FEI vs ENJ: The Battle of Blockchain Gaming Platforms

Introduction: FEI vs ENJ Investment Comparison

In the cryptocurrency market, the comparison between FEI and ENJ has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

FEI (FEI): Launched in 2021, it has gained market recognition for its decentralized stablecoin mechanism.

ENJ (ENJ): Introduced in 2017, it has been hailed as a pioneer in gaming-related cryptocurrencies, focusing on virtual goods and gaming communities.

This article will comprehensively analyze the investment value comparison between FEI and ENJ, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

FEI (Coin A) and ENJ (Coin B) Historical Price Trends

- 2023: FEI experienced significant volatility, dropping to its all-time low of $0.15544 on December 30, 2023.

- 2024: ENJ faced a prolonged bearish trend, with its price declining throughout the year.

- Comparative analysis: In the recent market cycle, FEI recovered from its low point to reach a new all-time high of $5.55 on March 16, 2024, while ENJ continued to struggle, falling further from its previous highs.

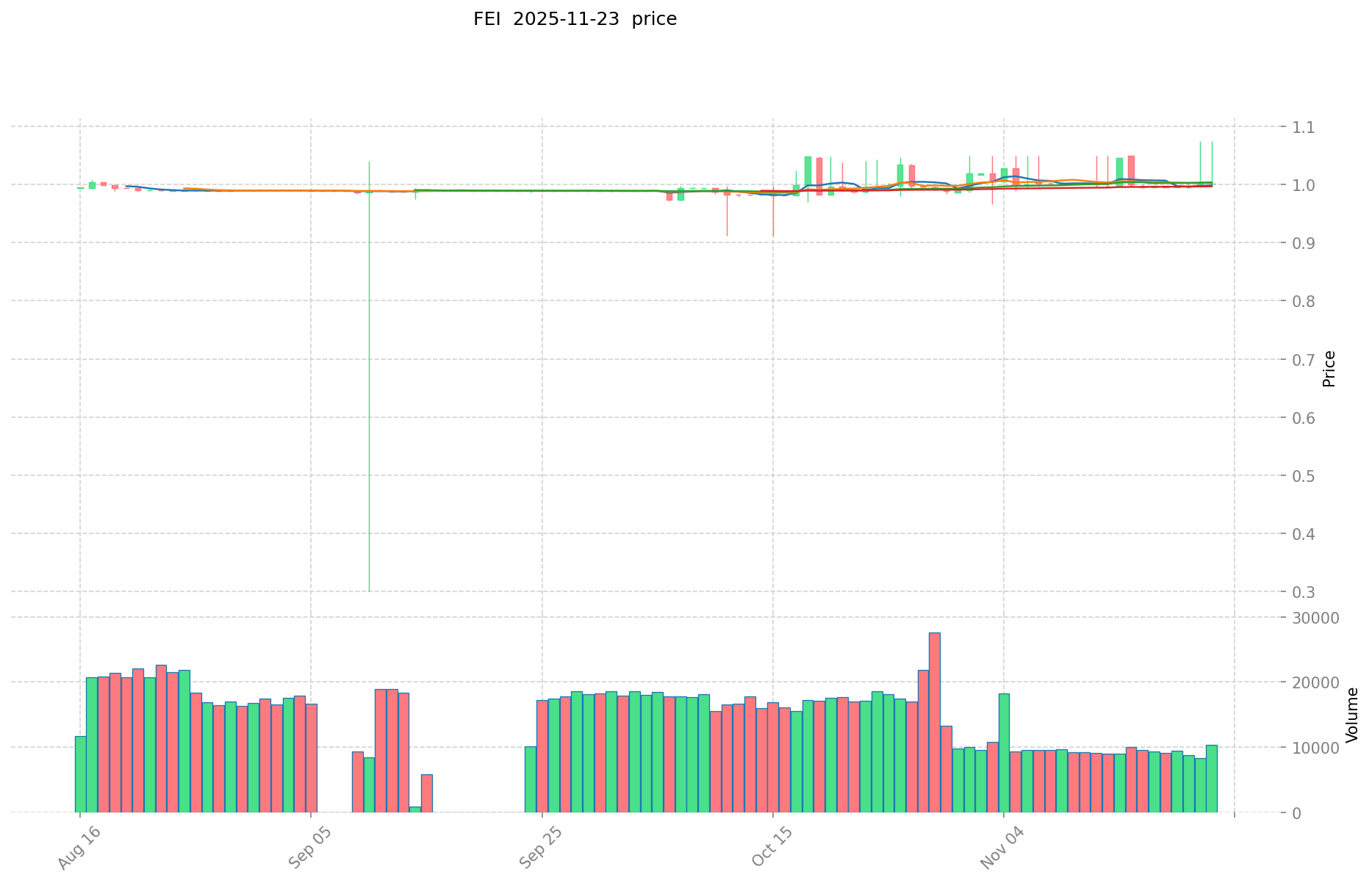

Current Market Situation (2025-11-23)

- FEI current price: $1.072

- ENJ current price: $0.03304

- 24-hour trading volume: FEI $10,879.08 vs ENJ $122,016.16

- Market Sentiment Index (Fear & Greed Index): 13 (Extreme Fear)

Click to view real-time prices:

- Check FEI current price Market Price

- Check ENJ current price Market Price

II. Core Factors Affecting FEI vs ENJ Investment Value

Supply Mechanism Comparison (Tokenomics)

-

FEI: A decentralized stablecoin designed to maintain a peg to $1 through direct incentives and protocol-controlled value

-

ENJ: Fixed maximum supply of 1 billion tokens with a deflationary model where tokens are locked into digital assets

-

📌 Historical pattern: FEI's stability mechanism aims for price consistency while ENJ's deflationary model tends to create scarcity value as more tokens are locked in NFTs.

Institutional Adoption and Market Applications

- Institutional holdings: ENJ has gained more traction with gaming industry partners, while FEI has attracted DeFi-focused institutions

- Enterprise adoption: ENJ is utilized in gaming ecosystems for NFT creation and monetization, whereas FEI serves as a stability mechanism in DeFi protocols

- Regulatory attitudes: Stablecoins like FEI face increasing regulatory scrutiny globally, while NFT-focused tokens like ENJ navigate emerging digital asset frameworks

Technical Development and Ecosystem Building

- FEI technical upgrades: Implementation of direct incentives system and protocol-controlled value (PCV) to maintain stability

- ENJ technical development: Efinity parachain on Polkadot for scalable NFT infrastructure and JumpNet for lower transaction costs

- Ecosystem comparison: FEI integrates with various DeFi platforms focusing on lending and liquidity provision, while ENJ powers gaming ecosystems, NFT marketplaces, and digital asset creation

Macroeconomic Factors and Market Cycles

- Performance in inflationary environments: FEI aims to maintain stable value regardless of inflation, while ENJ may benefit from crypto adoption as an inflation hedge

- Macroeconomic monetary policy: Interest rate changes potentially impact FEI's stability mechanisms and ENJ's speculative demand differently

- Geopolitical factors: Increased digital asset adoption in uncertain regions may benefit both tokens for different use cases - FEI as a stable medium of exchange and ENJ for digital asset preservation

III. 2025-2030 Price Prediction: FEI vs ENJ

Short-term Prediction (2025)

- FEI: Conservative $0.63 - $1.07 | Optimistic $1.07 - $1.12

- ENJ: Conservative $0.027 - $0.033 | Optimistic $0.033 - $0.039

Mid-term Prediction (2027)

- FEI may enter a growth phase, with projected prices of $0.83 - $1.47

- ENJ may enter a growth phase, with projected prices of $0.029 - $0.051

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- FEI: Base scenario $0.93 - $1.60 | Optimistic scenario $1.60 - $1.88

- ENJ: Base scenario $0.060 - $0.062 | Optimistic scenario $0.062 - $0.077

Disclaimer: This information is for educational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

FEI:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.118355 | 1.0651 | 0.628409 | 0 |

| 2026 | 1.517501225 | 1.0917275 | 0.80787835 | 1 |

| 2027 | 1.474214229625 | 1.3046143625 | 0.834953192 | 21 |

| 2028 | 1.7228737271175 | 1.3894142960625 | 1.181002151653125 | 29 |

| 2029 | 1.6495126522854 | 1.55614401159 | 1.3382838499674 | 45 |

| 2030 | 1.875309148367109 | 1.6028283319377 | 0.929640432523866 | 49 |

ENJ:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0385164 | 0.03292 | 0.0273236 | 0 |

| 2026 | 0.049291116 | 0.0357182 | 0.033217926 | 8 |

| 2027 | 0.05143063618 | 0.042504658 | 0.02932821402 | 28 |

| 2028 | 0.0685727647514 | 0.04696764709 | 0.0267715588413 | 42 |

| 2029 | 0.067013438868012 | 0.0577702059207 | 0.032351315315592 | 74 |

| 2030 | 0.076741941545057 | 0.062391822394356 | 0.060520067722525 | 88 |

IV. Investment Strategy Comparison: FEI vs ENJ

Long-term vs Short-term Investment Strategies

- FEI: Suitable for investors focused on DeFi ecosystem potential and stability mechanisms

- ENJ: Suitable for investors interested in gaming and NFT market growth

Risk Management and Asset Allocation

- Conservative investors: FEI: 70% vs ENJ: 30%

- Aggressive investors: FEI: 40% vs ENJ: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- FEI: Volatility in maintaining peg, DeFi market fluctuations

- ENJ: Gaming industry trends, NFT market sentiment

Technical Risk

- FEI: Scalability, network stability, smart contract vulnerabilities

- ENJ: Blockchain interoperability, NFT standard evolution

Regulatory Risk

- Global regulatory policies affecting stablecoins (FEI) and NFT tokens (ENJ) differently

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- FEI advantages: Stability mechanism, DeFi integration, potential for consistent value

- ENJ advantages: Gaming industry adoption, NFT ecosystem growth, deflationary model

✅ Investment Advice:

- New investors: Consider a balanced approach with higher allocation to FEI for stability

- Experienced investors: Explore strategic allocation based on DeFi and gaming sector outlook

- Institutional investors: Evaluate FEI for DeFi exposure and ENJ for gaming/NFT market potential

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between FEI and ENJ? A: FEI is a decentralized stablecoin designed to maintain a peg to $1, while ENJ is a gaming-focused cryptocurrency with a fixed supply used for creating and managing digital assets in games.

Q2: Which token has shown better price performance recently? A: Based on recent data, FEI has shown better price recovery, reaching a new all-time high of $5.55 in March 2024, while ENJ has continued to struggle with a bearish trend.

Q3: How do the supply mechanisms of FEI and ENJ differ? A: FEI uses a stability mechanism to maintain its peg through direct incentives and protocol-controlled value, while ENJ has a fixed maximum supply of 1 billion tokens with a deflationary model as tokens are locked into digital assets.

Q4: What are the primary use cases for FEI and ENJ? A: FEI is primarily used in DeFi protocols for lending and liquidity provision, while ENJ is utilized in gaming ecosystems for NFT creation and monetization.

Q5: How do institutional adoptions differ between FEI and ENJ? A: ENJ has gained more traction with gaming industry partners, while FEI has attracted DeFi-focused institutions.

Q6: What are the long-term price predictions for FEI and ENJ by 2030? A: For FEI, the base scenario predicts $0.93 - $1.60, with an optimistic scenario of $1.60 - $1.88. For ENJ, the base scenario predicts $0.060 - $0.062, with an optimistic scenario of $0.062 - $0.077.

Q7: How should investors allocate their portfolio between FEI and ENJ? A: Conservative investors might consider 70% FEI and 30% ENJ, while aggressive investors might opt for 40% FEI and 60% ENJ, depending on their risk tolerance and market outlook.

Q8: What are the main risks associated with investing in FEI and ENJ? A: For FEI, risks include volatility in maintaining its peg and DeFi market fluctuations. For ENJ, risks involve gaming industry trends and NFT market sentiment. Both face technical risks such as scalability and smart contract vulnerabilities, as well as evolving regulatory challenges.

Share

Content