Bitcoin Hovers Around $117,000: Will Fed Policy Ignite a New Rally?

Hello

Welcome to our weekly macro-economic and news analysis.

It’s a strange stand-off that we are witnessing in the crypto markets.

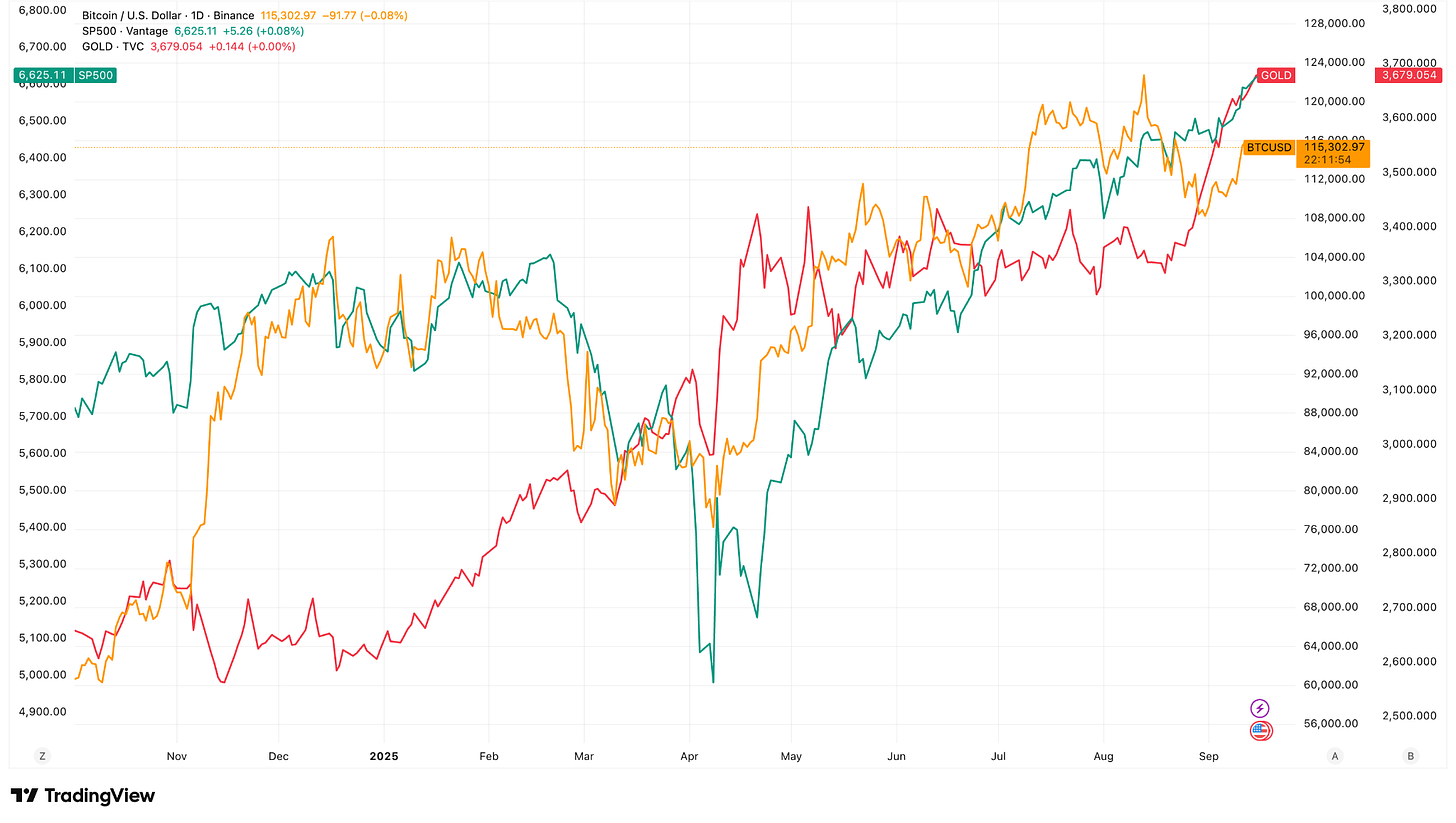

Gold has marched to record highs, equities are whistling past earnings warnings, and the dollar is starting to soften. The stage looks set for risk assets to keep climbing. And yet Bitcoin, usually the loudest in the room when liquidity is loosening, has stopped just shy of $117,000.

This is despite enough fuel in the tank — ETFs have taken in billions, stablecoins are piling up on exchanges, and long-term holders are trickling out supply.

What’s missing?

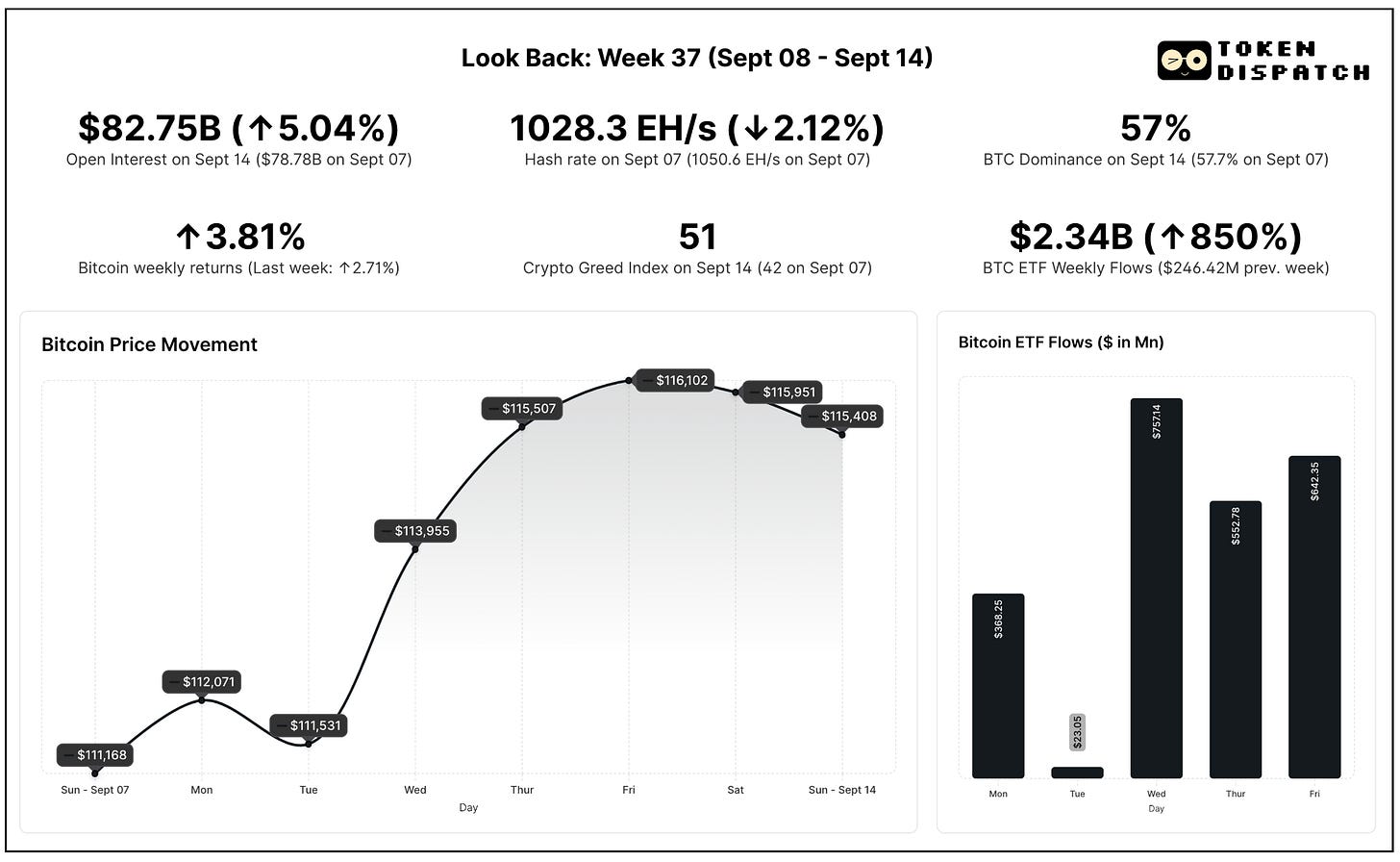

We find out as we dive into week 37 of 2025: September 08-14.

TOKEN2049 Happy Bird Ends Friday!

In two weeks, the global crypto community converges at Marina Bay Sands for the world’s largest crypto event: TOKEN2049 Singapore. You can still save US$400 off your tickets.

The unmatchable speaker lineup includes Eric Trump and Donald Trump Jr. (World Liberty Financial), Tom Lee (Fundstrat CIO), Vlad Tenev (Robinhood Chairman & CEO), Paolo Ardoino (Tether CEO), and Arthur Hayes (CIO, Maelstrom), with many more to be announced.

Join 25,000+ attendees, 500+ exhibitors, and 300 speakers as the entire venue transforms into a festival-style pop-up city, featuring a rock-climbing wall, zipline, pickleball courts, live performances, wellness sessions, and more.

Don’t miss your chance to be part of the defining crypto event of the year.

Bitcoin filled the August futures gap on the Chicago Mercantile Exchange (CME) at $117,000 last week and then stopped, between accumulation and price discovery, after a fortnight marked by significant macroeconomic developments.

The market moved up and registered two consecutive weeks in the green for the first time in over two months. However, it struggled to break through the $117,000 resistance level, awaiting one key event: the Federal Reserve’s decision on September 17.

The stage was set against a backdrop of economic uncertainty. First, the US jobs data came in weaker than expected two weeks back.

Now, the inflation data is giving a split signal. Producer prices cooled, turning negative on a monthly basis, suggesting that cost pressures in the pipeline are easing. However, consumer prices diverged. The Consumer Price Index (CPI) for August rose 0.4% month-on-month, pushing the annual rate to 2.9%, its highest since February. That is still well above the Fed’s 2% target, signalling that inflation is far from being defeated.

While PPI data suggests a less inflationary future, CPI figures indicate that households are still feeling the strain. When combined with labour market weakness, the case for easing remains strong. Markets have priced in over a 95% probability of a 25bp cut, CME’s FedWatch showed.

Meanwhile, other assets are making headlines.

Gold surged to a record high above $3,640 an ounce. In equities, both the S&P 500 and the Nasdaq reached record highs ahead of the upcoming Fed meeting.

Bitcoin attempted to follow the same trajectory.

From lows near $108,000 in late August, it climbed back above $116,000 last week. However, unlike gold or equities, it couldn’t break through. The gap was filled, momentum was building, but the resistance at $117,000 proved stubborn.

Bitcoin managed to hold above the $110,000 mark for the entire week, registering a 3.81% weekly gain by Sunday night.

Spot Bitcoin ETFs absorbed over $2.3 billion in just five days, marking their strongest week since July and the fifth best of 2025. Institutions are supporting the bid, building positions with fresh capital.

However, the derivatives market is not showing the same conviction.

Bitcoin Futures open interest grew slightly, but speculative energy has shifted towards Ethereum and altcoins. This shift was reflected in Bitcoin’s dominance, which fell by 0.7 percentage points over the week.

The Crypto Fear and Greed Index rose by nine points into neutral territory, moving further away from the fear zone, signalling a strengthening of investor sentiment.

On-chain data aligns with this, showing that liquidity is waiting for market conviction.

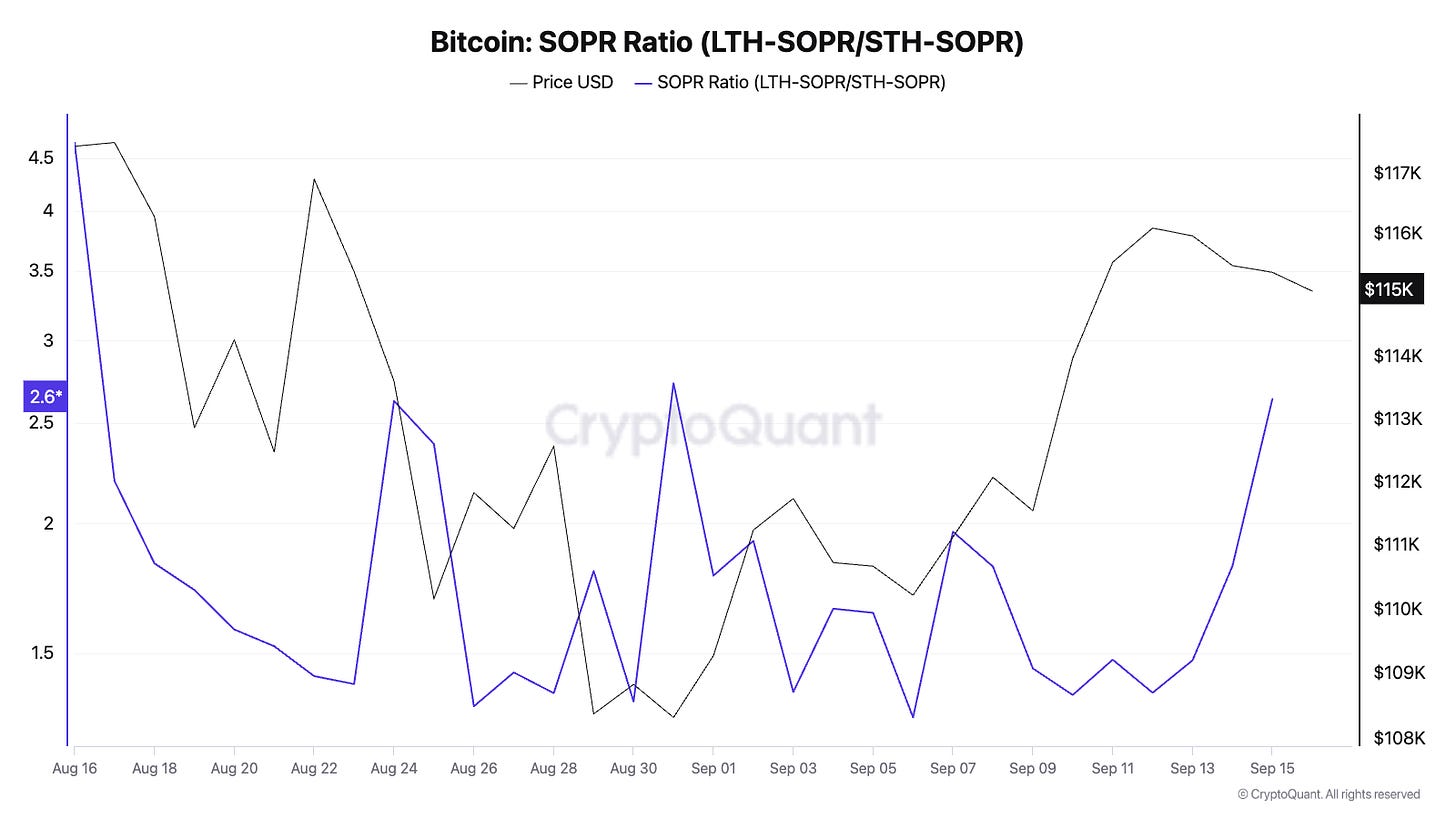

The Spent Output Profit Ratio (SOPR) shows that long-term holders continue to distribute into strength, while short-term holders have returned to selling at a profit rather than a loss. This indicates healthy churn, keeping supply moving without signalling stress.

The Long-Term Holder/Short-Term Holder SOPR ratio remains elevated, highlighting that the selling is primarily coming from seasoned wallets, not nervous new entrants.

Market Value to Realised Value (MVRV) rose from 2.09 to 2.17 during the week, placing Bitcoin in mid-cycle territory. Historically, MVRV levels between 3.5 and 4 have marked overheated tops. At 2.2, the market is neither cheap nor overextended. The valuation is stable, not frothy.

The Stablecoin Supply Ratio, which compares the market cap of cryptocurrencies to the combined market cap of all stablecoins, has dropped to a four-month low. This indicates that more stablecoin liquidity is sitting idle on exchanges, relative to Bitcoin balances.

Short-term RSI has also cooled to around 50, signalling neutral momentum and potential for upside. All of this data supports the broader view that liquidity is abundant, but conviction remains on hold.

What Next?

Rate cuts have not always been a straightforward positive for Bitcoin.

In March 2020, when the Fed slashed rates in response to the pandemic, Bitcoin initially collapsed alongside risk assets before rebounding spectacularly as liquidity flooded in. A similar pattern unfolded in late 2024: the first rate cut triggered volatility and profit-taking before the easing cycle set the foundation for another rally.

On-chain metrics like MVRV and the Whale Ratio during those times showed short-term pain, followed by long-term gains. If history repeats, the first cut this week could bring volatility rather than a straight-line rally, even if the bigger picture remains supportive.

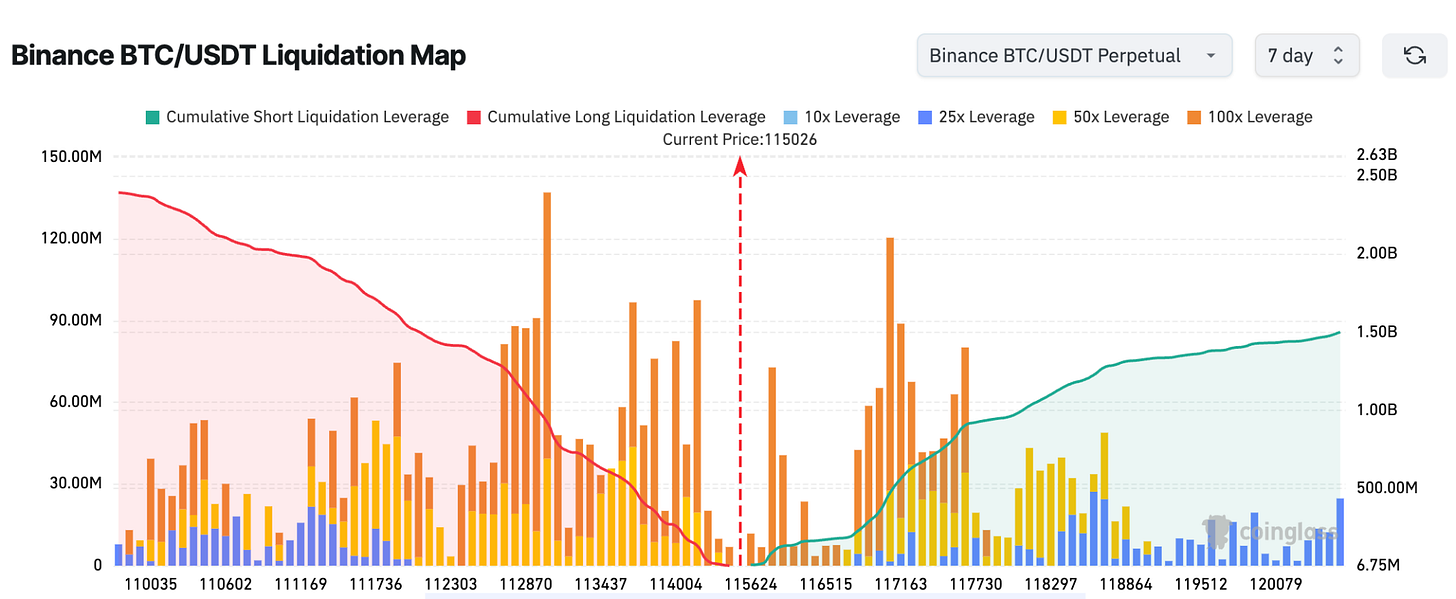

If Bitcoin reclaims and holds above $117,000, the path to new highs could open quickly. However, a failure at that, especially if the Fed holds off on a rate cut in response to recent inflation data, could send the market back to $113,000 or lower. The order books show heavy liquidity at these levels, with traders already positioned for a sweep.

Institutions are clearly favouring Bitcoin ETFs as their preferred vehicle, while speculative traders rotate treasury capital to Ethereum and Solana.

If BTC breaks higher after the Fed’s decision, expect that momentum to spill over. ETH, which has already been attracting leverage, would likely outperform BTC. However, if BTC stalls, altcoins risk being the first domino to fall as speculative capital reverses.

Liquidity is building as ETFs absorb supply, stablecoin balances swell, and long-term holders gradually distribute. Yet, the market lacks conviction and waits for a catalyst.

If Powell signals an easing cycle with few caveats, Bitcoin is likely to reclaim $117,000 and enter price discovery above that level. If he hedges, warning of persistent inflation or external risks, the market may remain stuck in this range for longer, potentially until the next print in October.

For investors, on-chain metrics suggest that the current phase is healthy, though caution is advised. Institutions and corporate treasuries are pouring money into ETFs. The risks lie more in timing than direction.

The week ahead will reveal whether the wait for conviction ends here. All eyes are on Powell.

That’s it for this week’s macro and news analysis.

I’ll see you next week.

Until then … stay sharp,

Disclaimer:

- This article is reprinted from [TOKEN DISPATCH]. All copyrights belong to the original author [@prathikdesai">Prathik Desai]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

What is the Altcoin Season Index?