Gate Ventures Research Insights: Strategy-Based Synthetic Stablecoins – Financial Lego Built on Interest Rates

TL;DR

Stablecoins have long been seen as the crown jewel of the crypto industry. Early development was driven by algorithmic stablecoins, notably Ampleforth’s AMPL and Terra’s UST (LUNA). These projects sought to break free from dependence on USD reserves, using algorithmic mechanisms to construct USD-pegged stablecoins and spur adoption across crypto and DeFi, ultimately reaching traditional, off-chain users. Ampleforth pursued a fully crypto-native settlement unit—not maintaining a 1:1 USD peg—while TerraUSD (UST) aimed for a stable dollar peg to enable broader payment and value storage use.

With Ethena’s launch, DeFi stablecoins now anchor not only price stability, but yield sources. A new wave of “strategy-backed stablecoins” is gaining ground, essentially wrapping hedge strategies or low-risk yield products into $1 denominated, tradable tokens. Ethena’s USDe resembles a fund share, generating returns through a delta-neutral strategy—long stETH, short perpetuals—with yield distributed to holders as sUSDe. Due to their hedge fund-like structure, such stablecoins are classified as securities by regulators like Germany’s BaFin.

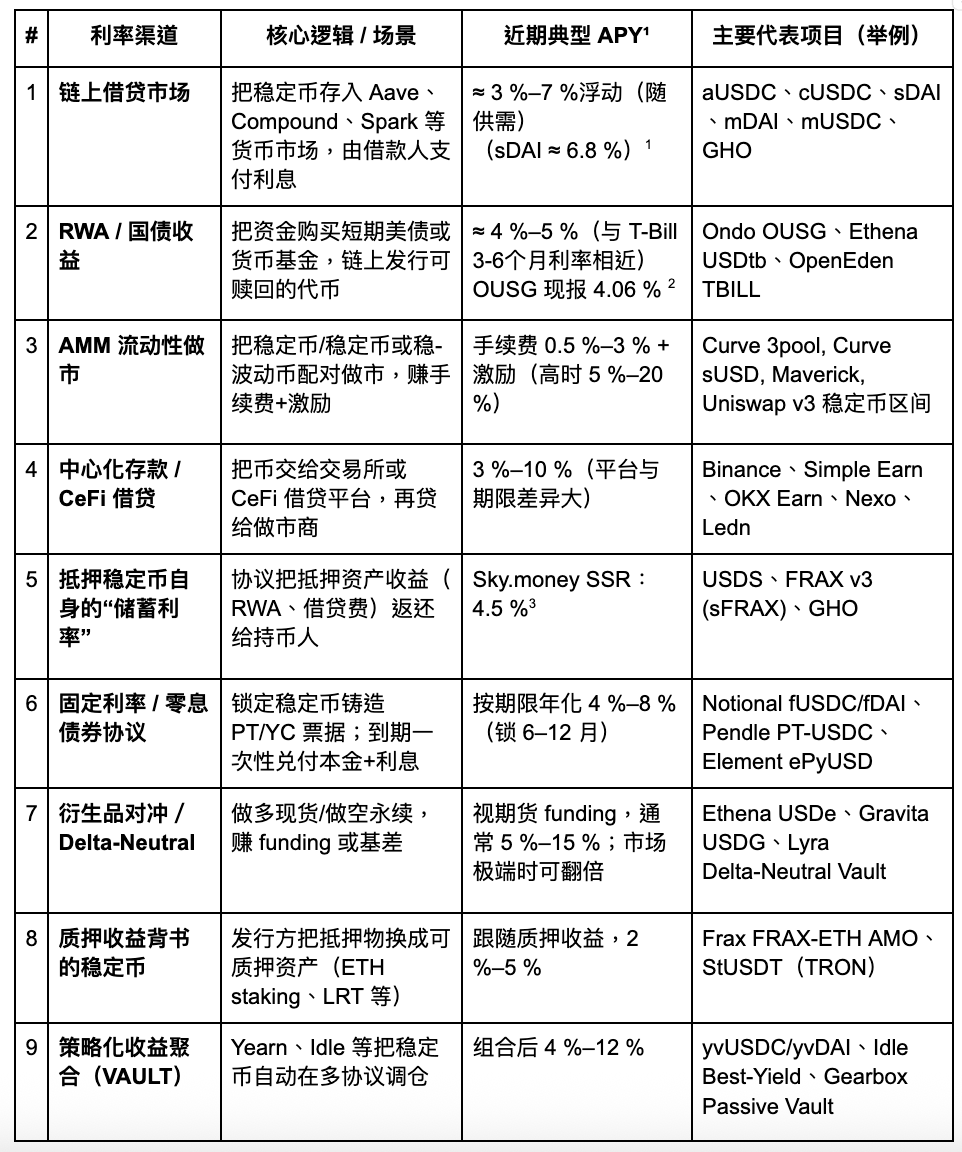

This report categorizes stablecoin yield mechanisms into nine types, including on-chain lending, real-world assets (RWA), AMM market making, CeFi deposits, protocol savings rates (e.g., DSR), fixed-rate notes, derivatives hedging, staking yields, and strategy aggregator vaults. Most channels yield 3–8% annually in today’s market, with sporadic double-digit returns during abnormal periods (e.g., USDC depeg, surging funding rates).

While strategy-focused stablecoins can seem commoditized, their critical differences lie in three areas: yield sustainability, yield transparency, and regulatory compliance. RWA-backed stablecoins like USDY and OUSG are ahead on compliance, with some regulatory recognition, though their upside is capped by U.S. Treasury market structure. Derivative-linked stablecoins such as USDe offer greater flexibility and yield potential but depend heavily on perpetual contract market open interest (OI), making them more sensitive to volatility.

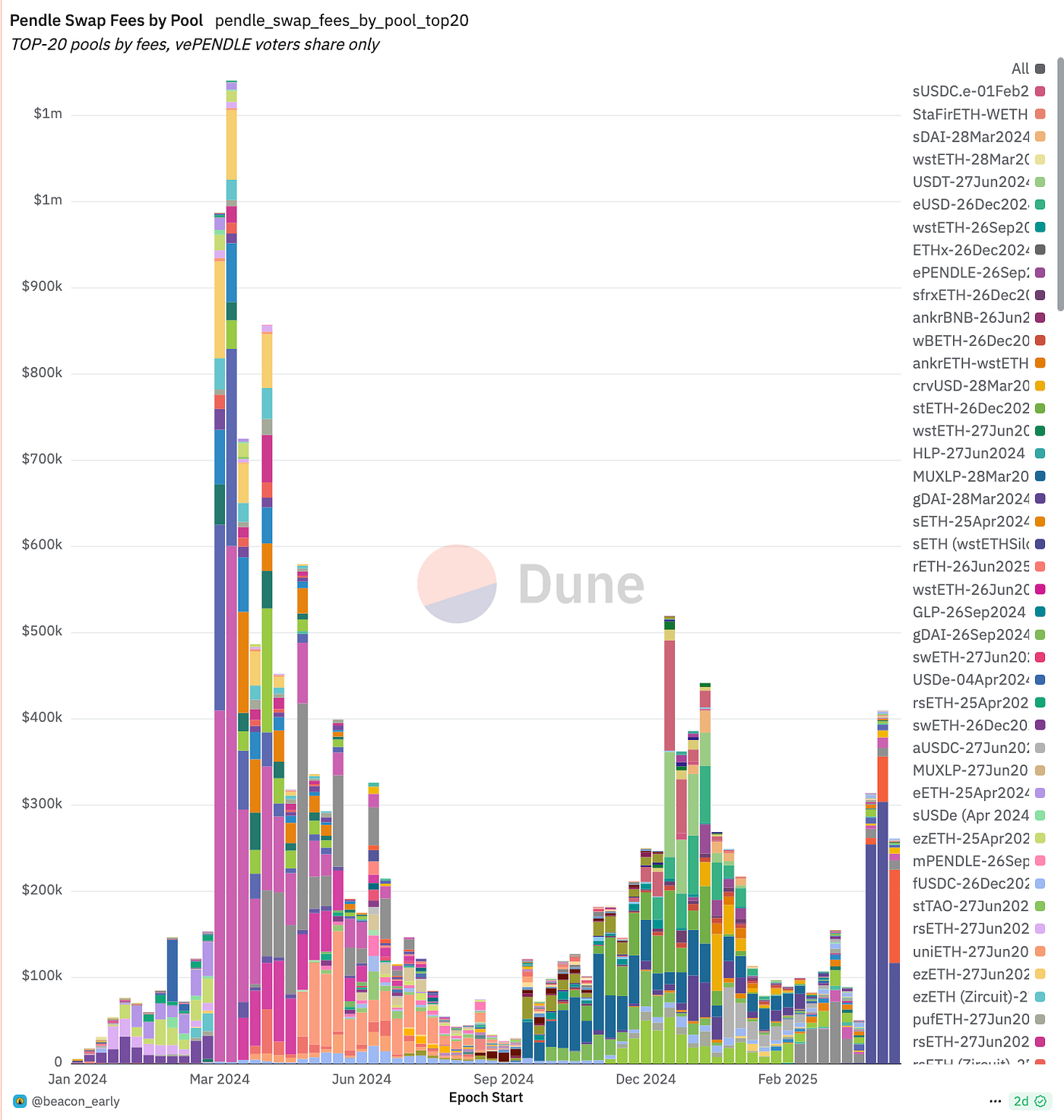

Pendle stands out as the infrastructure winner from this trend. Pendle splits yield assets into fixed principal tokens (PT) and floating yield tokens (YT), building an on-chain interest rate market and enabling standardized “spread hedging” and “yield transfers.” As more stablecoin projects use Pendle for cash flow management, its TVL, trading volume, and bribe system are likely to keep growing.

We expect future strategy stablecoins to evolve toward modular, compliance-oriented, and transparent yield models. Projects with unique yield sources, robust redemption mechanisms, and deep liquidity moats (ecosystem adoption) will form the next “on-chain money market fund” foundation. However, such products may be deemed securities by regulators, posing nontrivial compliance challenges.

Strategy-Based Stablecoins

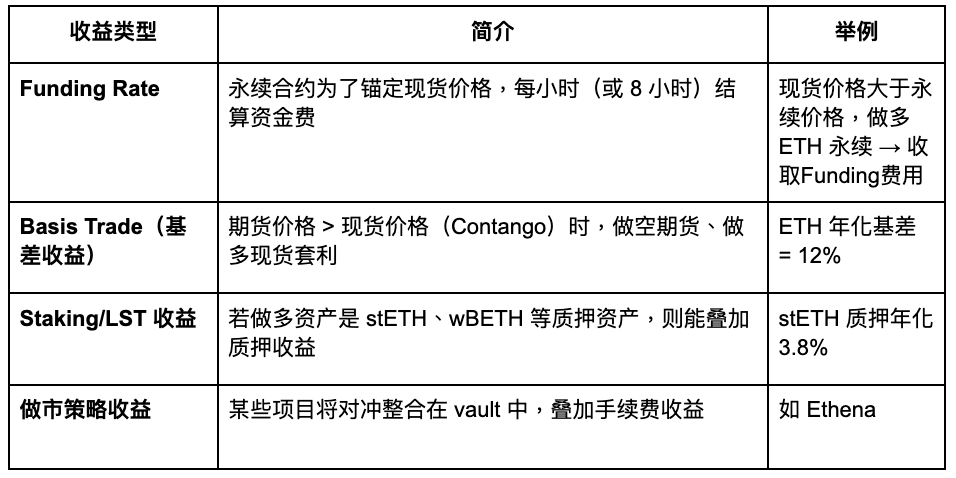

Yield stablecoins tap various revenue channels: lending protocols, liquidity mining, market-neutral arbitrage, RWA Treasury yields, options structures, stablecoin baskets, and staking yields. Below is a summary of major strategies:

Gate Ventures

We’ll break down the status quo and catalysts for innovative yield channels to assess future potential.

On-Chain Lending Markets

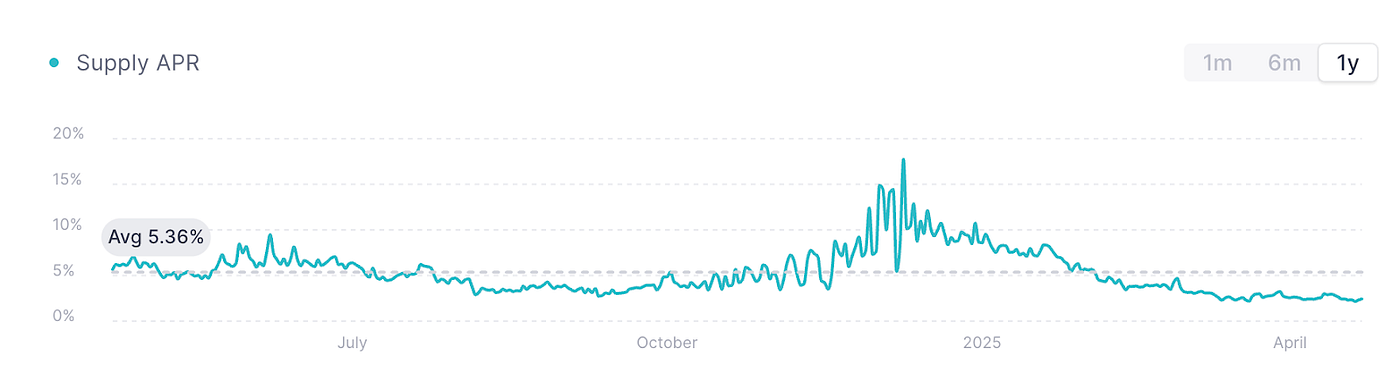

AAVE V3 USDC, source: AAVE

The chart above shows USDC borrowing rates on AAVE V3 (Ethereum mainnet), typically considered the benchmark for on-chain lending rates. Amid weak market sentiment and subdued capital demand, lending activity has dropped sharply, with rates staying near 2% year-to-date.

AAVE has also launched its native stablecoin GHO, supported by overcollateralization and with rates determined by market lending demand. While most mainstream stablecoins on AAVE can earn interest, only via borrowing—limiting capital efficiency. GHO’s borrowing rate currently ranges from 2–4%, fluctuating with broader market cycles. In bull runs, lending rates can spike to 10–20%, though with intense volatility. Pendle provides a way to settle such interest prematurely in these high-volatility scenarios.

RWA Markets (Treasuries)

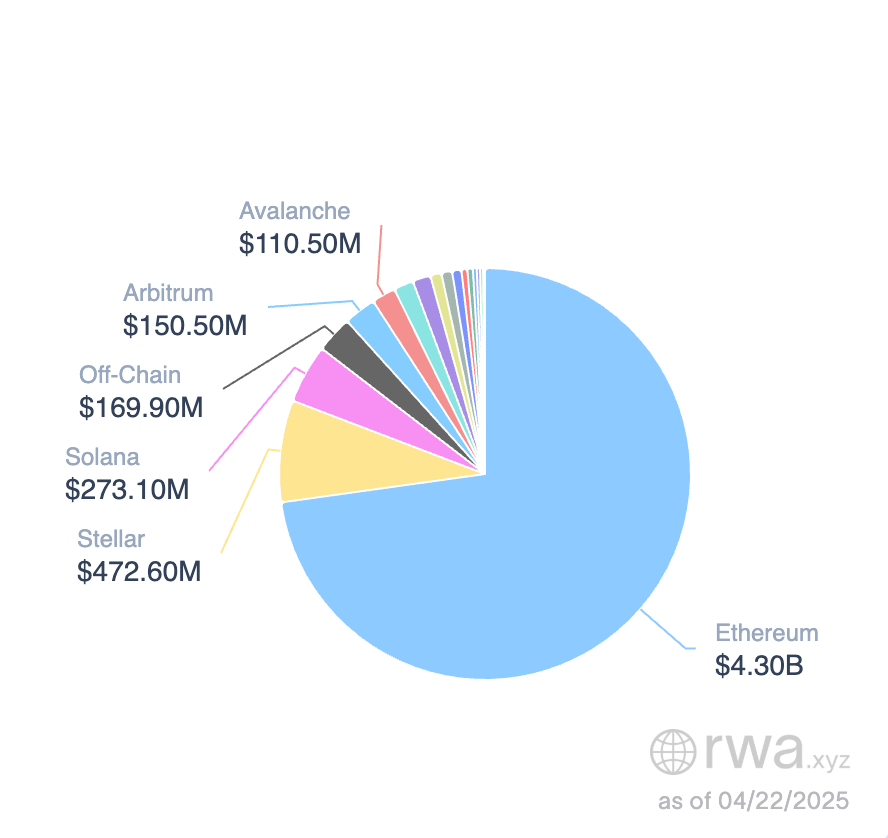

Stablecoins on the RWA market, source: RWA.xyz

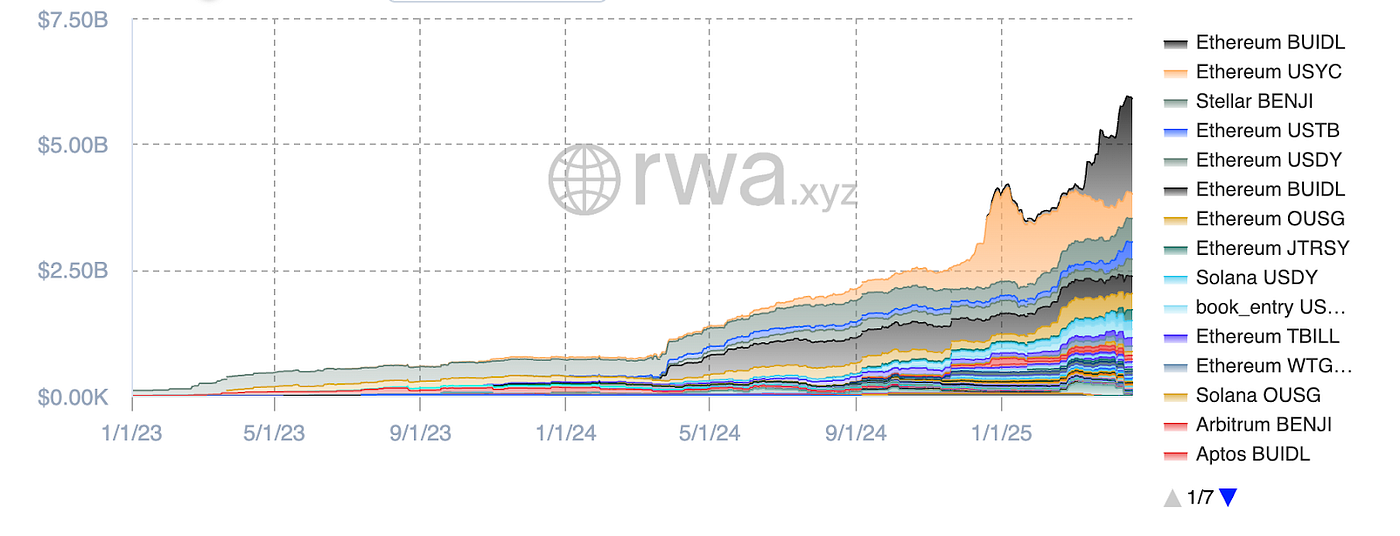

Stablecoins backed by U.S. Treasuries are gaining traction, with a total market size around $5.9 billion. The Ethereum ecosystem dominates, with over 80% market share. BlackRock’s BUILD leads Treasury-backed stablecoins (32%, ~$1.9B), followed by Circle’s USYC ($490M) and Franklin Templeton’s BENJI.

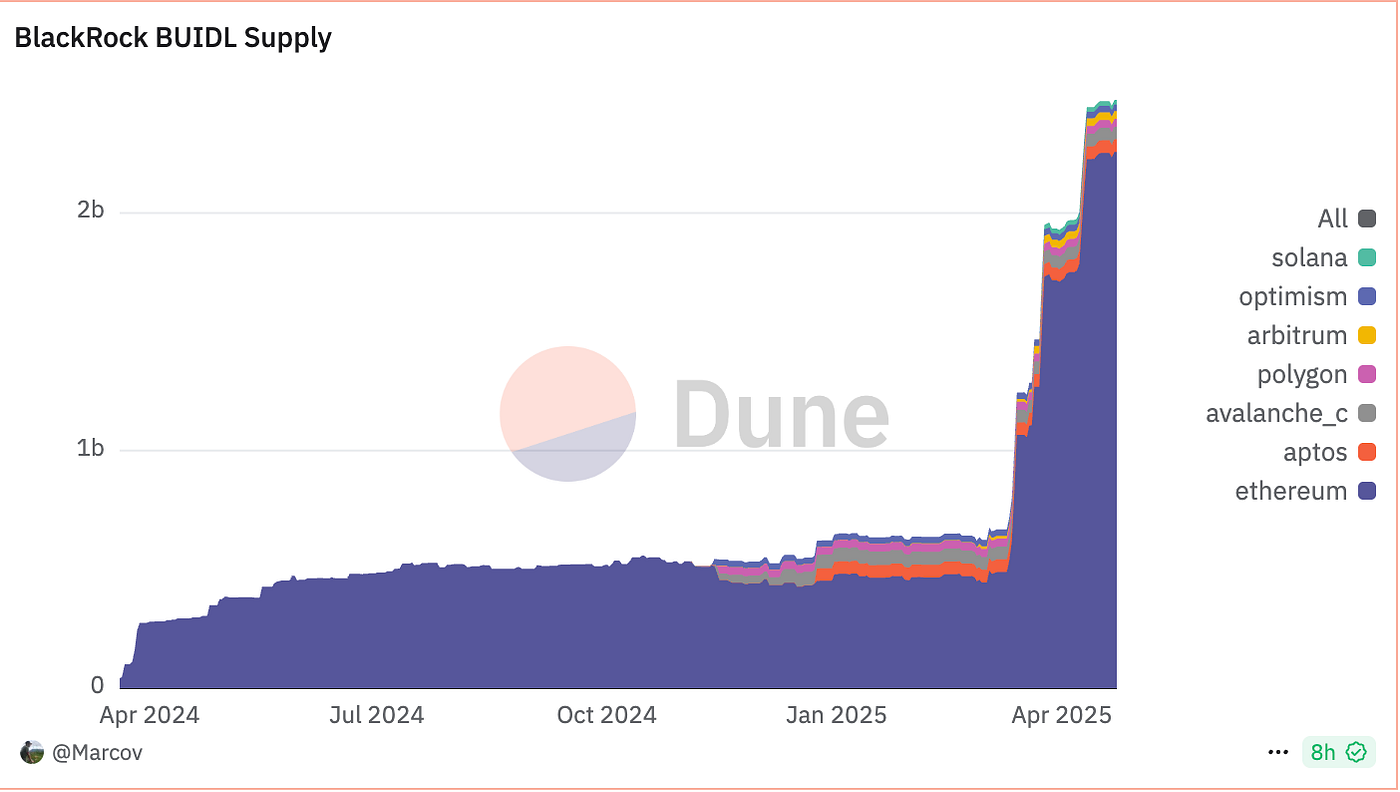

BUIDL Supply, source: Dune

With BUIDL, although pegged to $1, it’s essentially not for daily payments but functions as a fund share referencing short-term Treasuries, cash, and overnight repo agreements. Users subscribe via USDC/USD, each BUIDL representing $1 principal, with monthly yield distributed through a Rebase. Early adopters include Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks.

BUIDL’s supply is accelerating, with a minimum subscription of $5 million. As of May 1, 2025, there were 48 clients, and AUM reached $2.47B. Ondo Finance reports the APY is around 4%, matching current 3–6 month Treasury yields.

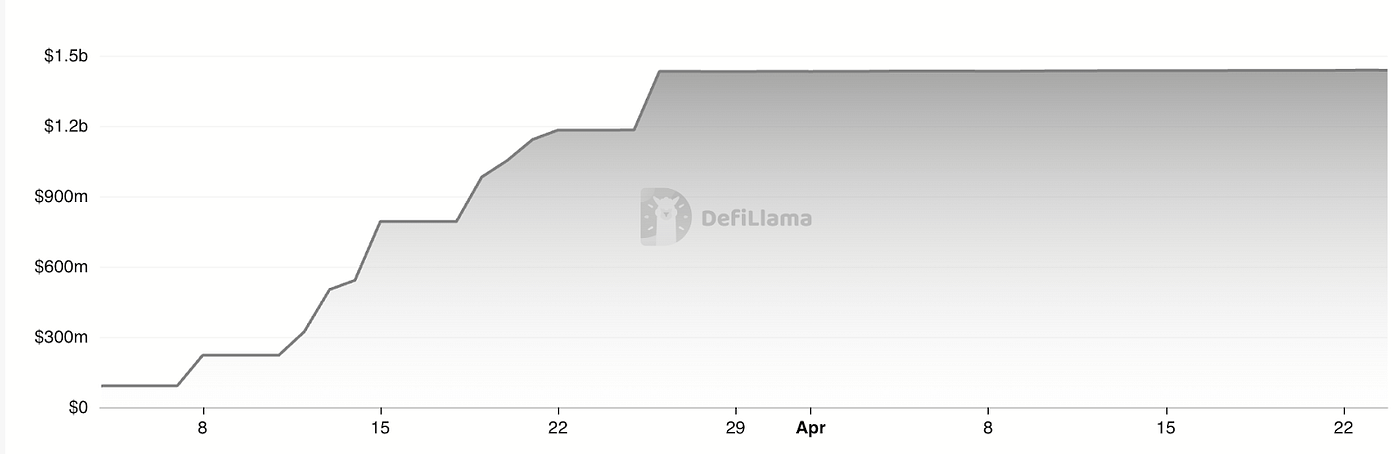

USDtb TVL, source: Defillama

Ethena’s USDtb builds on the money market fund model, using tokenized BUIDL funds as the underlying asset, and—unlike Ondo’s OUSG or BlackRock’s BUIDL—offers free-flowing transferability. USDtb’s AUM is approximately $1.43B; its partnership with Bybit ensures robust market liquidity.

The RWA stablecoin market is expanding rapidly, with total size near $5.9B. Ethena’s USDtb signals a new direction: should U.S. regulators allow “interest-separated stablecoin” models, market capacity could theoretically match U.S. money market funds at $6 trillion.

In the near term, though, Treasury yields face downward pressure. As stablecoin demand is rate-driven, not payment-driven, money-market stablecoins may see shrinking returns; however, over the long term, this sector still has strong growth potential.

Native Stablecoin “Savings Rate”

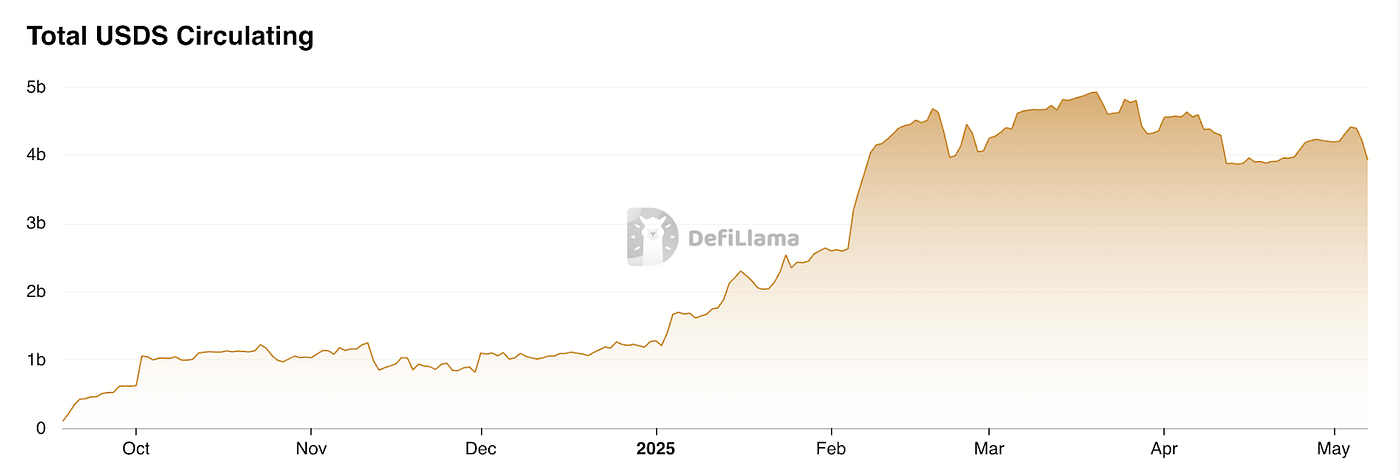

MakerDAO’s DSR (Dai Savings Rate) has evolved into Sky.money’s SSR (Stablecoin Savings Rate) module, letting USDS holders earn protocol revenues at an annualized rate, with real-time block-level interest, no lockups or fees, and free withdrawal.

MakerDAO/Sky.money generates yields from its profits. To boost USDS usage in DeFi, Sky.money allocates part of protocol income to USDS holders. Currently, the SSR yields about 4.5% APY.

USDS Growth, source: Defillama

This is a protocol-dividend stablecoin model. When markets are weak, Sky.money re-allocates original token revenues to USDS to promote adoption—potentially undermining native token price support. In bull cycles, moderate yield sharing for holistic growth lifts both token price and protocol. But because this approach is tightly linked to a single protocol, Sky.money needs scale and influence to make USDS a widely-accepted unit of account—which is a significant challenge that demonstrates the project’s ambition.

Derivatives Hedging + Staking Yields

Delta-neutral yields are generated by derivatives strategies: holding offsetting long and short positions, eliminating directional risk (Delta), and earning yield through funding rates or futures-spot price spreads. Perpetual futures are the main instrument. Strategies include:

Gate Ventures

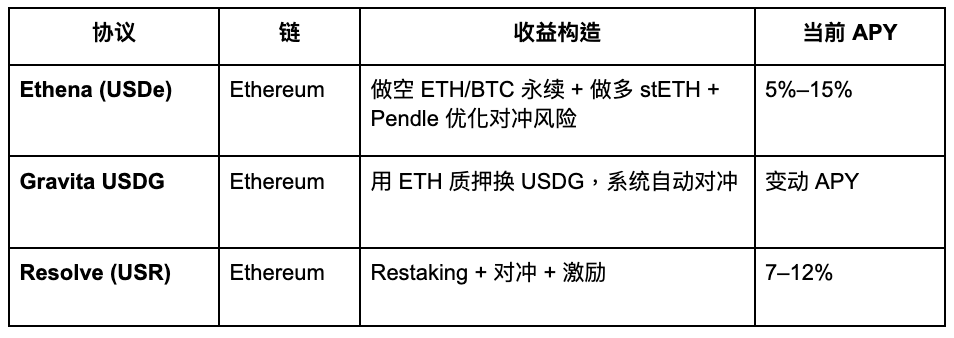

Representative projects:

Gate Ventures

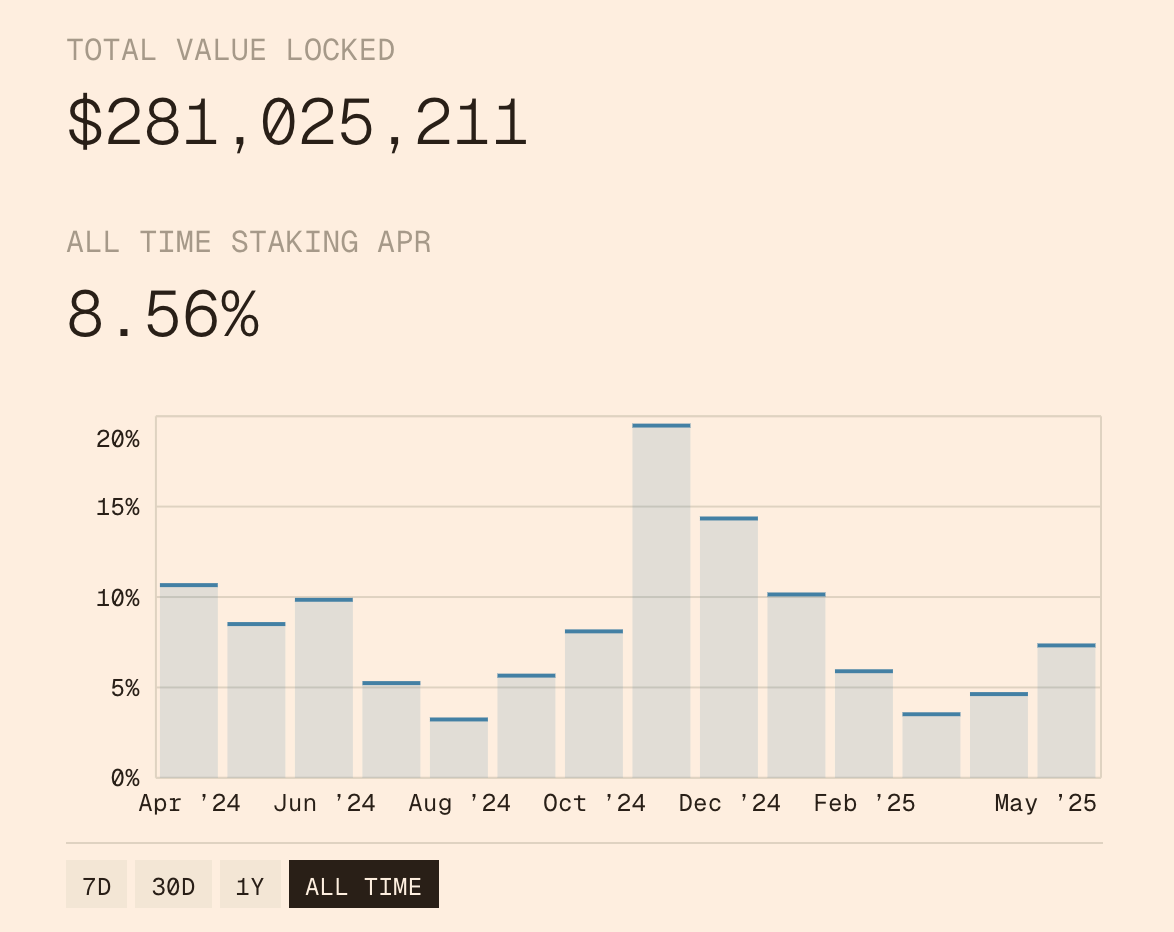

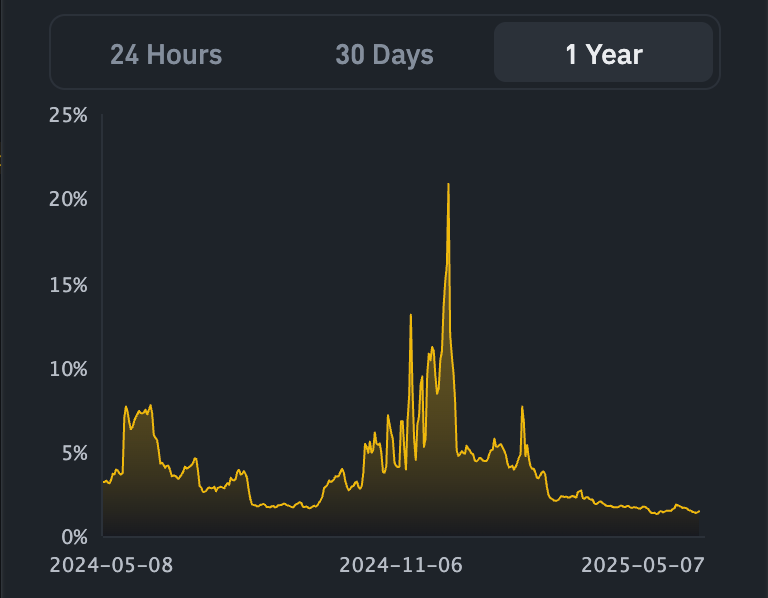

USDe APY, Source: Exponential.FI

USR APR, source: Resolve

Above are rate trends for USDe and USR. USDe launched as the first delta-neutral stablecoin; USR followed with higher rates to attract users, but fundamentally isn’t vastly different from Ethena.

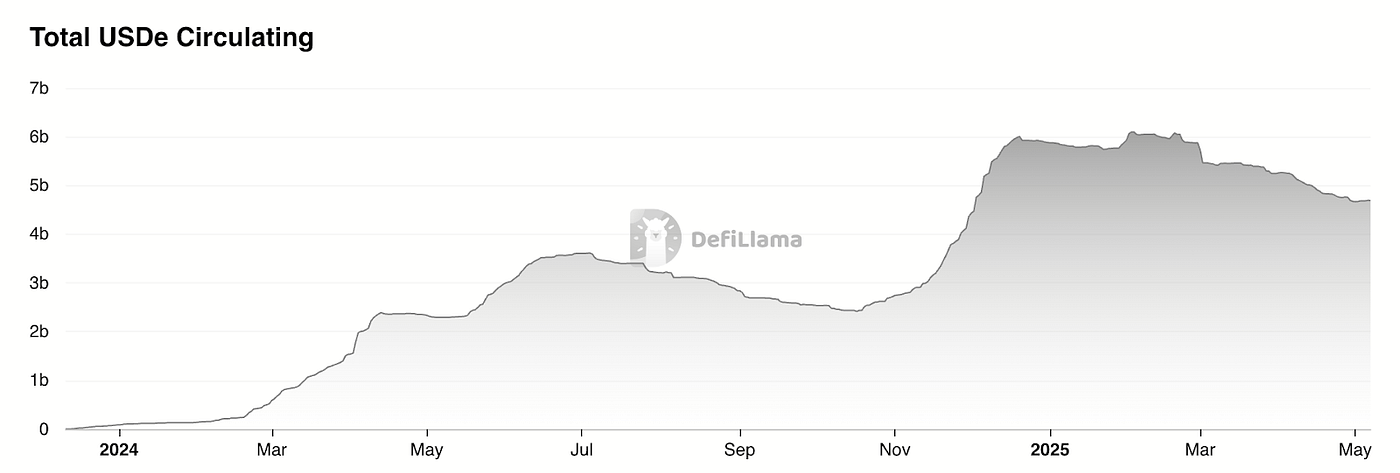

USDe TVL, source: Defillama

Defillama data show Ethena’s stablecoin market cap has dropped ~20% post-airdrop, mainly due to falling USDe yields. Across the sector, stablecoins face the “DeFi Lego” problem—lacking real-world demand, functioning mainly as fund wrappers for funding rate arbitrage.

Delta-neutral stablecoins are minted by:

- Buying dollar-equivalent spot (or LST)

- Opening equal-value short positions in perpetual markets

Minting $1 stablecoin = $1 spot + $1 nominal short. Thus, scale is capped by available perpetual market OI.

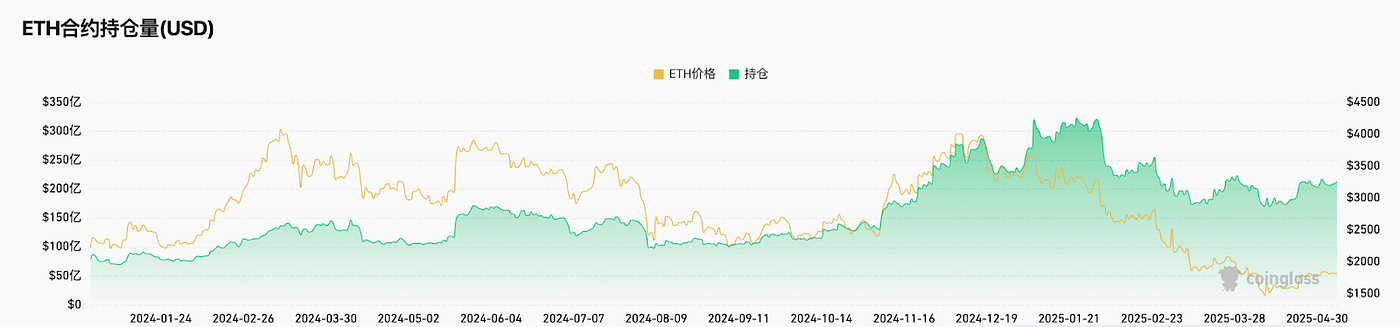

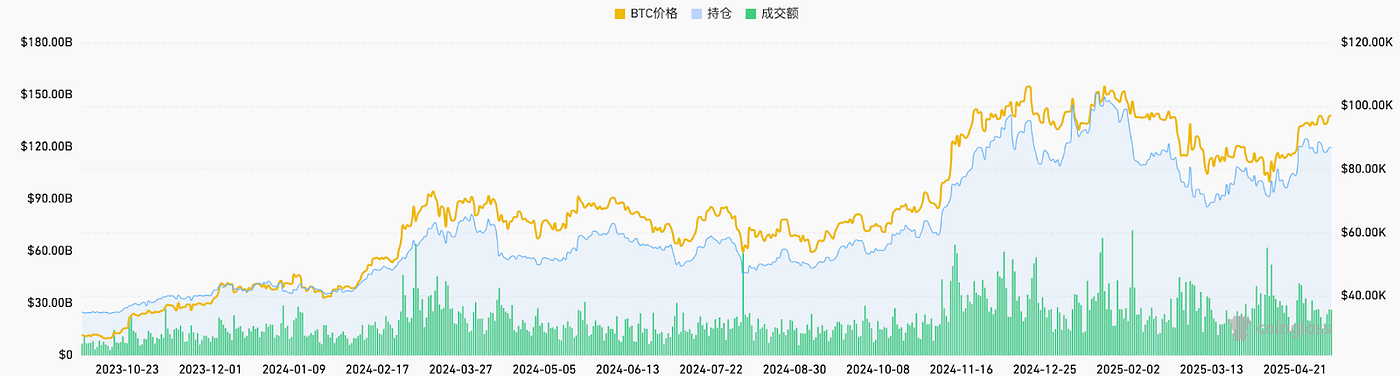

Ethereum OI, source: Coinglass

Coinglass shows aggregate ETH OI at ~$20B across exchanges. This sets a conservative cap for USDe at $4B.

All tokens’ OI, source: Coinglass

Counting all tokens, contract rate hedging markets could reach $120B. If 20% is addressable, that’s $24B.

So, the total obtainable market for contract rate hedging is $24B. For ETH-focused USDe, potential size is ~$4–8B. USDe’s current circulating supply is about $4.6B and declining—suggesting it’s near the ceiling.

Strategy Aggregator Vaults

For instance, Idle Best-Yield runs automated strategies on Ethereum and Polygon, dynamically reallocating for optimal stablecoin returns. Hyperliquid’s HLP is another example—a strategy-based yield pool, primarily earning from market-neutral counterparty flows. Multi-strategy models can offer higher yields but entail greater risk exposure.

Binance Launches LDUSDT

Extreme caution is needed here: these assets function as hedge fund subscription shares. According to Binance’s introduction, LDUSDT is not a stablecoin, but a new margin asset for Simple Earn USDT participants. It’s a wrapper for USDT, usable as contract margin and able to earn Simple Earn APY. The underlying yield comes from Binance’s lending market.

Simple earn APR, source: Binance

Ethena’s USDe may be an innovative strategy-based stablecoin. The rise of strategy stablecoins signals the crypto market’s conservative shift—yet marks progress. While previous stablecoins relied on subsidized growth, today’s models depend on diversified organic yield for greater sustainability. Notably, subtracting points or airdrop subsidies, their yields have no clear advantage versus Treasuries.

Meanwhile, DeFi’s synergy remains untapped, leaving stablecoins mostly an internal “DeFi Lego” tool rather than enabling large-scale real-world use. Listing synthetic stablecoins on exchanges is crucial for mainstream Web3 adoption. Ethena is moving rapidly—Bybit and Bitget have listed pairs, and Gate has a strategic partnership. Still, daily USDE/USDT global volumes remain below $100M.

Stablecoin Project Landscape

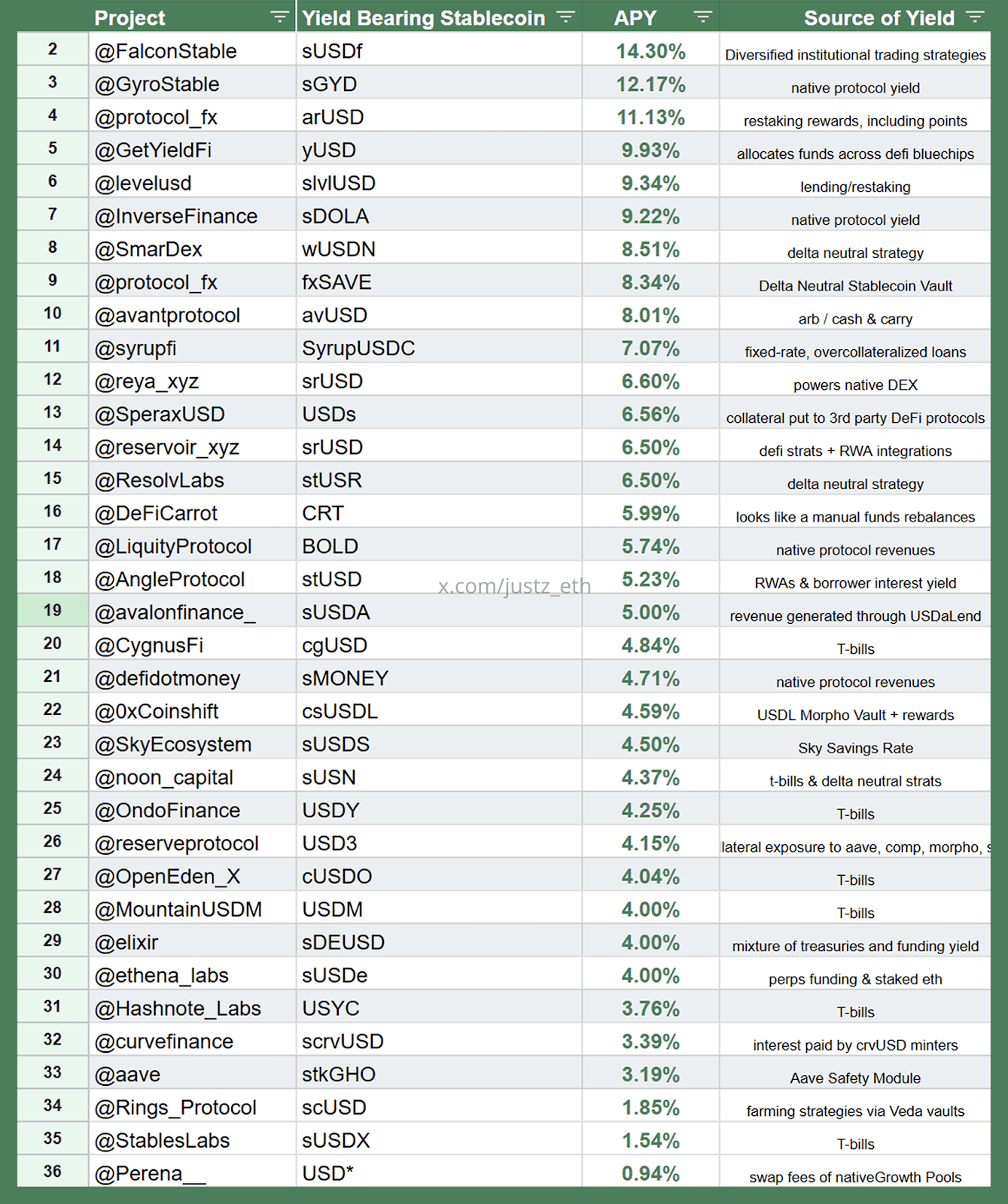

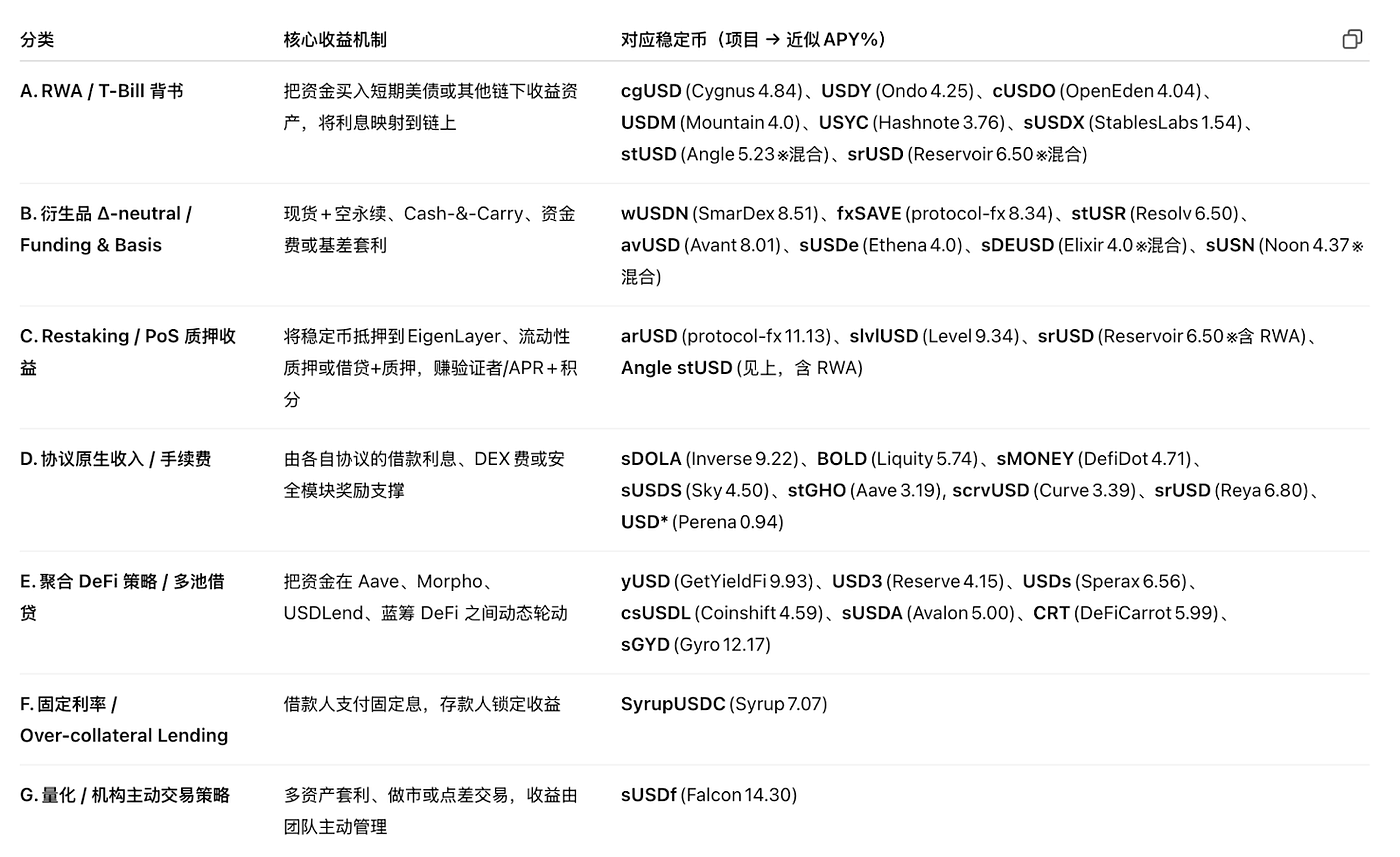

Strategy-backed Synthetic Stablecoins Landscape, source:justz_eth

The chart above maps more strategy-based synthetic stablecoins, with corresponding yield sources and strategies.

Strategy Classification, source:justz_eth

Most popular stablecoin projects anchor their synthetic asset yields in the strategy categories detailed earlier. Notably, TVL data may be inflated and some projects have special arrangements with whales—so caution is warranted. Fundamentally, these stablecoins resemble hedge fund shares and carry clear legal risks of being designated as securities.

U.S. Treasury-backed stablecoins have the largest market share, with real-world rollout dependent on legal frameworks and banking sector support—making us most optimistic on this track. Other approaches (lending rates, restaking rates, contract risk-free rates, protocol income, etc.) have hard caps and are best entered moderately.

New Rate Concepts

Below are ideas for founders:

- Asset innovation. BTC, as the critical bridge between TradFi and Web3, boasts a multi-trillion dollar market cap. Introducing base rates into BTC-backed stablecoins—building a BTC ecosystem stablecoin—could prove easier than other chains. The challenge is BTC’s weak infrastructure. Off-chain contract rate arbitrage could be a starting point, but it’s still fundamentally a hedge fund strategy.

- Strategy innovation. Any arbitrage strategy could be a stablecoin yield source: on-chain MEV, IV-RV divergence, term structure volatility arbitrage, GameFi yields, even EigenLayer AVS security fees or DePIN device revenues could be funneled into stablecoin yield models, creating entirely new rate mechanisms.

Fundamentally, these remain strategy-based synthetic stablecoins—not traditional models backed by real assets. Market capacity depends on the available scope of the underlying strategy and reference market size, which, at present, remains small. As DeFi expands, this track has growth potential—crypto-native strategies are especially responsive to on-chain market changes.

Stablecoin Wars: Beneficiary Pendle

Fixed rates are an innovative yield model, providing predictable returns similar to zero-coupon bonds in TradFi—issued below face value, redeemed at par, with yield coming from the price differential. In DeFi, Pendle replicates this mechanism by tokenizing future yield and letting users:

- Lock in fixed yield: buy principal tokens, hold until maturity for guaranteed returns.

- Speculate on rates: buy yield tokens to bet on rate changes.

- Enhance capital efficiency: sell future yield for instant liquidity, keeping principal ownership.

Pendle Snapshot, source:pendle

Pendle is a DeFi protocol for yield tokenization—splitting yield assets into principal and yield tokens for trading. Pendle builds a market for yield itself, offering hedging tools for stablecoin issuers and enabling fixed rates.

During the last LRT boom and EigenLayer token launch, Pendle’s token price slumped. With strategy-based stablecoins rising, Pendle’s TVL increased significantly. Pendle is evolving into the sector’s “yield swap layer,” enabling stablecoin issuers to sell future yield for instant hedging, while asset managers and traders buy or market-make those streams. As more delta-neutral and RWA hybrid yield coins launch, Pendle’s TVL, volume, protocol fees, and vePENDLE ecosystem have all surged; Pendle is becoming dominant in this niche.

Source:

- https://defillama.com/yields/pool/13392973-be6e-4b2f-bce9-4f7dd53d1c3a?utm_source=chatgpt.com

- https://ondo.finance/ousg?utm_source=chatgpt.com

- https://defillama.com/yields/pool/c8a24fee-ec00-4f38-86c0-9f6daebc4225?utm_source=chatgpt.com

Disclaimer:

This content does not constitute an offer, solicitation, or recommendation. Always seek independent professional advice before making investment decisions. Gate and/or Gate Ventures may restrict or prohibit services from certain regions. Please refer to the relevant user agreements for details.

About Gate Ventures

Gate Ventures is Gate’s venture capital division, focused on investing in decentralized infrastructure, ecosystems, and applications shaping the Web3 era. Gate Ventures partners with global industry leaders to empower innovative teams and startups, redefining social and financial interactions.

Website: https://ventures.gate.com/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook