GUSD: The Smart Dollar Redefining Stablecoins in the Yield Era

GUSD: The Next Evolution in Stablecoins

Historically, stablecoins have acted as a safe harbor in the crypto world. No matter how turbulent the market became, investors could always move funds into stablecoins to shield themselves from volatility. Today, that role is evolving. As DeFi intersects with Real World Assets (RWA), stablecoins have evolved beyond temporary parking for capital—they’re transforming into financial instruments that consistently generate yield.

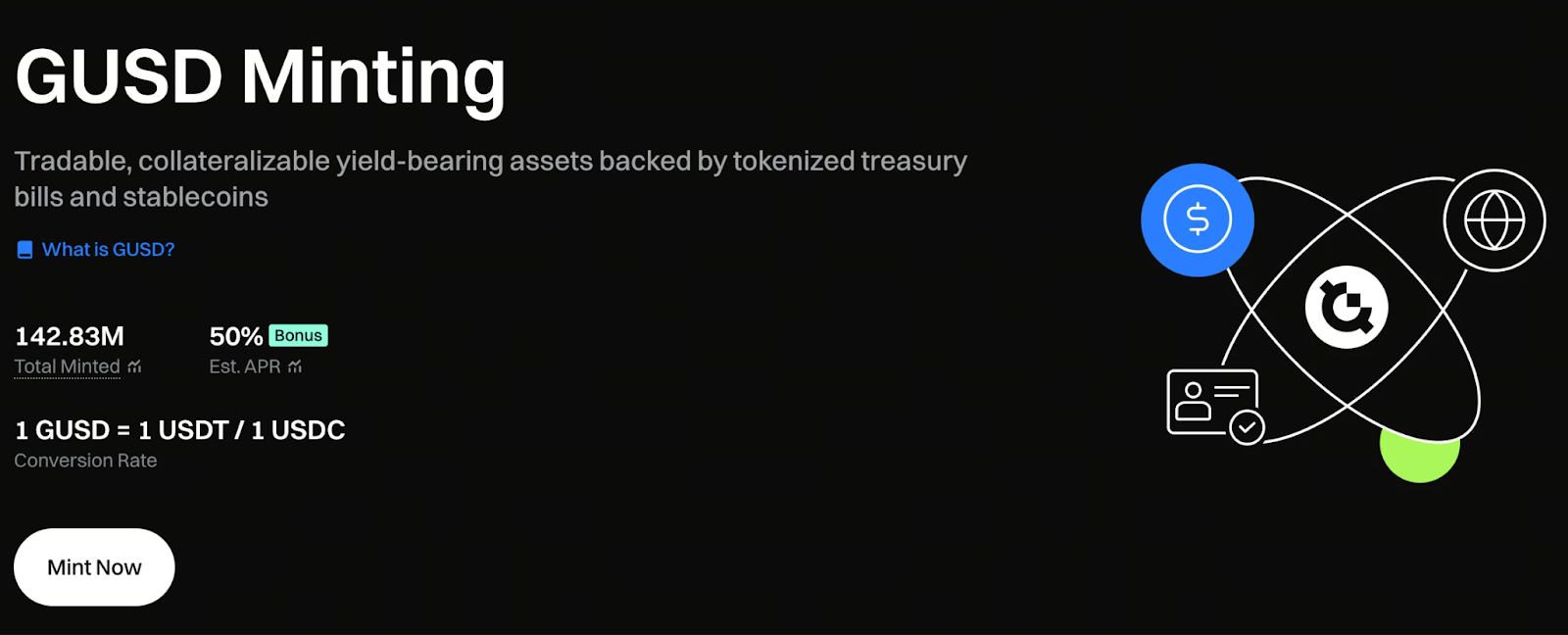

GUSD preserves its 1:1 peg to the US dollar while implementing an automatic yield distribution mechanism. This innovation turns stablecoins into yield-generating dollars.

Yield Backed by Real Assets

Unlike many projects that rely exclusively on tokenomics, GUSD sources its yield from tangible, verifiable assets. Its reserves consist of low-risk, real-world financial instruments, such as:

- U.S. short-term Treasuries

- High-rated corporate notes

- Other financial assets with stable interest income

This structure guarantees two core advantages:

- Price Stability — Consistently maintains a 1:1 peg to the US dollar, remaining largely insulated from market swings.

- Genuine Yield — Real assets generate interest, delivering sustainable, ongoing returns.

For investors prioritizing robust asset allocation, GUSD operates like an automatically appreciating dollar, seamlessly combining stability with returns.

Flexible Onboarding and Redemption

GUSD’s design addresses diverse investor needs by offering two flexible participation models:

- Exchange Swap: Instantly exchange USDT or other stablecoins for GUSD—ideal for users seeking immediate market entry.

- On-Chain Minting: Mint GUSD at a 1:1 ratio through smart contracts, automatically participate in on-chain yield distribution—transparent, real-time, and efficient.

Whether your strategy favors centralized or decentralized operations, GUSD provides an entry route that matches your preferences.

Users can mint GUSD and earn a daily, annualized yield: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

Smart Yield Model with Automatic Compounding

GUSD leverages an accumulated interest and periodic settlement mechanism, allowing your returns to grow automatically over time—no manual action required.

For example:

If you mint GUSD with 100 USDT and the annualized yield is 20%, you can redeem approximately 120 USDC upon maturity.

This approach combines the reliability of traditional bonds with DeFi’s adaptability. Investors can benefit from compounding over time on a secure foundation.

GUSD: The Core Engine of On-Chain Finance

GUSD is more than a stablecoin—it’s a foundational component powering Web3 financial infrastructure. Today, GUSD is integrated across a wide range of ecosystem applications, including:

- Staking and Lock-Up Programs: Long-term holders earn additional rewards.

- Community Incentives and Airdrops: Used to reward early supporters and active users.

- DeFi Protocol Integration: Multiple leading DeFi protocols and applications integrate GUSD, supporting lending, liquidity pools, margin trading, Launchpool modules, and more.

These applications transform GUSD from a passive asset into a continually active force at the heart of on-chain finance.

Three Key Advantages

- Greater Value for Long-Term Holders

Returns compound with holding duration—the longer you hold, the greater the accumulated yield. This makes GUSD ideal for medium- and long-term portfolio strategies. - High Liquidity and Flexibility

Supports both exchange and on-chain redemptions, empowering users to enter or exit the market at any time and maintain liquidity. - Deep Ecosystem Integration

GUSD is embedded in multiple leading DeFi protocols and applications, increasing asset utility and market circulation efficiency.

These features position GUSD beyond the traditional stablecoin framework, establishing it as a flagship for the next generation of yield-bearing on-chain assets.

Compliance and Risk Disclosure

The team engineered GUSD to meet stringent compliance standards, but investments remain subject to market volatility and regulatory risk. Before engaging with any yield-bearing stablecoin, users should fully understand the product mechanism, the platform’s terms, and their personal risk tolerance. Seeking advice from a professional financial advisor is recommended.

User Agreement: https://www.gate.com/legal/user-agreement

Conclusion

GUSD marks a new era for stablecoins—one where stability is just the starting point for yield. It retains the security of traditional stablecoins and integrates real-world asset returns with on-chain automation. As the Web3 financial system grows, GUSD will bridge traditional finance and the crypto economy. In this new landscape, each GUSD represents a stablecoin that accrues value over time.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution