# Foreign Crypto Influencer Scam Tactics Exposed: Coordinated Manipulation, Artificial Hype, and Strategic Deception

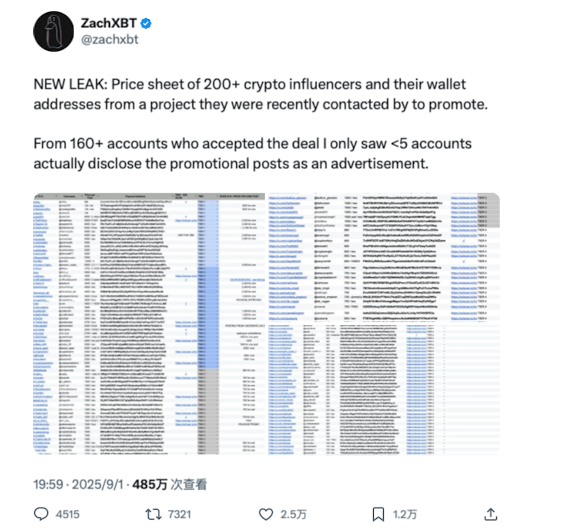

On September 1, while the market’s attention and liquidity converged on Trump’s $WLFI, prominent on-chain investigator @ZachXBT released another exposé.

He published a spreadsheet listing international KOLs (Key Opinion Leaders) who were paid to promote crypto projects on X to English-speaking audiences. The roster features numerous accounts, with total payments exceeding $1 million. Individual post rates ranged from $1,500 to $60,000, depending on the KOL’s stature.

ZachXBT noted that fewer than five KOLs on the list labeled their promotional posts as “ads,” meaning the vast majority of paid posts weren’t clearly disclosed as such. As a result, it’s often unclear whether a post is sponsored content or a genuine personal recommendation.

Soon after, another investigator, @dethective, further analyzed and categorized the original spreadsheet. This analysis revealed even more elaborate methods these international KOLs use when engaging in paid promotions.

One Person, Multiple Accounts: Double-Dipping on Project Payments

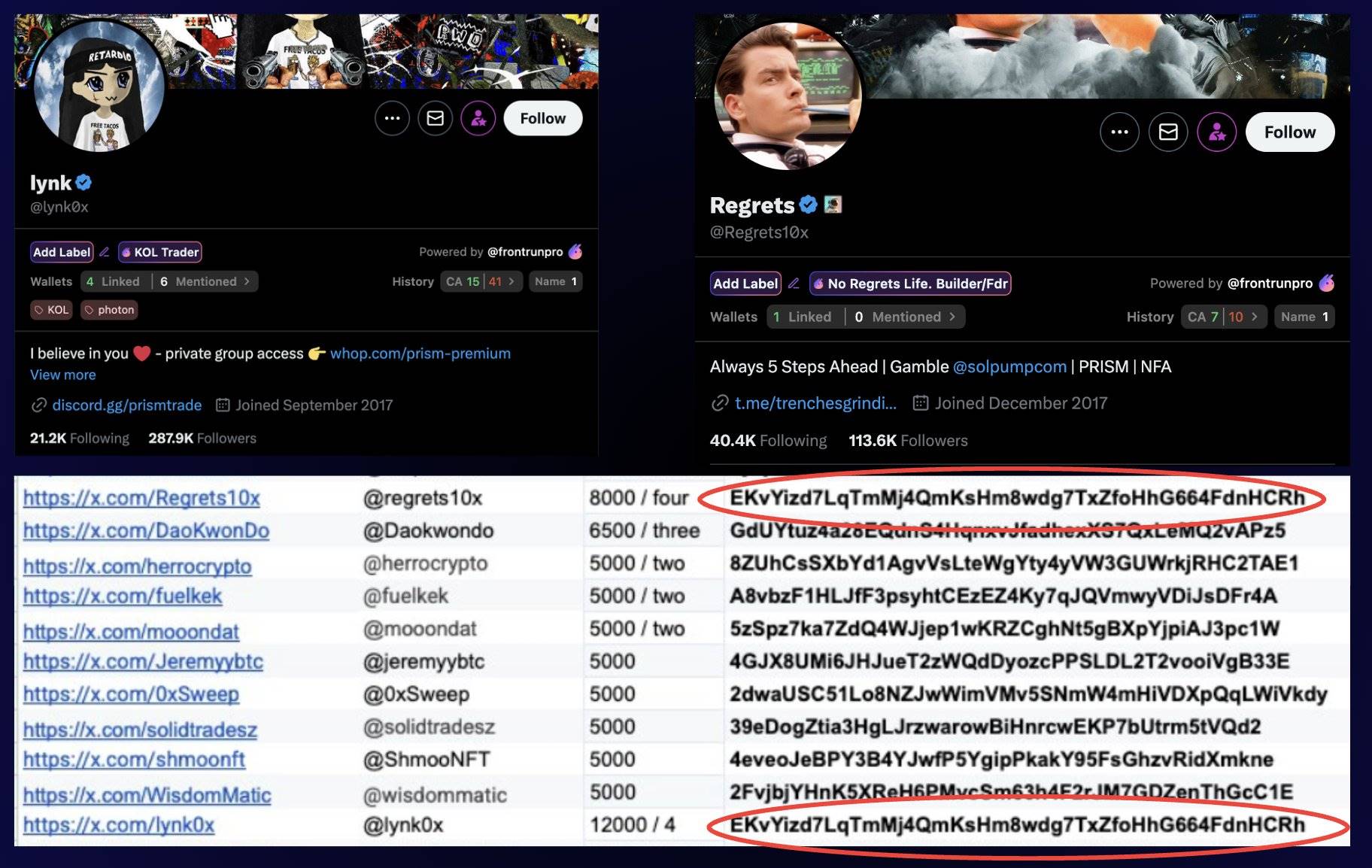

In @dethective’s review, one glaring issue was that certain wallet addresses appeared repeatedly in the data.

This points to single wallets linked to multiple KOL accounts, all collecting promotional fees—sometimes several times—from the same project.

For example, both @Regrets10x and @lynk0x appeared in the spreadsheet. The former was paid $8,000 for four posts; the latter received $12,000 for the same number of posts, possibly reflecting differences in follower count.

However, both accounts used the identical wallet address:

EKvYizd7LqTmMj4QqmKsHm8wdg7TXzFoHHg664FdnhCRh

After thorough cross-checking, @dethective uncovered approximately 10 instances of such wallet duplication in the dataset.

One likely explanation is that some international KOLs employ burner or affiliated accounts to broaden their promotional reach, but fail to change wallet addresses, making these patterns easy to spot.

Looking deeper, the lack of wallet separation—whether due to negligence or indifference—actually exposes a coordinated approach: flooding social timelines with posts from multiple accounts tied to the same individual amplifies project visibility and can trigger follower FOMO.

As expected, the two KOLs exposed here responded to the allegations.

@lynk0x denied receiving payments, claiming in the comments that @Regrets10x was simply a friend and that sharing a wallet was mere coincidence. However, @dethective quickly posted contrary evidence:

The wallet in question received $60,000 from a “Boop” project airdrop, and collecting the airdrop required linking to an X account—effectively confirming the account–wallet relationship and undermining the denial.

@Regrets10x offered a more casual response, sidestepping the accusation and maintaining that as long as he disclosed paid promotions in his posts, there was no problem.

Paid promotions are common, and transparent disclosure helps followers understand motivations and potential conflicts of interest. Professional KOLs typically include statements such as “sponsored” or “paid partnership” at the end of relevant posts.

The problem arises when two accounts controlled by the same person promote identical content, but only one account discloses the sponsored nature while the other remains silent. This strategy resembles persona and brand-building via a network of accounts.

Some have turned bulk account promotions into a business model.

Previously, research organization DFRLab published “Anatomy of a Twitter-Augmented Crypto Scam”, describing how certain gray-market operators control dozens of accounts, post up to 300 tweets daily, and use techniques like bulk account creation, automated replies, and cross-endorsement to manufacture the appearance of community consensus.

Operators often purchase aged accounts or mass-register new ones. They then rebrand them with new usernames and avatars to create the illusion of fresh KOLs. By using scripts to copy the same pitches into high-visibility tweet comments, they rapidly attract new followers.

“To The Moon”

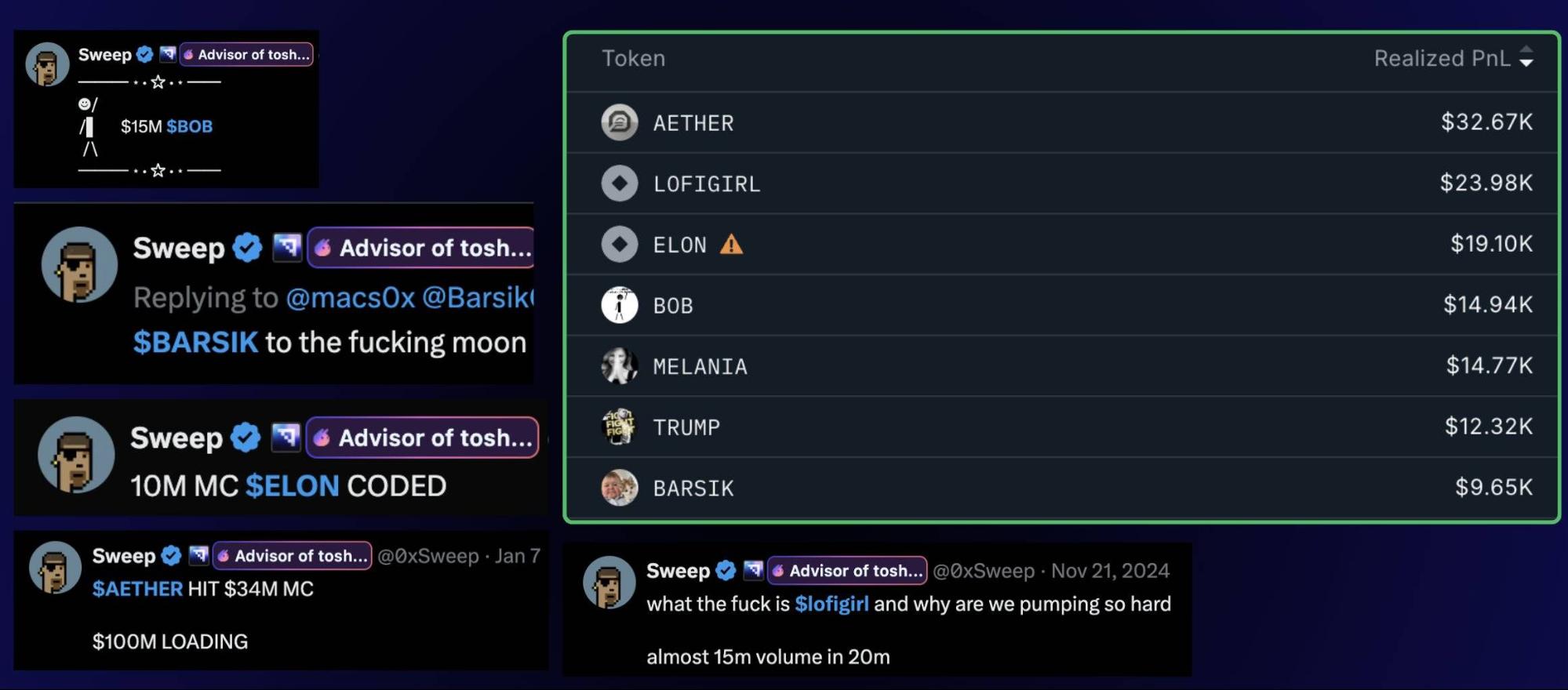

Another striking trend from the leak: Many of these international KOLs’ wallet profits directly align with the tokens they promote.

Put simply, these KOLs aren’t just sharing random opinions—they’re taking paid promotions, posting about tokens, and then personally trading those same tokens.

For instance, @0xSweep’s largest source of profit, according to @dethective’s wallet analysis, came from trading $AETHER, $BOB, $BARSIK, and similar tokens on the BullX platform.

All of these tokens feature in ZachXBT’s paid promotion spreadsheet, and @0xSweep repeatedly hyped their “to the moon” potential in his X posts.

Transaction data indicates that the KOL received payment, promoted the token, and then capitalized on the resulting price pump, as these profitable trades occurred just before or after the promotional posts.

This pattern indicates that when an account repeatedly shares trading “insights,” its earnings may come from paid marketing deals—not actual trading skill or market judgment.

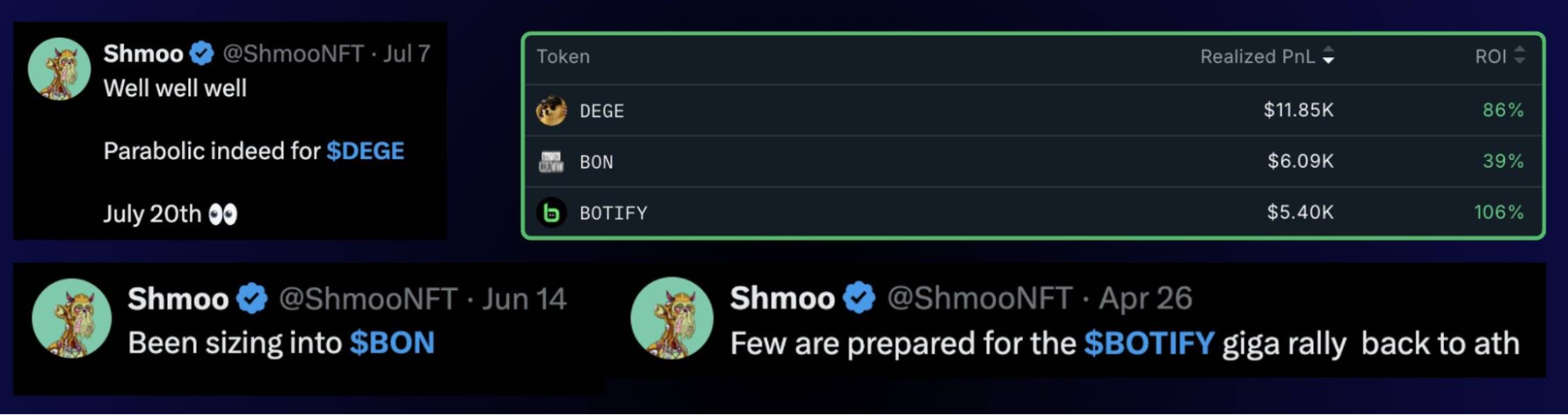

A similar pattern emerged with @ShmooNFT, who appears to generously promote about ten tokens daily on his Telegram channel.

However, on-chain analysis shows that his profitable trades—$DEGE, $BON, and $BOTIFY—were all tokens he promoted on X and were included in ZachXBT’s exposé.

The fundamental risk with this model is that KOL “recommendations” are self-serving: without clear ad labels, followers might believe the endorsements are impartial when, in fact, they’re paid sponsorships.

If the tokens do have merit, everyone wins. But if a string of so-called “gems” crash to zero, the KOL’s reputation and influence take a hit.

What makes this tactic particularly sophisticated is that international KOLs can extract three revenue streams: They receive free airdropped tokens, collect project promotion fees, and then dump those tokens for profit after artificially boosting prices through hype.

Another common playbook: by posting screenshots of “big” trading gains, KOLs build a “trading guru” persona, then cash in by charging for access to private groups.

Supply Meets Demand

At the end of his analysis, dethective posed a key question:

Why do some project teams knowingly choose these international KOLs—even aware of their practices?

The answer is simple: supply meets demand.

Certain projects target audiences seeking get-rich-quick opportunities, and the aforementioned KOLs—and their groups and channels—perfectly capture this segment: individuals who lack independent research capability, believe in influencer calls, and are hunting for the next “undervalued” meme coin.

In a market where bad actors drive out good ones, these accounts are often seen as more commercially valuable.

Exposing these arrangements can stir up controversy, but if just one or two promoted tokens skyrocket, the posts are widely shared to build the KOL's reputation as a “master trader.”

In a market awash with noise and misinformation, crypto investing is far more complex than following influencer calls. “Always-winning” influencers will always exist, but lost funds are rarely recovered.

Disclaimer:

- This article is reprinted from [TechFlow]. Copyright belongs to the original author [伞 & David, Deep Tide TechFlow]. Please contact the Gate Learn team with any concerns about this reprint, and we will address your request following our procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Reproduction, distribution, or plagiarism of the translated article is prohibited without clear attribution to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?