AURA vs XRP: Comparing Two Promising Cryptocurrencies in the Digital Asset Landscape

Introduction: AURA vs XRP Investment Comparison

In the cryptocurrency market, the comparison between AURA and XRP has always been an unavoidable topic for investors. The two not only differ significantly in market cap ranking, application scenarios, and price performance but also represent different positioning in crypto assets.

AURA (AURA): Since its launch, it has gained market recognition for its focus on accelerating the adoption of NFTs worldwide.

XRP (XRP): Since its inception in 2012, it has been hailed as a solution for fast and cheap cross-border payments, becoming one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between AURA and XRP, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning investors:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

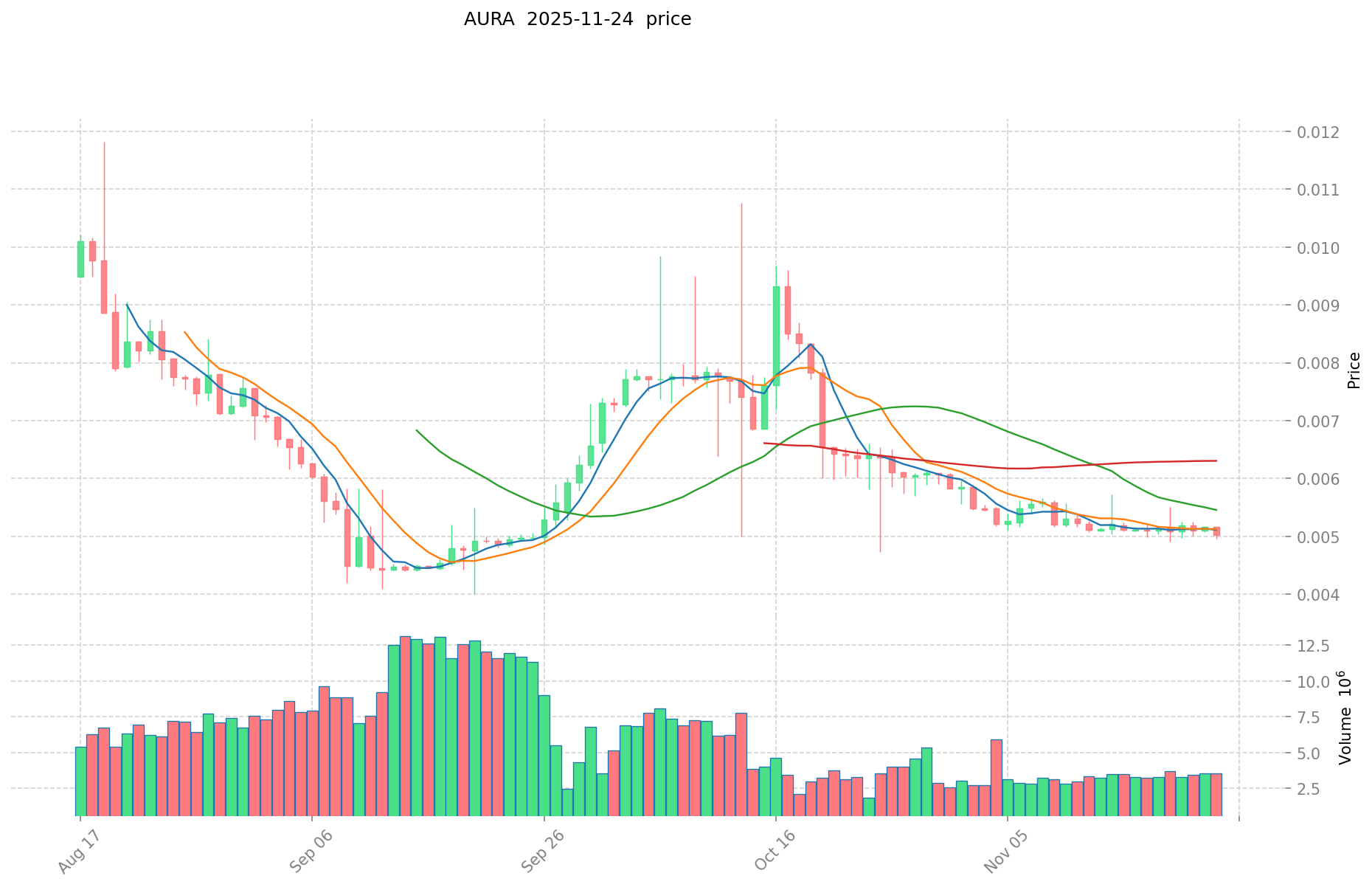

AURA and XRP Historical Price Trends

- 2024: AURA reached its all-time high of $0.06798 on January 6, 2024.

- 2025: XRP hit a new all-time high of $3.65 on July 18, 2025.

- Comparative analysis: In recent market cycles, AURA dropped from its peak of $0.06798 to a low of $0.003149, while XRP has shown more resilience, maintaining a higher price level.

Current Market Situation (2025-11-24)

- AURA current price: $0.005133

- XRP current price: $2.075

- 24-hour trading volume: AURA $17,238.82 vs XRP $97,978,968.89

- Market Sentiment Index (Fear & Greed Index): 19 (Extreme Fear)

Click to view real-time prices:

- View AURA current price Market Price

- View XRP current price Market Price

II. Core Factors Affecting AURA vs XRP Investment Value

Supply Mechanism Comparison (Tokenomics)

- AURA: Total supply of 1 billion tokens, with 50% reserved for community distribution through staking and participation. Deflationary mechanism through burning of fees.

- XRP: Fixed supply of 100 billion tokens created at launch with no mining. Approximately 45.6 billion currently in circulation with the remainder held in escrow by Ripple.

- 📌 Historical pattern: XRP's fixed supply model has created price stability during market volatility, while AURA's tokenomics aim for long-term deflationary pressure as network usage increases.

Institutional Adoption and Market Applications

- Institutional holdings: XRP has stronger institutional backing with partnerships with banks and financial institutions, while AURA is more focused on DeFi applications.

- Enterprise adoption: XRP leads in cross-border payment solutions through RippleNet, while AURA serves as governance token for Aura Finance's liquidity solutions.

- Regulatory stance: XRP faces ongoing regulatory scrutiny in the US due to the SEC lawsuit, while AURA has not faced significant regulatory challenges.

Technological Development and Ecosystem Building

- AURA technological upgrades: Integration with Balancer v2 for enhanced liquidity provision and yield farming capabilities.

- XRP technological development: XRPL's Automated Market Maker (AMM) features and new smart contract functionality through Hooks amendment.

- Ecosystem comparison: XRP has a more established payment network with RippleNet, while AURA focuses on DeFi applications within the Balancer ecosystem for liquidity management.

Macroeconomic Factors and Market Cycles

- Performance during inflation: XRP's stability and institutional backing provides some inflation resistance, while AURA's performance is more closely tied to DeFi market trends.

- Monetary policy impact: Both are affected by interest rate changes, with XRP showing more correlation to traditional markets.

- Geopolitical factors: XRP benefits from increased cross-border payment demand, particularly in regions with banking restrictions, while AURA is more exposed to DeFi regulatory developments.

III. 2025-2030 Price Prediction: AURA vs XRP

Short-term Forecast (2025)

- AURA: Conservative $0.00339 - $0.00514 | Optimistic $0.00514 - $0.00735

- XRP: Conservative $1.93 - $2.07 | Optimistic $2.07 - $2.36

Mid-term Forecast (2027)

- AURA may enter a growth phase, with an estimated price range of $0.00490 - $0.00987

- XRP may enter a consolidation phase, with an estimated price range of $1.82 - $2.99

- Key drivers: Institutional inflows, ETF developments, ecosystem growth

Long-term Forecast (2030)

- AURA: Base scenario $0.01180 - $0.01296 | Optimistic scenario $0.01296 - $0.01452

- XRP: Base scenario $3.28 - $3.61 | Optimistic scenario $3.61 - $5.37

Disclaimer: This forecast is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

AURA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00734877 | 0.005139 | 0.00339174 | 0 |

| 2026 | 0.00930338865 | 0.006243885 | 0.00605656845 | 21 |

| 2027 | 0.00987251876775 | 0.007773636825 | 0.00489739119975 | 51 |

| 2028 | 0.01199938580307 | 0.008823077796375 | 0.007323154570991 | 71 |

| 2029 | 0.015512735381586 | 0.010411231799722 | 0.005413840535855 | 102 |

| 2030 | 0.014517421621533 | 0.012961983590654 | 0.011795405067495 | 152 |

XRP:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.36208 | 2.072 | 1.92696 | 0 |

| 2026 | 3.1260264 | 2.21704 | 1.2858832 | 6 |

| 2027 | 2.992117184 | 2.6715332 | 1.816642576 | 28 |

| 2028 | 4.13446478032 | 2.831825192 | 2.46368791704 | 36 |

| 2029 | 3.7269651351912 | 3.48314498616 | 3.1696619374056 | 67 |

| 2030 | 5.371532040406644 | 3.6050550606756 | 3.280600105214796 | 73 |

IV. Investment Strategy Comparison: AURA vs XRP

Long-term vs Short-term Investment Strategies

- AURA: Suitable for investors focused on DeFi potential and ecosystem growth

- XRP: Suitable for investors seeking stability and cross-border payment solutions

Risk Management and Asset Allocation

- Conservative investors: AURA: 20% vs XRP: 80%

- Aggressive investors: AURA: 40% vs XRP: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risks

- AURA: Higher volatility due to smaller market cap and DeFi sector exposure

- XRP: Regulatory uncertainty impact on price stability

Technical Risks

- AURA: Scalability, network stability

- XRP: Centralization concerns, potential security vulnerabilities

Regulatory Risks

- Global regulatory policies have different impacts on both, with XRP facing more immediate scrutiny due to the ongoing SEC lawsuit

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- AURA advantages: Focus on NFT adoption, deflationary mechanism, DeFi integration

- XRP advantages: Established cross-border payment solution, institutional partnerships, larger market cap

✅ Investment Advice:

- New investors: Consider a higher allocation to XRP for its relative stability and established use case

- Experienced investors: Balanced portfolio with both AURA and XRP to capture DeFi growth and payment solutions

- Institutional investors: Focus on XRP for its regulatory clarity and cross-border payment utility

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between AURA and XRP? A: AURA focuses on accelerating NFT adoption and DeFi applications, while XRP is designed for fast and cheap cross-border payments. AURA has a total supply of 1 billion tokens with a deflationary mechanism, while XRP has a fixed supply of 100 billion tokens.

Q2: Which cryptocurrency has shown better price performance recently? A: XRP has shown more resilience in recent market cycles, maintaining a higher price level compared to AURA. As of November 24, 2025, XRP's price is $2.075, while AURA's price is $0.005133.

Q3: How do institutional adoption and market applications differ between AURA and XRP? A: XRP has stronger institutional backing with partnerships in the banking and financial sectors, primarily used for cross-border payment solutions through RippleNet. AURA is more focused on DeFi applications and serves as a governance token for Aura Finance's liquidity solutions.

Q4: What are the key technological developments for each cryptocurrency? A: AURA has integrated with Balancer v2 for enhanced liquidity provision and yield farming. XRP's XRPL has introduced Automated Market Maker (AMM) features and new smart contract functionality through the Hooks amendment.

Q5: How do the long-term price predictions for AURA and XRP compare? A: By 2030, AURA's base scenario price range is predicted to be $0.01180 - $0.01296, with an optimistic scenario of $0.01296 - $0.01452. XRP's base scenario price range is predicted to be $3.28 - $3.61, with an optimistic scenario of $3.61 - $5.37.

Q6: What are the main risk factors for each cryptocurrency? A: AURA faces higher volatility due to its smaller market cap and exposure to the DeFi sector. XRP's main risk is regulatory uncertainty, particularly due to the ongoing SEC lawsuit. Both face technical risks related to scalability and network stability.

Q7: How should investors approach allocation between AURA and XRP? A: Conservative investors might consider allocating 20% to AURA and 80% to XRP, while aggressive investors might opt for 40% AURA and 60% XRP. New investors may prefer a higher allocation to XRP for its relative stability, while experienced investors might balance their portfolio with both to capture different market segments.

Share

Content