NARRATIVES TO LOOK OUT FOR: 2026

Crypto moves in cycles of trends and narratives, the ability to spot these shifts early while they’re still forming is a skill that has created many of crypto’s biggest winners.

In this article, I’ll cover most narratives that should lead CT mindshare in 2026.

▪️GambleFI: Prediction and Opinions markets:

Prediction and opinion markets have evolved from tools used mainly by crypto enthusiasts to becoming key resources for decision-making in everyday life.

When people want to know whether a certain event is likely true or false, they often have to scroll through endless articles, blogs, and social media posts, yet still struggle to find reliable insights.

Opinion markets change that. They give a clear view of what people think about specific events, backed not just by opinions, but also by the financial stakes they place on them.

Which brings us to the simple truth: if you’re so sure about it, you should have skin in the game or gtfo 😡

Polymarket and Kalshi currently dominate most of the mindshare and volume in this space, but I still think they haven’t reached their full potential and a lot of other protocols would explore different dynamics to the narrative.

It’s a space to watch closely, especially because it connects so naturally with real-world users.

▪️Launchpads: Fundraising and ICOs:

As airdrops gradually fade as the default community launch model, we’ll likely see more community-led fundraises, starting as early as seed rounds, alongside a resurgence of ICOs.

Since Oct 27, 2025 (62 days ago), over $341.35M has already been raised through community offerings and community-led fundraises, with much more still scheduled for Q1:

MegaETH $50M, Monad $187.5M, Gensyn $16.14M, Aztec $52.31M, Superform $3M, Vooi $1.5M, Solomon Labs $8M, Solstice , Football Fun $1.5M, Makina $1.3M, Rainbow $3M, Immune fi $5M, Reya Labs $3M, Humidi fi $6.1M, Zkpass $3M.

With a few successful launches, community offerings could become the default model for community launches, shifting how projects engage with their communities.

In all of this, the biggest winners will be the platforms that offer the most investor-friendly terms while prioritizing strong protocol economics.

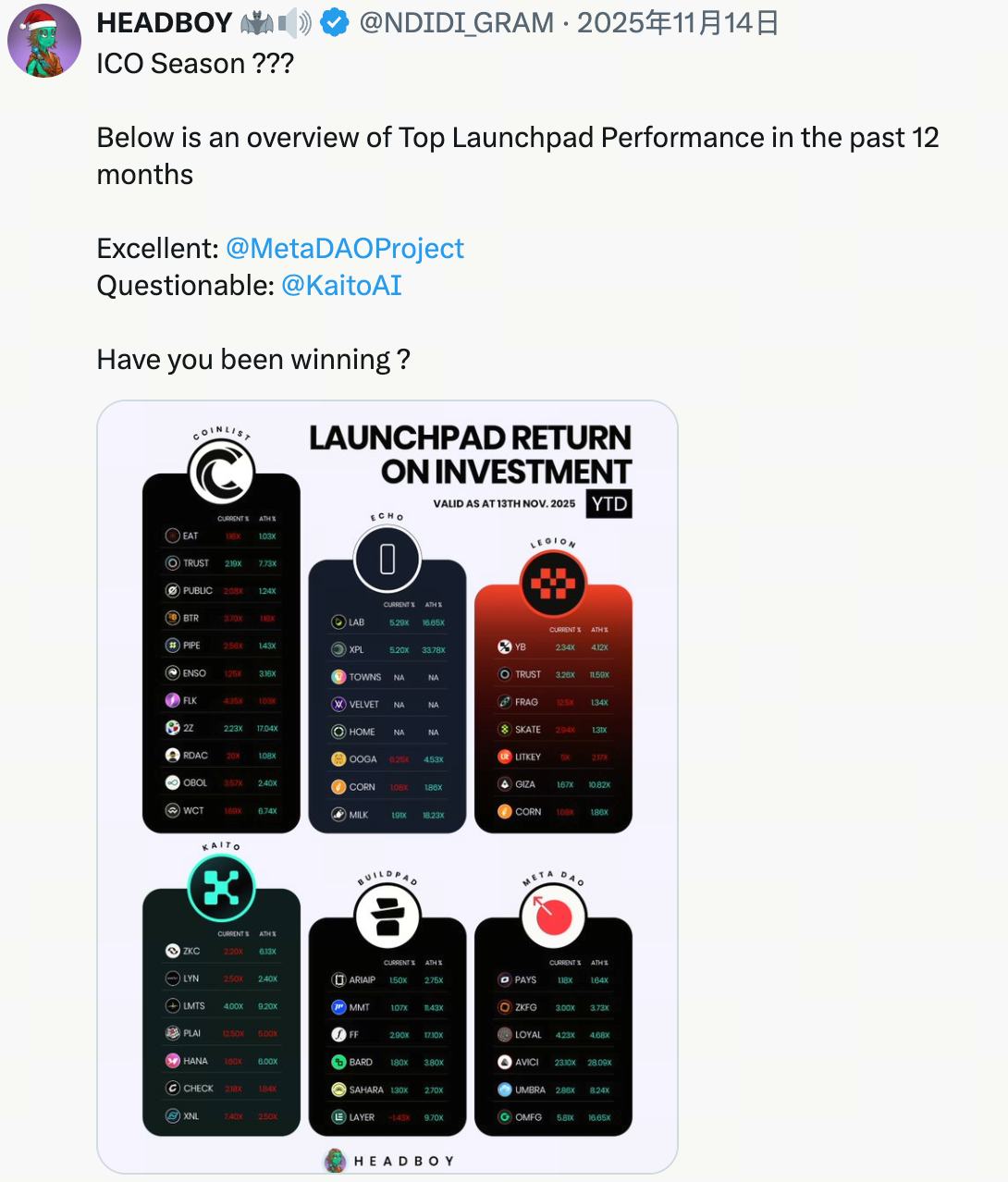

Platforms like Legion, MetaDao, Buildpad, Echo, Coinlist, and Kaito have hosted the most token sales this year.

On Nov 14th, I analyzed the state of launchpads based on their performance:

Next year, we will undoubtedly see new platforms exploring dynamic token launch models for community offerings that protect both investors and the protocol.

▪️Privacy: Secrecy On-chain

Crypto lives and breathes on liquidity, and institutions control a large share of it. To attract institutional capital, privacy is no longer optional, it’s a requirement.

Certain data simply cannot live in the open: trading strategies, balances, counterparties, or internal treasury movements, especially when competitors are watching.

The next phase of on-chain adoption won’t be about hiding activity from the system, but about selective disclosure: proving validity without exposing everything.

That’s the only way serious capital comes on-chain.

Since the start of 2025, over 44 privacy-focused dapps and chains have been funded, surpassing $500M in cumulative funding, a clear signal of the growing demand for privacy-first applications.

In 2026, we’re likely to see more of these, while existing protocols finally unlock their full potential as privacy becomes a core requirement rather than a niche feature.

▪️ NeoBanking: Banking for Digital Assets

Crypto has outgrown traditional wallets.

Tools built only for holding and sending tokens are no longer enough.

As more capital, protocols, and real businesses operate on-chain, the gap is clear: there’s still no proper bridge between wallets and full financial workflows.

Next year, the shift will be from standalone wallets to wallet-native neo-banks, products that combine custody, payments, yield, reporting, and compliance into a single interface.

This isn’t about replacing banks. It’s about upgrading wallets into financial infrastructure.

This year, @ Revolut led overall mindshare, while the breakout of @ AviciMoney stood out, raising just $3.5M through a community-led round and still posting strong numbers.

We’re likely to see many more apps like this emerge, especially as they deliver real utility not just for CT natives, but well beyond them.

▪️DePINs: Internet of Things:

We saw the rise of decentralized physical infrastructure in 2024, followed by a sharp decline in 2025, but I believe next year it will finally reach its full potential.

Projects like Helium proved that distributed connectivity can work at scale. Hivemapper showed that crowdsourced mapping can compete with incumbents. Render pushed decentralized compute into real demand cycles. And newer networks like Grass are turning idle resources into measurable economic output.

More interestingly, VCs are still funding these infrastructures and notable ones are sustaining usage and convert it into revenue.

What used to be “tokenized hardware narratives” “malware in disguise” is starting to look like networks with users, usage, and revenue.

There’s a clear shift toward products with real use cases and revenue, and this is exactly where DePINs stand out.

Perp Dexs: Derivatives:

Perpetual DEXs have led much of the crypto trading narrative this year, and they’re far from done.

Platforms like Hyperliquid, dYdX, Lighter, and Aster have shown that perps can generate significant trading volume and fees, even competing with centralized alternatives.

Next year, the winners won’t just be the largest DEXs, they’ll be the platforms that offer capital-efficient products, low slippage, and innovative risk management, making derivatives accessible to both retail and institutional traders.

▪️AI: Artificial Intelligence

For the past few years, AI has dominated the broader internet, and it’s only a matter of time before it does the same to crypto.

We’ve already seen people vibe-code DeFi apps from scratch to production, which says a lot about how far AI tooling has come.

AI in crypto won’t just be about bots or trading signals.

The real shift will happen when AI becomes infrastructure, writing contracts, managing risk, optimizing liquidity, and operating protocols faster and cheaper than humans.

AI as a crypto narrative will only get stronger over time. It’s something worth paying close attention to.

Vibecoding, Prompting, AI-Augmented Research, Automation, are new AI skill sets that you should get accustomed to before the start of next year.

▪️A few other narratives to still watch out for:

→ x402: On-chain Simplicity:

→ Robotics: Tokenized Automation Systems

→ Stablecoins: Tokenized Fiats

→ Real world assets

The future for crypto is bright and I do think 2026 would be adventurous for people who are curious as to where crypto is headed. See you on the side that prints.

Disclaimer:

- This article is reprinted from [NDIDI_GRAM]. All copyrights belong to the original author [NDIDI_GRAM]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?