P00LS vs AAVE: The Battle of Decentralized Finance Platforms Shaping the Future of Crypto Lending

Introduction: Investment Comparison between P00LS and AAVE

In the cryptocurrency market, the comparison between P00LS vs AAVE has always been a topic that investors can't ignore. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset landscape.

P00LS (P00LS): Since its launch, it has gained market recognition for its role in fan tokens and creator cryptocurrencies.

AAVE (AAVE): Since its inception in 2020, it has been hailed as a leading decentralized lending protocol, providing deposit and lending services to users.

This article will comprehensively analyze the investment value comparison between P00LS vs AAVE, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?" Here is the report section based on the provided template and data:

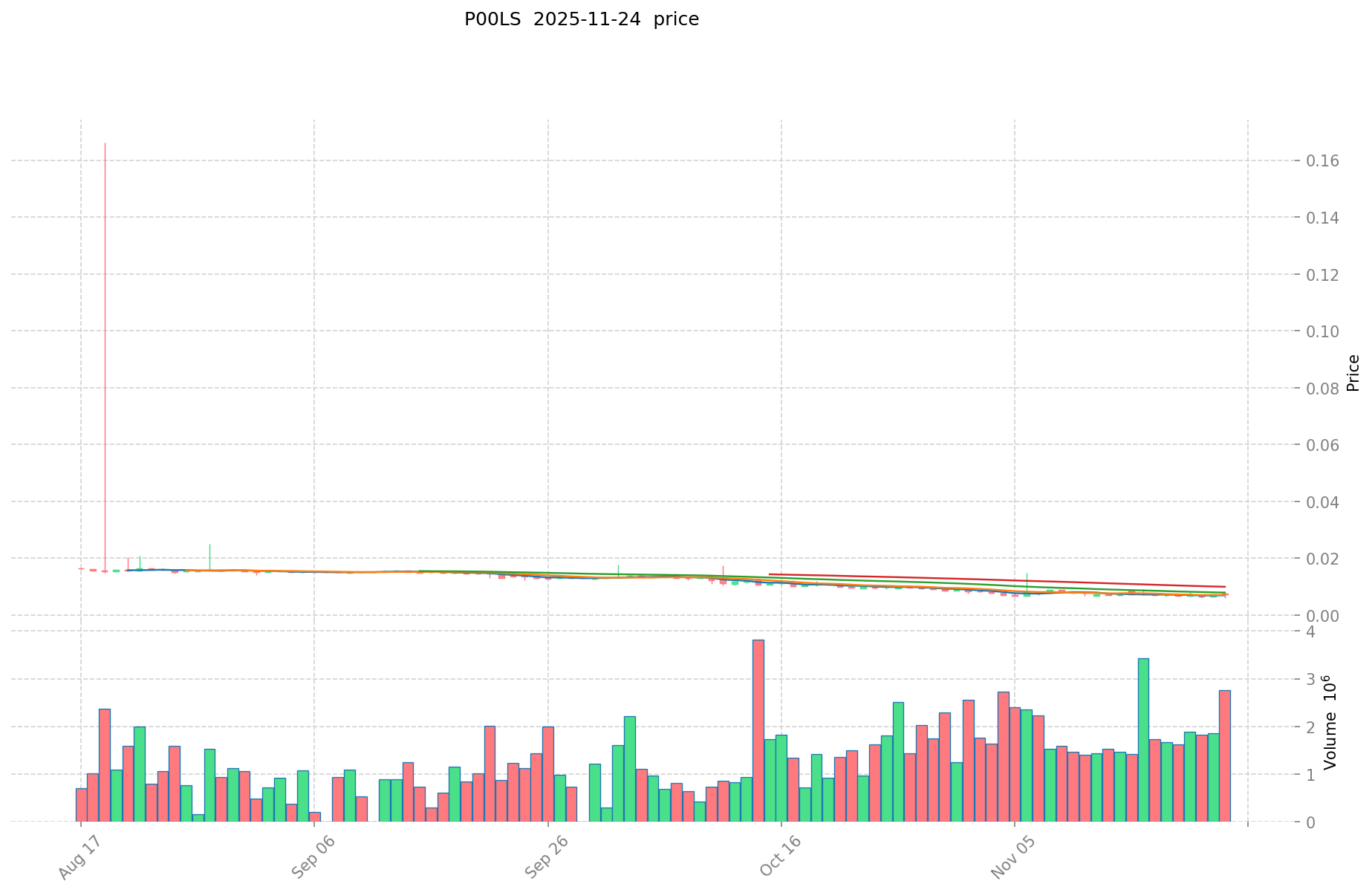

I. Price History Comparison and Current Market Status

P00LS and AAVE Historical Price Trends

- 2020: AAVE launched its token through a token swap from LEND, with price increasing significantly.

- 2021: AAVE reached its all-time high of $661.69 amid the overall crypto bull market.

- Comparative analysis: During the 2021 bull market, P00LS rose from its initial price of $0.04 to a high of $0.980104, while AAVE surged from around $50 to over $660.

Current Market Situation (2025-11-25)

- P00LS current price: $0.006892

- AAVE current price: $177.65

- 24-hour trading volume: $12,141.77 (P00LS) vs $4,926,479.00 (AAVE)

- Market Sentiment Index (Fear & Greed Index): 19 (Extreme Fear)

Click to view real-time prices:

- View P00LS current price Market Price

- View AAVE current price Market Price

II. Key Factors Affecting P00LS vs AAVE Investment Value

Supply Mechanisms Comparison (Tokenomics)

- P00LS: Protocol allowing creators to tokenize their social capital, with creator-specific token distribution models

- AAVE: Deflationary mechanism with burning of fees and staking rewards for governance

- 📌 Historical pattern: Deflationary mechanisms like AAVE's tend to provide more price stability during market volatility compared to newer tokenomic models

Institutional Adoption and Market Applications

- Institutional holdings: AAVE has attracted more institutional interest with established DeFi credentials

- Enterprise adoption: AAVE leads in lending market applications across DeFi ecosystems, while P00LS focuses on creator economy applications

- Regulatory stance: Both face varying regulatory scrutiny, with creator tokens potentially facing additional securities classification risks

Technical Development and Ecosystem Building

- P00LS technical focus: Building creator economy infrastructure with social capital tokenization

- AAVE technical development: Continuous improvement of lending protocols with V3 enhancing capital efficiency

- Ecosystem comparison: AAVE has wider DeFi integration across multiple chains, while P00LS is developing its niche in social token ecosystems

Macroeconomic Factors and Market Cycles

- Inflation performance: AAVE's utility in generating yield may provide better inflation resistance

- Monetary policy effects: Interest rate changes affect lending protocols like AAVE more directly

- Geopolitical factors: Creator economy platforms like P00LS may be less affected by cross-border transaction restrictions

III. 2025-2030 Price Prediction: P00LS vs AAVE

Short-term Prediction (2025)

- P00LS: Conservative $0.00544468 - $0.006892 | Optimistic $0.006892 - $0.00709876

- AAVE: Conservative $119.2801 - $178.03 | Optimistic $178.03 - $231.439

Mid-term Prediction (2027)

- P00LS may enter a growth phase, with estimated prices ranging from $0.006402871314 to $0.011303834542

- AAVE may enter a bullish market, with estimated prices ranging from $187.4958551 to $276.3096812

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- P00LS: Base scenario $0.013426821145458 - $0.015328473925716 | Optimistic scenario $0.015328473925716 - $0.015575112528731

- AAVE: Base scenario $329.6954253636375 - $339.586288124546625 | Optimistic scenario $339.586288124546625 - $391.345789456025

Disclaimer: The above predictions are based on historical data and market trends. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

P00LS:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00709876 | 0.006892 | 0.00544468 | 0 |

| 2026 | 0.0088141788 | 0.00699538 | 0.0053164888 | 1 |

| 2027 | 0.011303834542 | 0.0079047794 | 0.006402871314 | 14 |

| 2028 | 0.0134460297594 | 0.009604306971 | 0.00624279953115 | 39 |

| 2029 | 0.015328473925716 | 0.0115251683652 | 0.010603154895984 | 67 |

| 2030 | 0.015575112528731 | 0.013426821145458 | 0.008324629110183 | 94 |

AAVE:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 231.439 | 178.03 | 119.2801 | 0 |

| 2026 | 288.675645 | 204.7345 | 122.8407 | 15 |

| 2027 | 276.3096812 | 246.7050725 | 187.4958551 | 38 |

| 2028 | 274.5827456925 | 261.50737685 | 162.134573647 | 47 |

| 2029 | 391.345789456025 | 268.04506127125 | 166.187937988175 | 50 |

| 2030 | 339.586288124546625 | 329.6954253636375 | 253.865477530000875 | 85 |

IV. Investment Strategy Comparison: P00LS vs AAVE

Long-term vs Short-term Investment Strategies

- P00LS: Suitable for investors focused on creator economy potential and social capital tokenization

- AAVE: Suitable for investors seeking DeFi exposure and yield-generating opportunities

Risk Management and Asset Allocation

- Conservative investors: P00LS: 10% vs AAVE: 90%

- Aggressive investors: P00LS: 30% vs AAVE: 70%

- Hedging tools: Stablecoin allocation, options, cross-token portfolios

V. Potential Risk Comparison

Market Risks

- P00LS: Higher volatility due to newer market and smaller cap

- AAVE: Exposure to overall DeFi market fluctuations

Technical Risks

- P00LS: Scalability, network stability in creator token ecosystems

- AAVE: Smart contract vulnerabilities, liquidity risks

Regulatory Risks

- Global regulatory policies may impact P00LS more due to potential securities classification of creator tokens, while AAVE faces general DeFi regulatory scrutiny

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- P00LS advantages: Potential for growth in creator economy, unique tokenization model

- AAVE advantages: Established DeFi protocol, wider ecosystem integration, deflationary mechanism

✅ Investment Advice:

- New investors: Consider AAVE for more established market presence and lower volatility

- Experienced investors: Balanced portfolio with both, leaning towards AAVE for stability

- Institutional investors: Focus on AAVE for its institutional adoption and DeFi market leadership

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between P00LS and AAVE? A: P00LS focuses on creator economy and social capital tokenization, while AAVE is a leading decentralized lending protocol in the DeFi space. P00LS has a smaller market cap and is newer, while AAVE is more established with wider ecosystem integration.

Q2: Which token has performed better historically? A: AAVE has shown stronger historical performance, reaching an all-time high of $661.69 in 2021. P00LS, being newer, has had less time in the market but rose from $0.04 to $0.980104 during the 2021 bull market.

Q3: What are the key factors affecting the investment value of P00LS and AAVE? A: Key factors include supply mechanisms (tokenomics), institutional adoption, technical development, ecosystem building, and macroeconomic factors such as inflation and monetary policy.

Q4: How do the supply mechanisms differ between P00LS and AAVE? A: P00LS allows creators to tokenize their social capital with creator-specific distribution models. AAVE has a deflationary mechanism with fee burning and staking rewards for governance.

Q5: Which token is considered a safer investment? A: AAVE is generally considered safer due to its established market presence, wider ecosystem integration, and deflationary mechanism. It has attracted more institutional interest and has a longer track record in the DeFi space.

Q6: What are the potential risks for each token? A: P00LS faces higher volatility and potential regulatory risks due to securities classification of creator tokens. AAVE is exposed to overall DeFi market fluctuations and smart contract vulnerabilities.

Q7: How should investors allocate their portfolio between P00LS and AAVE? A: Conservative investors might consider 10% P00LS and 90% AAVE, while more aggressive investors could opt for 30% P00LS and 70% AAVE. However, individual allocation should be based on personal risk tolerance and investment goals.

Share

Content