WUSD vs DOGE: The Battle of Stablecoins and Meme Coins in the Crypto Arena

Introduction: WUSD vs DOGE Investment Comparison

In the cryptocurrency market, the comparison between WUSD vs DOGE has always been a topic that investors cannot avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency asset positioning.

WUSD (WUSD): Since its launch, it has gained market recognition for its focus on optimizing payment solutions for Web3 industry enterprise users.

DOGE (DOGE): Since its inception in 2013, it has been hailed as a fun, light-hearted cryptocurrency, becoming the second largest virtual currency in terms of user base after Bitcoin.

This article will comprehensively analyze the investment value comparison between WUSD vs DOGE, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, and attempt to answer the question most concerning investors:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

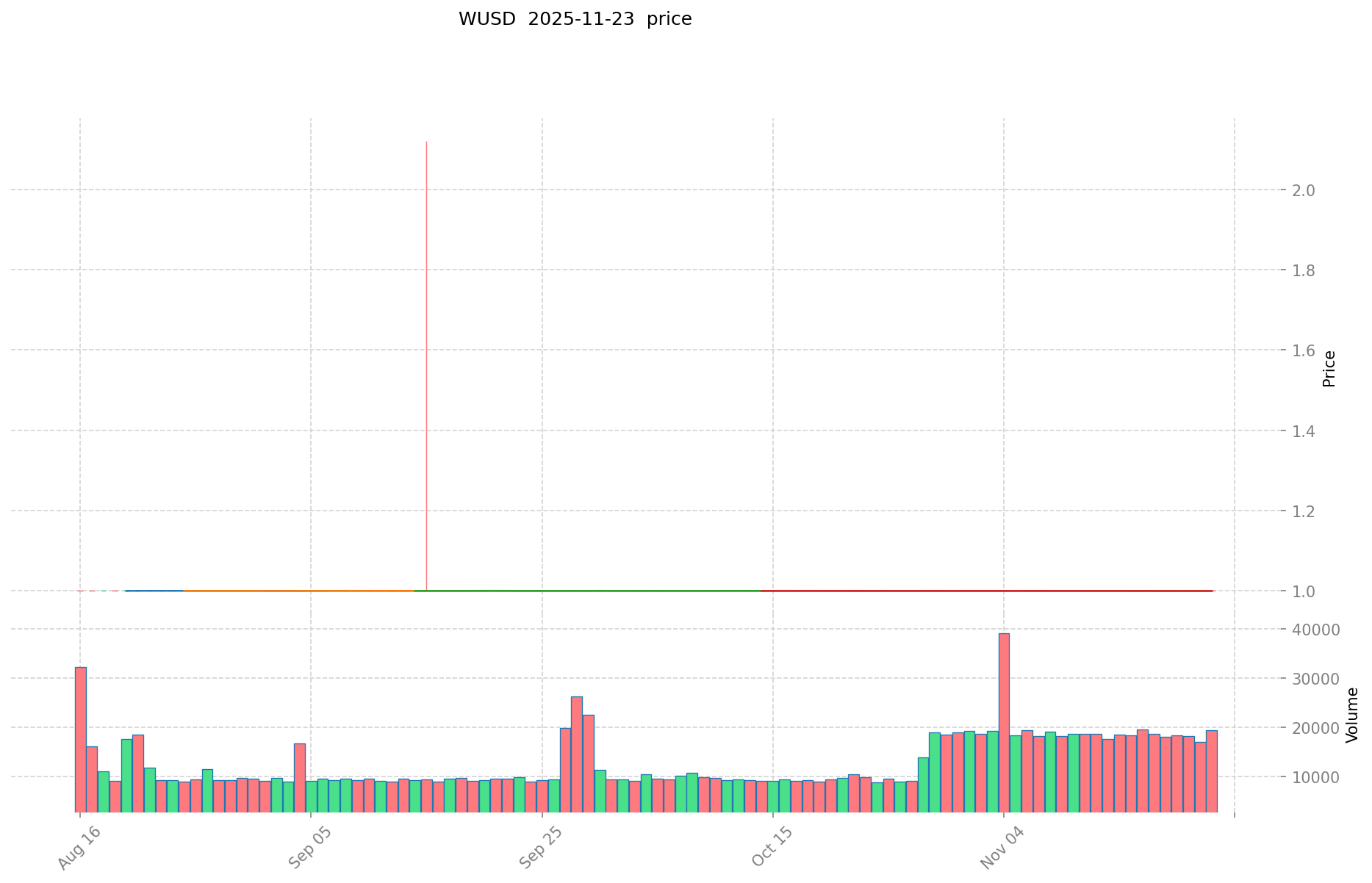

WUSD (Coin A) and DOGE (Coin B) Historical Price Trends

- 2025: WUSD reached its all-time high of $2.1209 on September 15, 2025.

- 2021: DOGE hit its all-time high of $0.731578 on May 8, 2021, driven by social media hype and celebrity endorsements.

- Comparative analysis: Since their respective all-time highs, WUSD has maintained relative stability as a stablecoin, while DOGE has experienced significant volatility, dropping from its peak to the current price of $0.14247.

Current Market Situation (2025-11-23)

- WUSD current price: $0.9996

- DOGE current price: $0.14247

- 24-hour trading volume: WUSD $19,446.99 vs DOGE $19,190,819.86

- Market Sentiment Index (Fear & Greed Index): 13 (Extreme Fear)

Click to view real-time prices:

- View WUSD current price Market Price

- View DOGE current price Market Price

II. Core Factors Affecting WUSD vs DOGE Investment Value

Supply Mechanism Comparison (Tokenomics)

- WUSD: Collateralized stablecoin with supply directly tied to demand and backing assets

- DOGE: Inflationary supply with approximately 5 billion new DOGE created annually

- 📌 Historical pattern: DOGE's unlimited supply tends to create price dilution over time, while WUSD aims for price stability as a stablecoin.

Institutional Adoption and Market Applications

- Institutional holdings: WUSD likely more appealing to institutions seeking stability for treasury operations

- Enterprise adoption: DOGE has gained traction as a payment method with Tesla and other businesses accepting it, while WUSD would serve primarily as a stable medium of exchange

- National policies: Regulatory approaches vary by country, with stablecoins like WUSD facing increasing regulatory scrutiny in most jurisdictions

Technical Development and Ecosystem Building

- WUSD technical foundation: Built on blockchain infrastructure with focus on maintaining peg stability

- DOGE technical development: Limited core development, though community efforts continue to maintain network security

- Ecosystem comparison: DOGE has established itself as a payment cryptocurrency with cultural significance, while WUSD would integrate into DeFi protocols as a stablecoin

Macroeconomic Factors and Market Cycles

- Performance in inflationary environments: WUSD designed to maintain purchasing power, while DOGE typically underperforms during high inflation

- Macroeconomic monetary policy: Interest rates and USD strength directly impact WUSD stability, while DOGE shows higher correlation with risk assets

- Geopolitical factors: WUSD could serve cross-border transaction needs in unstable regions, while DOGE remains vulnerable to regulatory actions in different jurisdictions

III. 2025-2030 Price Prediction: WUSD vs DOGE

Short-term Prediction (2025)

- WUSD: Conservative $0.789605 - $0.9995 | Optimistic $0.9995 - $1.11944

- DOGE: Conservative $0.0813846 - $0.14278 | Optimistic $0.14278 - $0.1841862

Mid-term Prediction (2027)

- WUSD may enter a growth phase, with an estimated price range of $0.88571692 - $1.57331295

- DOGE may enter a bullish market, with an estimated price range of $0.1281707504 - $0.282376184475

- Key drivers: Institutional fund inflows, ETF, ecosystem development

Long-term Prediction (2030)

- WUSD: Base scenario $1.156401334088 - $1.65200190584 | Optimistic scenario $1.65200190584 - $1.9328422298328

- DOGE: Base scenario $0.210098411527946 - $0.287806043188967 | Optimistic scenario $0.287806043188967 - $0.325220828803532

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to various factors. These projections should not be considered as financial advice. Always conduct your own research before making investment decisions.

WUSD:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.11944 | 0.9995 | 0.789605 | 0 |

| 2026 | 1.271364 | 1.05947 | 0.7522237 | 5 |

| 2027 | 1.57331295 | 1.165417 | 0.88571692 | 16 |

| 2028 | 1.478914173 | 1.369364975 | 1.0133300815 | 36 |

| 2029 | 1.87986423768 | 1.424139574 | 1.0681046805 | 42 |

| 2030 | 1.9328422298328 | 1.65200190584 | 1.156401334088 | 65 |

DOGE:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1841862 | 0.14278 | 0.0813846 | 0 |

| 2026 | 0.237050495 | 0.1634831 | 0.137325804 | 14 |

| 2027 | 0.282376184475 | 0.2002667975 | 0.1281707504 | 40 |

| 2028 | 0.325784012833125 | 0.2413214909875 | 0.1834043331505 | 69 |

| 2029 | 0.292059334467621 | 0.283552751910312 | 0.249526421681075 | 99 |

| 2030 | 0.325220828803532 | 0.287806043188967 | 0.210098411527946 | 102 |

IV. Investment Strategy Comparison: WUSD vs DOGE

Long-term vs Short-term Investment Strategies

- WUSD: Suitable for investors focused on stability and potential use in DeFi ecosystems

- DOGE: Suitable for investors seeking higher risk-reward and potential cultural impact

Risk Management and Asset Allocation

- Conservative investors: WUSD: 80% vs DOGE: 20%

- Aggressive investors: WUSD: 40% vs DOGE: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency combinations

V. Potential Risk Comparison

Market Risk

- WUSD: Risk of de-pegging from USD, liquidity concerns

- DOGE: High volatility, susceptibility to market sentiment and social media influence

Technical Risk

- WUSD: Scalability, network stability

- DOGE: Mining concentration, security vulnerabilities

Regulatory Risk

- Global regulatory policies have different impacts on both: WUSD faces increased scrutiny as a stablecoin, while DOGE may be subject to broader cryptocurrency regulations

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- WUSD advantages: Stability, potential integration with DeFi protocols, hedge against market volatility

- DOGE advantages: Strong community support, cultural significance, potential for high returns in bull markets

✅ Investment Advice:

- New investors: Consider a higher allocation to WUSD for stability, with a small position in DOGE for exposure to potential upside

- Experienced investors: Balance portfolio with both WUSD and DOGE based on risk tolerance and market outlook

- Institutional investors: WUSD may be more suitable for treasury operations and as a stable medium of exchange

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between WUSD and DOGE? A: WUSD is a stablecoin designed for price stability and optimized for Web3 industry enterprise users, while DOGE is an inflationary cryptocurrency known for its community and meme status. WUSD aims to maintain a stable value, whereas DOGE has high price volatility.

Q2: Which coin is better for long-term investment? A: The better long-term investment depends on your risk tolerance and investment goals. WUSD offers stability and potential integration with DeFi protocols, making it suitable for conservative investors. DOGE provides higher risk-reward potential and cultural significance, appealing to more aggressive investors.

Q3: How do the supply mechanisms of WUSD and DOGE differ? A: WUSD is a collateralized stablecoin with supply tied to demand and backing assets. DOGE has an inflationary supply with approximately 5 billion new DOGE created annually, which can lead to price dilution over time.

Q4: What are the key risks associated with investing in WUSD and DOGE? A: For WUSD, key risks include potential de-pegging from USD and liquidity concerns. DOGE faces risks such as high volatility, susceptibility to market sentiment, and social media influence. Both are subject to regulatory risks, with WUSD facing increased scrutiny as a stablecoin.

Q5: How do institutional adoptions differ between WUSD and DOGE? A: WUSD is likely more appealing to institutions seeking stability for treasury operations. DOGE has gained traction as a payment method with some businesses accepting it. However, regulatory approaches vary by country, affecting institutional adoption of both cryptocurrencies.

Q6: What factors should be considered when allocating investments between WUSD and DOGE? A: Consider your risk tolerance, investment timeline, and market outlook. Conservative investors might allocate more to WUSD for stability, while aggressive investors might favor a higher allocation to DOGE for potential gains. Also, consider the current market sentiment and regulatory environment.

Share

Content