Gate Ventures Weekly Crypto Recap (October 13, 2025)

TL;DR

- The Fed’s resumption of rate cuts marks a new phase, and they may follow a fast-slow-fast rate cut pattern in the coming months.

- This week’s incoming data includes the US CPI, PPI, housing data, industrial production and New York and Philadelphia Fed Manufacturing Index.

- Crypto markets pulled back sharply after Trump’s China tariff remarks triggered leverage and perp liquidations: BTC -6.3%, ETH -7.9%. Still, BTC ETFs saw $2.71B of inflows and ETH ETFs $488M. The Fear & Greed Index dropped to 38 (Fear), and ETH/BTC fell to 0.036.

- Altcoins were hit hardest (-14.9%), though Zcash (+68%), Bittensor (+27%), and BNB (+10%) outperformed. Zcash rallied on the “Zashi effect” as adoption of its new privacy wallet picked up.

- Bittensor gained after Grayscale filed a Form 10 for a potential Bittensor Trust, signaling institutional interest. BNB was boosted by strong on-chain volume in China-themed meme coins and several listings on Binance Alpha.

- Solana-based liquidity protocol Meteora ($MET) launched at a $1.6B FDV, surpassing Raydium’s debut. Meanwhile, Monad ($MON), an EVM-compatible Layer-1, traded around $0.087 in pre-market futures, implying an $8.7B FDV.

- Antalpha leads $150M Aurelion financing to build first Tether Gold treasury.

- Jupiter partners with Ethena to launch Solana-based stablecoin JupUSD.

- Galaxy raises $460M to fuel transition from mining to AI infrastructure.

Macro Overview

The Fed’s resumption of rate cuts marks a new phase, and they may follow a fast-slow-fast rate cut pattern in the coming months.

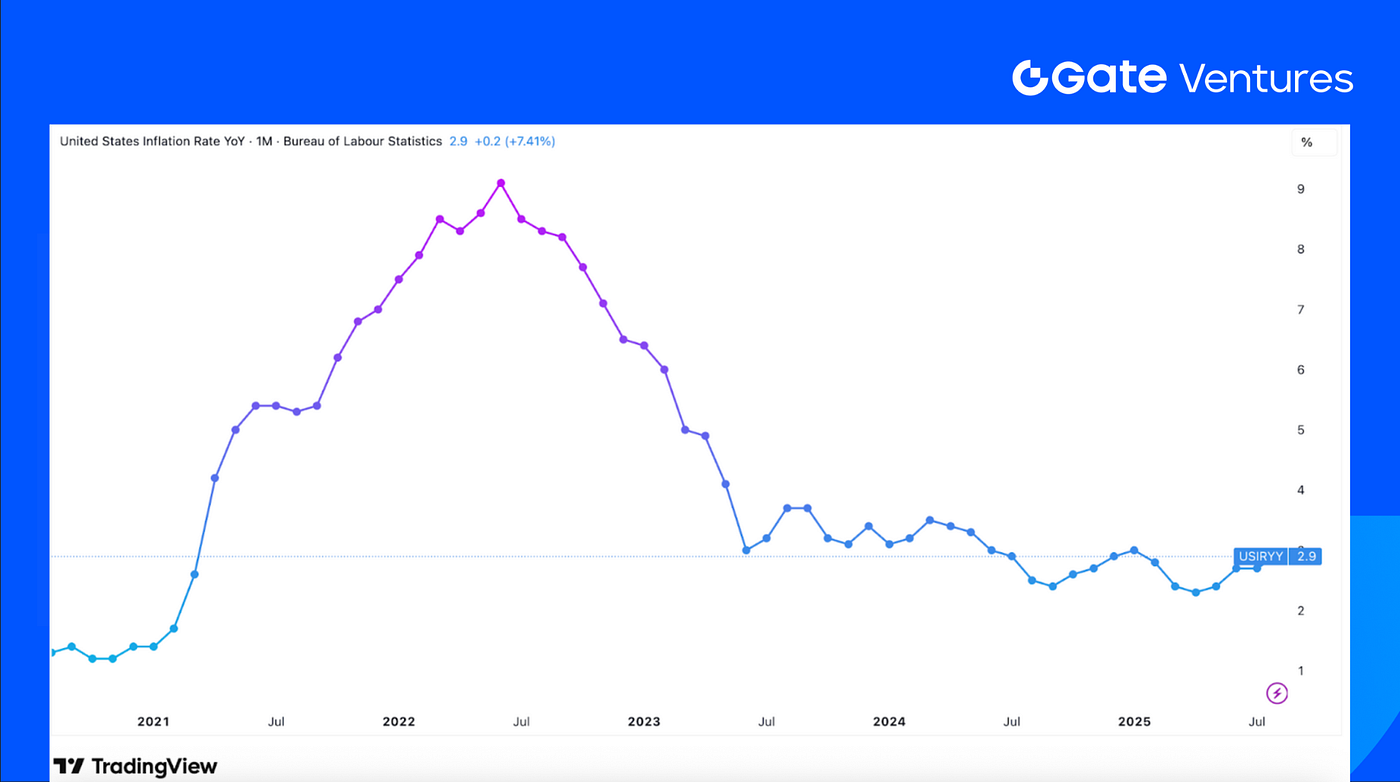

The Fed’s resumption of rate cuts in September marks a new phase, which impacts both US domestic and international economies. The expectation is that the Fed’s rate-cut cycle may unfold in different stages. From 2025Q4 onwards, there could be a more rapid rate for rate cuts. US CPI and PPI have confirmed an upward turning point and may continue to rise over the next quarters. With downside risks to employment more pressing than upside inflation risks, stabilizing economic growth takes priority over controlling inflation. Coupled with significant political pressure from Trump, the Fed is likely to cut at a faster pace.

In 2026H1, as inflation keeps rising, the Fed may need to rebalance between downside growth risks and upside inflation risks, making it difficult to keep cutting quickly. It may use a halt to quantitative tightening to smooth the financial markets. In 2026H2, With Powell’s term expiring in May 2026, the Trump administration is likely to nominate a more dovish Fed chair. Tariffs’ inflationary effects may have run their course at the same time, allowing the Fed to re-accelerate rate cuts. From a long-term view, easing trades are the main theme of global markets and may drive a depreciation of the dollar, broadly benefiting equities, bonds, commodities, and gold.

This week’s incoming data includes the US CPI, PPI, housing data, industrial production and New York and Philadelphia Fed Manufacturing Index. The markets are expecting CPI to have risen 0.3% after a 0.4% rise in August, but for core CPI to hold steady at 0.3%. PPI is meanwhile anticipated to have risen 0.3% after a surprise 0.1% drop in August. Weakening price trends will add to the odds of a further Fed rate cut. Industrial production data and New York and Philly Fed surveys will further provide guidance this week. (1, 2)

US CPI in the past 5 years

DXY

The US dollar has seen a strong growth last week, breaking through the $99 level on Thursday but quickly dropping back to $98 on Friday. The resilient dollar after government shutdown has shown traders are betting the Fed will stay cautious on rate cuts.(3)

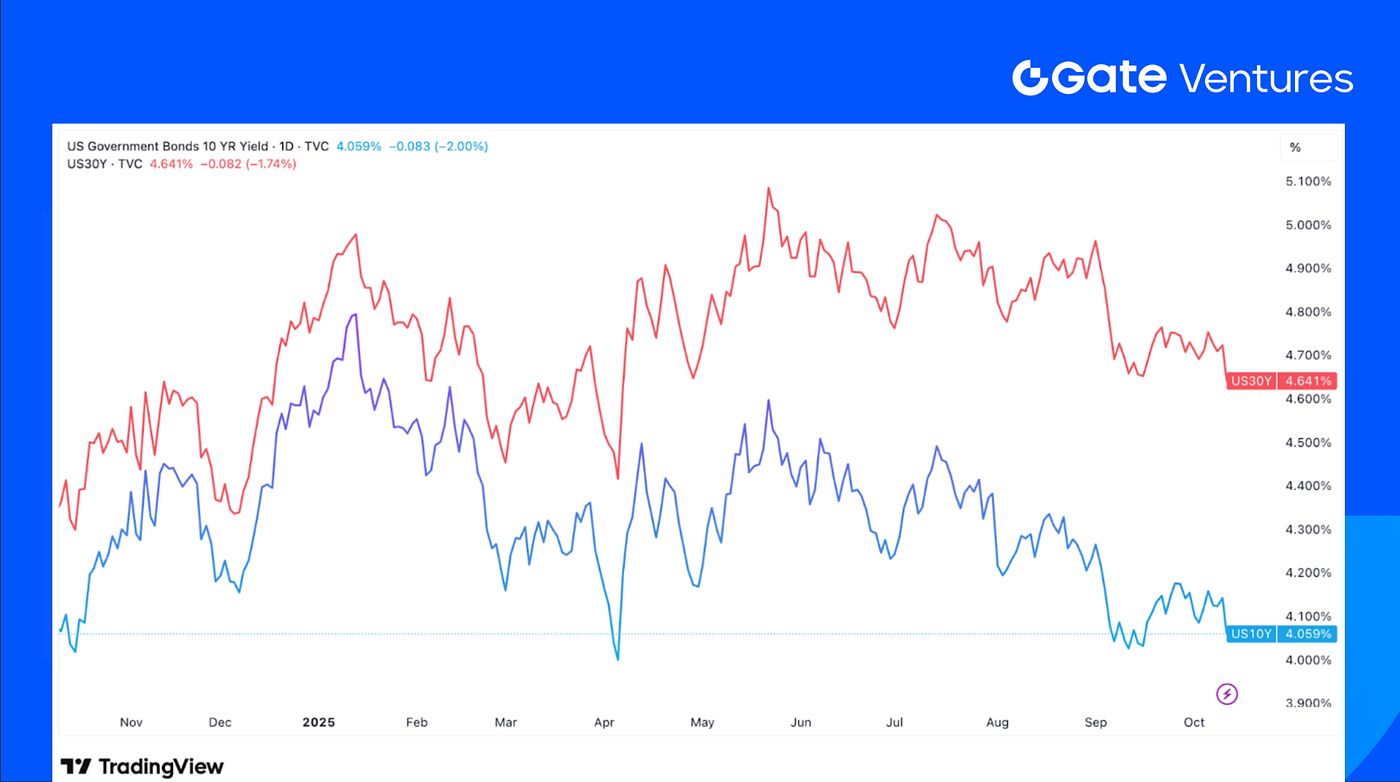

US 10-Year and 30-Year Bond Yields

The US short and long term bond yield both showed a significant drop last week, and the 10-year bond yield has reached a monthly low figure. Trump’s announcements last Friday significantly raised bond prices and dropped the yields. (4)

Gold

Gold prices have seen a strong rally last week, breaking through the $4,000 level. Trump’s new tariffs on China, alongside China’s rare earth restrictions and the uncertainty of US economic data publication contributed to the price reactions. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC fell 6.3% and ETH declined 7.93% this week, mainly driven by Trump’s tariff announcement on China, which triggered panic selling and widespread liquidations across lend-looping and perpetual positions. Despite the downturn, U.S. Bitcoin ETFs saw $2.71B of net inflows, while U.S. Ethereum ETFs attracted $488.27M. (6)

The Bitcoin Fear & Greed Index plunged to 38 (Fear) following the sharp correction. Meanwhile, the ETH/BTC ratio slipped 1.2% to 0.036, briefly touching 0.032, reflecting deeper liquidations in ETH-linked leveraged positions. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The overall crypto market dropped 7.09%, and excluding BTC and ETH, it fell 7.25%. Altcoins were hit the hardest — the market cap excluding the top 10 tokens plunged 14.86%. This was mainly because many altcoin market makers faced liquidity issues, triggering stop-losses and forced selling, which caused even more tokens to be dumped and deepened the crash.

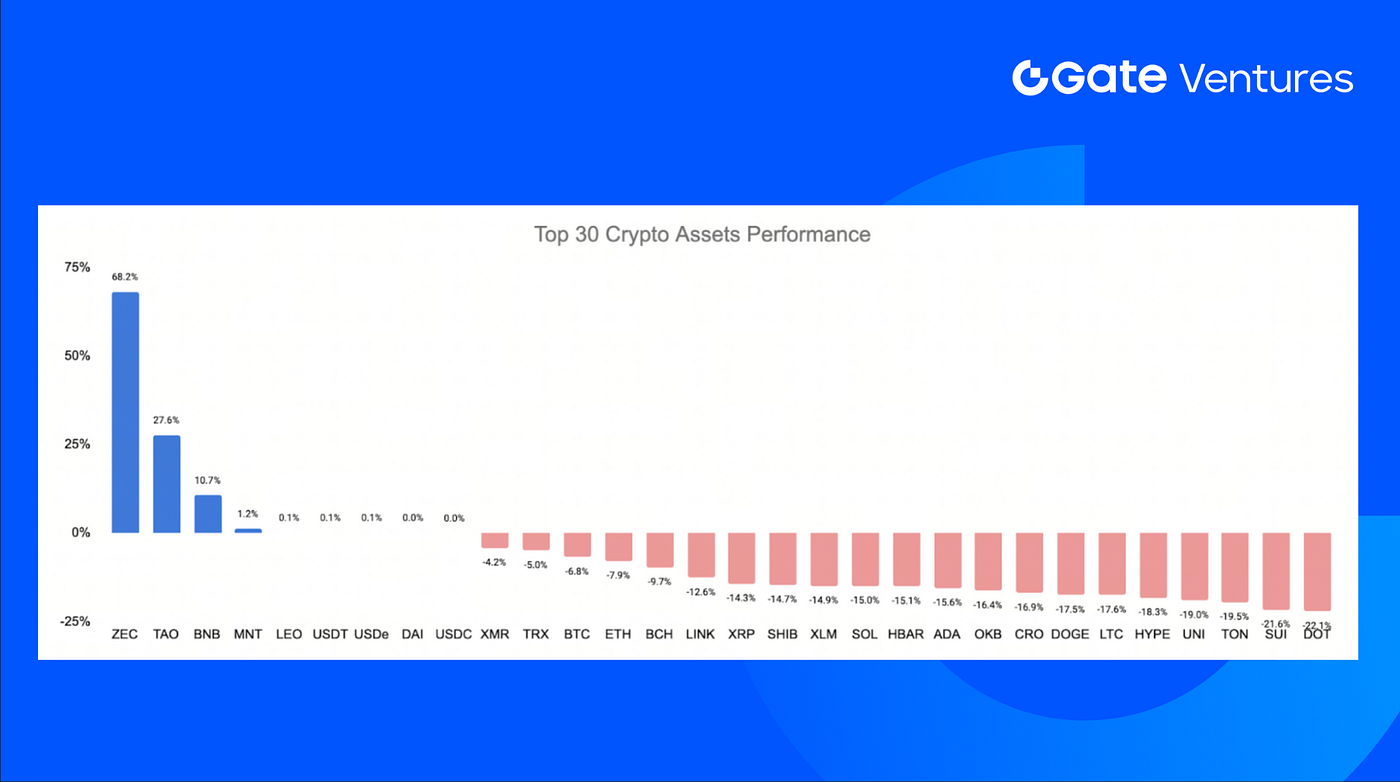

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Sept 29th 2025

The top 30 crypto assets fell by an average of 15% this week, with a few exceptions such as Zcash (ZEC), Bittensor (TAO), and BNB.

Zcash stood out as the top performer, surging 68.2% over the week. Its rally was largely driven by the “Zashi effect” within the Western community — sparked by the launch and rapid adoption of the Zashi wallet app, which enables private swaps and cross-chain payments. This surge in usage pushed shielded pool holdings to 27% of all ZEC and generated over $40M in swap volume since late August.

Bittensor (TAO) jumped 27.6% this week, following news that Grayscale filed a Form 10 with the SEC for the Grayscale Bittensor Trust. This filing is a key step toward making TAO accessible to institutional investors, potentially paving the way for large-scale institutional participation and greater market exposure to Bittensor. (8)

BNB rose 10.7% this week, with its ecosystem maintaining strong momentum as the market began to recover. Chinese-themed meme coins have dominated on-chain trading volume, and several were recently listed on Binance Alpha, further amplifying the wealth effect and driving renewed interest across the BNB ecosystem.

4. New Token Launched

Meteora (MET) is a Solana-based DeFi liquidity infrastructure protocol, built to offer dynamic liquidity pools (DLMM, DAMM v2, etc.), enhanced capital efficiency, and integrated vaults.

The MET token launched with ~48% initial circulating supply, traded via major exchanges (Binance, Bybit pre-market, Hyperliquid Futures,etc). Hyperliquid perpetual contracts are trading at ~$1.61, implying a fully diluted valuation of ~$1.6B given a 1 billion total supply. This FDV edges past Raydium’s earlier ~$1.13B FDV. (9)

Monad (MON) is a high-performance, EVM-compatible Layer-1 blockchain designed to combine scale, compatibility, and efficiency.

The MON token is currently trading on Hyperliquid Futures and OKX& Binance’s pre-market futures, at around $0.087, which implies a fully diluted valuation of ~$8.7 billion based on a 100 billion total supply. (10)

The Key Crypto Highlights

1. Antalpha leads $150M Aurelion financing to build first Tether Gold treasury.

Antalpha led a $100M private placement and $50M debt round to establish Aurelion Treasury, the first Nasdaq-listed corporate treasury backed entirely by Tether Gold (XAUT). The deal positions Antalpha as controlling shareholder with 32.4% equity and 73.1% voting rights, alongside participants TG Commodities (Tether) and Kiara Capital. Backed by LBMA-standard bullion stored in Switzerland, XAUT now exceeds seven tons in reserve. The move highlights rising institutional demand for tokenized gold amid record prices and a broader “digital gold” strategy. (11)

2. Jupiter partners with Ethena to launch Solana-based stablecoin JupUSD.

Solana’s leading DEX aggregator Jupiter is launching JupUSD, a native stablecoin built with Ethena Labs, scheduled for mid–Q4 2025. The token will be fully collateralized by USDtb, Ethena’s Treasury-backed dollar — and later include USDe to enhance yields. Integrated across Jupiter’s perps, lending pools, and trading pairs, JupUSD will gradually replace ~$750M in stablecoins on the platform. The collaboration leverages Ethena’s white-label stablecoin-as-a-service stack, underscoring the rise of branded, yield-bearing stable assets across major ecosystems. (12)

3. Galaxy raises $460M to fuel transition from mining to AI infrastructure.

Galaxy Digital raised $460M from a top global asset manager to transform its former Texas bitcoin mining site, Helios, into a large-scale AI data center hosting CoreWeave. The deal includes 9M new shares at $36 each and 3.8M from executives. Helios’ first phase launches in 1H 2026, supported by a $1.4B project-finance facility and a 15-year lease expected to generate $1B+ in annual revenue, marking Galaxy’s pivot from mining to AI-driven infrastructure. (13)

Key Ventures Deals

1. Crunch Lab raises $5M co-led by Galaxy Digital and Road Capital to build decentralized AI intelligence layer.

Crunch Lab, core contributor to CrunchDAO, raised $5M in a strategic round co-led by Galaxy Digital and Road Capital, with VanEck and Multicoin participating, bringing total funding to $10M. Its decentralized network of 10,000+ ML engineers and 1,200+ PhDs delivers measurable accuracy gains for ADIA Lab, MIT’s Broad Institute, and global banks. The model turns enterprise problems into encrypted challenges, creating an “intelligence layer” for decentralized AI that investors see as key Web3 infrastructure. (14)

2. Coinflow raises $25M Series A to scale stablecoin-powered global payments

Coinflow, a Chicago-based stablecoin payments platform, raised $25M in a Series A led by Pantera Capital with CMT Digital, Coinbase Ventures, The Fintech Fund, Jump Capital, and Reciprocal Ventures participating. The firm has grown revenue 23× since 2024 and now operates in 170+ countries, processing multi-billion-dollar annual volume. By merging stablecoins, AI fraud prevention, and blockchain proof-of-delivery, Coinflow targets the $194T cross-border market, positioning itself as next-generation global payment infrastructure. (15)

3. Meanwhile raises $82M to scale Bitcoin-denominated life insurance

Meanwhile, the first regulated Bitcoin life insurer, raised $82M co-led by Bain Capital Crypto and Haun Ventures with Pantera Capital, Apollo, Northwestern Mutual Future Ventures, and Stillmark participating. Regulated by the Bermuda Monetary Authority, the firm offers BTC-based life insurance, annuities, and savings products to hedge inflation and currency risk. With Bitcoin AUM up 200% this year, Meanwhile positions itself as the institutional bridge for long-duration BTC savings and retirement solutions. (16)

Ventures Market Metrics

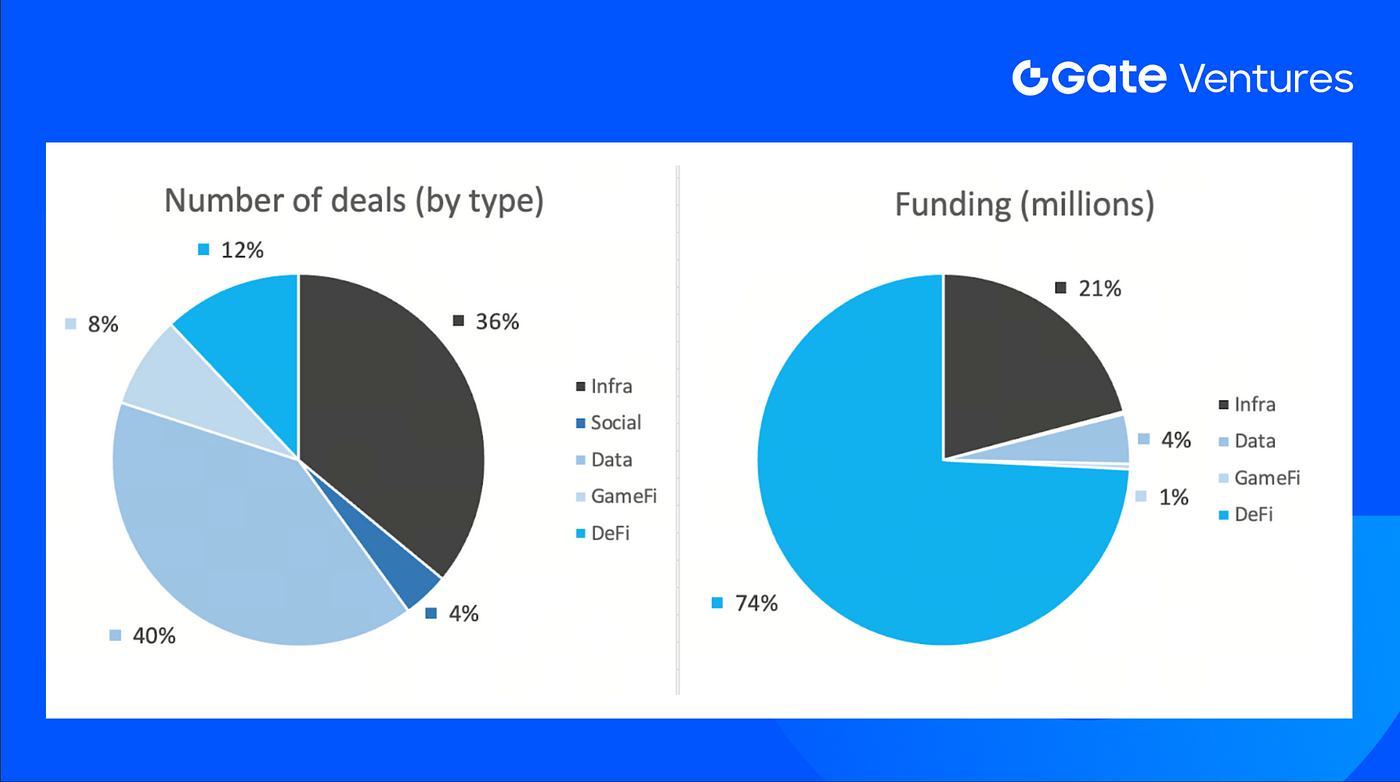

The number of deals closed in the previous week was 25, with Data having 10 deals, representing 38% for each sector of the total number of deals. Meanwhile, Infra had 9 (36%), Social had 1 (4%), Gamefi had 2 (8%) and DeFi had 3 (38%) deals.

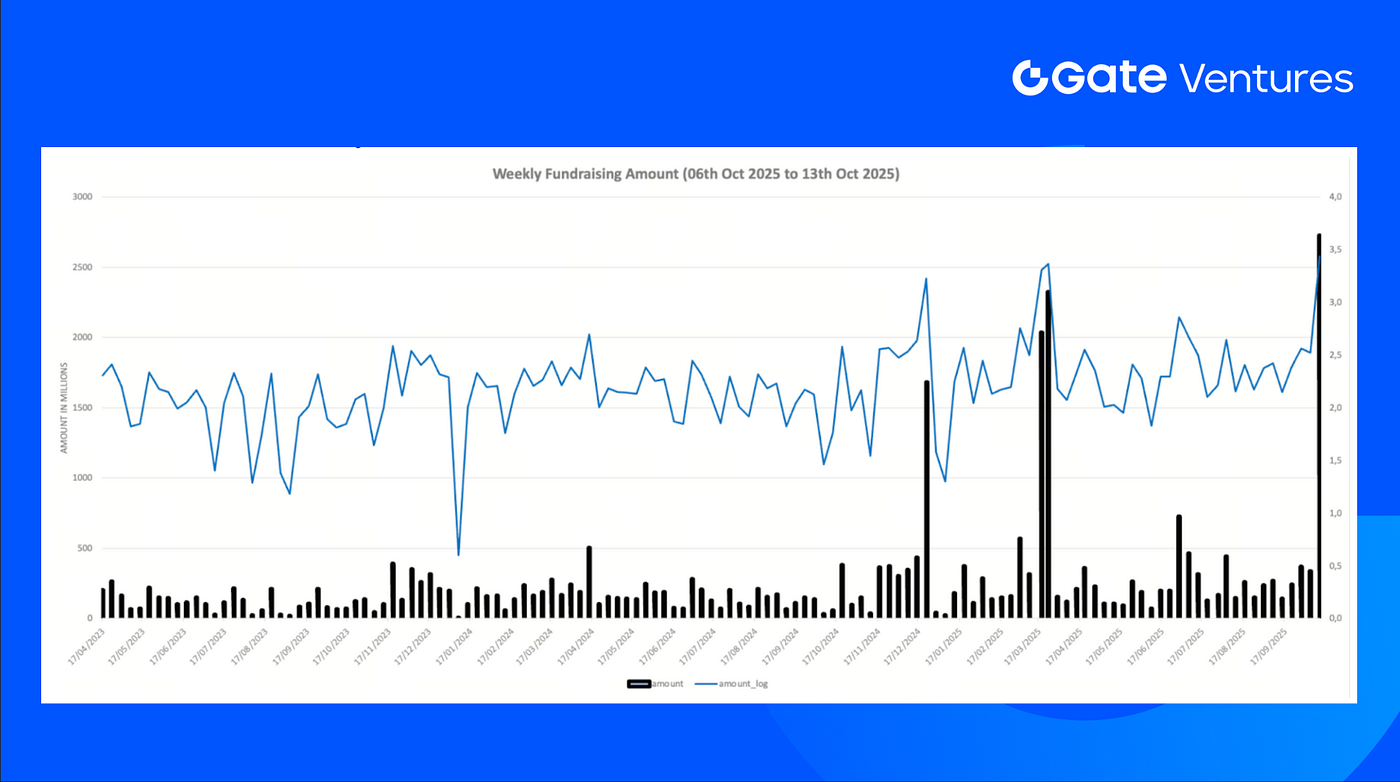

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 13th Oct 2025

The total amount of disclosed funding raised in the previous week was $2724M, 20% deals (5/25) in previous week didn’t public the raised amount. The top funding came from DeFi sector with $2022M. Most funded deals: PolyMarket $2B, Kalshi $300M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 13th Oct 2025

Total weekly fundraising rose to $2724M for the 2nd week of Oct-2025, an increase of +713% compared to the week prior. Weekly fundraising in the previous week was up +4597% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-13-october-2025.html

- TradingView on US inflation rate in the past 5 years, https://www.tradingview.com/symbols/ECONOMICS-USIRYY/?timeframe=60M

- TradingView on DXY Index, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US Treasury Security Issuance, https://www.sifma.org/resources/research/statistics/us-treasury-securities-statistics/

- TradingView on Gold, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Grayscale filing Form 10 for Bittensor Trust, https://x.com/Grayscale/status/1976761631263858812

- MET Hyperliquid Futures, https://app.hyperliquid.xyz/trade/MET

- MON Hyperliquid Futures, https://app.hyperliquid.xyz/trade/MON

- Antalpha leads $150M Aurelion financing to build first Tether Gold treasury,https://www.theblock.co/post/374161/antalpha-150-million-usd-aurelion-financing-tether-gold-treasury

- Jupiter partners with Ethena to launch Solana-based stablecoin JupUSD,https://cointelegraph.com/news/jupiter-ethena-labs-new-solana-stablecoin

- Galaxy raises $460M to fuel transition from mining to AI infrastructure,https://www.theblock.co/post/374243/galaxy-raises-460-million-push-transform-texas-bitcoin-site-ai-data-hub

- Crunch Lab raises $5M co-led by Galaxy Ventures and Road Capital to build decentralized AI intelligence layer,https://crunchdao.com/crunch-lab-raises-5m-to-build-the-intelligence-layer-for-decentralized-ai

- Coinflow raises $25M Series A to scale stablecoin-powered global payments, https://www.businesswire.com/news/home/20251006771358/en/Coinflow-Closes-%2425M-Series-A-Led-by-Pantera-Capital-To-Power-Billions-in-Global-Payment-Volume

- Meanwhile raises $82M to scale Bitcoin-denominated life insurance,https://www.businesswire.com/news/home/20251007203460/en/Meanwhile-the-First-Regulated-Bitcoin-Life-Insurer-Raises-%2482M-to-Meet-Strong-Demand-for-Inflation-Proof-Savings-and-Retirement-Products

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)