Bitcoin at $108,000 – Danger Zone

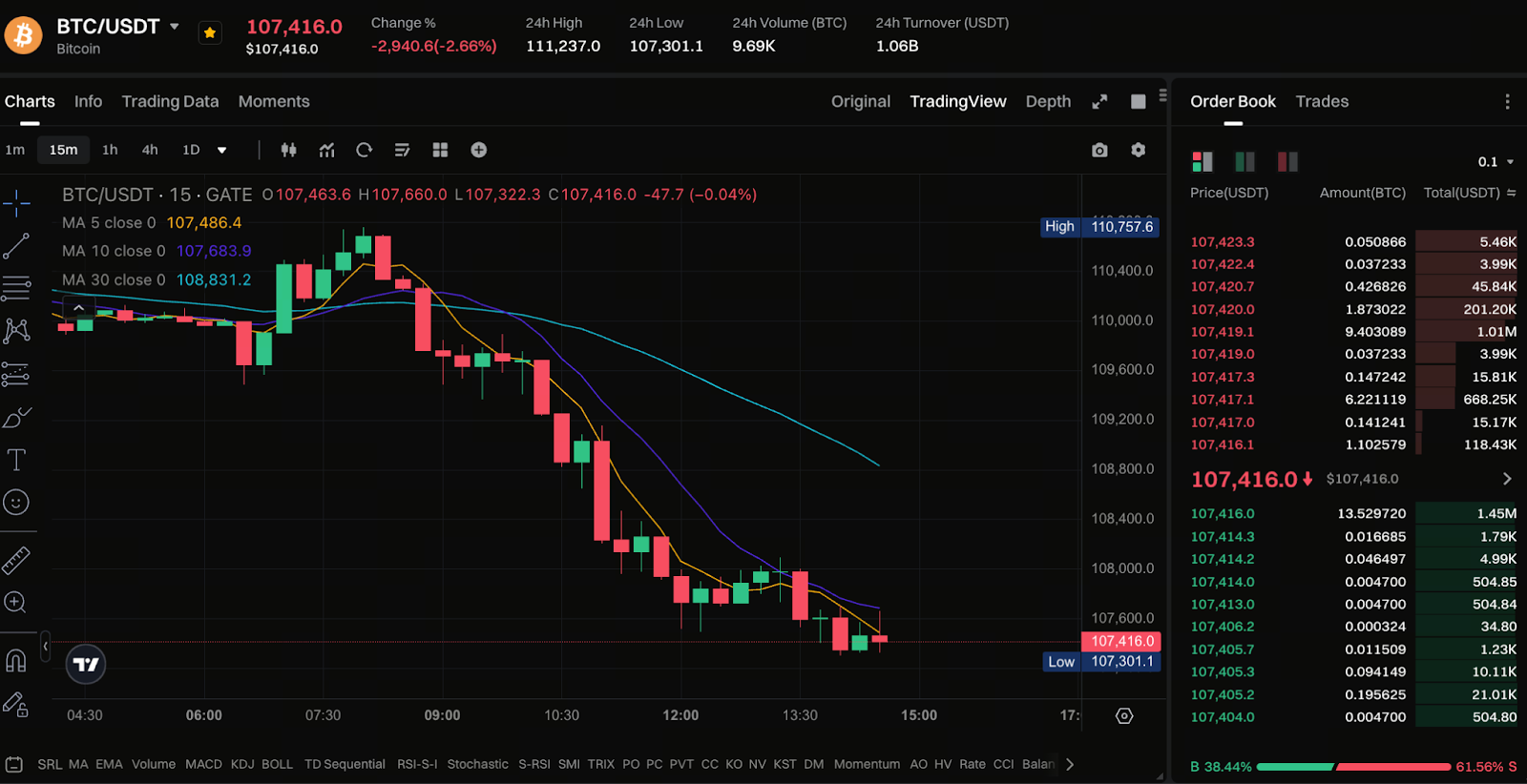

On November 3, 2025, Bitcoin’s price has fallen below the critical $108,000 threshold. According to several data platforms, Bitcoin is currently trading between $107,900 and $108,000. For many investors, this is more than a simple price drop—it may signal that the market has entered a “danger zone.”

What’s Happening: What Does Bitcoin Dropping Below $108,000 Mean?

When Bitcoin pulls back from its highs and breaks through a key psychological level like $108,000, it’s typically viewed as a sign of weakening short-term market confidence. Recent reports indicate significant outflows from spot Bitcoin products and a reduction in institutional holdings. Data further shows that if the price continues to breach support, it could drop to around $104,000. For newcomers or those monitoring crypto assets, this trend is a clear reminder to take risk management seriously.

Key Risk Factors Driving the Decline

Several factors are intensifying downward pressure on Bitcoin:

- Institutional capital outflows: Spot Bitcoin ETFs have reported net outflows of approximately $40.5 million, signaling that institutions may be reducing their exposure.

- Weak market sentiment: As Bitcoin breaks below major price levels, multiple market indicators point to rising fear and widespread liquidation of leveraged positions.

- Uncertain macro environment: The crypto market does not exist in isolation—Federal Reserve policy, US dollar trends, and inflation expectations all influence Bitcoin’s trajectory. Some analysts suggest a temporary dip below $100,000 is possible in the current environment.

Support and Resistance Levels

For beginners, understanding key price levels is crucial:

- Current support: The $107,000–$108,000 range. If this level fails, the next major support is likely near $104,000.

- Resistance: For Bitcoin to resume its upward momentum, it must break through approximately $115,400 to attract renewed bullish interest.

What Should Beginners Do? Risk Management and Strategic Advice

If you’re new to crypto, consider these strategies:

- Assess your risk tolerance: If you’re uncomfortable with high volatility, consider reducing your position size or waiting to enter the market.

- Implement stop-loss/take-profit strategies: For example, if Bitcoin falls below a key support like $107,000, consider scaling back or exiting to prevent unchecked losses.

- Avoid chasing rallies or panic selling: Breaking below a critical price level is risky, but it can also present opportunities for a rebound. Avoid impulsive buying at highs or panic selling at lows.

- Stay informed: Monitor institutional flows, liquidation data, and macroeconomic indicators, as all these factors impact Bitcoin’s price action.

- Use dollar-cost averaging/diversify investments: If you have long-term confidence in Bitcoin, consider building your position gradually instead of investing all your capital at once.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution