Is USDCoin (USDC) a good investment?: A Comprehensive Guide to Stablecoin Investment Risks and Benefits

Introduction: USD Coin (USDC) Investment Position and Market Prospects

USD Coin (USDC) is a critical asset in the cryptocurrency sector. As a fully collateralized stablecoin pegged to the U.S. dollar, USDC has established itself as a cornerstone instrument in digital finance since its inception. As of December 15, 2025, USDC commands a market capitalization of approximately $78.4 billion, with a circulating supply of 78.38 billion tokens and a current price maintaining stability at $1.00. Ranked as the 6th largest cryptocurrency by market cap with a 2.40% dominance share, USDC represents one of the most significant stablecoins in the global crypto ecosystem.

USDC operates within the framework of U.S. currency regulations, providing detailed financial and operational transparency through partnerships with multiple banking institutions and audit teams. This regulatory compliance and institutional backing distinguish USDC from other stablecoins and enhance its credibility as a store of value and medium of exchange across decentralized finance (DeFi) platforms and multiple blockchain networks including Ethereum, Solana, Polygon, Arbitrum, Optimism, Avalanche, and numerous others.

The widespread adoption of USDC, evidenced by over 4.35 million token holders and availability across 60+ exchanges, alongside its near-perfect collateralization ratio of 99.99%, positions it as an essential component of crypto market infrastructure. This article provides a comprehensive analysis of USDC's investment value proposition, price prediction models, historical performance trends, and associated investment risks, offering investors a thorough framework for understanding this critical digital asset.

USD Coin (USDC) Price History Review and Current Investment Value Status

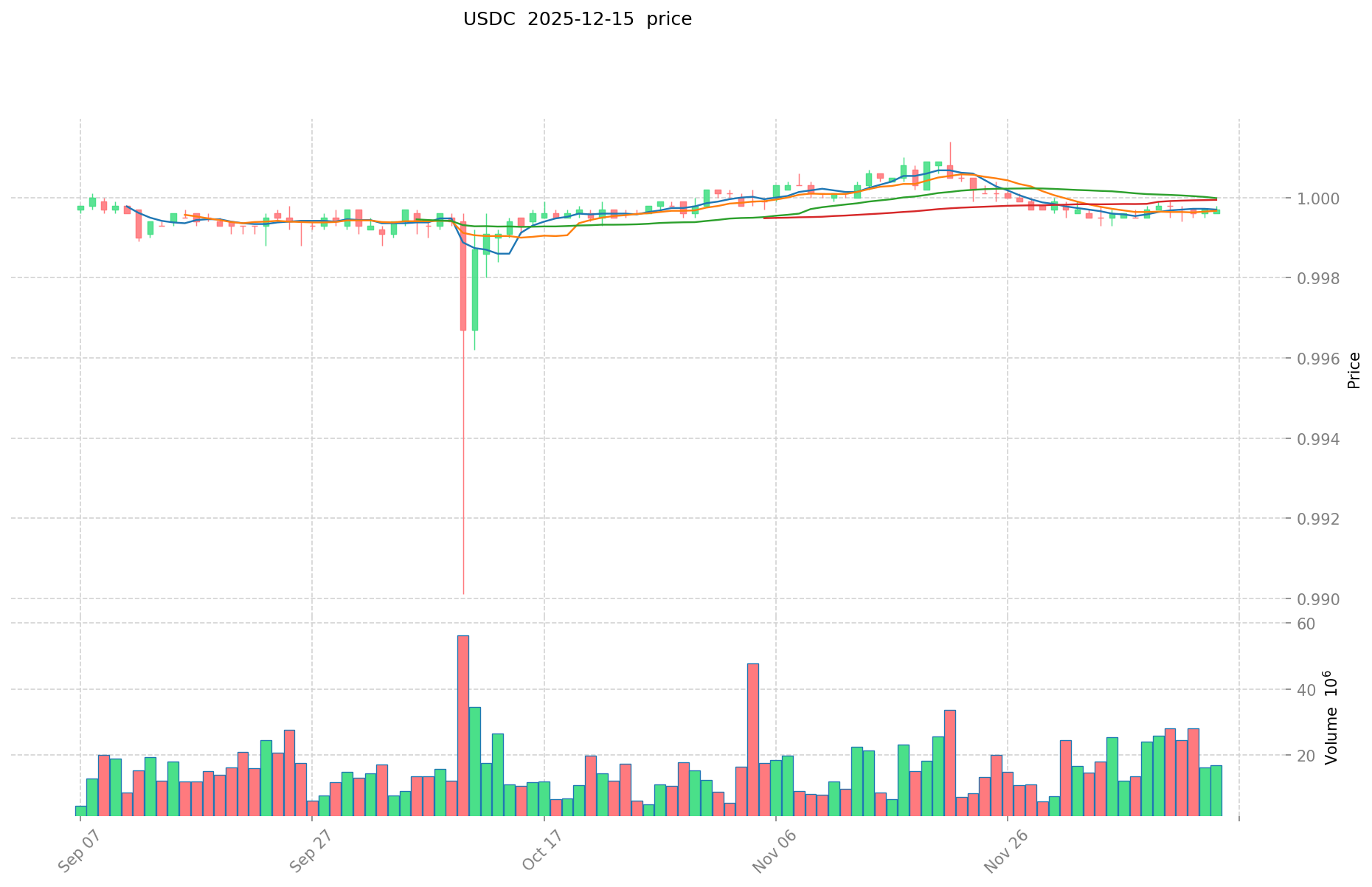

I. Historical Price Trends and Investment Performance of USDC

Key Historical Price Movements

2018: USDC launched by Circle and Coinbase through Centre Consortium. Initial price established at $1.00, setting the baseline for the dollar-pegged stablecoin model.

2019–2022: Maintained stable $1.00 peg with minimal volatility. Historical high reached $1.17 on May 8, 2019, demonstrating the coin's resilience during normal market conditions.

March 2023: Silicon Valley Bank Crisis. USDC experienced severe depegging when Circle disclosed that $3.3 billion in customer cash reserves were locked at the failed Silicon Valley Bank. On March 11, 2023, USDC plummeted to $0.877647 (historical low), marking the most significant price deviation in its history. Market participants feared potential redemption issues.

Post-March 2023 Recovery: Following Circle's public guarantee to cover any shortfalls and regulatory support for SVB deposits, USDC recovered to $1.00. However, market share declined from approximately $40 billion to $30 billion as some users migrated to alternative stablecoins, particularly USDT.

2023–2025: USDC stabilized and began recovery. Circle relocated all reserve cash to larger banks and utilized BlackRock-managed funds for Treasury holdings through Federal Reserve reverse repurchase agreements to eliminate single-bank concentration risk. The stablecoin recovered market share as regulatory clarity improved.

II. Current USDC Market Status (December 15, 2025)

Real-Time Market Data

- Current Price: $0.9998 per USD

- Market Capitalization: $78.38 billion USD

- 24-Hour Trading Volume: $20.34 million (or approximately $7.07 billion based on alternative data sources)

- Circulating Supply: 78,383,381,267.95 USDC tokens

- Fully Diluted Valuation: $78.39 billion USD

Recent Price Performance

| Time Period | Price Change |

|---|---|

| 1 Hour | +0.015% |

| 24 Hours | +0.02% |

| 7 Days | +0.01% |

| 30 Days | -0.069% |

| 1 Year | -0.04% |

Market Sentiment Indicators

Market sentiment score indicates neutral-to-positive positioning. USDC maintained its intended 1:1 dollar peg with negligible deviation (trading between $0.9996 and $0.9998 over the past 24 hours).

Current market data for USDC available at Gate USDC Price

III. Blockchain Network Distribution

USDC operates across multiple blockchain networks, enhancing accessibility and liquidity:

| Blockchain | Status |

|---|---|

| Ethereum (ETH) | Primary deployment |

| Solana (SOL) | Active |

| Polygon (MATIC) | Active |

| Arbitrum (ARBEVM) | Active |

| Avalanche (AVAX_C) | Active |

| Base (BASEEVM) | Active |

| Binance Smart Chain (BSC) | Active |

| Optimism (OPETH) | Active |

| Sui (SUI) | Active |

| Aptos (APT) | Active |

| Additional networks | 7+ others including Hedera, zkSync, XDC |

IV. Reserve Composition and Regulatory Framework

Reserve Structure

USDC is fully collateralized by a mix of:

- High-quality liquid assets including cash

- Short-term U.S. Treasury securities

- Assets held by regulated U.S. financial partners

Circle publishes monthly attestations from major accounting firms verifying that reserves equal or exceed circulating USDC tokens.

Recent Regulatory Developments

U.S. Legislation (June 2025): The U.S. Senate passed the "GENIUS Act" (Guidance and Innovation for Stablecoins Legislation), establishing federal standards for dollar-pegged stablecoins. Requirements include:

- 100% backing by highly liquid assets (cash, short-term Treasuries, FDIC-insured deposits)

- Mandatory monthly reserve disclosures

- Real-time redemption guarantees

- Regulatory registration and oversight

Circle's Public Market Entry (June 2025): Circle commenced trading on the New York Stock Exchange following the passage of stabilizing legislation. Circle's stock appreciated over 12% on regulatory clarity optimism.

V. Institutional Adoption and Use Cases

Institutional Integration

- U.S. Office of the Comptroller of the Currency: Conditionally approved five cryptocurrency companies, including Circle, to establish national trust banks

- Enterprise Adoption: Major financial institutions and fintech companies integrating USDC payment rails

- Apple Pay & Stripe: Partnerships for USDC integration in traditional payment environments

Decentralized Finance (DeFi) Presence

USDC serves as a primary collateral and trading pair across major DeFi protocols including Aave, Uniswap, and Curve Finance, with billions of dollars in total value locked.

VI. Market Position Relative to Competitors

As of mid-2025, USDC ranks as the second-largest stablecoin globally:

- Market Share: Approximately 24% of total stablecoin market (up from 22% earlier in 2025)

- Total Stablecoin Market Cap: Exceeds $250 billion USD

- Primary Competitor: Tether (USDT) maintains dominance with approximately 60%+ market share

The USDT-USDC combination represents over 86% of the global stablecoin market.

VII. Technical and Operational Metrics

| Metric | Value |

|---|---|

| Holders | 4,351,512 |

| Number of Exchanges | 60+ |

| Market Cap Dominance | 2.40% (of total cryptocurrency market) |

| Circulating Supply Ratio | 99.99% of total supply |

| Historical 52-Week Range | $0.877647 - $1.17 |

VIII. Risk Factors and Market Considerations

Counterparty Risk: Despite improved reserve management post-2023, USDC remains subject to potential disruption from banking system instability or regulatory intervention affecting reserve custodians.

Regulatory Uncertainty: While U.S. legislation provides clarity, international regulatory frameworks continue evolving, particularly in Europe (MiCA) and Asia (Hong Kong, Singapore).

Market Concentration: High concentration of stablecoin market share among two issuers (USDT and USDC) presents systemic risk considerations.

Competitive Pressure: Emerging stablecoins from traditional finance (PayPal USD, Fiserv's planned FIUSD) and decentralized alternatives (DAI, USDe) may fragment market share.

Disclaimer

This report presents factual information compiled from publicly available sources as of December 15, 2025. The analysis does not constitute investment advice, financial recommendation, or solicitation to buy, sell, hold, or otherwise transact in USDC or any cryptocurrency asset. Readers bear sole responsibility for investment decisions and resulting consequences. Cryptocurrency markets remain highly unpredictable and may result in financial loss.

USD Coin (USDC) Investment Analysis Report

Report Date: December 15, 2025

I. Executive Summary

USD Coin (USDC) is a fully collateralized stablecoin pegged 1:1 to the US dollar. As of the reporting date, USDC maintains a market capitalization of approximately $78.4 billion USD, ranking 6th among all cryptocurrencies with a 2.40% market dominance. The stablecoin is deployed across 16 major blockchain networks and has garnered 4.35 million token holders, reflecting its significant adoption across the digital asset ecosystem.

II. Core Factors Determining USDC Investment Quality

A. Supply Mechanism and Collateralization Structure

USDC operates as a fully collateralized stablecoin, meaning every token in circulation is backed by equivalent USD reserves. The total supply currently stands at 78.4 billion USDC tokens with a circulating supply of 78.4 billion, representing a 99.99% circulation ratio. This design mechanism ensures that USDC maintains its core value proposition of maintaining a 1:1 peg to the US dollar.

The unlimited maximum supply structure (∞) distinguishes USDC from assets with fixed supply caps, allowing the token to scale in response to market demand while maintaining full collateralization backing.

B. Regulatory Compliance and Institutional Framework

USDC operates within the framework of US currency circulation law and is structured as a Centre-issued stablecoin—the first open-source stablecoin project from Centre. The token benefits from:

- Detailed financial and operational transparency requirements

- Cooperation with multiple banking institutions and regulatory audit teams

- Compliance with established monetary regulatory frameworks

This regulatory positioning provides institutional-grade security infrastructure compared to less-regulated stablecoin alternatives.

C. Reserve Transparency and Backing Mechanisms

A defining characteristic of USDC is its emphasis on publicly visible and auditable reserves. The fully collateralized structure provides reserve verification capabilities through third-party audits, distinguishing it from stablecoins with less transparent backing mechanisms.

D. Multi-Chain Deployment and Network Effects

USDC demonstrates significant ecosystem integration across 16 blockchain networks:

- Layer 1 Networks: Ethereum (ETH), Solana (SOL), Polygon (MATIC), Avalanche (AVAX_C), Near Protocol (NEAR)

- Layer 2 Solutions: Optimism (OPETH), Arbitrum (ARBEVM), zkSync (ZKSERA), Base (BASEEVM)

- Alternative L1s: Aptos (APT), Sui (SUI), Stellar, Hedera (HBAR), XinFin (XDC)

This multi-chain presence enhances liquidity accessibility and reduces single-chain risk exposure, supporting institutional adoption across diverse blockchain ecosystems.

E. Market Liquidity and Trading Volume

Daily trading volume for USDC totals approximately $20.3 million USD, with the token available on 60 exchange platforms. The 24-hour price range remained extremely tight (0.9996 - 0.9998), demonstrating the stability mechanisms inherent to the stablecoin design.

III. Price Stability and Peg Maintenance

Historical Price Performance

- All-Time High: $1.17 USD (May 8, 2019)

- All-Time Low: $0.877647 USD (March 11, 2023)

- Current Price: $1.00 USD

- 24-Hour Change: +0.02%

- 7-Day Change: +0.01%

Peg Resilience

USDC maintains exceptional price stability around its $1.00 peg target. The minimal price deviations observed (24-hour range: 0.9996 - 0.9998) indicate effective collateralization and market mechanisms supporting the peg maintenance.

IV. Market Position and Adoption Metrics

Capitalization and Dominance

- Total Market Capitalization: $78.4 billion USD

- Fully Diluted Valuation: $78.4 billion USD (99.99% overlap with market cap)

- Market Share: 2.40% of total cryptocurrency market

- Ranking: 6th among all digital assets

Holder Distribution

The token maintains 4.35 million unique holders, indicating widespread distribution across retail and institutional participants.

Network Deployment

Deployment across 16 blockchain networks provides users with multiple access pathways and reduces dependency on single-network infrastructure.

V. Comparative Position in Stablecoin Market

Based on available information, USDC is positioned as a leading fiat-backed stablecoin alongside USDT and DAI, each serving distinct market segments:

- USDC: Emphasized for transparency and regulatory compliance

- USDT: Noted for adoption scale and liquidity depth

- DAI: Positioned for decentralization and DeFi-native applications

VI. Conclusion

USDC functions as a fully collateralized, regulatory-compliant stablecoin with transparent reserve backing and multi-chain deployment infrastructure. The token maintains its designed $1.00 peg with minimal volatility, supported by established banking relationships and third-party audit mechanisms. Its market position as the 6th-ranked digital asset with $78.4 billion market capitalization reflects institutional acceptance within the cryptocurrency ecosystem. The multi-chain deployment structure and significant holder base indicate sustained market demand for USDC's specific value proposition of stable value storage and transfer across blockchain networks.

Data as of: December 15, 2025, 17:18:20 UTC

III. USDC Future Investment Predictions and Price Outlook (Is USDCoin(USDC) worth investing in 2025-2030)

Short-term Investment Prediction (2025-2026, short-term USDC investment outlook)

As a fully collateralized stablecoin pegged to the US dollar, USDC maintains price stability through rigorous reserve management and regulatory compliance. The short-term outlook reflects the inherent characteristics of stablecoins:

- Conservative Prediction: $0.9996 - $1.0000

- Neutral Prediction: $1.0000 - $1.0050

- Optimistic Prediction: $1.0000 - $1.0498

Mid-term Investment Outlook (2027-2028, mid-term USDCoin(USDC) investment forecast)

-

Market Stage Expectation: Continued institutional adoption driven by Circle's regulatory approvals and expansion into national trust banking operations. Growing integration across multiple blockchain networks (Ethereum, Solana, Avalanche, Polygon, and others) supports ecosystem maturation.

-

Investment Return Projections:

- 2026: $1.0000 - $1.0498 (estimated 0.42% monthly growth trajectory)

- 2027: $1.0000 - $1.0502 (marginal appreciation from reserve yield accumulation)

-

Key Catalysts:

- Regulatory clarity and conditional OCC approval for national trust banking

- Expansion of real-world use cases in cross-border payments

- Reserve yield optimization from US Treasury holdings (77% of $77 billion reserves)

- Integration into emerging digital payment infrastructure

Long-term Investment Outlook (Is USDC a good long-term investment?)

-

Base Case Scenario: $0.9900 - $1.0100 (assuming stable macroeconomic conditions and consistent regulatory framework within US currency circulation law)

-

Optimistic Scenario: $1.0100 - $1.0500 (assuming accelerated mainstream adoption, increased institutional custody, and expanded cross-chain interoperability)

-

Risk Scenario: $0.8800 - $0.9900 (under regulatory uncertainty, de-pegging events, or significant reduction in reserve-backed asset value)

Explore USDC long-term investment and price predictions: Price Prediction

2025-12-15 to 2030 Long-term Outlook

- Base Case: $0.9900 - $1.0200 USD (corresponding to stable institutional adoption and incremental ecosystem growth)

- Optimistic Case: $1.0100 - $1.0500 USD (corresponding to scaled mainstream adoption and favorable regulatory environment)

- Transformative Case: $1.0500+ USD (corresponding to breakthrough developments in real-world payment infrastructure and global CBDC integration)

- 2030-12-31 Predicted High: $1.0500 USD (based on optimistic development assumptions)

Disclaimer:

This analysis is provided for informational purposes only and does not constitute investment advice, recommendations to buy or sell USDC, or solicitation to participate in any specific investment strategy. USDC's fundamental nature as a stablecoin limits price volatility significantly compared to other cryptocurrencies. Price predictions involve inherent uncertainty and depend on macroeconomic conditions, regulatory developments, Federal Reserve policy, and market adoption rates. Past performance does not guarantee future results. Readers should conduct independent research and consult qualified financial advisors before making investment decisions. All price forecasts are estimates subject to material change.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

USD Coin (USDC) Market Analysis Report

Report Date: December 15, 2025

I. Project Overview

Basic Information

USD Coin (USDC) is a fully collateralized stablecoin pegged to the US Dollar. It provides detailed financial and operational transparency while operating within the framework of US currency circulation law, in collaboration with multiple banking institutions and audit teams. USDC represents the first stablecoin open-source project from Centre.

Key Metrics (As of December 15, 2025)

| Metric | Value |

|---|---|

| Current Price | $1.00 |

| Market Capitalization | $78.38 Billion |

| Fully Diluted Valuation | $78.40 Billion |

| Circulating Supply | 78,383,381,268 USDC |

| Total Supply | 78,395,021,566 USDC |

| Market Ranking | 6th |

| Market Dominance | 2.40% |

| 24h Trading Volume | $20.34 Million |

| Active Holders | 4,351,512 |

II. Market Performance Analysis

Price Dynamics

Current Status:

- 24-Hour Change: +0.02% (High: $0.9998, Low: $0.9996)

- 1-Hour Change: +0.015%

- 7-Day Change: +0.01%

- 30-Day Change: -0.069%

- 1-Year Change: -0.04%

Historical Price Range:

- All-Time High: $1.17 (May 8, 2019)

- All-Time Low: $0.877647 (March 11, 2023)

Market Share and Volatility

USDC maintains a 2.40% market share within the broader cryptocurrency market and demonstrates minimal price volatility, consistent with its stablecoin designation. The coin trades on 60 different exchanges, providing substantial liquidity and accessibility.

III. Network Infrastructure and Multi-Chain Deployment

Blockchain Integration

USDC operates across a diverse ecosystem of blockchain networks, ensuring broad accessibility and interoperability:

| Chain | Contract Address |

|---|---|

| Ethereum (ETH) | 0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48 |

| Aptos (APT) | 0xbae207659db88bea0cbead6da0ed00aac12edcdda169e591cd41c94180b46f3b |

| Arbitrum (ARBEVM) | 0xaf88d065e77c8cc2239327c5edb3a432268e5831 |

| Base (BASEEVM) | 0x833589fCD6eDb6E08f4c7C32D4f71b54bdA02913 |

| Binance Smart Chain (BSC) | 0x8ac76a51cc950d9822d68b83fe1ad97b32cd580d |

| Avalanche (AVAX_C) | 0xB97EF9Ef8734C71904D8002F8b6Bc66Dd9c48a6E |

| Polygon (MATIC) | 0x3c499c542cef5e3811e1192ce70d8cc03d5c3359 |

| NEAR | 17208628f84f5d6ad33f0da3bbbeb27ffcb398eac501a31bd6ad2011e36133a1 |

| Optimism (OPETH) | 0x0b2c639c533813f4aa9d7837caf62653d097ff85 |

| Solana (SOL) | EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v |

| Sui (SUI) | 0xdba34672e30cb065b1f93e3ab55318768fd6fef66c15942c9f7cb846e2f900e7::usdc::USDC |

| zkSync Era (ZKSERA) | 0x1d17cbcf0d6d143135ae902365d2e5e2a16538d4 |

| Hedera (HBAR) | 0.0.456858 |

| XDC Network | 0xfa2958cb79b0491cc627c1557f441ef849ca8eb1 |

This extensive multi-chain deployment underscores USDC's role as a critical bridge asset across the decentralized finance ecosystem.

IV. Investment Strategy and Risk Management

Investment Methodology

Long-term Holding (HODL USDC): Suitable for conservative investors seeking a stablecoin allocation for wealth preservation and collateral purposes in DeFi protocols. USDC provides a USD-pegged hedge within cryptocurrency portfolios.

Active Trading: While USDC's minimal volatility limits traditional trading opportunities, it serves as a stable denomination for executing trades across volatile assets and managing portfolio rebalancing.

Risk Management

Asset Allocation Considerations:

- Conservative Investors: Use USDC as portfolio stabilization (10-30% allocation)

- Active Traders: Maintain USDC reserves for entry/exit liquidity management

- Institutional Investors: Strategic USDC positions for collateralization in lending protocols and derivative markets

Security Storage:

- Hot Wallets: Web-based or mobile wallets for active trading operations

- Cold Storage: Hardware wallets and multi-signature contracts for long-term holdings

- Custody Solutions: Institutional-grade custodial services for large positions

V. Investment Risks and Challenges

Market Risks

Stablecoin depegging events represent the primary market risk, wherein USDC temporarily diverges from its $1.00 peg due to liquidity constraints or liquidity crises in reserve institutions. While rare, such events have occurred in the broader stablecoin market.

Regulatory Risks

USDC operates under varying regulatory frameworks across jurisdictions. Changes in US monetary policy, banking regulations, or international cryptocurrency frameworks could impact USDC's operational status and collateral arrangements.

Reserve and Counterparty Risks

USDC's collateralization depends on the stability and solvency of partner banking institutions holding reserve assets. Banking sector stress or institutional failures could potentially affect reserve backing quality.

VI. Conclusion: Is USDC a Good Investment?

Investment Value Summary

USDC serves a critical utility function within the cryptocurrency ecosystem as a reliable, fully collateralized stablecoin. Its stable price characteristics make it unsuitable as a speculative investment vehicle, but essential as a portfolio stabilizer and medium of exchange.

Investor Recommendations

✅ Beginners: Use USDC as a portfolio stabilization tool and DeFi collateral; maintain allocations in secure wallets or custodial services.

✅ Experienced Investors: Leverage USDC for strategic portfolio rebalancing, liquidity management, and DeFi protocol participation with multi-chain deployment.

✅ Institutional Investors: Consider USDC for treasury collateral, derivative market participation, and strategic cryptocurrency portfolio hedging.

⚠️ Disclaimer: Cryptocurrency investments carry inherent risks including volatility, regulatory uncertainty, and technical vulnerabilities. This report is for informational purposes only and does not constitute investment advice. Conduct independent research and consult qualified financial advisors before making investment decisions.

Sources: Official websites—https://www.circle.com/en/usdc, https://www.centre.io | GitHub Repository—https://github.com/centrehq/centre-tokens | Social Media—https://twitter.com/circlepay

USD Coin (USDC) Frequently Asked Questions

FAQ

Q1: What is USD Coin (USDC) and how does it maintain its $1.00 peg?

A: USD Coin (USDC) is a fully collateralized stablecoin pegged 1:1 to the U.S. dollar, issued by Circle in partnership with Coinbase through the Centre Consortium. USDC maintains its $1.00 peg through 99.99% collateralization backed by high-quality liquid assets including cash, short-term U.S. Treasury securities, and FDIC-insured deposits held by regulated U.S. financial partners. Circle publishes monthly attestations from major accounting firms verifying that reserves equal or exceed circulating USDC tokens, ensuring transparency and trust in the collateralization mechanism.

Q2: How has USDC performed since its launch, particularly during the March 2023 crisis?

A: USDC launched in 2018 at $1.00 and maintained a stable peg through 2019-2022, with an all-time high of $1.17 in May 2019. The most significant deviation occurred on March 11, 2023, when USDC plummeted to $0.877647 (historical low) following the Silicon Valley Bank crisis, which froze $3.3 billion in Circle's customer cash reserves. Post-crisis, USDC recovered to $1.00 after Circle publicly guaranteed to cover any shortfalls. Since March 2023, USDC has stabilized and recovered market share through improved reserve management by relocating assets to larger banks and utilizing BlackRock-managed Treasury holdings.

Q3: What is USDC's current market position as of December 2025?

A: As of December 15, 2025, USDC ranks as the 6th largest cryptocurrency by market capitalization with approximately $78.4 billion USD. The stablecoin commands a 2.40% dominance share of the total cryptocurrency market and serves 4.35 million token holders across 60+ exchanges. USDC maintains its 1:1 dollar peg with negligible price deviation (trading between $0.9996 and $0.9998), representing the second-largest stablecoin globally with approximately 24% of the total stablecoin market share, trailing only Tether (USDT).

Q4: Across how many blockchain networks is USDC deployed, and what does this mean for accessibility?

A: USDC operates across 16+ major blockchain networks, including Ethereum (primary deployment), Solana, Polygon, Arbitrum, Optimism, Avalanche, Base, Binance Smart Chain, Sui, Aptos, Hedera, zkSync, XDC Network, Near Protocol, Stellar, and others. This extensive multi-chain deployment enhances accessibility, reduces single-chain risk exposure, and provides users with multiple access pathways for USDC across diverse DeFi ecosystems. The multi-network infrastructure supports institutional adoption and enables cross-chain liquidity management.

Q5: What regulatory developments have supported USDC's institutional adoption in 2025?

A: Two major regulatory developments strengthened USDC's position in June 2025: First, the U.S. Senate passed the "GENIUS Act" (Guidance and Innovation for Stablecoins Legislation), establishing federal standards requiring 100% backing by highly liquid assets, mandatory monthly reserve disclosures, real-time redemption guarantees, and regulatory registration. Second, Circle commenced trading on the New York Stock Exchange following passage of this stabilizing legislation, with Circle's stock appreciating over 12% on regulatory clarity optimism. Additionally, the U.S. Office of the Comptroller of the Currency conditionally approved five cryptocurrency companies, including Circle, to establish national trust banks.

Q6: What are the primary risks associated with investing in or holding USDC?

A: Key risks include: (1) Counterparty Risk—despite improved reserve management, USDC remains subject to potential disruption from banking system instability or regulatory intervention affecting reserve custodians; (2) Regulatory Uncertainty—while U.S. legislation provides clarity, international frameworks continue evolving (MiCA in Europe, varying Asian regulations); (3) Market Concentration Risk—high stablecoin market concentration between USDT and USDC (over 86% combined) presents systemic risk; (4) Competitive Pressure—emerging stablecoins from traditional finance (PayPal USD, FIUSD) and decentralized alternatives (DAI, USDe) may fragment market share; (5) Depegging Risk—although rare, liquidity constraints or institutional stress could temporarily cause price deviations from the $1.00 peg.

Q7: Is USDC suitable for long-term investment, and what are realistic return expectations?

A: USDC's fundamental nature as a stablecoin limits price appreciation significantly compared to other cryptocurrencies. Long-term price predictions remain conservative: Base Case ($0.9900-$1.0100), Optimistic Case ($1.0100-$1.0500), and Transformative Case ($1.0500+). Rather than serving as an investment vehicle for capital appreciation, USDC functions as a store of value, portfolio stabilizer, and medium of exchange. It is most suitable for conservative investors seeking wealth preservation, DeFi collateral, or liquidity management. Expected returns derive primarily from reserve yield accumulation from Treasury holdings (approximately 77% of reserves) rather than price appreciation.

Q8: How does USDC differ from competitors like USDT and DAI in terms of use cases and market positioning?

A: USDC differentiates through transparency and regulatory compliance—Circle publishes detailed financial disclosures and maintains multi-bank reserve custody with third-party audits. USDT dominates in trading volume and adoption depth (60%+ stablecoin market share) but with less institutional transparency. DAI distinguishes as a decentralized, DeFi-native alternative backed by crypto collateral rather than fiat reserves. USDC's positioning emphasizes institutional-grade infrastructure, regulatory clarity, and real-world payment integration (Apple Pay, Stripe partnerships), making it preferred for institutional adoption, cross-border payments, and enterprise applications requiring compliance frameworks.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?