SPARKLET vs AVAX: Comparing Two Promising Blockchain Platforms for DeFi Innovation

Introduction: Investment Comparison of SPARKLET vs AVAX

In the cryptocurrency market, the comparison between SPARKLET and AVAX has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in crypto assets.

Upland (SPARKLET): Launched as an immersive layer 1 gaming platform, it has gained market recognition for its virtual property-based digital economy in the open metaverse.

Avalanche (AVAX): Since its inception, it has been hailed as a platform for launching decentralized applications and interoperable blockchains, becoming one of the globally recognized cryptocurrencies in terms of transaction volume and market capitalization.

This article will provide a comprehensive analysis of the investment value comparison between SPARKLET and AVAX, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning investors:

"Which is the better buy right now?"

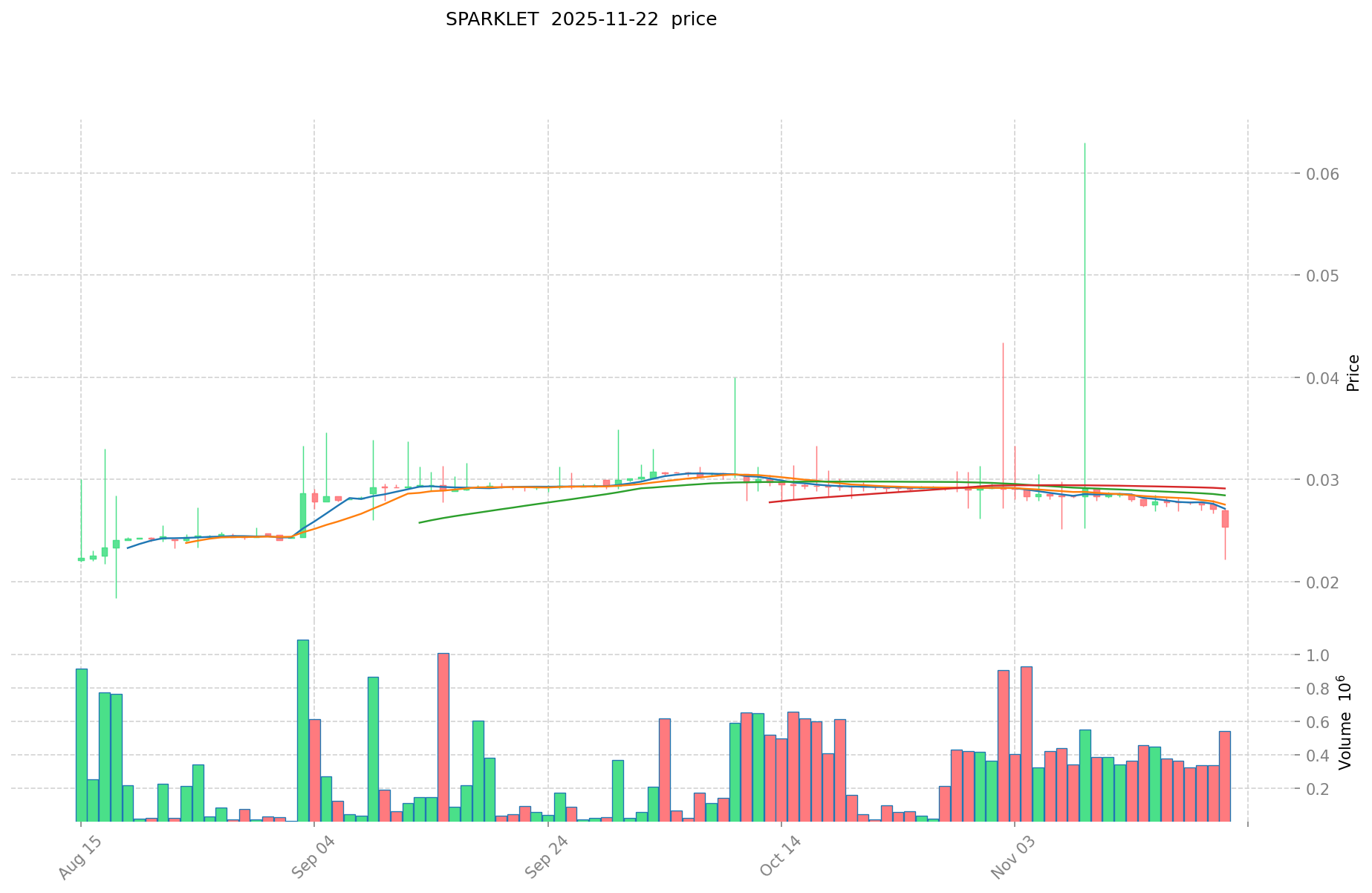

I. Price History Comparison and Current Market Status

SPARKLET (Coin A) and AVAX (Coin B) Historical Price Trends

- 2024: SPARKLET reached its all-time high of $0.1927 on July 24, 2024.

- 2025: SPARKLET hit its all-time low of $0.01144 on April 9, 2025.

- Comparative Analysis: In this market cycle, SPARKLET dropped from its peak of $0.1927 to a low of $0.01144, while AVAX declined from its all-time high of $144.96 (reached on November 21, 2021) to a current price of $13.3.

Current Market Situation (2025-11-23)

- SPARKLET current price: $0.02498

- AVAX current price: $13.3

- 24-hour trading volume: SPARKLET $10,767.80 vs AVAX $2,188,938.09

- Market Sentiment Index (Fear & Greed Index): 11 (Extreme Fear)

Click to view real-time prices:

- View SPARKLET current price Market Price

- View AVAX current price Market Price

II. Key Factors Affecting Investment Value of SPARKLET vs AVAX

Supply Mechanism Comparison (Tokenomics)

- SPARKLET: Fixed supply of 100 million tokens with deflationary model through token burns

- AVAX: Capped supply of 720 million tokens with staking rewards and fee-based burning mechanism

- 📌 Historical Pattern: Deflationary models like SPARKLET's have historically created upward price pressure during market recovery phases, while AVAX's larger but still capped supply provides more liquidity but less scarcity value.

Institutional Adoption and Market Applications

- Institutional Holdings: AVAX has gained more institutional traction with support from Grayscale and other investment firms, while SPARKLET remains primarily retail-focused

- Enterprise Adoption: AVAX leads in enterprise applications through its subnets technology enabling customized blockchains, whereas SPARKLET's enterprise partnerships are still developing

- Regulatory Attitudes: Both assets face similar regulatory scrutiny, though AVAX's longer market presence has established clearer regulatory positioning in major jurisdictions

Technical Development and Ecosystem Building

- SPARKLET Technical Upgrades: Layer-2 scaling solutions and cross-chain interoperability improvements

- AVAX Technical Development: Subnet expansion, Avalanche-Ethereum bridge enhancements, and consensus algorithm optimizations

- Ecosystem Comparison: AVAX boasts a more mature DeFi ecosystem with higher TVL and established protocols, while SPARKLET offers emerging NFT marketplaces and specialized DeFi applications with competitive fee structures

Macroeconomic Factors and Market Cycles

- Inflation Performance: AVAX has demonstrated stronger correlation with traditional tech assets during inflationary periods, while SPARKLET's newer market entry provides insufficient data for conclusive inflation-resistance analysis

- Monetary Policy Impact: Both assets show sensitivity to Federal Reserve policies, with interest rate hikes typically creating stronger selling pressure on AVAX due to its larger market capitalization and institutional exposure

- Geopolitical Factors: AVAX's more global distribution and adoption provides better resilience to regional regulatory changes III. 2025-2030 Price Prediction: SPARKLET vs AVAX

Short-term Prediction (2025)

- SPARKLET: Conservative $0.01575-$0.025 | Optimistic $0.025-$0.03175

- AVAX: Conservative $12.0666-$13.26 | Optimistic $13.26-$14.1882

Mid-term Prediction (2027)

- SPARKLET may enter a growth phase, with an estimated price range of $0.0198937125-$0.0464186625

- AVAX may enter a steady growth phase, with an estimated price range of $12.48206895-$18.20913588

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- SPARKLET: Base scenario $0.052791870696093-$0.068629431904921 | Optimistic scenario $0.068629431904921+

- AVAX: Base scenario $14.65804189113264-$22.209154380504 | Optimistic scenario $22.209154380504-$25.76261908138464

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to various unpredictable factors. These projections should not be considered as financial advice. Always conduct your own research before making investment decisions.

SPARKLET:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03175 | 0.025 | 0.01575 | 0 |

| 2026 | 0.0414275 | 0.028375 | 0.0227 | 13 |

| 2027 | 0.0464186625 | 0.03490125 | 0.0198937125 | 39 |

| 2028 | 0.0491985470625 | 0.04065995625 | 0.0357807615 | 62 |

| 2029 | 0.060654489735937 | 0.04492925165625 | 0.03055189112625 | 79 |

| 2030 | 0.068629431904921 | 0.052791870696093 | 0.05120811457521 | 111 |

AVAX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 14.1882 | 13.26 | 12.0666 | 0 |

| 2026 | 15.645474 | 13.7241 | 7.548255 | 2 |

| 2027 | 18.20913588 | 14.684787 | 12.48206895 | 9 |

| 2028 | 22.8612764016 | 16.44696144 | 15.7890829824 | 22 |

| 2029 | 24.764189840208 | 19.6541189208 | 15.72329513664 | 46 |

| 2030 | 25.76261908138464 | 22.209154380504 | 14.65804189113264 | 65 |

IV. Investment Strategy Comparison: SPARKLET vs AVAX

Long-term vs Short-term Investment Strategies

- SPARKLET: Suitable for investors focused on gaming and metaverse potential

- AVAX: Suitable for investors seeking ecosystem growth and DeFi exposure

Risk Management and Asset Allocation

- Conservative investors: SPARKLET: 10% vs AVAX: 90%

- Aggressive investors: SPARKLET: 30% vs AVAX: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- SPARKLET: Higher volatility due to lower market cap and trading volume

- AVAX: Susceptible to broader crypto market trends and DeFi sector performance

Technical Risk

- SPARKLET: Scalability, network stability

- AVAX: Decentralization concerns, potential security vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both, with AVAX potentially facing more scrutiny due to its wider adoption and DeFi focus

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- SPARKLET advantages: Niche market in gaming and metaverse, potential for high growth

- AVAX advantages: Established ecosystem, institutional adoption, and proven track record

✅ Investment Advice:

- New investors: Consider a small allocation to AVAX for exposure to a more established asset

- Experienced investors: Balanced portfolio with both SPARKLET and AVAX, adjusting based on risk tolerance

- Institutional investors: AVAX may be more suitable due to its liquidity and regulatory clarity

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between SPARKLET and AVAX? A: SPARKLET is focused on gaming and metaverse applications, with a smaller market cap and higher potential for growth. AVAX is a more established platform for decentralized applications and interoperable blockchains, with a larger market cap and institutional adoption.

Q2: Which cryptocurrency has performed better historically? A: AVAX has demonstrated stronger overall performance, reaching an all-time high of $144.96 in November 2021. SPARKLET's all-time high was $0.1927 in July 2024, but it has since experienced a significant drop.

Q3: How do the supply mechanisms of SPARKLET and AVAX differ? A: SPARKLET has a fixed supply of 100 million tokens with a deflationary model through token burns. AVAX has a capped supply of 720 million tokens with staking rewards and a fee-based burning mechanism.

Q4: Which cryptocurrency is more suitable for long-term investment? A: Both have long-term potential, but AVAX may be more suitable for risk-averse investors due to its established ecosystem and institutional adoption. SPARKLET could offer higher growth potential for those willing to take on more risk.

Q5: What are the main risks associated with investing in SPARKLET and AVAX? A: SPARKLET faces higher volatility risk due to its lower market cap and trading volume. AVAX is more susceptible to broader crypto market trends and DeFi sector performance. Both face regulatory risks, with AVAX potentially facing more scrutiny due to its wider adoption.

Q6: How do institutional investors view SPARKLET and AVAX? A: AVAX has gained more institutional traction with support from investment firms like Grayscale. SPARKLET remains primarily retail-focused and has less institutional adoption at present.

Q7: What factors should be considered when allocating investments between SPARKLET and AVAX? A: Consider your risk tolerance, investment horizon, and belief in the potential of gaming/metaverse vs. broader DeFi applications. Conservative investors might allocate more to AVAX, while aggressive investors could increase their SPARKLET allocation for potentially higher returns.

Share

Content