2026 ETH Update with Etherealize

Welcome Avatar! This is a guest post written entirely by Vivek Raman (source) of Etherealize (source). To start the year, we think it makes sense to paint the bull case case and update all of you on the institutional changes happening in the background.

Once again, all of this is written by Vivek and if you have an interest in our long-term predictions for various assets that is on the paid side (for a measly coffee a month).

On that note, handing it over!

Ethereum 2026: Doing Business with ETH

Over the course of the last decade, Ethereum has established itself as the safest, most secure, most reliable blockchain for global institutional adoption.

Ethereum technology has scaled. Institutional precedent is set. The global regulatory landscape is openly welcoming blockchain infrastructure. And the growth of stablecoins and tokenization is a foundational shift.

As a result - from 2026 onward - Ethereum will become the best place to do business.

After ten years of adoption, consistency, global accessibility, and uptime - Ethereum is the preferred choice for institutional blockchain deployment. Let’s take a look at what happened over the last two years for Ethereum to become the default home for tokenized assets.

And then - we’ll end with our 2026 predictions for Ethereum: 5x growth in tokenization, stablecoins, and ETH price. The stage is set for an Ethereum Renaissance and for every business to adopt Ethereum-based infrastructure.

Ethereum: The Home for Tokenization

Blockchains are doing for assets what the internet did for information - making them digital, programmable, and globally interoperable.

Tokenization upgrades entire business processes by digitizing assets, data, and payments onto the same infrastructure. Assets (like stocks, bonds, real estate) and money will be able to move at the speed of the Internet. This is an obvious upgrade to the financial system that should have happened decades ago; public global blockchains like Ethereum enable this today.

Tokenization is quickly moving from a buzzword to a fundamental business model upgrade. Just as no business would go back from the Internet to the fax machine, no financial institution will reverse tokenization once they experience the efficiency, automation, and speed of shared global blockchain infrastructure.

Most high value tokenization happens on Ethereum – since it is the most neutral and secure global infrastructure which, like the Internet, is controlled by no single entity, and accessible to all.

As of 2026, the “experimentation phase” of tokenization is over - we have shifted into the deployment phase, where major players are launching flagship products directly on Ethereum to access global liquidity.

Some examples of institutional tokenization on Ethereum:

JPMorgan deployed its money market fund directly on Ethereum, marking one of the first times a bank has directly used a public blockchain

Fidelity launched a money market fund on Ethereum L1, bringing asset management and operations onto blockchains

Apollo launched a private credit fund, ACRED, on public blockchains - with the largest liquidity on Ethereum and its Layer 2 networks

BlackRock, one of the most vocal proponents for the “tokenization of everything,” pioneered the institutional tokenization wave with their tokenized money market fund, BUIDL, on Ethereum

Amundi, Europe’s largest asset manager, tokenized its EUR-denominated money market fund on Ethereum

BNY Mellon, America’s oldest bank, tokenized an AAA-rated CLO Fund onto Ethereum

Baillie Gifford, one of the largest asset managers in the UK, is launching a first-of-its-kind tokenized bond fund, on Ethereum and its Layer 2 network

Ethereum: The Stablecoin Chain

Stablecoins are the first, and clearest, example of product-market fit for tokenization, with $10T+ in stablecoin transfer volumes in 2025. Stablecoins are simply tokenized dollars, acting as a “software upgrade” for money enabling USD to move with the speed and programmability of the Internet.

2025 was a defining year for stablecoins and public blockchains due to the GENIUS Act (a.k.a the Stablecoin Bill) passing in the U.S. In one fell swoop, stablecoins were given a regulatory framework, and the underlying public blockchain rails for stablecoins were given a green light.

Even before GENIUS, Ethereum had the largest stablecoin adoption by far. And today, 60% of all stablecoins are on Ethereum and its Layer 2 networks. However, GENIUS marks the point when Ethereum became officially “open for business,” as institutional players received regulatory clearance to deploy their own stablecoins on public blockchains.

Email and websites achieved mass adoption and scale when plugging into one global Internet (vs dozens of fragmented Intranets). Similarly, stablecoins, and all tokenized assets, only achieve their full potential for utility and network effects when used in one public global blockchain ecosystem.

And so the stablecoin surge is just beginning. An immediate data point is SoFi - the first national bank to issue a stablecoin (SoFiUSD) on a public, permissionless blockchain. And SoFi chose Ethereum.

This is the tip of the iceberg for stablecoins. Investment banks and neobanks are exploring launching their own stablecoins, whether individually or in consortium format. Fintech companies are looking at stablecoin deployments and integrations. The digitization of the dollar on public blockchains is fully underway - and Ethereum is the default.

Ethereum: Build Your Own Blockchain

Blockchains are not a one-size-fits-all tool. Global financial markets need customization by geography, by regulatory regime, and by customer base. This is why Ethereum, from its early days, has been designed for maximum security and for maximum customizability via “Layer 2” blockchains that can be easily deployed on top of Ethereum.

Just like every company has its own website, its own applications, and its own customized environments on the Internet, many companies will have their own Layer 2 blockchains on Ethereum.

This is not theoretical architecture - this is in production today. Ethereum Layer 2s have institutional precedent, they have scaled, and they make Ethereum the best place to do business. Some examples:

Coinbase built its Base blockchain as an Ethereum L2, tapping into Ethereum’s security and liquidity while creating a new revenue stream for Coinbase

Robinhood is building its own chain, which will have tokenized stocks, prediction markets, and many other assets, as an Ethereum L2

SWIFT, the global banking messaging network, is using an Ethereum L2, Linea, for blockchain-based settlements

JPMorgan deployed its tokenized deposits on an Ethereum L2, Base

Deutsche Bank is building its own public, permissioned blockchain network as an Ethereum L2, setting the stage for additional bank L2s

More than just customizability, Layer 2s are the best business model in the blockchain space. Layer 2s combine the global security of Ethereum with 90+% profit margins from operating a Layer 2, unlocking new revenue streams for businesses.

This is the best way institutions using blockchains can have their cake and eat it too - they can inherit the security and liquidity of Ethereum while keeping their profit margins intact and operating their own environment on Ethereum. Robinhood chose an Ethereum Layer 2 architecture for their own blockchain because “creating the security of a real proper decentralized chain is extremely difficult…with Ethereum, we get the security by default.”

All the world’s financial markets will not live on one chain. But the global financial system can live in one interconnected network - that’s Ethereum and its Layer 2 ecosystem.

The Regulatory Shift

A transformative upgrade of the global financial system would not be possible without regulatory support. Financial institutions are not tech companies; they cannot simply “move fast and break things” to innovate. And the movement of high-value assets and money requires a strong regulatory framework - on which the US is now leading the charge:

The SEC, under Chairman Paul Atkins, has created the first innovation-friendly regime since the advent of Ethereum in 2015. Institutions have embraced tokenization; the financial system is primed to move onto digital infrastructure, and Atkins himself is saying “all U.S. markets will be on chain within two years.”

Congress is also supportive of responsible blockchain adoption. The GENIUS Act (described in the “Stablecoins” section above), passed in 2025, and the CLARITY Act, creating a comprehensive framework for tokenization and public blockchain infrastructure, is up next. Blockchains are now encoded in law, providing guidelines for financial institutions to embrace the technology.

The DTCC, while not a government entity, is the core infrastructure for U.S. securities. And the DTCC itself is embracing tokenization fully, allowing for DTC-custodied assets to live on public blockchains.

The blockchain ecosystem has been in regulatory purgatory for over a decade, suppressing its potential for true institutional adoption. The regulatory regime, led by the U.S., has now transformed at last into a tailwind rather than a headwind. The stage is set for Ethereum to thrive as the best place to do business.

ETH: The Institutional Treasury Asset

Ethereum has established itself as the safest and most secure blockchain - and therefore the default choice for institutional adoption. As a result, ETH will reprice to become an institutional-grade store of value alongside BTC in 2026.

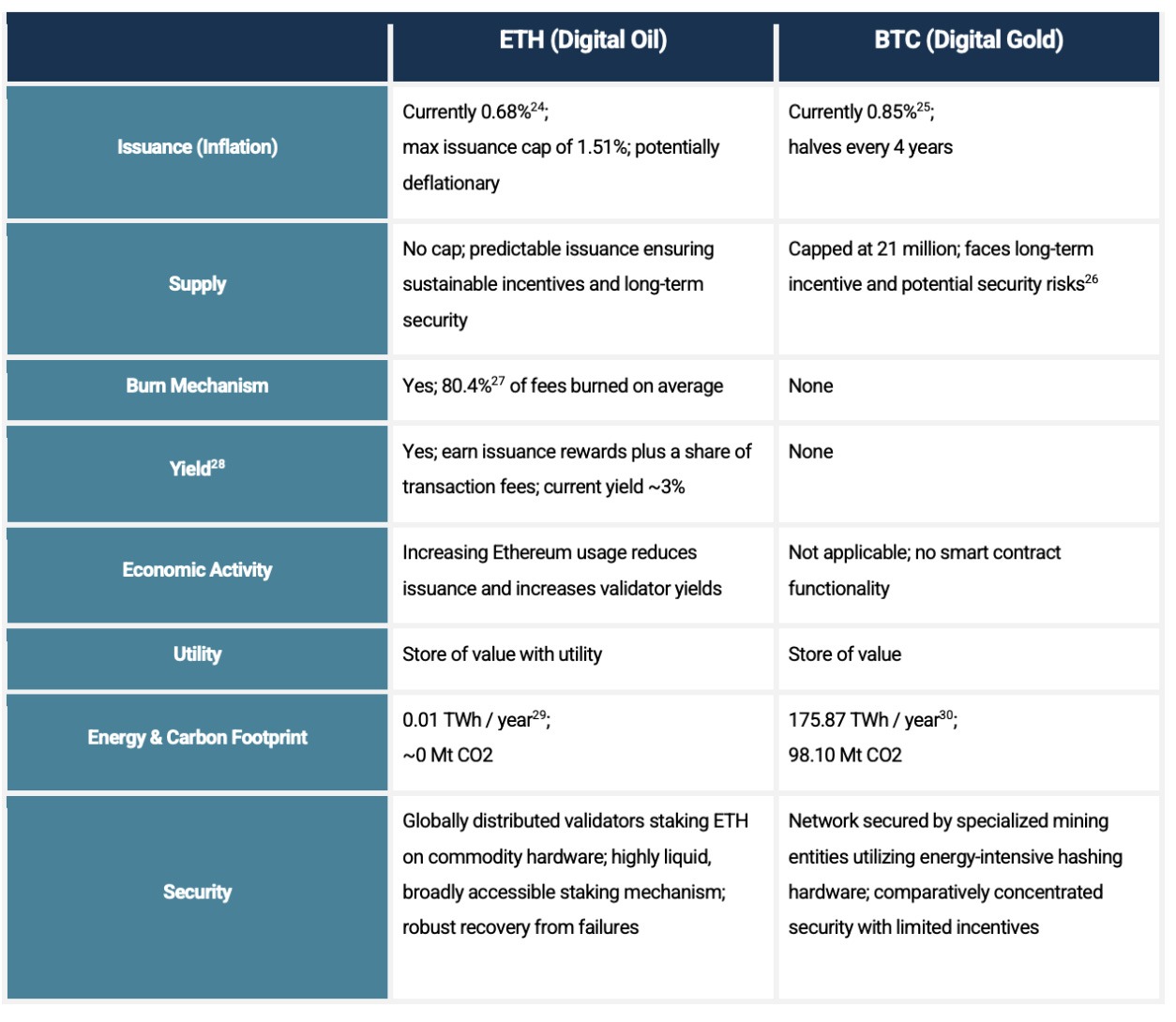

The blockchain ecosystem will have more than one store of value asset. While Bitcoin (BTC) has established itself as “digital gold,” ETH has become “digital oil” - a productive store of value that has yield, utility, and an underlying ecosystem driving economic activity.

MicroStrategy, the largest company holding Bitcoin as a treasury asset, led the charge in elevating BTC to store-of-value status. Over the course of 4 years, MicroStrategy bought BTC as a treasury asset, championed BTC’s values, and became a core digital asset institutional holding.

The Ethereum ecosystem now has 4 MicroStrategy-equivalents doing the same for ETH:

BitMine Immersion (BMNR), run by Tom Lee

Sharplink Gaming (SBET), run by Joe Lubin and Joseph Chalom

The Ether Machine (ETHM), run by Andrew Keys

Bit Digital (BTBT), run by Sam Tabar

MicroStrategy owns 3.2% of BTC. These four ETH treasury companies have purchased ~4.5% of the ETH supply in the last 6 months - and they are just getting started.

With four major companies stockpiling ETH on their balance sheets, institutional ownership of the ETH treasury companies is rapidly increasing, and ETH is primed to reprice as an institutional store of value alongside BTC.

Ethereum 2026 Predictions: 5x Growth

Tokenized Assets: 5x Growth to $100B

During 2025, the total value of tokenized assets on blockchains increased from ~$6B to more than $18B. 66% is on Ethereum and its L2s.

The global financial system is just starting to embrace tokenization, and institutions like JP Morgan, Blackrock, Fidelity, and others are choosing Ethereum as the default home for high-value tokenized assets.

We believe that the total amount of tokenized assets will 5x in 2026 to nearly $100bn, with the vast majority residing on the Ethereum network.

Stablecoins: 5x Growth to $1.5T

Today, the amount of stablecoins on public blockchains is $308 bn, with ~60% on Ethereum and its L2s (if we include other Ethereum Virtual Machine-based chains that could become future Ethereum L2s, that number becomes 90%).

Stablecoins are a strategic asset for the U.S. government. The U.S. Treasury has repeatedly stated that stablecoins are a national priority to extend dollar dominance into the 21st Century. Today, the amount of USD outstanding is $22.3T. With the GENIUS Act in law and with the mass adoption of stablecoins beginning, the tailwinds are in place for 20-30%+ of that to move onto public blockchains.

For 2026, we believe stablecoin market cap can 5x to reach $1.5T, with Ethereum leading the charge.

ETH: 5x Growth to $15k

ETH is rapidly evolving to become an institutional-grade store of value asset, alongside BTC. ETH is a call option on the growth of blockchain technology, representing the best way to capture upside in:

The growth of tokenization

The growth of stablecoins

Institutional blockchain adoption

The “ChatGPT moment” for the financial system upgrading to the Internet era

Owning ETH is like owning a piece of the new financial Internet. And the value accrual is clear - more users, more assets, more applications, more L2s, and more transactions - all flow value to ETH.

We believe ETH could reprice at least 5x in 2026 (to a $2T market cap, where BTC is today) as ETH has its “NVIDIA moment.”

Ethereum: The Best Place to Do Business

As of 2026, we are past the point of “why use blockchains?” We are now in a full-fledged institutional race to adopt tokenization, stablecoins, and customized blockchains - and structurally upgrading the global financial system as a result.

Institutions are choosing the blockchain infrastructure with the longest track record, the most precedent, the best security, the deepest liquidity, the most uptime and reliability, and the least risk. This is Ethereum. If a business wants to:

Increase margins? Cut costs with tokenization, pay fewer fees using stablecoins, build your own blockchain - on top of Ethereum.

Create new revenue lines? Build structured products, create new asset offerings, launch your own stablecoins - on top of Ethereum.

Upgrade your business for the digital era? Streamline operations, automate accounting and payments, reduce manual reconciliation - using Ethereum.

2025 marked the inflection point for Ethereum: infrastructure was upgraded, institutional proof of concepts proliferated, the regulatory regime shifted.

Now, in 2026, we will see the “Internet moment” for the global financial system. And it will be on Ethereum - the best place to do business.

Disclaimer:

- This article is reprinted from [BowTied Bull]. All copyrights belong to the original author [BowTied Bull]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

Our Across Thesis

What is Neiro? All You Need to Know About NEIROETH in 2025

An Introduction to ERC-20 Tokens