Is Worldwide USD (WUSD) a good investment?: Analyzing the Risks and Potential of a New Stablecoin

Introduction: Investment Status and Market Prospects of Worldwide USD (WUSD)

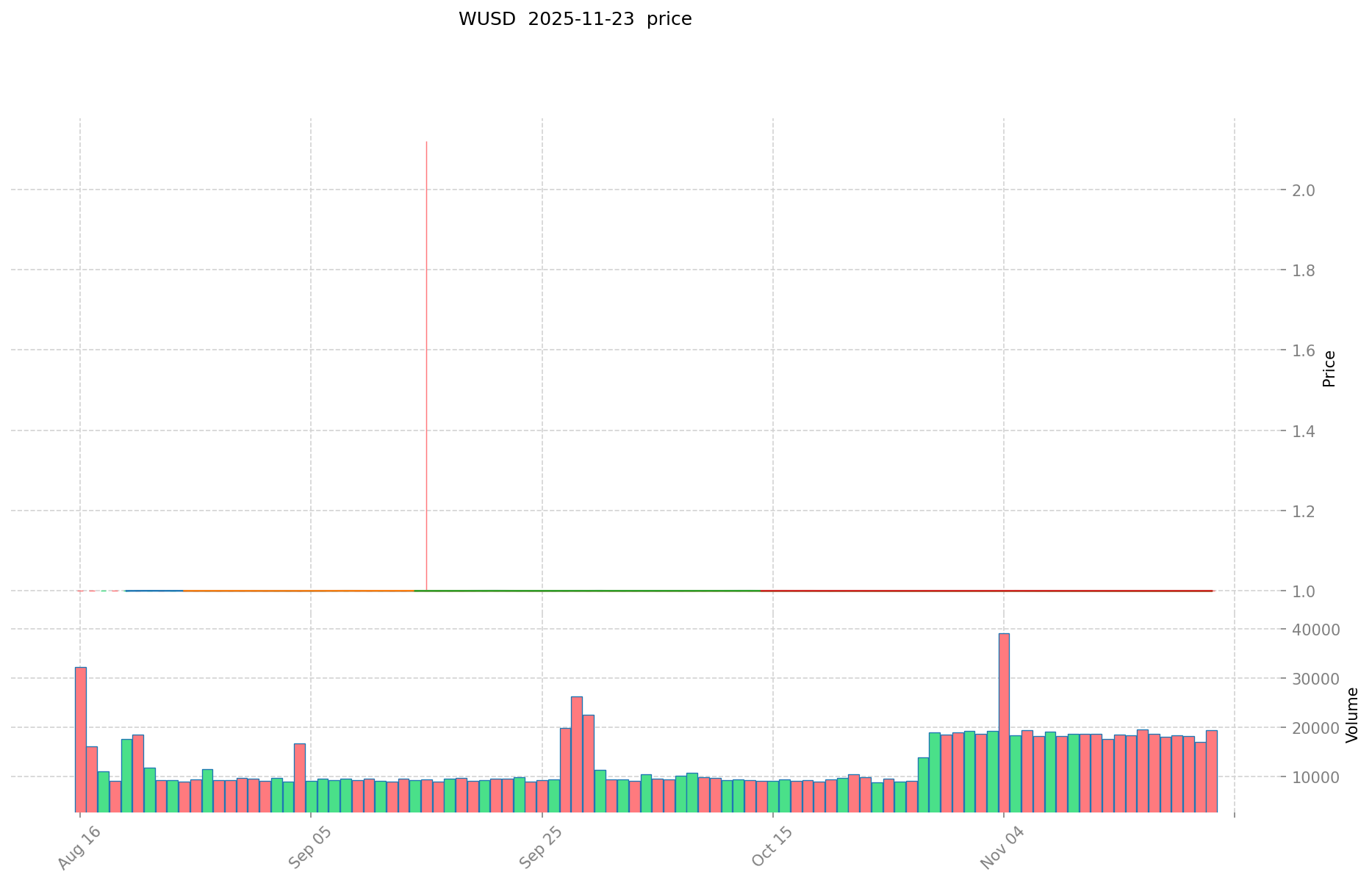

WUSD is an important asset in the cryptocurrency field, which has achieved significant success in the Web3 industry since its launch. As of 2025, WUSD's market capitalization has reached $4,057,648.17, with a circulation of approximately 4,059,271.88 tokens, and the current price maintaining around $0.9996. With its positioning as a "fiat-collateralized stablecoin", WUSD has gradually become a focal point for investors discussing "Is Worldwide USD (WUSD) a good investment?". This article will comprehensively analyze WUSD's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. Worldwide USD (WUSD) Price History Review and Current Investment Value

WUSD Historical Price Trends and Investment Returns (Worldwide USD(WUSD) investment performance)

- 2024: WUSD launched → Initial price stabilization around $1

- 2025: Market fluctuations → WUSD price dropped to all-time low of $0.9974 on November 23

Current WUSD Investment Market Status (November 2025)

- WUSD current price: $0.9996

- Market sentiment: Neutral (based on stable price near $1)

- 24-hour trading volume: $19,478.43

- Institutional investor holdings: Data not available

Click to view real-time WUSD market price

II. WUSD Project Overview and Core Technology Analysis

WUSD Project Background and Team

WUSD is a fiat-collateralized stablecoin pegged to the U.S. Dollar at a 1:1 ratio. It focuses on optimizing payment solutions for Web3 industry enterprise users.

WUSD's Core Technology and Features

- Stable value: Pegged 1:1 to the US Dollar

- Fiat-collateralized: Backed by traditional currency reserves

- Web3 focus: Tailored for enterprise users in the Web3 industry

- Comprehensive ecosystem: Includes stablecoins, exchanges, and card services

WUSD's Technical Advantages and Innovations

- Secure and compliant digital payments

- Designed for global expansion

- Empowering real economy through blockchain technology

III. WUSD Ecosystem and Application Scenarios

Current WUSD Ecosystem

WUSD's ecosystem encompasses:

- Stablecoin issuance and management

- Exchange services

- Payment card solutions

WUSD's Main Application Scenarios

- Web3 enterprise payments

- Cross-border transactions

- Digital asset trading pairs

WUSD's Future Ecosystem Expansion Plans

The project aims for global expansion, potentially including:

- Integration with more Web3 platforms

- Expansion of payment services to traditional businesses

- Development of additional financial products within the ecosystem

IV. WUSD Token Economics Model

WUSD Token Distribution and Circulation

- Total supply: 4,059,271.88 WUSD

- Circulating supply: 4,059,271.88 WUSD (100% of total supply)

- Market cap: $4,057,648.17

WUSD Token Utility and Value Capture Mechanism

- Primary use: Stable medium of exchange within the Web3 ecosystem

- Value stability: Maintained through 1:1 USD backing

WUSD Token Burning and Repurchase Mechanisms

No specific token burning or repurchase mechanisms mentioned in the available information.

V. WUSD Project Progress and Milestone Achievements

WUSD Development Roadmap and Progress

Specific roadmap details not provided in the available information.

Key Partnerships and Collaborations

No specific partnerships or collaborations mentioned in the available data.

Recent Major Updates or Announcements

No recent major updates or announcements found in the provided information.

VI. WUSD Investment Risk Analysis

Potential Risks in WUSD Investment

- Regulatory risks: Potential changes in stablecoin regulations

- Market competition: Competition from other stablecoins and payment solutions

- Technical risks: Potential vulnerabilities in the underlying technology

- Collateral risks: Ensuring sufficient and secure backing of the stablecoin

Risk Mitigation Measures

- Compliance focus: WUSD emphasizes secure and compliant digital payments

- Diversification: Offering a range of services including exchanges and cards

Expert Opinions on WUSD's Future Prospects

No specific expert opinions provided in the available information.

VII. Comparative Analysis of WUSD and Similar Projects

Comparison with Other Stablecoins

Comparative data with other stablecoins not provided in the available information.

WUSD's Unique Selling Points

- Focus on Web3 enterprise users

- Comprehensive ecosystem including exchanges and payment cards

- Emphasis on global expansion and real economy empowerment

WUSD's Market Position and Competitiveness

- Market cap rank: 1703

- Market share: 0.00013%

VIII. WUSD Community Analysis and Social Metrics

WUSD Community Size and Activity

- Twitter followers: Not specified

- Other social media metrics: Not provided

Recent Hot Topics in the WUSD Community

No specific community discussions or hot topics mentioned in the available data.

WUSD's Social Influence and Brand Awareness

Limited information available to assess social influence and brand awareness.

II. Key Factors Affecting Whether Worldwide USD (WUSD) is a Good Investment

Supply Mechanism and Scarcity (WUSD investment scarcity)

- Pegged 1:1 to USD → Stable value proposition

- Historical pattern: Price maintained close to $1

- Investment significance: Stability rather than scarcity is key for long-term investment

Institutional Investment and Mainstream Adoption (Institutional investment in WUSD)

- Institutional holdings trend: Limited data available

- Adoption by Web3 industry enterprise users → Enhances investment value

- Regulatory compliance may positively impact investment prospects

Macroeconomic Environment's Impact on WUSD Investment

- Monetary policy and interest rate changes → May affect demand for stablecoins

- Hedge against market volatility → "Digital dollar" positioning

- Geopolitical uncertainties → May increase demand for stable digital assets

Technology & Ecosystem for WUSD Investment

- Focus on secure and compliant digital payments → Enhances long-term value proposition

- Expansion into stablecoins, exchanges, and cards → Supports ecosystem growth

- Payment solutions for Web3 industry may drive adoption and investment value

III. WUSD Future Investment Forecast and Price Outlook (Is Worldwide USD(WUSD) worth investing in 2025-2030)

Short-term WUSD investment outlook (2025)

- Conservative forecast: $0.809595 - $0.9995

- Neutral forecast: $0.9995 - $1.05

- Optimistic forecast: $1.05 - $1.11944

Mid-term Worldwide USD(WUSD) investment forecast (2026-2027)

- Market phase expectation: Steady growth with potential for increased adoption

- Investment return forecast:

- 2026: $0.7734131 - $1.3243375

- 2027: $0.7508993625 - $1.2395799

- Key catalysts: Expansion of Web3 payment solutions, increased enterprise adoption

Long-term investment outlook (Is WUSD a good long-term investment?)

- Base scenario: $1.184684788274006 - $1.538551673083125 (Assuming continued stable growth and adoption)

- Optimistic scenario: $1.538551673083125 - $2.153972342316375 (Assuming widespread adoption and favorable market conditions)

- Risk scenario: $0.809595 - $1.184684788274006 (Under extreme market volatility or regulatory challenges)

Click to view WUSD long-term investment and price prediction: Price Prediction

2025-11-23 - 2030 Long-term Outlook

- Base scenario: $1.184684788274006 - $1.538551673083125 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $1.538551673083125 - $2.153972342316375 (Corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $2.153972342316375 (In case of breakthrough developments in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $2.153972342316375 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.11944 | 0.9995 | 0.809595 | 0 |

| 2026 | 1.3243375 | 1.05947 | 0.7734131 | 5 |

| 2027 | 1.2395799 | 1.19190375 | 0.7508993625 | 19 |

| 2028 | 1.49536244475 | 1.215741825 | 0.97259346 | 21 |

| 2029 | 1.72155121129125 | 1.355552134875 | 1.17933035734125 | 35 |

| 2030 | 2.153972342316375 | 1.538551673083125 | 1.184684788274006 | 53 |

IV. How to invest in WUSD

WUSD investment strategy

- HODL WUSD: Suitable for conservative investors seeking stable value preservation

- Active trading: Not recommended for WUSD due to its stable nature as a stablecoin

Risk management for WUSD investment

- Asset allocation ratio: Conservative - up to 5-10% of portfolio for stablecoins

- Risk hedging: Diversify across multiple stablecoins and fiat-backed assets

- Secure storage: Use reputable exchanges or hardware wallets for WUSD storage

V. Risks of investing in stablecoins

- Market risk: Depegging from USD value

- Regulatory risk: Potential government restrictions on stablecoins

- Technical risk: Smart contract vulnerabilities, hacks of issuing platform

VI. Conclusion: Is WUSD a Good Investment?

- Investment value summary: WUSD offers stability but limited upside potential as a stablecoin pegged to USD.

- Investor recommendations: ✅ Beginners: Use as a store of value or for crypto-to-fiat conversions ✅ Experienced investors: Utilize for trading pairs or short-term holdings ✅ Institutional investors: Consider for treasury management or as a base for DeFi activities

⚠️ Disclaimer: Cryptocurrency investments carry risks. This article is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is Worldwide USD (WUSD) and how does it work? A: Worldwide USD (WUSD) is a fiat-collateralized stablecoin pegged to the U.S. Dollar at a 1:1 ratio. It works by maintaining a reserve of traditional currency to back the issued tokens, focusing on providing stable payment solutions for Web3 industry enterprise users.

Q2: Is WUSD a good investment for 2025-2030? A: WUSD, as a stablecoin, is designed for stability rather than price appreciation. It may be a good investment for those seeking value preservation or as a medium of exchange in the crypto ecosystem. However, it's not typically considered for significant returns like other cryptocurrencies.

Q3: What are the main risks associated with investing in WUSD? A: The main risks include regulatory changes affecting stablecoins, potential depegging from the USD value, technical vulnerabilities, and competition from other stablecoins or payment solutions.

Q4: How does WUSD compare to other stablecoins in the market? A: WUSD differentiates itself by focusing on Web3 enterprise users and offering a comprehensive ecosystem including exchanges and payment cards. However, specific comparative data with other stablecoins is not available in the provided information.

Q5: What is the future outlook for WUSD's price and adoption? A: The price of WUSD is expected to remain close to $1 due to its stablecoin nature. Adoption may increase with the expansion of Web3 payment solutions and increased enterprise use, potentially leading to ecosystem growth rather than price appreciation.

Q6: How can I invest in WUSD? A: You can invest in WUSD by purchasing it on supported cryptocurrency exchanges. It's suitable for conservative investors seeking stable value preservation or as a medium for crypto-to-fiat conversions. However, active trading is not recommended due to its stable nature.

Q7: What are the unique features of WUSD's ecosystem? A: WUSD's ecosystem includes stablecoin issuance and management, exchange services, and payment card solutions. It focuses on secure and compliant digital payments, designed for global expansion and empowering the real economy through blockchain technology.

Share

Content