Gate GUSD Staking Launched: A New Choice with 4.4% Annualized Stable Yield

GUSD’s Stable Earnings Feature

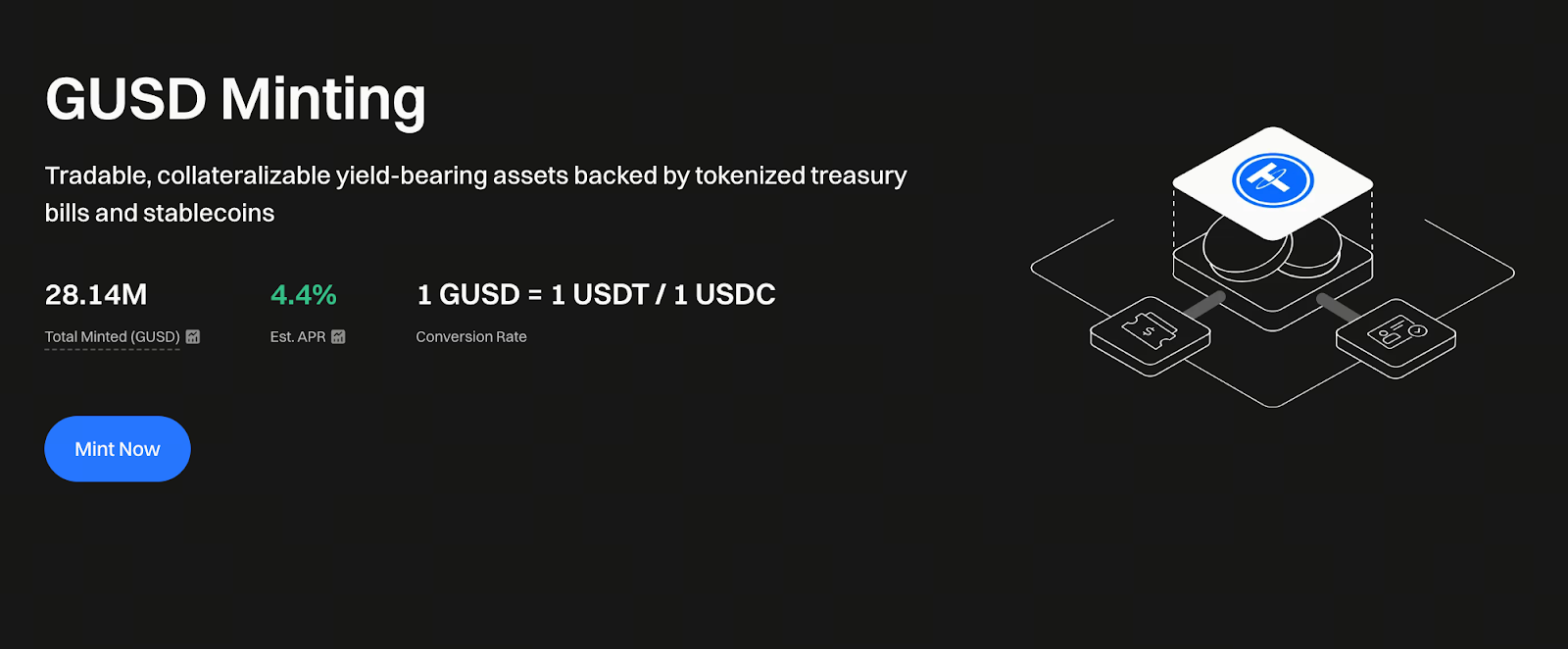

Image source: https://www.gate.com/staking/GUSD

In the highly volatile crypto market, stable and predictable returns are a rare find for investors. That’s why Gate introduced GUSD. Users can mint GUSD 1:1 with USDT or USDC and start earning automatically settled daily returns, with a current annualized yield set at 4.4%.

GUSD’s yield comes from two primary sources: the interest generated by underlying U.S. Treasury assets and a revenue share from the Gate ecosystem. This structure means GUSD’s returns aren’t solely driven by crypto market volatility—they’re fundamentally supported by real-world assets.

Easy Minting and Staking

Within Gate’s “On-chain Earn” section, users can mint GUSD using either USDT or USDC—always at a 1:1 ratio, with no complicated steps. Interest starts accruing immediately after minting. Returns are distributed daily to your spot account. Real-time tracking and management are facilitated. Additionally, users can increase their earnings by participating in Launchpool or Earn products.

Flexible Redemption—Funds Always Accessible

One of GUSD’s standout advantages is its flexible redemption. Regardless of the method used to acquire GUSD, they can exchange it back to USDT or USDC at a 1:1 ratio at any time. The platform offers both standard redemption (with lower fees) and fast redemption (for quicker settlement), meeting investors’ diverse liquidity needs.

Multiple Use Cases to Maximize Capital Efficiency

Beyond holding and staking, GUSD is also integrated across multiple features in the Gate ecosystem:

- Spot Trading: Multiple GUSD trading pairs are available for seamless asset allocation in the market.

- Unified Account Margin: GUSD can be used as margin, increasing your account’s capital utilization.

- Earn: GUSD can function as a flexible savings product, allowing deposits and withdrawals at any time.

- Launchpool: By staking GUSD, users can participate in project token rewards, with certain events offering estimated annualized returns as high as 365%.

Investment Value and Risk Notice

For investors seeking steady returns, GUSD’s 4.4% annualized yield is a noteworthy choice. Unlike high-risk, high-return DeFi staking products, GUSD is backed by U.S. Treasuries and other low-risk assets, prioritizing security and transparency. Still, investors should be aware that yields may fluctuate with market conditions. They should review associated redemption terms.

Conclusion

Gate GUSD bridges real-world assets with crypto wealth management, delivering an innovative “stablecoin plus stable yield” experience. By staking GUSD to earn a 4.4% annualized return, investors can enjoy stable earnings while flexibly participating in spot trading and ecosystem features—expanding their asset management options while managing risk.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution