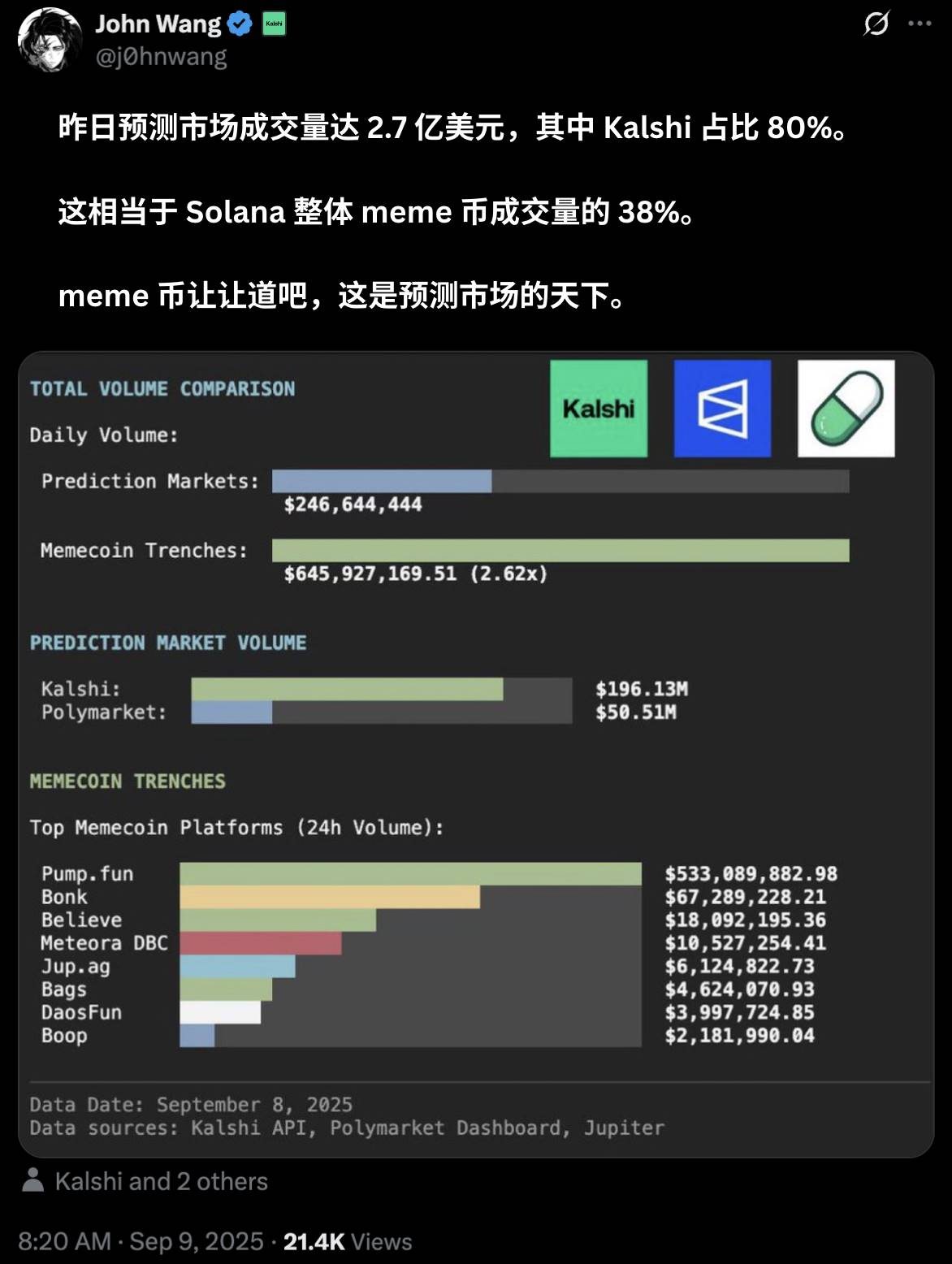

This scenario is now repeating in prediction markets. On September 8, prediction market volume reached $270 million in a single day, with Kalshi capturing 80%, equivalent to 38% of Solana’s overall meme coin transaction volume. Prediction markets are thriving and beginning to challenge the meme coin sector.

As more prediction market platforms emerge, traders once again face the issue of information overload.

When supply exceeds human processing capacity, aggregation and automation tools become essential. This is a process experienced by all rapidly growing crypto ecosystems.

Prediction markets are now at this turning point.

Major Players Compete, New Entrants Emerge

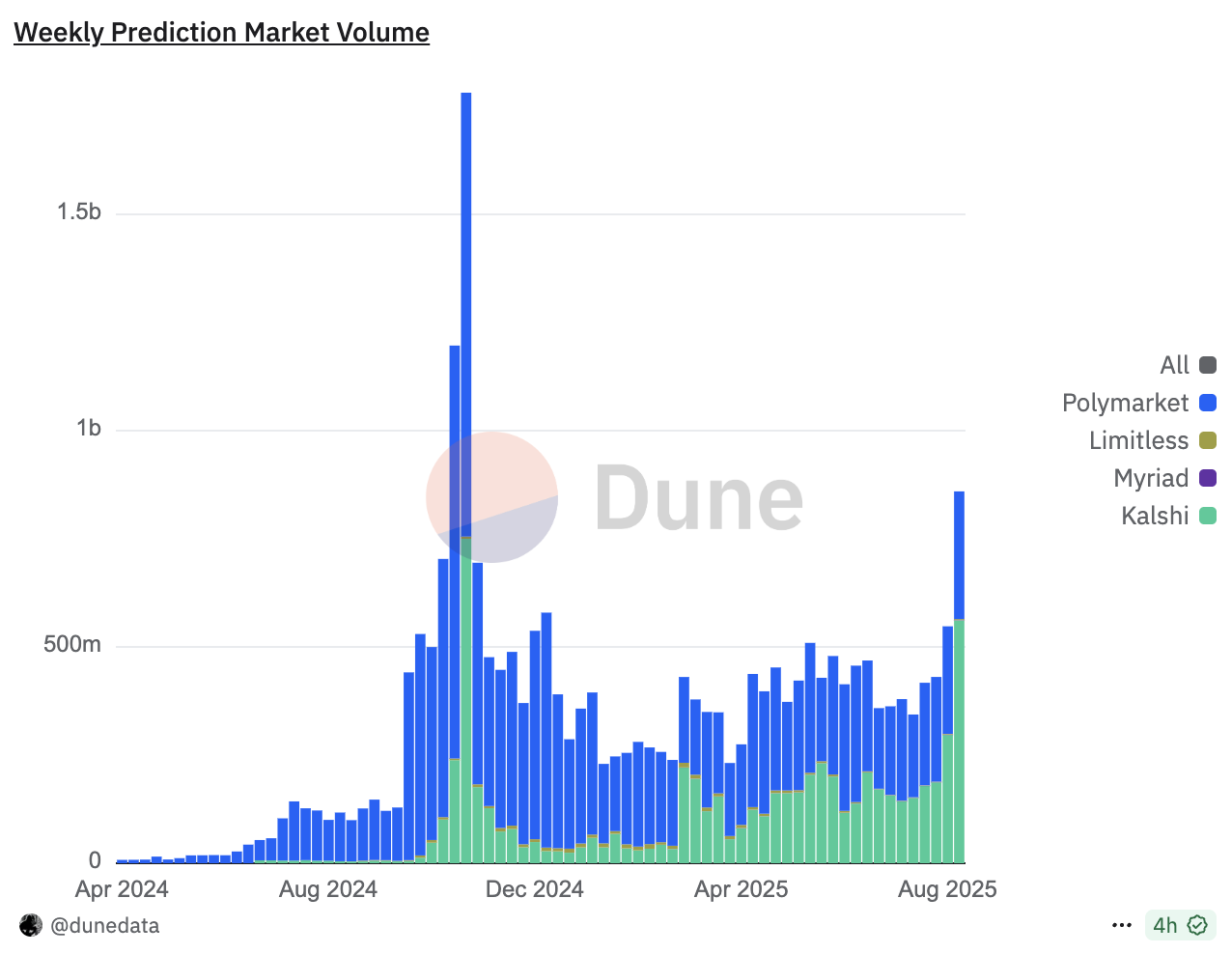

The prediction market surge has been evident for months.

In May, the U.S. Commodity Futures Trading Commission (CFTC) withdrew its appeal against Kalshi. That same month, Kalshi began supporting crypto deposits—including USDC, RLUSD, SOL, BTC, WLD, and XRP—offering users more funding options. In June, Kalshi secured $185 million in Series C funding led by Paradigm, raising its valuation to $2 billion and officially joining the ranks of unicorn companies.

Meanwhile, Polymarket reportedly plans to raise about $200 million at a valuation exceeding $1 billion. Both giants are attracting significant capital, but Polymarket’s journey in the U.S. has been challenging. In 2022, the CFTC fined Polymarket $1.4 million for operating an unregistered binary options market, forcing the platform to restrict access for U.S. users.

Just as Polymarket gained recognition for accurately forecasting the 2024 U.S. presidential election result, the FBI arrived eight days later and seized founder Coplan’s computer and phone. During the Trump administration, the investigation ended abruptly, Polymarket acquired QCEX (its “return ticket” to the U.S.), and on September 4, the CFTC officially approved its re-entry.

Relaxed regulation and ample capital have created the perfect groundwork for prediction market growth.

At this moment, the competitive landscape is quietly changing. After recruiting crypto KOL John Wang as Head of Crypto, Kalshi’s performance improved significantly. Since August 25, its weekly trading volume has surpassed Polymarket, intensifying the rivalry between the two giants.

While the major players compete, new entrants are already preparing to join the market: MyriadMarkets (founded by Rug Radio and Decrypt Media’s Farokh), Truemarkets, HedgehogMarket, DriftProtocol, and Limitless.

Prediction markets are being reshaped rapidly, and these platforms are all seeking to capture a share of this growing market.

Just as early aggregation tools emerged during the meme coin boom—from Bananabot to GMGN, and later Axiom—the prediction market competition is now generating significant demand for aggregators.

Aggregators: Early-Stage Prototypes Appear

The pain points mentioned at the beginning have given rise to a batch of innovative solutions. While most are still in beta, they already demonstrate considerable potential.

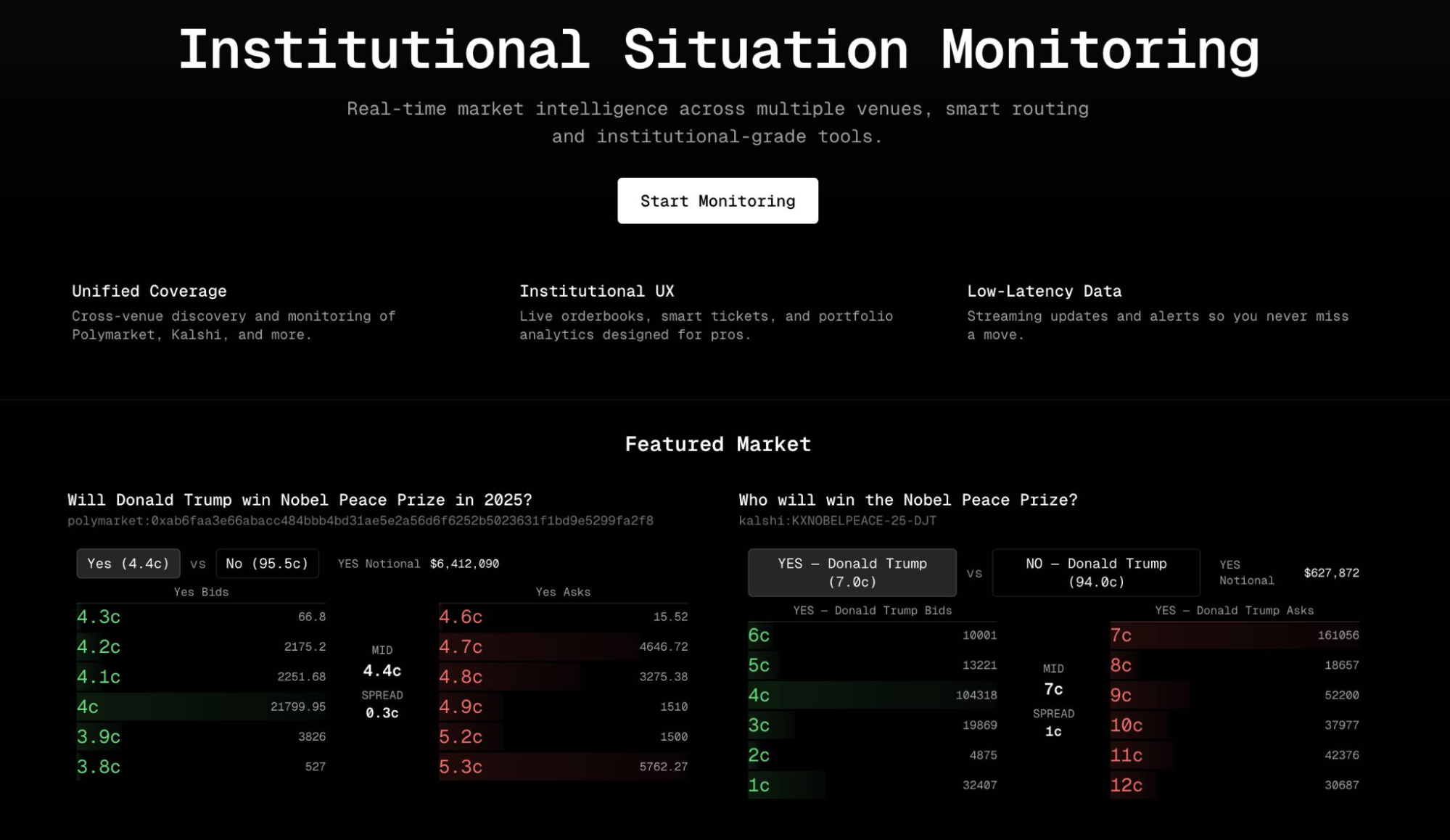

@rileyxcook developed monitorthesituation.lol, which provides live cross-platform order book displays and automatically matches similar markets on Kalshi, Limitless, and Polymarket, helping traders instantly identify price differences.

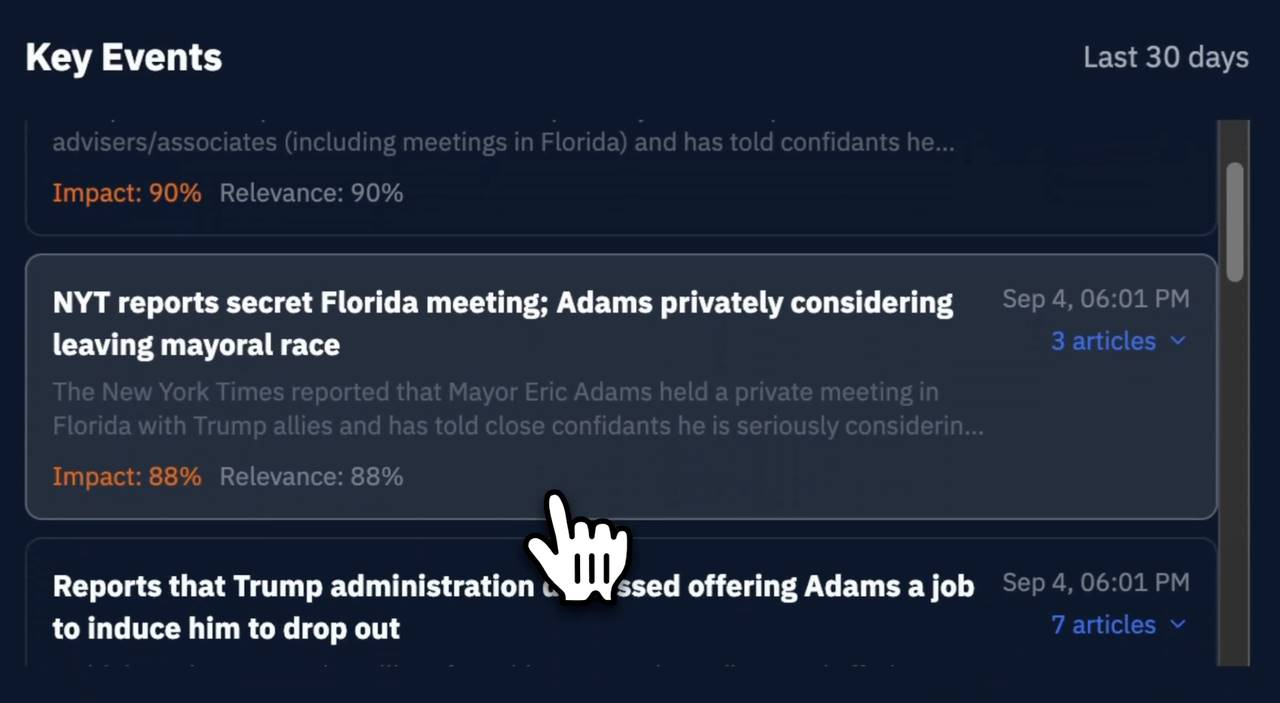

Verso Trading has built a more intelligent news engine, consolidating duplicate headlines into single events and offering impact and relevance scores. This helps users see which news truly influences Kalshi contract prices. The platform will soon launch a low-latency real-time alert feature to notify users instantly when news or tweets might affect the market.

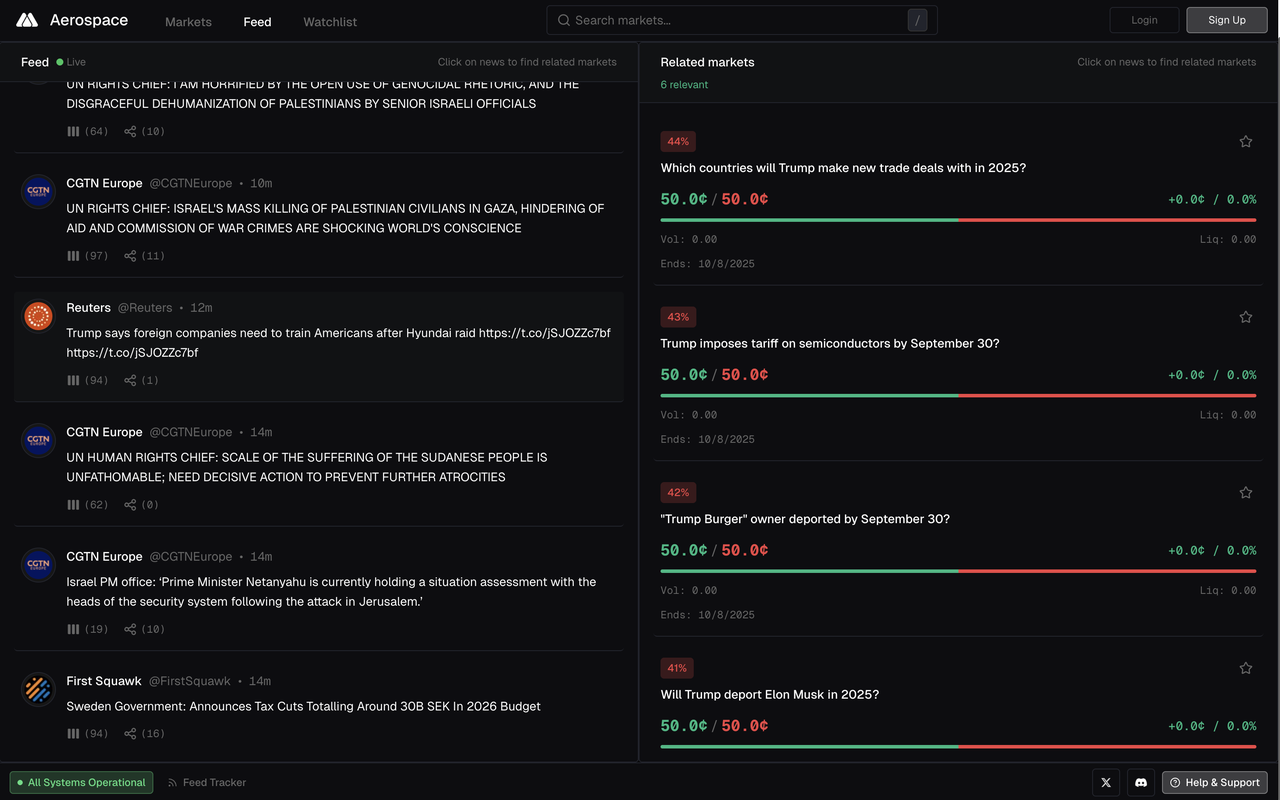

At just 16 years old, engineer @agpkeleta created Aerospace, a prediction market trading terminal with real-time news push and precise matching of alpha information and relevant markets. This enables traders to quickly target market opportunities before the market resolves in favor of “Yes.” Currently, the website supports Polymarket, with Kalshi integration coming soon.

These tools all address the same core issue: integrating news information with relevant prediction markets on a unified platform to facilitate complex trading. Although still in early stages, these beta versions have already demonstrated the value of aggregators.

Future Outlook: Larger Opportunities Ahead

When a market gap arises, opportunities follow.

The rise of prediction market aggregators is not accidental but the inevitable result of a thriving ecosystem.

A flourishing ecosystem requires diverse infrastructure, as seen during the meme coin boom earlier this year. Once core asset categories mature, tools, analytics platforms, and automation solutions emerge rapidly, eventually forming a complete market loop.

Prediction markets today may be at a similar critical juncture.

As more platforms emerge and the user base expands, demand for specialized tools will continue to grow.

Aggregators may be just the beginning.

We will likely see more innovation, such as cross-platform arbitrage bots, AI-driven market analysis tools, and institutional-grade risk management systems. Prediction markets are evolving from simple “betting” into a complex trading ecosystem requiring professional tools and in-depth analysis. Projects that provide core infrastructure during this transformation may become the most important components of this emerging ecosystem.

Additionally, since prediction markets are the focus here, AI was asked to forecast the sector’s future. Below are its predictions:

Short-term (6–12 months):

- Aggregator competition will begin

- Polymarket vs Kalshi: both will launch more similar markets, leading to intense price competition for the same events across platforms

- New platforms will replicate popular markets, increasing homogenization

Mid-term (1–2 years):

- API integration becomes standard; successful aggregators will drive platforms to improve their APIs or risk losing users

- Institutional investors enter: hedge funds and quant teams will start using prediction market arbitrage extensively, reducing retail advantages

- Vertical segmentation emerges: specialized prediction markets for sports, politics, and crypto will rise, and general platforms will diversify

Long-term (3–5 years):

- Major platform reshuffling: only two to three mainstream platforms will remain, with others being acquired or exiting

- Aggregators become comprehensive gateways: leading aggregators may launch their own markets, serving as both channels and platforms

- AI-driven prediction becomes mainstream: AI will automatically analyze news and social media data for betting, making manual prediction a niche activity

Most ambitious prediction: In the future, prediction market aggregators will resemble today’s brokerages, offering not only price discovery but also leverage, options, and portfolio investment tools. By then, prediction markets will have evolved into a mature financial asset class.

Readers may consider which prediction is most plausible.

Disclosure:

- This article is reprinted from [TechFlow]. Copyright belongs to the original author [June, Deep Tide TechFlow]. For any concerns regarding republication, please contact the Gate Learn team for resolution in accordance with established procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless explicitly mentioning Gate, reproduction, distribution, or plagiarism of translated versions is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?