FeiUSD (FEI) yatırım için uygun mu?: Bu stablecoin'in değişken kripto piyasasındaki potansiyelini ve risklerini değerlendiriyoruz

Giriş: FeiUSD (FEI) Yatırım Durumu ve Piyasa Beklentileri

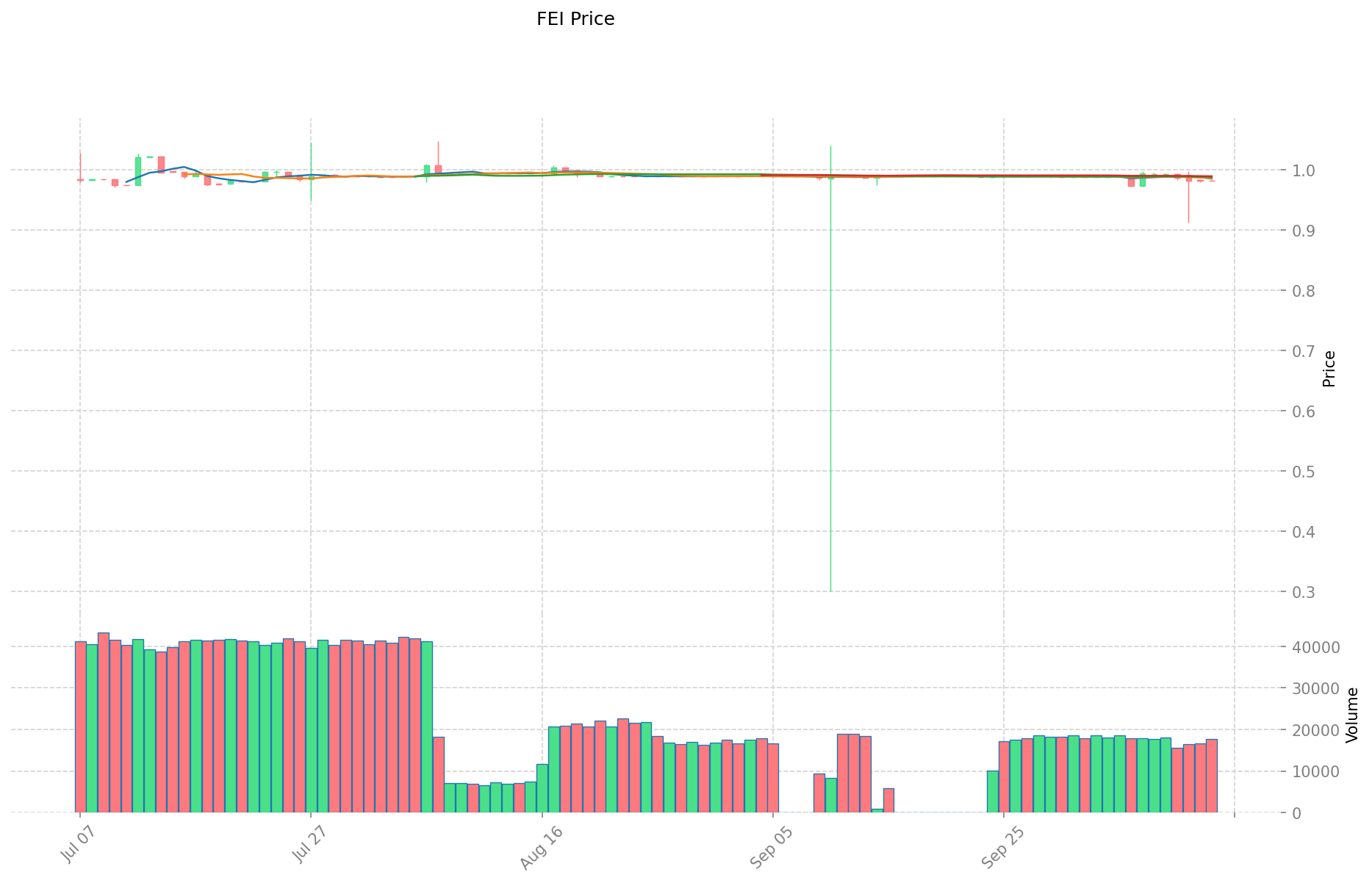

FEI, kripto para sektöründe önemli bir varlık olarak 2021'de piyasaya sunulmasından bu yana merkeziyetsiz stablecoin alanında kayda değer başarılara ulaşmıştır. 2025 yılı itibarıyla FEI'nin piyasa değeri 3.124.876 $ olarak kaydedilirken, dolaşımdaki arzı yaklaşık 3.180.859 adet ve güncel fiyatı yaklaşık 0,9824 $ seviyesindedir. “Tamamen merkeziyetsiz stablecoin” konumuyla FEI, yatırımcılar arasında “FeiUSD (FEI) iyi bir yatırım mı?” sorusunun odak noktasına yerleşmiştir. Bu makale, FEI’nin yatırım değerini, geçmiş performansını, geleceğe yönelik fiyat tahminlerini ve yatırım risklerini kapsamlı şekilde analiz ederek yatırımcılara yol gösterici bir kaynak sunmayı amaçlamaktadır.

I. FEI Fiyat Geçmişi ve Güncel Yatırım Değeri

FeiUSD (FEI) Yatırım Performansı

- 2021: Protokol lansmanı → İlk yatırımcı ilgisi

- 2022: Piyasa gerilemesi → Fiyat tüm zamanların en yüksek seviyesinden düştü

- 2023: Piyasa toparlanması → Fiyat 1 $ sabit değeri civarında dengelendi

Güncel FEI Yatırım Piyasa Durumu (Ekim 2025)

- FEI güncel fiyatı: 0,9824 $

- 24 saatlik işlem hacmi: 17.268,27 $

- Dolaşımdaki arz: 3.180.859,94 FEI

Gerçek zamanlı FEI piyasa fiyatını görüntülemek için tıklayın

II. FeiUSD (FEI) Yatırımının Cazibesini Etkileyen Temel Unsurlar

Arz Mekanizması ve Kıtlık (FEI yatırımında kıtlık)

- Talebe göre sınırsız arz → Fiyat ve yatırım değerini etkiler

- Tarihsel olarak: Arz değişimleri FEI fiyatını yönlendirdi

- Yatırım açısından: Kıtlık, uzun vadeli yatırım için temel bir unsur değildir

Kurumsal Yatırım ve Ana Akım Benimseme (FEI’de kurumsal yatırım)

- Kurumsal varlık eğilimleri: Sınırlı veri mevcut

- FEI’nin önemli bir kurumsal benimsenmesi yok → Yatırım cazibesini sınırlandırıyor

- Düzenleyici politikaların FEI yatırım görünümüne etkisi halen belirsiz

Makroekonomik Ortamın FEI Yatırımına Etkisi

- Para politikası ve faiz oranı değişiklikleri → Yatırım cazibesini değiştirebilir

- Enflasyonist ortamlarda koruma aracı olarak işlevi → Sınırlı “dijital altın” konumu

- Jeopolitik belirsizlikler → FEI gibi stabil varlıklara talebi artırabilir

Teknoloji ve Ekosistem Gelişimi (FEI yatırımı için Teknoloji & Ekosistem)

- Birleşik eğri mekanizması: Fiyat istikrarı sağlamayı hedefler → Yatırım cazibesini artırabilir

- Protocol Controlled Value (PCV): İkincil piyasa likiditesini destekler → Uzun vadeli değer için potansiyel destek

- DeFi uygulamaları ve Uniswap gibi platformlarla entegrasyon → Yatırım değerini artırabilir

III. FEI Gelecek Yatırım Tahmini ve Fiyat Görünümü (FeiUSD(FEI), 2025-2030 arası yatırıma değer mi?)

Kısa Vadeli FEI Yatırım Beklentisi (2025)

- Ihtiyatlı tahmin: 0,84 $ - 0,92 $

- Nötr tahmin: 0,92 $ - 0,98 $

- İyimser tahmin: 0,98 $ - 1,04 $

Orta Vadeli FeiUSD(FEI) Yatırım Tahmini (2026-2027)

- Piyasa evresinde beklenti: Kademeli toparlanma ve istikrar

- Yatırım getirisi tahmini:

- 2026: 0,55 $ - 1,23 $

- 2027: 1,07 $ - 1,49 $

- Anahtar katalizörler: Fei Protokolü’nün daha geniş kabulü, istikrar mekanizmalarında gelişmeler

Uzun Vadeli Yatırım Beklentisi (FEI uzun vadede iyi bir yatırım mı?)

- Temel senaryo: 0,99 $ - 1,61 $ (DeFi benimsenmesinin istikrarlı artışı varsayımıyla)

- İyimser senaryo: 1,61 $ - 2,00 $ (Protokolde önemli gelişmeler ve yaygın kabul halinde)

- Risk senaryosu: 0,50 $ - 0,99 $ (Aşırı piyasa volatilitesi veya düzenleyici engeller durumunda)

FEI uzun vadeli yatırım ve fiyat tahmini için tıklayın: Fiyat Tahmini

14 Ekim 2025 - 2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99 $ - 1,61 $ (İstikrarlı ilerleme ve ana akım uygulamalarda artış öngörülüyor)

- İyimser senaryo: 1,61 $ - 2,00 $ (Geniş çaplı benimseme ve olumlu piyasa koşulları halinde)

- Dönüştürücü senaryo: 2,00 $ üzeri (Ekosistemde büyük yenilikler ve ana akım benimseme gerçekleşirse)

- 2030-12-31 Tahmini zirve: 1,62 $ (İyimser gelişme varsayımlarına dayalıdır)

Feragatname: Bu tahminler öngörüye dayalıdır ve yatırım tavsiyesi olarak değerlendirilmemelidir. Kripto para piyasalarında yüksek volatilite ve öngörülemezlik söz konusudur. Her zaman yatırım öncesinde kendi araştırmanızı yapınız.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.041238 | 0.9823 | 0.844778 | 0 |

| 2026 | 1.23435818 | 1.011769 | 0.55647295 | 2 |

| 2027 | 1.4936745747 | 1.12306359 | 1.0781410464 | 14 |

| 2028 | 1.439205990585 | 1.30836908235 | 0.7981051402335 | 33 |

| 2029 | 1.56611779157295 | 1.3737875364675 | 1.112767904538675 | 39 |

| 2030 | 1.616947930422247 | 1.469952664020225 | 0.999567811533753 | 49 |

IV. FEI’ye Yatırım Nasıl Yapılır?

FEI Yatırım Stratejisi

- FEI’yi HODL etmek: Riskten kaçınan yatırımcılar için uygundur

- Aktif al-sat: Teknik analiz ve dalgalı piyasa işlemleriyle hareket edilir

FEI Yatırımında Risk Yönetimi

- Varlık dağılım oranı: Muhafazakâr / Agresif / Profesyonel yatırımcı profilleri

- Riskten korunma yöntemleri: Çoklu varlık portföyü + hedge araçları

- Güvenli saklama: Sıcak ve soğuk cüzdanlar ile donanım cüzdanı önerileri

V. Stablecoin Yatırımının Riskleri

- Piyasa riskleri: Yüksek volatilite, fiyat manipülasyonu

- Düzenleyici riskler: Ülkelere göre değişen politika belirsizlikleri

- Teknik riskler: Ağ güvenliği açıkları, yükseltme hataları

VI. Sonuç: FEI Yatırımı Mantıklı mı?

- Yatırım özeti: FEI, uzun vadede kayda değer yatırım potansiyeline sahip görünmektedir; ancak kısa vadede sert fiyat dalgalanmaları yaşanabilmektedir.

- Yatırımcıya öneriler: ✅ Yeni başlayanlar: Ortalama maliyet yöntemiyle alım + güvenli cüzdan kullanımı ✅ Tecrübeli yatırımcılar: Dalgalı al-sat işlemleri + portföy çeşitlendirmesi ✅ Kurumsal yatırımcılar: Stratejik uzun vadeli portföy tahsisi

⚠️ Not: Kripto para yatırımları yüksek risk içerir. Bu makale sadece bilgilendirme amaçlıdır, yatırım tavsiyesi değildir.

VII. SSS

S1: FeiUSD (FEI) nedir ve diğer stablecoin’lerden farkı nedir? C: FeiUSD (FEI), Amerikan dolarına endeksli olmayı amaçlayan merkeziyetsiz bir stablecoin’dir. Geleneksel stablecoin’ler rezervle desteklenirken, FEI eşsiz bir istikrar mekanizması olan Protocol Controlled Value (PCV) kullanır. Bu sistem, arzı talebe göre dinamik biçimde ayarlayarak merkezi yapılarla kıyaslandığında daha fazla şeffaflık ve merkeziyetsizlik sunar.

S2: FEI’nin yatırım potansiyelini hangi faktörler etkiler? C: FEI’nin yatırım potansiyeli; istikrar mekanizması, DeFi uygulamalarında kullanımı, kurumsal ilgi düzeyi ve genel piyasa ortamı gibi birçok faktöre bağlıdır. Protokolün sabit değerini koruma ve farklı platformlarla entegre olabilme yeteneği, uzun vadeli değer teklifini güçlendirebilir.

S3: FEI’ye yatırım yaparken en önemli riskler nelerdir? C: FEI yatırımıyla ilgili ana riskler arasında piyasa volatilitesi, düzenleyici belirsizlikler, teknik açıklar ve sabit değerden ayrılma (depeg) olayları bulunur. Ayrıca, tüm kripto yatırımlarında olduğu gibi fiyat manipülasyonu ve likidite sorunları da mümkündür.

S4: FEI’ye nasıl yatırım yapabilirim? C: FEI, tokenın listelendiği kripto borsalarından alınabilir. Yatırım stratejileri uzun vadeli tutmadan (HODL) aktif al-sata kadar çeşitlenebilir. Güvenli cüzdanlar kullanmak ve çeşitlendirme gibi risk yönetimi yöntemlerine başvurmak önemlidir.

S5: Önümüzdeki yıllarda FEI için fiyat beklentisi nedir? C: Sunulan tahminlere göre FEI’nin fiyatı 2030’a kadar temel senaryoda 0,99 $ ile 1,61 $ arasında öngörülmektedir; iyimser senaryolarda daha yüksek artış potansiyeli de vardır. Ancak bu öngörüler tahmine dayalıdır ve yatırım tavsiyesi olarak kabul edilmemelidir.

S6: FEI uzun vadede iyi bir yatırım mı? C: FEI’nin uzun vadeli yatırım cazibesi; istikrarını koruma başarısı, DeFi ekosisteminde benimsenme seviyesi ve genel piyasa koşulları gibi faktörlere bağlıdır. Potansiyel vaat etse de, yatırımcılar risk toleranslarını göz önünde bulundurmalı ve karar öncesinde kapsamlı araştırma yapmalıdır.

S7: FEI’nin arz mekanizması yatırım değerini nasıl etkiler? C: FEI’nin arz mekanizması talebe göre esnek biçimde ayarlanır ve bu durum fiyat ve yatırım değerini etkileyebilir. Sabit arzlı kripto paralardan farklı olarak, FEI’nin talebe bağlı sınırsız arzı, uzun vadeli değer artışında kıtlığın belirleyici unsur olmadığı anlamına gelir.

2025 RESOLV Fiyat Tahmini: Piyasa trendleri ve gelecekteki değerleme potansiyelinin analizi

ENA ile CRO: İki Önde Gelen Genomik Veri Deposu Arasında Karşılaştırmalı Bir Analiz

2025 yılında ENA'nın mevcut piyasa durumu nedir?

2025 RSR Fiyat Tahmini: Dalgalı Kripto Piyasasında Reserve Rights Token'ın Geleceğine Yön Vermek

GHO (GHO) iyi bir yatırım mı?: Aave'nin yeni stablecoin'inin potansiyeli ve risklerinin incelenmesi

JST ve SNX: DeFi Ekosisteminde İki Sentetik Varlık Protokolünün Karşılaştırmalı Analizi

Web3 ağlarında yüksek hızlı Layer 1 çözümlerine dair kapsamlı bir rehber

Kripto para ticaretinde otomatik piyasa yapıcıları hakkında kapsamlı bilgi

GBP'den USDT'ye Döviz Kuru Rehberi: Akıllı Tüccarların Sermayelerini Nasıl Korudukları

2024'te İzlenmesi Gereken Önde Gelen DeFi Yenilikleri

Flash Loan’ları Anlamak: DeFi’de Teminatsız Krediye Kapsamlı Rehber