Ethereum Price Prediction: Bitmine Holdings Surpass 4 Million ETH, Short-Term Rally to $3000

Bitmine Continues to Expand Ethereum Holdings

Ethereum financial firm Bitmine reached a major milestone this week, pushing its total Ethereum holdings past 4 million ETH after a recent $40.61 million purchase. Data from Lookonchain shows Bitmine acquired 13,412 ETH in this transaction at an average price of about $2,991 per ETH.

In the past week, Bitmine has accumulated nearly 100,000 ETH, steadily increasing its overall position. Chairman Tom Lee commented, “Our ETH holdings have now exceeded 4 million, a significant milestone achieved in just five and a half months.”

Ethereum Price Recovery and Profitability

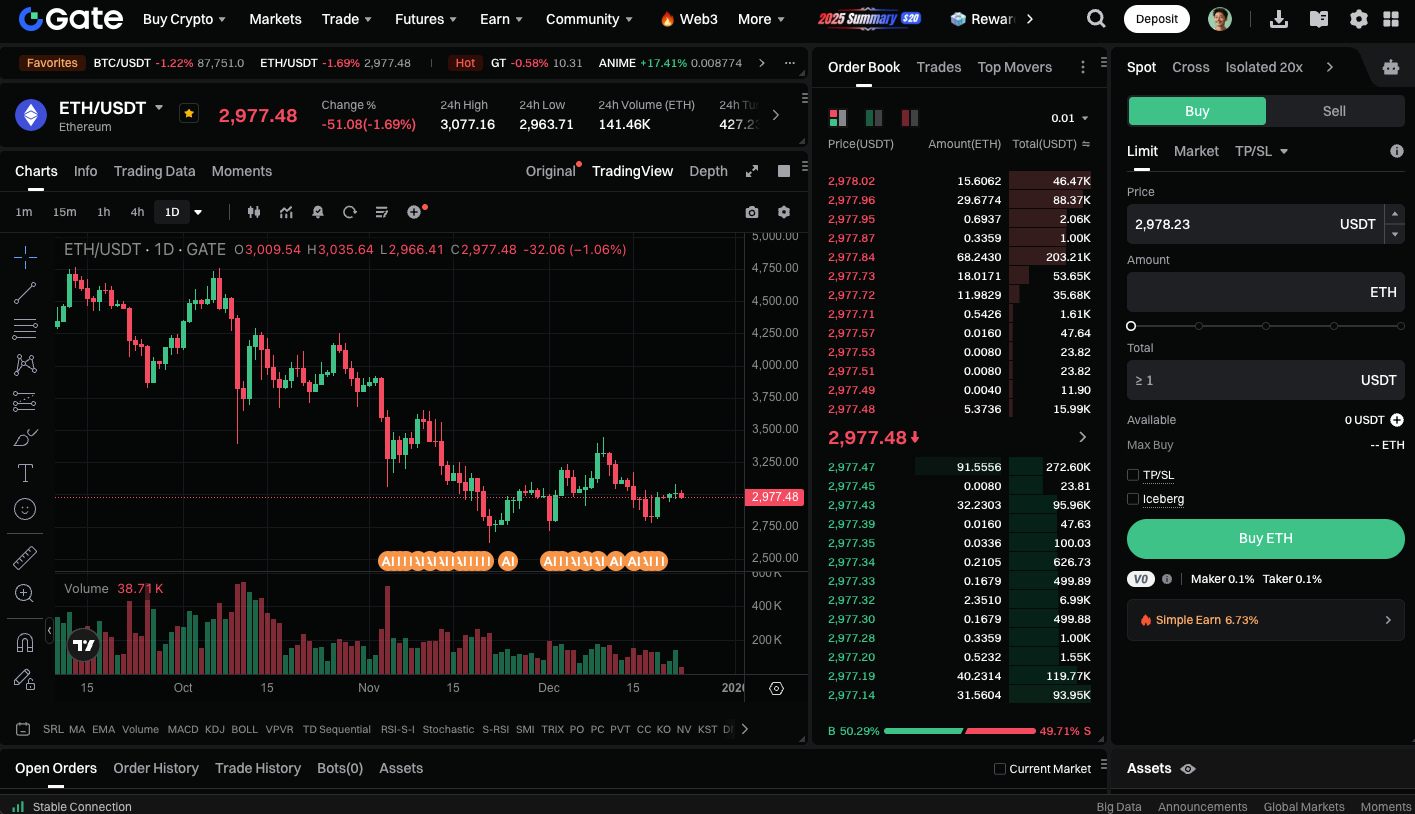

As ETH briefly climbed back above $3,000 over the weekend, Bitmine’s holdings returned to profitability after being underwater since the October market correction. The company stated its goal is to hold 5% of the total Ethereum supply and has already reached 67% of that target, with a portfolio valued at approximately $12.2 billion.

Staking and Future Plans

Bitmine plans to launch its staking solution, the Made in America Validator Network (MAVAN), in early 2026, delivering secure staking infrastructure to further enhance value for investors. Tom Lee emphasized, “Our staking initiative will set the industry standard and is scheduled for deployment in early 2026.”

Market Perspectives Comparison

While Bitmine maintains a bullish outlook on ETH, Sean Farrell, Head of Digital Asset Strategy at Fundstrat, offered a more cautious perspective. He forecasts that ETH could drop to the $1,800–$2,000 range during the first half of 2026, but also noted these levels could present compelling investment opportunities before year-end.

Start trading ETH spot now: https://www.gate.com/trade/ETH_USDT

Summary

Bitmine’s aggressive accumulation and substantial Ethereum holdings underscore its conviction in the asset. The recent short-term rebound of ETH near $3,000 sends a positive signal to the market. While downside risks persist, the rollout of staking initiatives and strengthening market demand could fuel new growth momentum for ETH.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution