2025 Popular Perp DEX Overview: Who Will Become the Next Airdrop Goldmine?

Introduction

In recent years, decentralized perpetual contract exchanges (Perp DEXs) have grown rapidly, with various projects using airdrops to incentivize community participation. Currently, well-performing projects that have already issued tokens include Hyperliquid, Avantis, Orderly, Drift, and Jupiter. While high-potential projects that have not yet issued tokens include Aster, Backpack, edgeX, Lighter, Paradex, BasedOneX, Bulk, Reya, and StandX. This article systematically examines these projects’ product features, token mechanisms, airdrop timelines, user participation methods, capital backgrounds, and ecosystem affiliations. It also offers interaction recommendations graded by popularity/expectations and summarizes future trends and risk warnings.

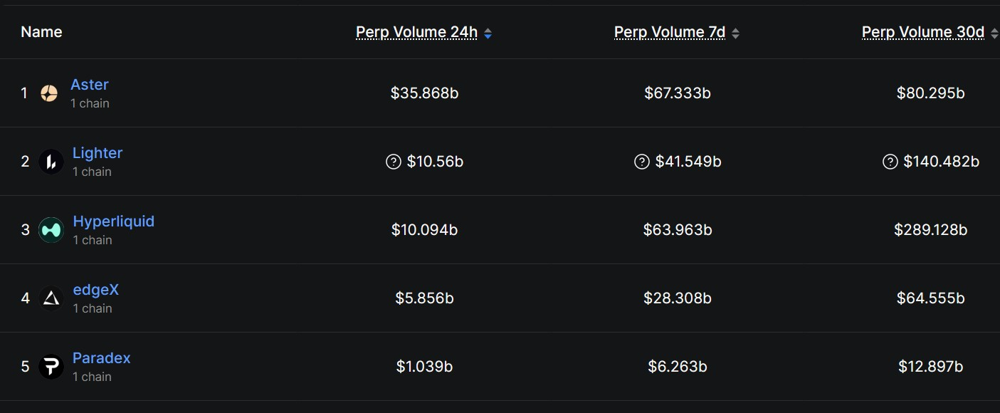

Source: https://defillama.com/perps

According to DefiLlama data, as of September 2025, Aster’s 24-hour trading volume reached approximately $35 billion, Lighter and Hyperliquid both exceeded $10 billion, and edgeX stood at around $5.856 billion. These massive volumes indicate that projects like Aster have driven surging trading activity through incentives. Let’s introduce each project in detail.

Overview of Projects That Have Issued Tokens

- Hyperliquid (HYPE): A high-performance perpetual contract platform built on a self-developed dual-layer architecture (HyperCore Chain + HyperEVM). It completed its GENESIS token issuance on November 29, 2024, with a total supply of 1 billion tokens: 31% (310 million tokens) was distributed to early users (unlocked immediately), 38.888% reserved for future community rewards, 23.8% allocated to the core team/contributors (locked until 2027–2028 for phased release), and the remainder earmarked for the foundation and ecosystem grants. The token adopts a governance + staking mechanism and can be used to launch white-label exchanges and other applications. After issuance, HYPE’s price surged over tenfold (its market cap rose from less than $2 billion at the end of 2024 to over $12 billion by September 2025). As of now, Hyperliquid has 10,000–20,000 daily active users (cumulative ~600,000), offers over 100 tradable assets, and averages nearly $7 billion in daily trading volume. Its proprietary liquidity mechanism (Hyperliquidity) and innovations like Builder Core have attracted many experienced traders. User feedback highlights strengths such as low fees and full-chain transparency, while noting areas for improvement including subpar mobile experience and high fiat on-ramp/off-ramp fees. Participation Method: Users who missed the first-round airdrop can accumulate points through continuous trading or staking liquidity (e.g., USDC) to qualify for future rewards.

- Aster (Aster, 2nd and 3rd phase activities ongoing): Aster has completed token issuance, with the second phase of incentives fully distributed, and is now entering the third phase, “Dawn” incentive period. It has also opened trading pairs on multiple mainstream exchanges to enhance liquidity. Deployed on BNB Chain, the platform supports both simple and professional interfaces with up to 1001x leverage, and issues the yield-bearing stablecoin USDF (stakeable for asUSDF). Users seeking rewards can accumulate points by depositing BNB/USDF, joining the ALP multi-asset pool, trading perpetual contracts, or participating in official point competitions. Be sure to monitor official snapshots and reward claim rules to avoid missing eligibility. Risk Warning: High-intensity incentives inflate short-term trading volume. A decline in volume may occur when incentives end or rules change, which always control positions and calculate trading/cross-chain costs.

- Drift Protocol (DRIFT): An early Perp DEX on Solana that launched its DRIFT token in 2023, with a total supply of 250 million tokens (specific allocation ratios omitted). Its key feature is “interest-earning collateral”: users’ margin generates interest simultaneously, improving capital efficiency. Drift’s airdrops and rewards have concluded; current participation focuses on token staking, governance, and using features like Vaults to earn yields (20%–50% APY). DRIFT’s market performance has been volatile, with its current market cap at a relatively low level. It is recommended to participate moderately after confirming market timing and project progress.

- Avantis (AVNT): The largest derivatives DEX on Base Chain, which raised funds via a public offering and launched its mainnet in February 2024. The AVNT token completed its TGE on September 15, 2025, and surged after listing on exchanges including Coinbase, Binance, and Upbit. With a total supply of 1 billion tokens, 12.5% (125 million tokens) was released at TGE for airdrops to active users, with the remaining tokens locked for phased release. Avantis uses a “zero fees + profit sharing” model: traders pay no opening/closing fees, only sharing a percentage of profits with the platform when profitable. It also offers loss rebates and positive slippage incentives to align trader and LP (Liquidity Provider) interests. The platform supports 80+ markets (crypto, forex, commodities, indices) with up to 500x leverage; as of writing, it has processed over $18 billion in total trading volume, with over 25,000 LPs and $23 million in locked assets. Participation Method: Hold and stake AVNT tokens to share platform fee dividends (current staking yield ~23%), or join platform trading events to earn rewards.

Orderly Network (ORDER): A full-chain liquidity infrastructure and trading chain built on OP Stack + Celestia, using an integrated order book for matching. It launched the ORDER token on August 26, 2025, with a total supply of 1 billion tokens: 55% (550 million) for community rewards (including 13.3% for airdrops), 20% for the team/advisors, 15% for strategic investors/early supporters, and 10% reserved for the foundation to support liquidity and ecosystem development. On TGE day, all airdrop allocations (92 million tokens distributed to ~230,000 addresses) were unlocked with no lock-up period. The platform pioneered “Merits point competitions” for airdrops—during the August trading peak, $15 million in daily revenue dividends was paid in advance to ORDER stakers. Orderly has achieved profitability: cumulative trading volume exceeds $80 billion, protocol revenue reaches $17.4 million, and net income hits $7.4 million. During the August market crash, its daily trading volume peaked at $1.8 billion, ranking top 3 in the DEX sector. The community recognizes Orderly’s strength as a full-chain matching engine, with potential to attract long-term traders (renowned analyst DefiSquared noted, “Currently valued at ~$25 million, it has huge potential and is undervalued by the market”). Participation Method: The original rules have expired; users can now stake ORDER tokens to unlock earnings (60% of protocol revenue is distributed to stakers, current APY about 50%). Orderly supports 6 major chains (Ethereum, BSC, Polygon, Arbitrum, Optimism, Avalanche) and partners with over 20 market makers—future attention should focus on DEX applications integrated into its ecosystem.

Jupiter (JUP): A leading DEX aggregator in the Solana ecosystem that issued the JUP token in January 2024 (total supply 10 billion tokens: 50% for community rewards, 50% for the team). Jupiter maintains a supply-demand balance by charging trading fees and using 50% of fees for token buybacks. As of mid-2025, JUP’s circulating supply is ~3.1 billion tokens (circulating market cap ~$1.5 billion), with its price falling from a high of $2.04 to ~$0.47. Jupiter continues to expand features: it has launched perpetual contracts with up to 100x leverage, advanced limit orders, and one-click strategies, and plans to roll out “Jupiter Lend” (a lending service) and yield-bearing stablecoins. The token is primarily used for community governance; staking JUP grants access to partner project airdrops and Launchpad benefits. Since Jupiter’s airdrop is complete, focus participation on its future ecosystem (e.g., Jupiter Lend) rather than point farming.

Popular Projects Without Tokens Yet

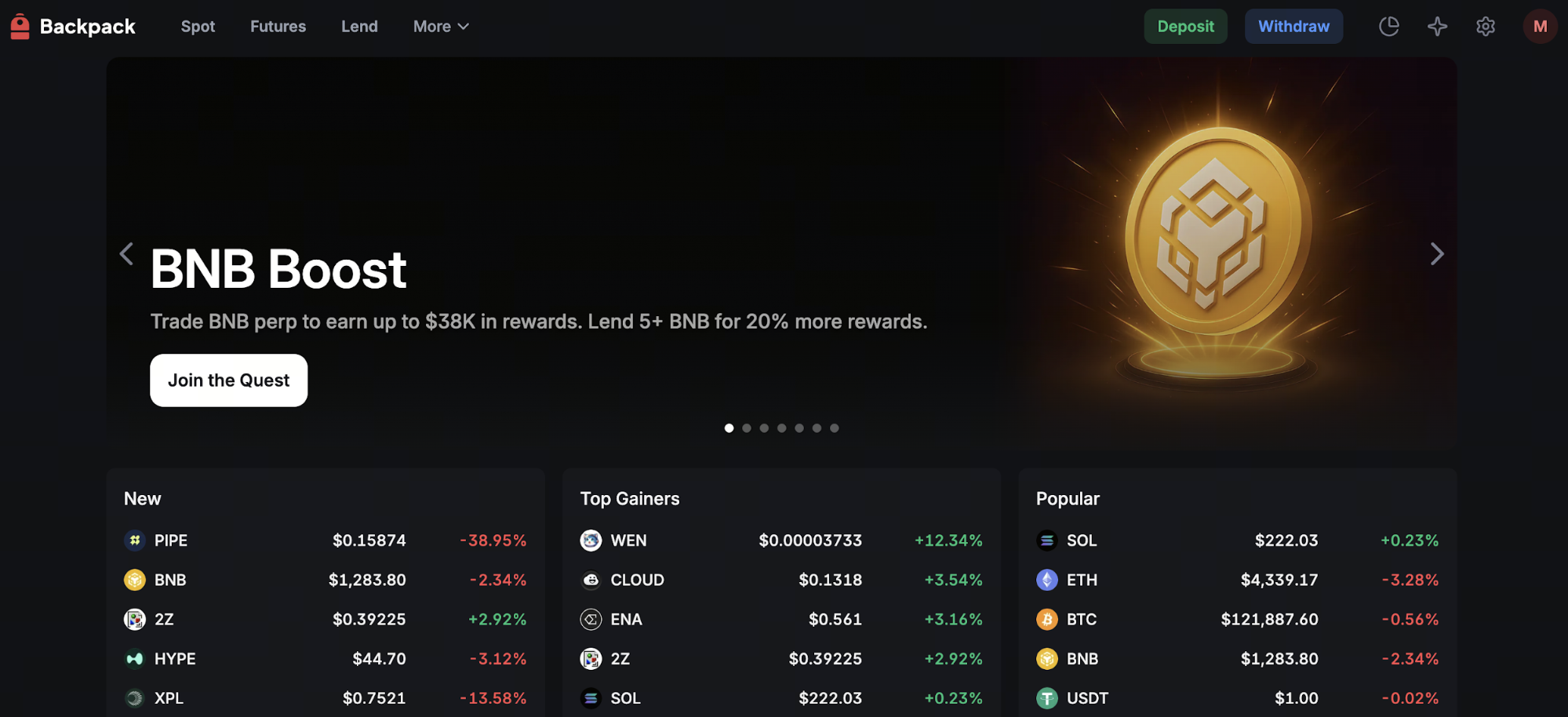

Official Website Link: https://backpack.exchange/

Backpack (no token yet): A multi-chain trading platform based on Solana and Ethereum that recently announced plans to launch perpetual contract functionality. Backpack emphasizes compliance and security, introducing KYC (Know Your Customer) verification to meet regulatory requirements, with operational processes similar to centralized exchanges (CEXs). Its user reward program lets users accumulate points via trading volume/coin deposit activities, with multiple point competition seasons already held. After Season 3, it was reported that trading volume weighting increased, improving point farming efficiency. Participation Method: Complete KYC registration to earn points through coin deposits (similar to staking BNB, USDT, etc.) or direct trading volume farming. Suitable for users willing to undergo identity verification. Suggestion: Accumulate Backpack points through small-volume transactions and consistent engagement (while ensuring security) to prepare for future token distribution.

Official Website Link: https://www.edgex.exchange/en

edgeX (no token yet): A multi-chain Perp DEX incubated by Amber Group, using StarkEx ZK-Rollup technology (balancing speed and privacy). edgeX’s user interface offers a CEX-like experience and integrates MPC (Multi-Party Computation) wallet support to reduce user friction. It uses a weekly point system: users’ trading volume and activity determine their weekly point weight, with a minimum investment of just $10 to participate in farming. Participation Method: Increase activity via wash trading or order placement on trading pairs—points are automatically accumulated per transaction. The community is drawn to its Amber Group backing; focuses on its incentive timeline and participates in weekly activities. Its low threshold makes it relatively friendly to retail users.

Official Website Link: https://lighter.xyz/

Lighter (no token yet): An invite-only private beta platform built as an exclusive Starknet L2 (EVM-compatible), focusing on privacy and efficient trading. Lighter remains in the invite-only testing phase, with no official token launch date announced. It features an open “Liquidity Aggregation Pool (LLP)” with an extremely high APY (~63%); full earnings require point unlocking. Participation Method: Join the private beta via invitation to trade and accumulate points per transaction (linked to future token airdrops). Currently limited to users with invitations (via reservations or community channels).Suggestion: Secure a test invitation code to conduct small-volume real transactions for points, and monitor official announcements for open access or reward programs.

Official Website Link: https://app.paradex.trade/trade/BTC-USD-PERP

Paradex (no token yet): The first StarkNet “Appchain” built on the StarkNet Stack, incubated by Paradigm’s institutional liquidity team. Paradex plans to integrate trading, perpetual contracts, and perpetual options into a unified account system, and uses zero transaction fees to drive growth. Participation Method: It divides “XP” activity seasons by quarter—users earn points via position holding, trading, or market making. Future attention should focus on the test version of Paradex’s first fully functional DEX (as planned) to participate in volume farming and point accumulation.

Official Website Link: https://based.one/

BasedOneX (no token yet): Positioned as a “channel trading platform” frontend for Hyperliquid, developed by industry veterans. Functionally, it resembles Hyperliquid’s frontend and dealer model, providing multi-channel access to Hyperliquid. Participation Method: Airdrop points are expected to be distributed via ecosystem trading competitions and community activities. Monitor official announcements for participation opportunities.

Image: https://standx.com/

StandX (no token yet): A project developed by the core team of Binance Futures (formerly). It has launched the yield-bearing stablecoin DUSD (with “trade-to-mine” mechanics, where mining rewards are earned during trading). Its Perp DEX functionality is still in internal testing, and the platform operates with self-raised funds (no external capital dependence). Participation Method: Currently, users can only apply to join the test list for internal testing; pre-deposit activities may offer early rewards. Prepare funds in advance to participate in testnet trading and accumulate points for future airdrops.

Official Website Link: https://www.bulk.trade/

BulkTrade (Bulk, no token yet): A Solana-native perpetual contract platform known for ultra-low-latency matching. Its matching engine is embedded in Solana validator nodes (via the Bulk-Tile module), enabling order matching within 20ms and confirmation within 40ms. Participation Method: The mainnet is not yet live—monitor testnet launches to participate in on-chain interactions. Its innovative architecture makes it suitable for users interested in low-latency trading. Suggestion: Monitor official test activities and tasks for participation opportunities.

Official Website Link: https://www.reya.network/

Reya Network (Reya, no token yet): A modular L2 focused on trading optimization, using Arbitrum Orbit technology to build a dedicated chain for DeFi trading. Reya introduces network-wide shared liquidity pools and cross-exchange margin accounts, significantly enhancing trading depth. It has secured tens of millions of dollars in funding from investors including Framework, Coinbase, and Wintermute. Participation Method: Reya uses a point system—points are accumulated weekly based on trading volume and USDC staking. It has already held a Liquidity Generation Event (LGE); users can earn early points by depositing funds and participating in trading on Reya Exchange (its first platform) to accumulate more points upon launch. Suggestion: Monitor its LGE and future exchange launch; participate in trading or USDC staking to accumulate weekly ranking points.

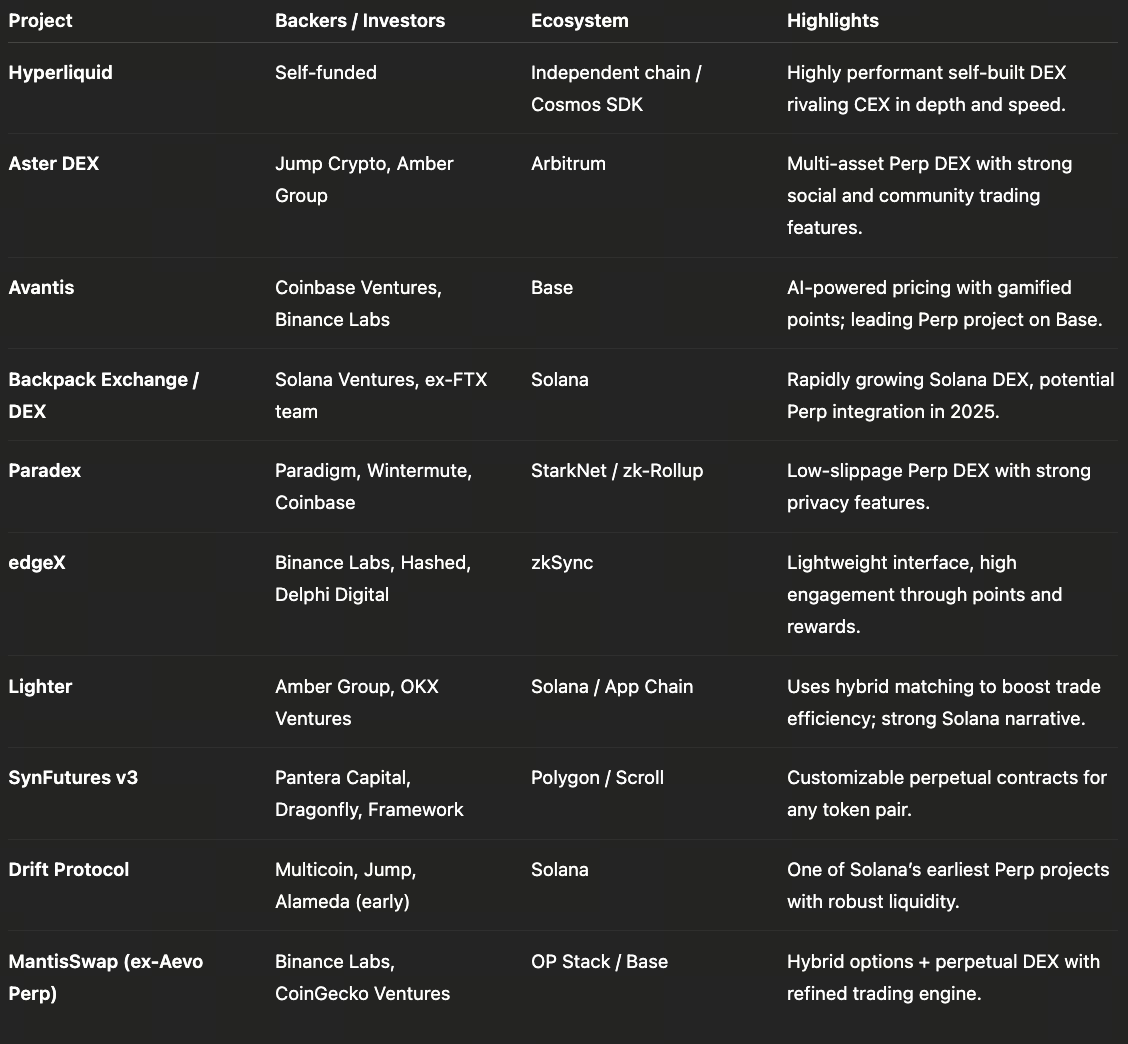

Project Capital Background and Ecosystem Alliances

Different projects show significant differences in capital and ecosystem support behind them. The Binance system camp (Aster, StandX) has strong resources; the Amber group (EdgeX) is incubated by Amber Group; the Paradigm system (Paradex) originates from the Paradigm team; Solana ecosystem projects (Jupiter, Drift, Bulk, Backpack, Lighter, etc.) mostly develop around Solana; Base ecosystem (Avantis) is the leading derivatives platform on Coinbase’s Base chain; others like Hyperliquid develop their own specialized chains; Orderly is supported by multiple renowned investors including OKX Ventures, Pantera, Dragonfly, Sequoia, etc. The following table lists the main camps and notes for each project:

Participation Priority Grading and Interaction Suggestions

Based on factors such as market heat and expected token issuance time, the above projects can be roughly classified into S+, S, and A grades:

- S+ Grade (Ultra-high heat, strongly participate):

Hyperliquid, Aster, Avantis, Backpack, edgeX, Lighter. These projects have either already issued tokens and quickly occupied the market’s top positions, or although not yet issued tokens, have become key focus objects due to huge trading volumes and incentive plans. It is recommended that users prioritize attention: actively register, deposit coins, trade, and accumulate as many points or lock-ups as possible. If funds are limited, allocate appropriately—focus on securing airdrop eligibility and early returns.

- S Grade (High heat, good opportunities): Paradex, Orderly, BasedOneX, StandX, Bulk, Reya. These projects have certain recognition and foundation, but slightly less heat than S+. Participation suggestions: Reasonably participate in community activities (trading for points, holding and staking tokens), pay attention to official information releases, and claim airdrops and rewards according to rules. Especially for Orderly and Paradex which have already issued tokens, consider staking for dividends; for those that haven’t issued tokens, follow up on point competitions. Avoid overexposure—diversify with small-volume participation.

- A Grade (Average heat, relatively high risk): Drift, Jupiter, and other emerging projects. Drift and Jupiter have entered a mature stage (tokens already issued), and can be treated as ordinary investment targets, no need for large-scale point farming. For other early-stage projects, try small amounts based on personal preferences. Overall, control positions, avoid excessive fee farming, and focus on risk management.

Interaction Suggestions

- Diversify across multiple projects: Don’t bet on a single project, choose 2-3 favorites from different categories.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Top 10 NFT Data Platforms Overview

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

7 Analysis Tools for Understanding NFTs