Is Aura Network (AURA) a good investment?: Analyzing the potential of this emerging blockchain platform

Introduction: Investment Status and Market Prospects of Aura Network (AURA)

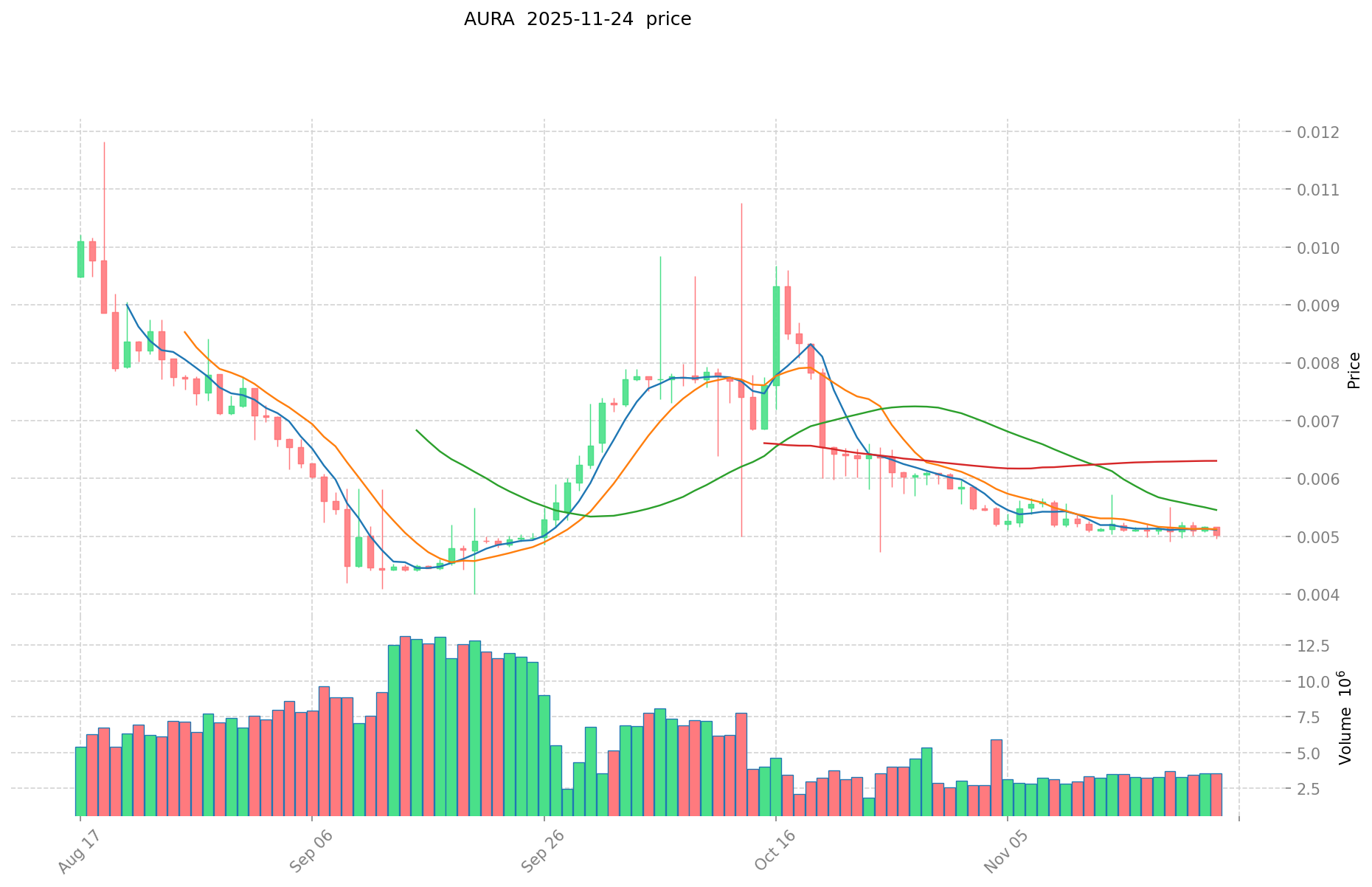

AURA is an important asset in the cryptocurrency space, having made significant achievements in accelerating the adoption of NFTs worldwide since its launch. As of 2025, Aura Network's market capitalization stands at $2,140,489.93, with a circulating supply of approximately 410,448,692.999531 tokens, and a current price hovering around $0.005215. Positioned as a "scalable, agile, and effortless layer 1 blockchain," AURA has gradually become a focal point for investors discussing "Is Aura Network (AURA) a good investment?" This article will comprehensively analyze AURA's investment value, historical trends, future price predictions, and investment risks to provide reference for investors.

I. AURA Price History Review and Current Investment Value

Aura Network (AURA) Investment Performance

- 2024: All-time high of $0.06798 reached on January 6, 2024

- 2025: All-time low of $0.003149 recorded on May 14, 2025

Current AURA Investment Market Status (November 2025)

- AURA current price: $0.005215

- 24-hour trading volume: $17,134.58

- Number of holders: 2,847

Click to view real-time AURA market price

II. AURA Tokenomics Analysis

AURA Token Distribution and Circulation

- Total supply: 1,000,000,000 AURA

- Circulating supply: 410,448,692.999531 AURA (41.04% of total supply)

- Market capitalization: $2,140,489.93

- Fully diluted market cap: $5,215,000.00

AURA Token Utility and Value Proposition

Aura Network is a layer 1 blockchain focused on accelerating global NFT adoption. The AURA token likely plays a role in the network's ecosystem and NFT-related functionalities.

III. AURA Technical Analysis and Price Predictions

Recent Price Trends

- 1 hour: -0.92% ($-0.000048423496164715)

- 24 hours: +1.89% ($0.000096735204632446)

- 7 days: +1.66% ($0.000085155420027542)

- 30 days: -15.84% ($-0.000981530418250951)

- 1 year: -48.87% ($-0.004984491492274592)

Key Support and Resistance Levels

- Current support level: $0.003149 (All-time low)

- Current resistance level: $0.06798 (All-time high)

IV. AURA Project Development and Future Outlook

Recent Project Developments

Aura Network aims to provide a scalable, agile, and effortless layer 1 blockchain with a comprehensive ecosystem for NFTs.

Upcoming Milestones and Potential Impact

Partnerships and Collaborations

V. Risk Analysis and Investment Considerations

Potential Risks

- Market volatility: AURA has experienced significant price fluctuations, with a 48.87% decrease over the past year

- Competition in the NFT and layer 1 blockchain space

Investment Considerations

- AURA is currently trading at $0.005215, which is 92.33% below its all-time high

- The project focuses on the growing NFT market, which could provide opportunities for growth

- Limited exchange listings may affect liquidity and price discovery

VI. How to Buy and Store AURA

Exchanges Listing AURA

AURA is currently listed on at least one exchange.

Recommended Storage Solutions

As AURA is the native token of the Aura Network blockchain, it is likely that it can be stored in wallets compatible with the Aura Network ecosystem.

VII. Additional Resources

- Official website: https://aura.network/

- Block explorer: https://aurascan.io/

- Twitter: https://twitter.com/AuraNetworkHQ

- GitHub: https://github.com/aura-nw

II. Key Factors Affecting Whether Aura Network (AURA) is a Good Investment

AURA investment scarcity

- Total supply of 1 billion AURA tokens → Impacts price and investment value

- Historical pattern: Supply changes have driven AURA price movements

- Investment significance: Scarcity is key to supporting long-term investment

Institutional investment in AURA

- Institutional holding trend: Data not available

- Adoption by notable companies → Could enhance investment value

- Impact of national policies on AURA investment prospects

Macroeconomic environment's impact on AURA investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → Potential "digital gold" positioning

- Geopolitical uncertainties → May increase demand for AURA investment

Technology & Ecosystem for AURA investment

- Scalable layer 1 blockchain: Enhances network performance → Increases investment appeal

- Comprehensive ecosystem for NFTs: Expands ecosystem applications → Supports long-term value

- DeFi, NFT, and payment applications driving investment value

III. AURA Future Investment Predictions and Price Outlook (Is Aura Network(AURA) worth investing in 2025-2030)

Short-term AURA investment outlook (2025)

- Conservative prediction: $0.00281232 - $0.005208

- Neutral prediction: $0.005208 - $0.0054684

- Optimistic prediction: $0.0054684 - $0.006192312

Mid-term Aura Network(AURA) investment forecast (2027-2028)

- Market stage expectation: Gradual growth and expansion

- Investment return forecast:

- 2027: $0.00466985736 - $0.00720657

- 2028: $0.00538330779 - $0.00693992691

- Key catalysts: Ecosystem development, NFT adoption, market trends

Long-term investment outlook (Is AURA a good long-term investment?)

- Base scenario: $0.004586266913256 - $0.0081897623451 (Steady growth in adoption and use cases)

- Optimistic scenario: $0.0081897623451 - $0.009500124320316 (Rapid ecosystem expansion and market penetration)

- Risk scenario: $0.00281232 - $0.004586266913256 (Market volatility or adoption challenges)

Click to view AURA long-term investment and price prediction: Price Prediction

2025-11-24 - 2030 Long-term Outlook

- Base scenario: $0.004586266913256 - $0.0081897623451 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $0.0081897623451 - $0.009500124320316 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $0.009500124320316 (In case of breakthrough progress in the ecosystem and mainstream adoption)

- 2030-12-31 Predicted high: $0.009500124320316 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0054684 | 0.005208 | 0.00281232 | 0 |

| 2026 | 0.006192312 | 0.0053382 | 0.004590852 | 2 |

| 2027 | 0.00720657 | 0.005765256 | 0.00466985736 | 10 |

| 2028 | 0.00693992691 | 0.006485913 | 0.00538330779 | 24 |

| 2029 | 0.0096666047352 | 0.006712919955 | 0.0059073695604 | 28 |

| 2030 | 0.009500124320316 | 0.0081897623451 | 0.004586266913256 | 57 |

IV. How to invest in AURA

AURA investment strategy

- HODL AURA: Suitable for conservative investors

- Active trading: Relies on technical analysis and swing trading

Risk management for AURA investment

- Asset allocation ratio: Conservative / Aggressive / Professional investors

- Risk hedging strategy: Multi-asset portfolio + hedging tools

- Secure storage: Hot and cold wallets + hardware wallet recommendations

V. Risks of investing in AURA

- Market risk: High volatility, potential price manipulation

- Regulatory risk: Policy uncertainties in different countries

- Technical risk: Network security vulnerabilities, upgrade failures

VI. Conclusion: Is AURA a Good Investment?

- Investment value summary: AURA shows significant long-term investment potential, but experiences intense short-term price fluctuations.

- Investor recommendations: ✅ Beginners: Dollar-cost averaging + secure wallet storage ✅ Experienced investors: Swing trading + portfolio allocation ✅ Institutional investors: Strategic long-term allocation

⚠️ Warning: Cryptocurrency investments carry high risks. This article is for reference only and does not constitute investment advice.

VII. FAQ

Q1: What is Aura Network (AURA)? A: Aura Network is a scalable, agile, and effortless layer 1 blockchain focused on accelerating global NFT adoption. AURA is its native token.

Q2: Where can I buy AURA tokens? A: AURA is currently listed on at least one cryptocurrency exchange. Always check the project's official channels for the most up-to-date information on exchange listings.

Q3: What is the current price of AURA? A: As of November 24, 2025, the price of AURA is $0.005215. However, cryptocurrency prices are highly volatile and can change rapidly.

Q4: What are the key factors affecting AURA's investment value? A: Key factors include AURA's tokenomics, institutional investment, macroeconomic environment, and the development of Aura Network's technology and ecosystem.

Q5: What are the potential risks of investing in AURA? A: Risks include market volatility, regulatory uncertainties, and technical risks associated with blockchain technology. AURA has experienced significant price fluctuations, with a 48.87% decrease over the past year.

Q6: What is the long-term price prediction for AURA? A: By 2030, predictions range from a base scenario of $0.004586266913256 - $0.0081897623451 to an optimistic scenario of $0.0081897623451 - $0.009500124320316. However, these are speculative and not guaranteed.

Q7: How can I store AURA tokens securely? A: AURA tokens can likely be stored in wallets compatible with the Aura Network ecosystem. For long-term storage, consider using hardware wallets for enhanced security.

Q8: Is AURA a good investment? A: AURA shows long-term potential but experiences short-term volatility. The suitability of AURA as an investment depends on individual risk tolerance and investment goals. Always conduct thorough research and consider consulting a financial advisor before investing.

Share

Content