Interpreting the HIP-4 Proposal: Hyperliquid Wants to Launch a Prediction Market?

Yesterday, Hyperliquid unveiled a new proposal, dubbed HIP-4.

While the crypto community remains fixated on live stream tokens and buyback stories, the HIP-4 proposal hasn’t made significant waves. Yet, a closer look reveals that the proposal directly addresses a rising trend in crypto—prediction markets.

At its core, HIP-4 introduces “Event Perpetuals,” a novel trading instrument.

In essence, Hyperliquid wants to enhance its perpetual contract exchange with binary prediction market capabilities. Users could bet on outcomes like “Will the Federal Reserve hike rates?” or “Will a given token list on Binance this month?”

One detail stands out: the proposal’s author team is a mix of investors from Framework Ventures, members of prediction market platform Kalshi, plus developers from Felix Protocol and Asula Labs.

It’s rare to see competitors co-author a plan—especially since Kalshi is a key player in U.S. regulated prediction markets.

This signals that Hyperliquid’s prediction market ambitions may be collaborative or seek unique differentiation, rather than disruption.

Hyperliquid, the dominant force in perpetuals, is betting on HIP-4 either to seize the vast prediction market opportunity or to revitalize the HYPE ecosystem narrative.

A Natural Extension

Polymarket shot to prominence during the 2024 U.S. presidential election, posting $3.6 billion in trading volume. In 2025, prediction markets are attracting heavy interest: Polymarket just acquired QCEX for $1.12 billion to re-enter the U.S.; Kalshi partnered with Robinhood to launch prediction features with monthly volumes over $800 million—traditional financial giants are also circling the sector.

Time Magazine named Polymarket one of the “100 Most Influential Companies of 2025” for a simple reason: prediction markets are fundamentally reinventing information price discovery.

Could Hyperliquid really ignore such momentum?

HIP-4 remains a proposal, subject to community vote and technical review, but its thoroughness and stakeholder lineup suggest serious intent.

Most importantly, this could be an opportunistic move for Hyperliquid.

First, the technical overlap is substantial.

Prediction markets and perpetual contracts share core infrastructure: order books, matching engines, margin systems. For Hyperliquid, launching Event Perpetuals is relatively inexpensive and low-risk; even if the product underwhelms, it won’t threaten their main business.

Second, there’s a natural user overlap.

Perpetual traders and prediction market bettors are, at heart, speculators—chasing volatility, embracing uncertainty, and willing to wager on their convictions. Hyperliquid’s user base fits this profile, so why not give them more options?

Finally, the HYPE ecosystem needs fresh narratives.

Hyperliquid, among 2024’s top-performing DEXs, already has a mature perpetuals business. Yet, markets crave growth, and HYPE needs broader utility to justify its valuation. Prediction markets offer both a promising business model and a compelling story—dynamic, imaginative, and on-trend.

This isn’t so much a strategic pivot as a low-cost experiment in product expansion. If it works, the business diversifies; if not, the core remains intact.

HIP-4: Smart Product Extension

Why not bolt prediction markets onto Hyperliquid’s existing platform?

The proposal uses NFL game prediction as an example.

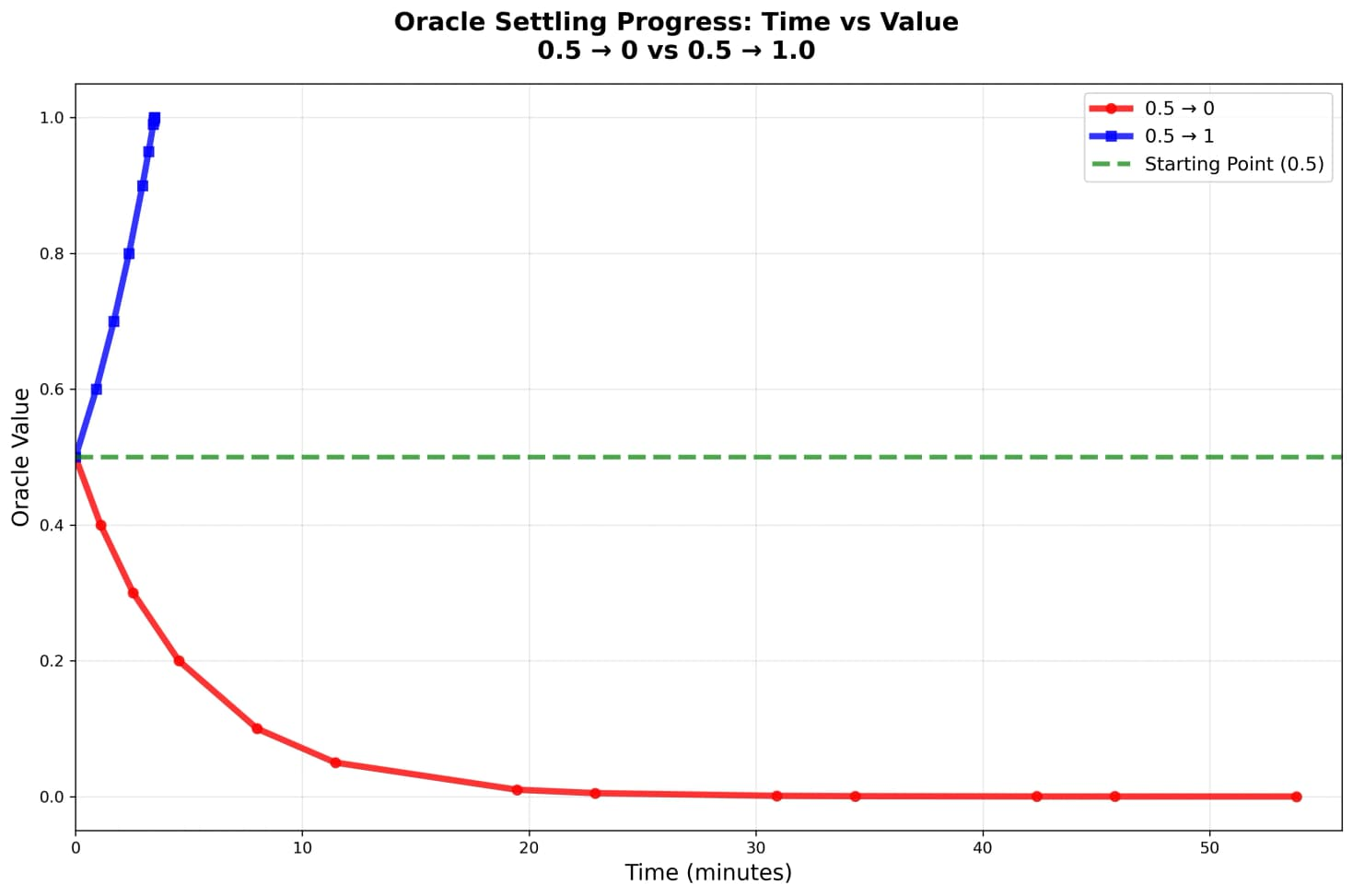

Let’s say you’re betting “Will the Chiefs win the Super Bowl?” A perpetual contract model would require ongoing oracle updates—every three seconds. But sports odds move in jumps, not continuous ticks. After a play, the odds might spike instantly.

HIP-3 (Hyperliquid’s current market protocol) caps price movement at 1% per tick. If the result is decided, the price has to move from 0.5 to 1.0 over 50 minutes.

During that window, anyone with inside knowledge could arbitrage the market with ease.

That’s why HIP-4’s Event Perpetuals are necessary.

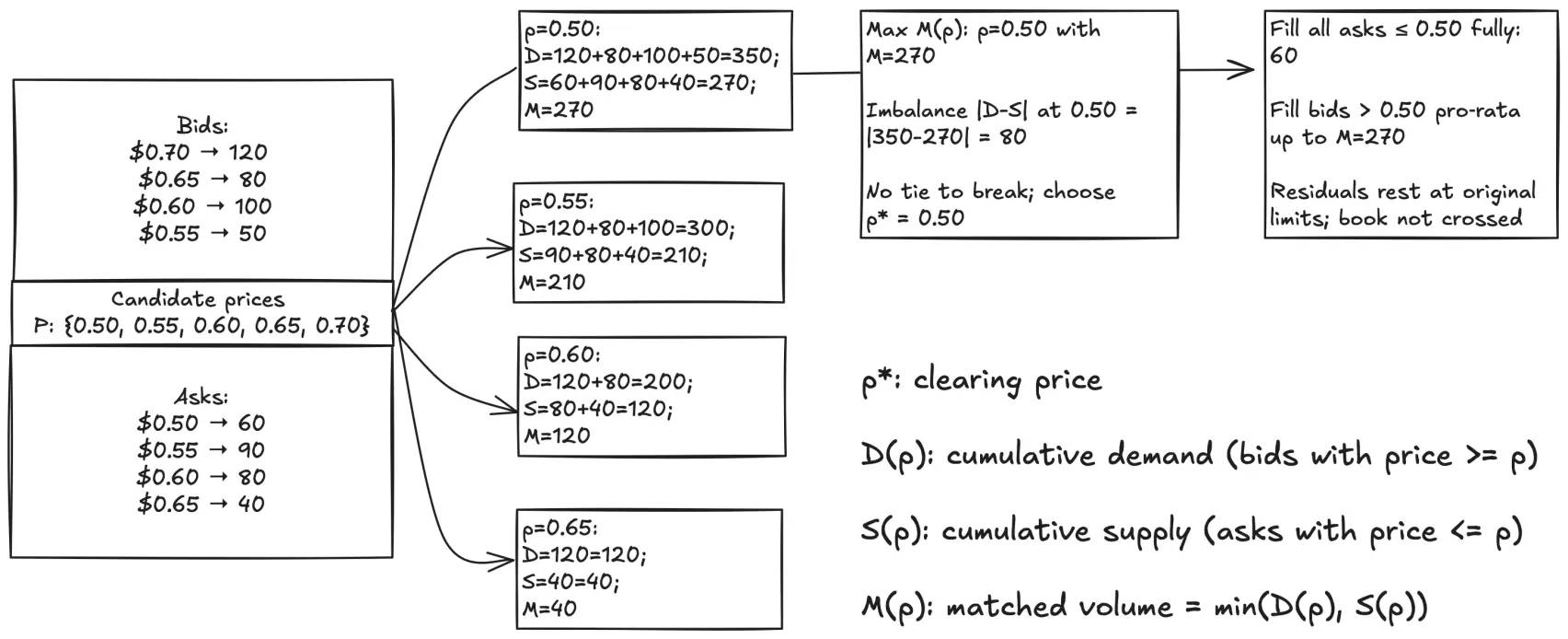

Event Perpetuals remove perpetuals’ two defining features: continuous oracle updates and funding rates. The market sets prices exclusively through trading, and a final oracle settles the event at expiry (0 or 1).

Key design elements include:

- Opening auction: 15-minute batch auction to stabilize initial pricing

- 1x isolated margin: no leverage, minimizing liquidation risk

- Slot reuse: markets can be redeployed instantly post-settlement to boost capital efficiency

On the surface, it’s a technical innovation; fundamentally, it’s a strategic pilot for Hyperliquid.

Expanding from a single product to a suite is evident. Perpetual contracts, no matter how successful, are just one line of business. If Event Perpetuals succeed, Hyperliquid’s infrastructure can power options, structured products, and more.

Even more strategic, Hyperliquid is delegating market creation.

Per the proposal, any team (“Builder”) wanting to launch a prediction market on Hyperliquid must stake 1 million HYPE tokens. Builders are responsible for the following:

- Choosing market topics (e.g., “Will Trump buy Bitcoin?”)

- Setting parameters (settlement time, oracle provider, etc.)

- Managing market operations (bootstrapping liquidity, marketing, etc.)

Builders earn up to 50% of their market’s trading fees.

This architecture is elegant. Hyperliquid doesn’t need to anticipate which prediction markets will gain traction—market forces do the job. Teams willing to lock up 1 million HYPE will be strategic about liquidity potential. If a market flops, the Builder loses; if it thrives, both the Builder and Hyperliquid benefit.

That’s why Kalshi team members joined the HIP-4 drafting effort.

They represent the caliber of Builder Hyperliquid hopes to attract. With proven operational methods, Kalshi knows how to seed liquid markets—and if they launch on Hyperliquid, they bring real expertise, not just markets.

For a DEX with over $2 billion TVL, this experimental approach is highly practical.

Challenges and Opportunities

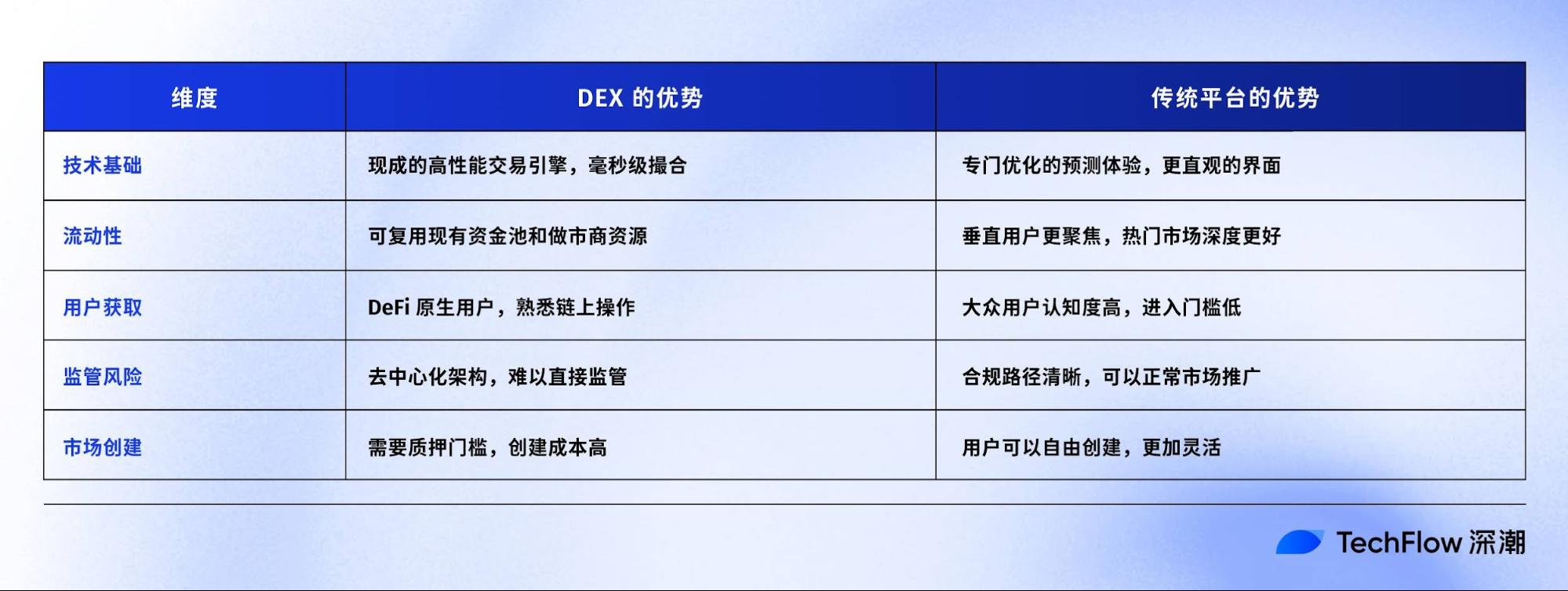

In theory, prediction markets are a logical fit for DEX architecture.

Core infrastructure—order books, matching engines, settlement, margin management—is already there, and prediction markets leverage the same stack.

But execution isn’t so straightforward.

The vibrancy of prediction markets depends on user-driven diversity.

Polymarket lets any user create a market, fueling constant innovation and buzz.

By contrast, HIP-4 requires a 1-million HYPE stake—equivalent to millions of dollars—making the barrier to entry steep. While it weeds out low-quality markets, it may also suppress creativity and experimentation.

Liquidity fragmentation is another issue.

Perpetuals share liquidity—ETH/USD depth supports all ETH-related trading. Prediction markets pool liquidity per event; each has its own silo.

So, even with $2 billion TVL, hundreds or thousands of prediction events could dilute depth, leaving some markets thinly traded—hurting user experience via slippage.

Moreover, users associate Polymarket and Kalshi with prediction markets, while Hyperliquid is known for perpetuals. If HIP-4 moves forward, educating and onboarding users is imperative.

Where, then, does Hyperliquid have an edge?

Prediction markets focused on crypto-native themes—listing events, protocol upgrades, etc.—could drive meaningful engagement. Hyperliquid’s users are likely more knowledgeable and motivated to wager on such topics than those on Polymarket.

Is HIP-4 Bullish for $HYPE?

Short-term impact will likely be modest.

For now, it’s just a proposal. Even after approval, months will pass before launch and revenue generation. Some speculative trading may occur, but sustained price support is unlikely.

Revenue potential is also unclear. If Hyperliquid captures 10% of Polymarket’s $800 million monthly volume and applies a standard 0.1% fee, that’s only $80,000 per month—insignificant for a multibillion-dollar project.

Yet, HIP-4’s medium- and long-term implications could surpass pure financial upside.

First, staking demand rises.

If 10–20 Builders launch markets, 10–20 million HYPE are locked up—reducing circulating supply, albeit modestly.

Crucially, HYPE’s utility as a “license” is validated: holders gain governance rights and commercial opportunity.

Second, brand value escalates.

If professional operators like Kalshi stake HYPE and build markets, it signals strong institutional endorsement, which may be more impactful than any fee revenue.

Crypto markets have plenty of capital—but they thrive on narratives. The DEX narrative is played out; with HIP-4, every new use case multiplies valuation potential.

Pushing the DEX Frontier

The real intrigue in HIP-4 is witnessing DEXs explore their own boundaries.

From simple token swaps to perpetual contracts, and now to prediction markets, successful DEXs are always expanding—transforming adjacent opportunities into growth drivers.

This isn’t a splashy launch, but a measured experiment—testing technology, gauging user response, and probing regulatory tolerance.

For those tracking Hyperliquid, the strategic trend is more important than any single proposal.

HIP-4 may succeed or fail, but it exemplifies a directional shift toward platformization, ecosystem building, and comprehensive DEX models. Projects that push boundaries will achieve higher valuations; those that stagnate will fade away.

Will Event Perpetuals win Hyperliquid a meaningful share of the prediction market? Only the market can answer—and that’s a prediction worth betting on.

Disclaimer:

- This article is republished from [TechFlow], with copyright retained by the original author [David, ShenChao TechFlow]. For republication concerns, contact the Gate Learn team, which will respond promptly in line with our policy.

- Disclaimer: Views and opinions herein are solely those of the author and do not constitute investment advice.

- Other language versions have been translated by the Gate Learn team. Unless Gate is expressly referenced, these translations may not be reproduced, distributed, or copied.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?