AURA vs NEAR: A Comparative Analysis of Two Promising Blockchain Platforms

Introduction: AURA vs NEAR Investment Comparison

In the cryptocurrency market, the comparison between AURA and NEAR has always been a topic that investors cannot ignore. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

Aura Network (AURA): Since its launch, it has gained market recognition for its focus on accelerating the adoption of NFTs worldwide.

Near (NEAR): Since its inception in 2020, it has been hailed as a highly scalable protocol supporting DApp operation on mobile devices, and is one of the top cryptocurrencies globally in terms of trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between AURA and NEAR, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

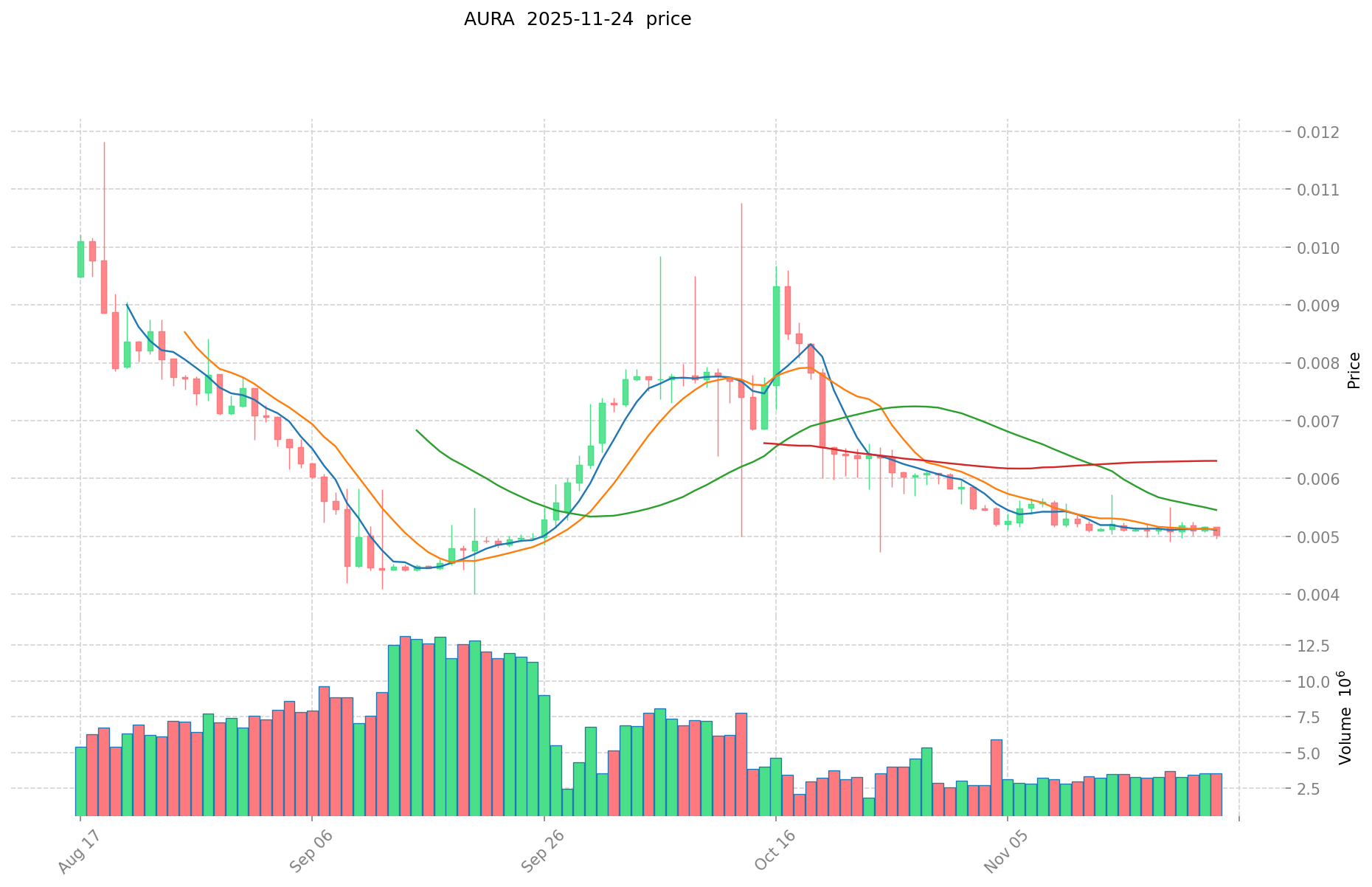

AURA and NEAR Historical Price Trends

- 2024: AURA reached its all-time high of $0.06798 on January 6, 2024.

- 2025: AURA hit its all-time low of $0.003149 on May 14, 2025.

- 2022: NEAR reached its all-time high of $20.44 on January 17, 2022.

- 2020: NEAR hit its all-time low of $0.526762 on November 5, 2020.

- Comparative analysis: In the recent market cycle, AURA has fallen from its peak of $0.06798 to its current price of $0.005182, while NEAR has declined from its high of $20.44 to $1.856.

Current Market Situation (2025-11-24)

- AURA current price: $0.005182

- NEAR current price: $1.856

- 24-hour trading volume: AURA $17,189.21 vs NEAR $4,029,713.21

- Market Sentiment Index (Fear & Greed Index): 19 (Extreme Fear)

Click to view real-time prices:

- View AURA current price Market Price

- View NEAR current price Market Price

II. Core Factors Affecting Investment Value of AURA vs NEAR

Supply Mechanism Comparison (Tokenomics)

- AURA: Limited supply model with a maximum cap of 1 billion AURA tokens

- NEAR: Inflationary model with an initial supply of 1 billion tokens and annual inflation targeting 5% (adjusted by protocol revenue)

- 📌 Historical pattern: Fixed supply tokens like AURA tend to create scarcity-driven value proposition, while NEAR's moderate inflation model provides sustainable validator incentives.

Institutional Adoption and Market Applications

- Institutional holdings: NEAR has attracted more institutional investment, with backers including a16z, Coinbase Ventures, and Pantera Capital

- Enterprise adoption: NEAR has stronger enterprise partnerships and established use cases in gaming, NFTs, and DeFi, while AURA focuses on providing infrastructure for native crypto applications

- Regulatory attitudes: Both protocols maintain regulatory compliance, though NEAR has more established relationships with regulatory bodies across different jurisdictions

Technical Development and Ecosystem Building

- AURA technical upgrades: Focus on high performance transaction processing and interoperability with other blockchain networks

- NEAR technical development: Nightshade sharding, Aurora EVM compatibility, and Fast Finality provide scalability advantages

- Ecosystem comparison: NEAR has a more mature ecosystem with established DeFi protocols, NFT marketplaces, and cross-chain bridges; AURA's ecosystem is still developing with focus on gaming and metaverse applications

Macroeconomic and Market Cycles

- Performance during inflation: NEAR has demonstrated more resilience during inflationary periods due to its wider adoption and use cases

- Monetary policy impacts: Both tokens are affected by broader crypto market sentiment during interest rate changes, though NEAR's larger market cap typically provides more stability

- Geopolitical factors: NEAR's focus on global accessibility and regional hubs creates more geographically diversified usage patterns compared to AURA

III. 2025-2030 Price Prediction: AURA vs NEAR

Short-term Prediction (2025)

- AURA: Conservative $0.00284 - $0.00517 | Optimistic $0.00517 - $0.00770

- NEAR: Conservative $1.332 - $1.85 | Optimistic $1.85 - $2.7195

Mid-term Prediction (2027)

- AURA may enter a growth phase, with prices expected to range $0.00700 - $0.01115

- NEAR may enter a consolidation phase, with prices expected to range $1.83 - $2.74

- Key drivers: Institutional fund inflows, ETF developments, ecosystem growth

Long-term Prediction (2030)

- AURA: Base scenario $0.01179 - $0.01242 | Optimistic scenario $0.01242 - $0.01527

- NEAR: Base scenario $2.75 - $2.92 | Optimistic scenario $2.92 - $3.33

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

AURA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0077033 | 0.00517 | 0.0028435 | 0 |

| 2026 | 0.0089469435 | 0.00643665 | 0.005278053 | 24 |

| 2027 | 0.0111531052875 | 0.00769179675 | 0.0069995350425 | 48 |

| 2028 | 0.013568329467 | 0.00942245101875 | 0.006313042182562 | 81 |

| 2029 | 0.013334652681735 | 0.011495390242875 | 0.010230897316158 | 121 |

| 2030 | 0.015270476398635 | 0.012415021462305 | 0.011794270389189 | 139 |

NEAR:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.7195 | 1.85 | 1.332 | 0 |

| 2026 | 2.787395 | 2.28475 | 1.7135625 | 23 |

| 2027 | 2.7389583 | 2.5360725 | 1.8259722 | 36 |

| 2028 | 2.822141478 | 2.6375154 | 1.371508008 | 42 |

| 2029 | 3.11200442046 | 2.729828439 | 2.42954731071 | 47 |

| 2030 | 3.3298447298922 | 2.92091642973 | 2.7456614439462 | 57 |

IV. Investment Strategy Comparison: AURA vs NEAR

Long-term vs Short-term Investment Strategies

- AURA: Suitable for investors focusing on NFT adoption and ecosystem potential

- NEAR: Suitable for investors seeking scalability and established DApp infrastructure

Risk Management and Asset Allocation

- Conservative investors: AURA: 20% vs NEAR: 80%

- Aggressive investors: AURA: 40% vs NEAR: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- AURA: Higher volatility due to lower market cap and trading volume

- NEAR: Susceptible to broader crypto market trends and macroeconomic factors

Technical Risks

- AURA: Scalability, network stability

- NEAR: Centralization concerns, potential security vulnerabilities in sharding implementation

Regulatory Risks

- Global regulatory policies may have a more significant impact on NEAR due to its wider adoption and institutional backing

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- AURA advantages: Focus on NFT adoption, limited supply model

- NEAR advantages: Established ecosystem, institutional backing, scalability solutions

✅ Investment Advice:

- New investors: Consider a higher allocation to NEAR for its established market position

- Experienced investors: Balanced approach with exposure to both AURA and NEAR

- Institutional investors: NEAR may be more suitable due to its liquidity and ecosystem maturity

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between AURA and NEAR in terms of supply mechanism? A: AURA has a limited supply model with a maximum cap of 1 billion tokens, while NEAR has an inflationary model with an initial supply of 1 billion tokens and annual inflation targeting 5% (adjusted by protocol revenue).

Q2: How do AURA and NEAR compare in terms of institutional adoption? A: NEAR has attracted more institutional investment, with backers including a16z, Coinbase Ventures, and Pantera Capital. It also has stronger enterprise partnerships and established use cases in gaming, NFTs, and DeFi, while AURA focuses on providing infrastructure for native crypto applications.

Q3: What are the key technical developments for AURA and NEAR? A: AURA focuses on high performance transaction processing and interoperability with other blockchain networks. NEAR has implemented Nightshade sharding, Aurora EVM compatibility, and Fast Finality for scalability advantages.

Q4: How do the ecosystems of AURA and NEAR compare? A: NEAR has a more mature ecosystem with established DeFi protocols, NFT marketplaces, and cross-chain bridges. AURA's ecosystem is still developing with a focus on gaming and metaverse applications.

Q5: What are the long-term price predictions for AURA and NEAR by 2030? A: For AURA, the base scenario predicts $0.01179 - $0.01242, with an optimistic scenario of $0.01242 - $0.01527. For NEAR, the base scenario predicts $2.75 - $2.92, with an optimistic scenario of $2.92 - $3.33.

Q6: How should investors allocate their assets between AURA and NEAR? A: Conservative investors might consider allocating 20% to AURA and 80% to NEAR, while aggressive investors might opt for 40% AURA and 60% NEAR. However, individual allocation should be based on personal risk tolerance and investment goals.

Q7: What are the main risks associated with investing in AURA and NEAR? A: AURA faces higher volatility due to lower market cap and trading volume, as well as potential scalability and network stability issues. NEAR is susceptible to broader crypto market trends and macroeconomic factors, with potential centralization concerns and security vulnerabilities in its sharding implementation.

Share

Content