Inside the KOL Round: A Wealth Experiment Driven by Hype and Influence

Not long ago, primary market strategies were clear-cut: VCs funded, KOLs spread the word, and retail investors provided liquidity.

But that formula is being upended.

VC backing is no longer a silver bullet. Project teams are rewriting the rules around “influence.” KOLs have evolved from mere traffic drivers to key stakeholders at the table—sometimes holding the power to make or break a project.

In many ways, the KOL round emerged as a new token distribution model in the wake of VC exits and retail silence, all under the banner of “influence supremacy.” XHunt’s data shows that in the past week, “KOL” appeared in 3,860 tweets across crypto, outpacing “VC” at 3,078—a subtle but fierce battle for influence is underway.

This article skips the theory and dives into the real stories behind KOL rounds: their origins, who wins, who loses, who counts their profits, and who lies awake at night.

How Did KOL Rounds Move to Center Stage?

Let’s go back to late 2022.

The crypto VC winter hit. Primary market valuations soared, exit timelines dragged, and the secondary market couldn’t absorb the flow. Big firms stayed on the sidelines, and startups struggled to raise capital.

Yet retail traders quietly returned. Blast, ZKsync, Friend.tech—each liquidity surge marked their resurgence.

What swayed these investors most wasn’t institutional research—it was KOLs who, while “appearing savvy,” were really “selling the story.”

Project teams caught on: VCs might not drive mainstream adoption, but KOLs could. Instead of burning cash on ads, it’s smarter to put discounted tokens in KOLs’ hands and let them set the pace on Twitter.

This gave rise to a new playbook:

- Project teams grant KOLs allocations, sometimes at prices even lower than VCs;

- KOLs hype the project pre-TGE, igniting FOMO;

- At unlock, traffic explodes, and KOLs liquidate and exit.

That’s how KOL rounds arrived—a “private placement with deliverables.” Low entry price, fast unlock, sometimes even minimum guarantee terms.

Project teams do the math: give tokens to the loudest voices with the biggest followings, and post-launch, they’ll rally buyers and lift prices.

KOLs see the upside: cheap tokens, some traffic, partial unlock and a quick sale—it sounds like a no-brainer.

But is it really?

The Truth About KOL Rounds: Some Get Rich, Some Get Wiped Out

The Two Extremes of KOL Round Returns

KOL round results vary widely depending on the project and market conditions.

In bull markets, KOL rounds are often a “win-win-win”: projects get funding, KOLs build positions early and cheap, and retail traders can ride the momentum. In bear markets, the script flips.

As liquidity shrinks, price drops at launch become standard. KOLs, locked up, can’t sell in time and face heavy losses. KOL @ realChainDoctor admitted to joining over ten KOL rounds last year with zero returns—some projects didn’t even issue tokens. Influencer @ kiki520_eth warns of systemic traps in KOL rounds: tokens may never be issued, or rules may change after price rallies.

Top KOL @ jason_chen998 shared that his best gains came from Aster and Mira, entering at low valuations when sentiment was low and with reliable teams, timing TGE with the bull run. He emphasized that KOL round profits hinge on bear market positioning and strong networks. But he also admitted most KOL rounds are high-yield gambles: luck brings gains, but bad luck means working for the project for free—pressured to produce, penalized, denied unlocks, and ending on bad terms.

Our review of recent KOL round cases shows some projects did deliver exceptional returns, such as:

- Aster: When the token hit $1.79, KOL round participants saw up to 70x unrealized gains. Even counting just the unlocked 30% at launch, that’s a 21x profit—$50,000 became $1.05 million.

- Holoworld AI: Lookonchain tracked blockchain address 0x3723, likely a KOL investor, receiving about 10.24 million HOLO in September at $0.088 apiece. Most were sold near $0.60, netting over $4.71 million—a 444%+ single-round yield and more than $4 million profit.

- WalletConnect: After unlock, ICO and KOL round investors saw just about 1.5x returns.

But many KOL round projects have crashed after launch or ran into project troubles.

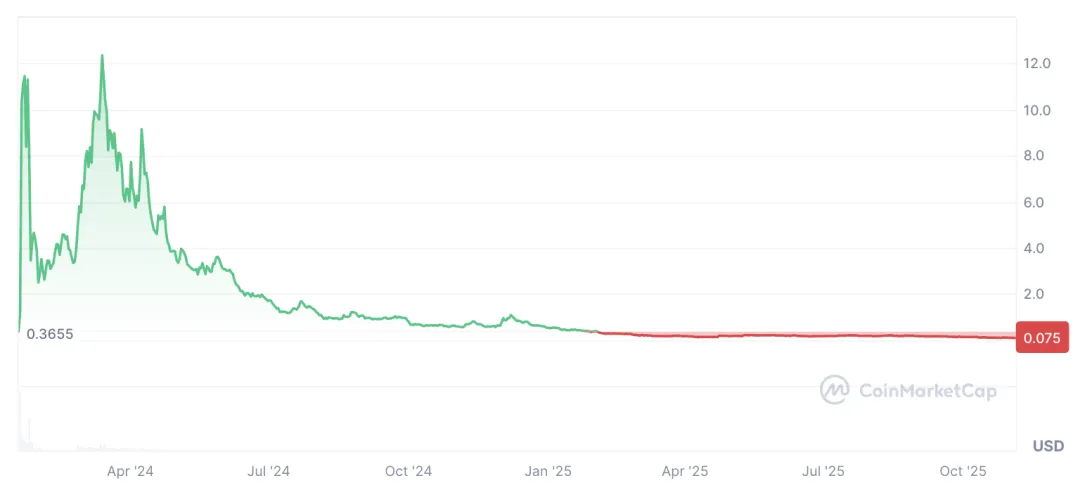

Case in point: SatoshiVM in early 2024. The $SAVM token surged above $11 thanks to heavy KOL promotion, but soon reports of KOLs cashing out at the top triggered a trust crisis and the project cooled. KOLs and retail traders who held on likely missed out; $SAVM now trades near $0.075.

Another example is ZKasino—after KOLs joined funding and promotion, the team unilaterally changed rules post-lockup and absconded with user assets. KOLs involved were condemned as complicit, suffering both financial and reputational damage.

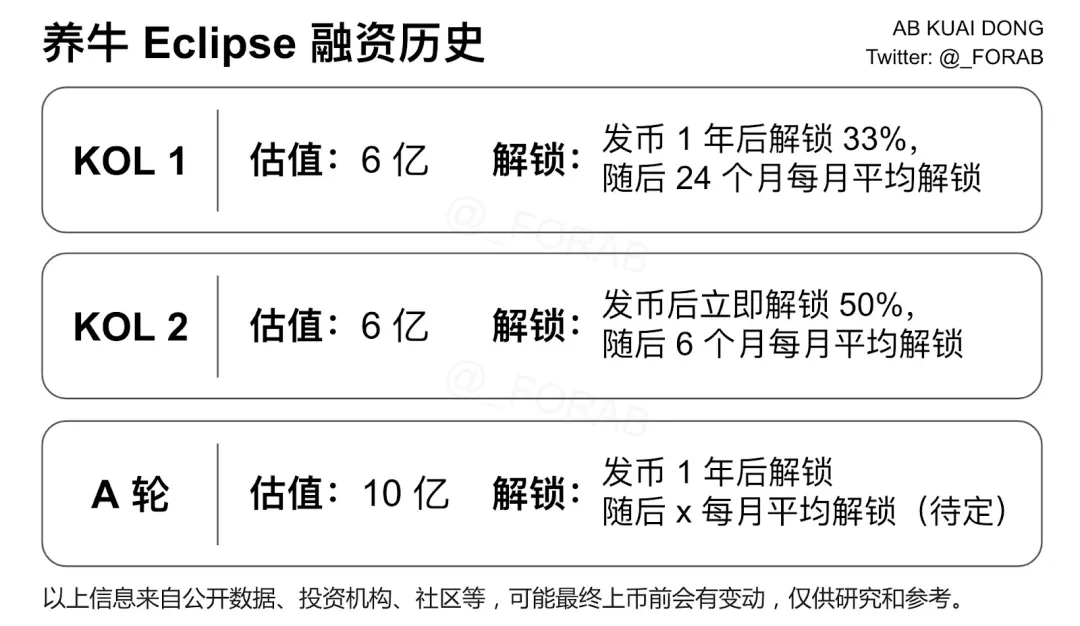

Another recent case, Eclipse, saw KOL round valuations hit $600 million and Series A $1 billion, but actual circulating market cap at launch was just $380 million—far below the rumored $600 million. Research KOL @ _FORAB noted that Eclipse’s KOL allocations went to media and community too, and the token never launched on Binance Futures.

On this, prominent KOL @ yuyue_chris posted that the real problem with KOL rounds isn’t losing money—it’s project teams and intermediaries using “promotion” as a cover to offload risk, forcing KOLs to use their followers to recover principal. That “pit your friends” model is the height of irresponsibility.

The Power Triangle: Projects, KOLs, and Retail Traders

The KOL round reflects an evolving power dynamic in the primary market.

Once, project teams relied on VC capital, and VCs controlled selection through influence. Now, teams find KOLs cheaper, faster, and better at building buzz.

VCs resent being sidelined—after investing millions, teams let discounted Twitter promoters in, sometimes with more influence than the VCs themselves. Some VCs are stepping away.

Retail traders are frustrated—they’re buying tokens dumped by KOLs post-unlock, seeing hype but getting sold out.

Project teams aren’t always satisfied either: KOL-driven hype is often short-lived, and launch day’s buzz and liquidity rarely guarantee long-term project health.

This sets up a tense triangle:

- KOLs weigh: how to protect both investment and reputation on the way out?

- Project teams ask: will allocations deliver the buzz and price lift?

- Retail traders wonder: is this trade a real opportunity or just a trap?

These interests pull in different directions. Unless a project is strong enough to hold this triangle together, any side’s excess pressure can cause the structure to collapse.

The Unsung “Middleman”: Agency

In KOL rounds, project teams rarely deal directly with KOLs—instead, specialized agencies handle allocation and management.

Agencies are the resource orchestrators. They help design KOL round terms (price, allocations, unlock schedules), select and recruit KOLs, oversee deliverables, and ensure campaign execution. Reliable agencies may also build in minimum return guarantees, promotional rewards, or refund mechanisms to help KOLs hedge risk.

As intermediaries, agencies control both traffic and resources. For new KOLs looking to join a round, the first step is finding the right agency—not approaching projects directly.

Notable agencies include:

- LFG Labs (@ dubailfg): Founded by @ snow949494 (XHunt China #134), focusing on China, Japan, Korea, and the Middle East, working with top projects and integrating KOL resources, content distribution, and KOL round fundraising.

- JE Labs (@ JELabs2024): Founded by @ 0xEvieYang (XHunt China #244), launched in 2024, building branding and communities for high-potential early-stage projects and connecting Chinese audiences.

- BlockFocus (@ BlockFocus11): Founder “Ergou” @ CryptoErgou (XHunt China #469), one of the earliest Chinese agencies, emphasizes project value creation and mid-to-long-term operations.

- Shard (@ ShardDXB): Founded by @ ciaobelindazhou (XHunt China #784), a marketing firm incubated by a crypto investment fund, specializing in strategic storytelling and global growth for Web3 infrastructure projects, covering key language markets.

- XDO: Led by @ mscryptojiayi (XHunt China #213), a senior investor with major exchange experience, favoring select high-quality projects and handling all aspects from mechanism design to market narrative and execution.

- Mango Labs (@ MangoLabs_): Founded by @ dov_wo (XHunt China #112), specializes in Chinese market campaigns and KOL placements, offering end-to-end narrative, marketing, and community services.

- Cipher Dance (@ Cipher_Dance): Founded by @ Jeffmindfulness (XHunt China #2178), specializes in pre-TGE content strategy and creative narrative amplification, with multi-language KOL campaigns.

- 4XLabs: “Strategic advisor + KOL matrix,” enabling global projects to achieve zero-to-one growth in China. Team includes @ jason_chen998 (#34), @ Bitwux (#24), @ Phyrex_Ni (#8), @ KuiGas (#31).

How Do You Get Noticed by Projects or Agencies?

Project teams and agencies allocate quotas to KOLs based on influence metrics (followers, engagement rates, etc.), with clear expectations for content and unlock schedules.

To land a KOL round, focus on building “content + data” and a credible personal brand:

- Consistently publish high-value content: market analysis, on-chain insights, project reviews.

- Engage actively on Twitter: interact with projects and other KOLs, join AMAs, livestreams, and discussions to boost industry presence.

- Use analytics tools to boost visibility: leverage tools like @ xhunt_ai to track your influence ranking, capability model, and adjust your strategy. XHunt’s “Soul Index” is a key metric for project teams and agencies evaluating KOLs.

- Build connections across channels: attend offline industry events or hackathons to network with project teams.

How Do KOLs Vet Projects?

KOL rounds aren’t charity—every participant needs to break even. Picking the wrong project means financial loss, reputation damage, and harming user interests. Before committing, run due diligence as you would for private placements, considering:

- Valuation and FDV: Is the overall project valuation reasonable? Is the KOL round priced at a genuine discount?

- Unlock structure: Are TGE unlock ratios and vesting schedules healthy? Is there risk of mass dumping?

- Capital backing: Are top VCs involved, lending credibility?

- Participant lineup: Which top KOLs are in? Are both institutions and individuals participating?

- Agency track record: Is the agency professional, with a strong history of quality deals?

- Team reputation: Does the founding team have a solid track record and industry standing? Any controversies?

- Terms and conditions: Is promotional content subject to pre-approval? Are there minimum guarantees or refund clauses?

Also use tools like XHunt to assess project reliability, financing, team data, KOL followings across languages, community sentiment, and influence rankings.

Conclusion: KOL Rounds—A Narrow Gateway for Ordinary Players in the Primary Market

Zooming out, the KOL round is a financing tool born out of crypto’s traffic-first, narrative-driven, community-powered evolution.

It lowers the fundraising bar, speeds up distribution, and has helped smaller projects break out without VC support.

While KOL rounds sometimes lack clear standards and accountability, they may be one of the few ways retail traders can “break into the primary market.” Compared to traditional private placements dominated by elite VCs and gated information, KOL rounds offer some liquidity and openness. Anyone who consistently produces content and builds influence can earn an allocation and truly join primary market price discovery.

It’s not a perfect system, but it’s the crypto-native capital market’s “homemade solution.” As rules and trust mechanisms are still forming, KOL rounds remain a meaningful market innovation.

Because in this era, influence is capital.

About XHunt

@ xhunt_ai is an AI-powered Web3 KOLFi platform providing transparent KOL metrics, real-time project research, and connections between projects and trusted KOLs.

Notice:

- This article is reproduced from [@ BiteyeCN]. Copyright belongs to the original author [Biteye Core Contributor Viee]. For any reprint objections, please contact the Gate Learn team for prompt resolution.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by Gate Learn; unless Gate is mentioned, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?