Bitcoin Price Prediction BTC Faces New Liquidity Cycle With Potential Moves Between 78000 And 89000

Short-Term Crypto Market Volatility Overview

Bitcoin has shown apparent stability after weeks of turbulence, but underlying shifts are quietly taking shape. Its price recently corrected more than 30% from all-time highs. While this drop is notable, it aligns with typical bull market cycles. During the downturn, long-term holders offloaded large volumes, pushing circulating supply to its lowest level since March. With the main selling phase now past, the market is turning its attention to upcoming supply trends.

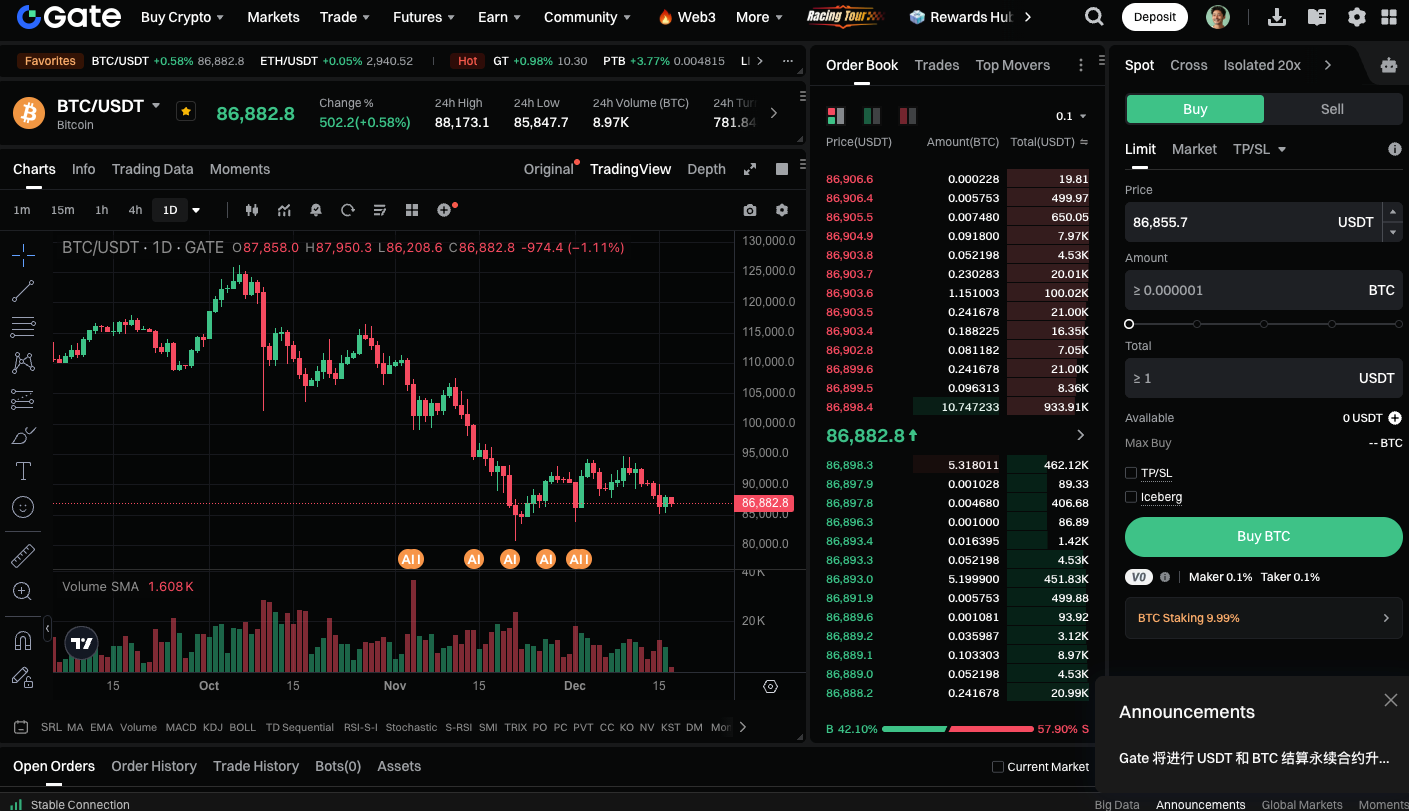

Bitcoin’s price has also entered the $88K - $89K range, a zone formed by a previous rapid rally that left a price gap. Retail investor activity has cooled noticeably, and the broader market remains in a holding pattern.

Key Policy Watch: Federal Reserve and Bank of Japan

The Federal Reserve’s interest rate decision is set to be the most significant short-term market catalyst. While most expect a 25 basis point cut, investors are focused on the policy statement’s tone and forward guidance. With thin order books and reduced volatility, even a single comment could spark sharp moves in Bitcoin’s price.

The Bank of Japan is also drawing attention. After years of negative rates, Japan may hike again, potentially attracting capital flows back to Japan, lifting U.S. yields, and tightening global liquidity. Such actions typically weigh on risk assets—including cryptocurrencies.

Regulatory Acceleration

U.S. SEC Chairman Paul Atkins recently announced that the Bitcoin Market Structure Bill is nearing passage, signaling consensus between Congress and regulators on crypto oversight. The bill will establish rules for spot Bitcoin ETFs, clarify SEC and CFTC regulatory responsibilities, and set baseline standards for crypto exchange operations.

BlackRock has filed for a new staked ETH ETF. MicroStrategy acquired 10,624 BTC following talks with banks and sovereign funds. Meanwhile, Argentina’s central bank is considering allowing banks to offer Bitcoin services.

Technical Price Outlook

In the near term, Bitcoin could rise on liquidity flows. If the Fed adopts a dovish stance, prices may test the $88K - $89K zone. If the tone is more hawkish, the market could pull back to $78K - $82K. Investors should closely track policy statements, liquidity conditions, and trading volume to gauge the next market direction.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Conclusion

Bitcoin’s recent stability masks significant liquidity changes beneath the surface. The major selloff has ended, supply is tightening, and policy and regulatory shifts will drive short-term price action. Investors should monitor the tone of decisions from the Federal Reserve and Bank of Japan, institutional positioning, and trading volumes to assess whether Bitcoin can break through the $88K - $89K resistance or fall back to the $78K - $82K support zone. Ultimately, a shift in the liquidity cycle could set the pace for the next phase of the market, giving informed investors an edge in the coming moves.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution