AURA vs APT: Comparing Advanced Threat Detection Strategies in Cybersecurity

Introduction: AURA vs APT Investment Comparison

In the cryptocurrency market, the comparison between AURA and APT has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different positioning in the crypto asset space.

Aura Network (AURA): Since its launch, it has gained market recognition for its focus on accelerating the adoption of NFTs worldwide.

Aptos (APT): Since its introduction in 2022, it has been hailed as a high-performance Layer 1 blockchain, aiming to provide a secure and scalable solution for blockchain applications.

This article will provide a comprehensive analysis of the investment value comparison between AURA and APT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most crucial to investors:

"Which is the better buy right now?"

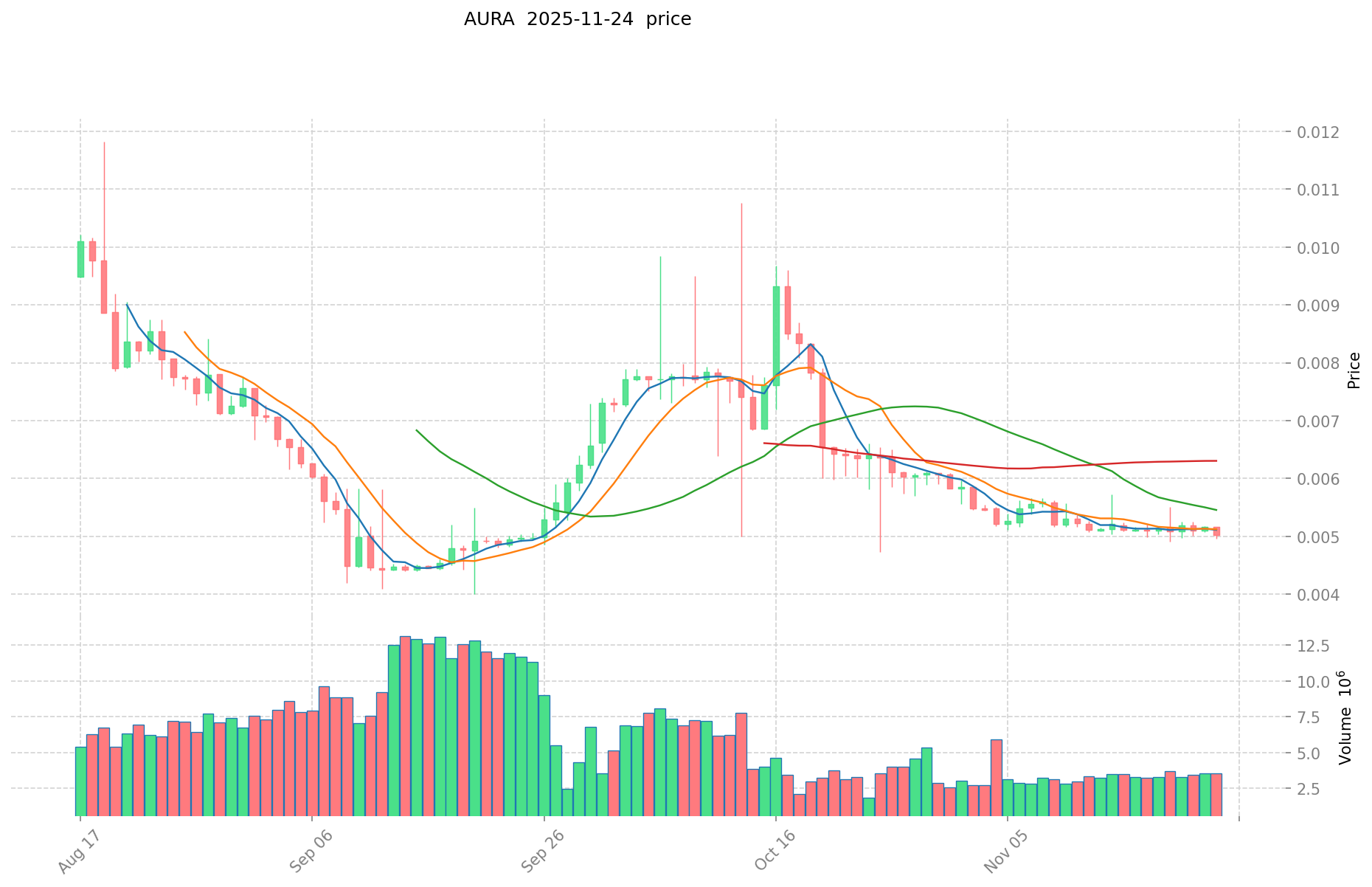

I. Price History Comparison and Current Market Status

AURA (Coin A) and APT (Coin B) Historical Price Trends

- 2024: AURA reached its all-time high of $0.06798 on January 6, 2024.

- 2025: APT hit its all-time low of $2.29 on November 22, 2025.

- Comparative Analysis: In the current market cycle, AURA has fallen from its peak of $0.06798 to $0.00522, while APT has declined from its all-time high of $19.92 to $2.31.

Current Market Situation (2025-11-24)

- AURA current price: $0.00522

- APT current price: $2.31

- 24-hour trading volume: AURA $17,148.40 vs APT $632,823.20

- Market Sentiment Index (Fear & Greed Index): 19 (Extreme Fear)

Click to view real-time prices:

- View AURA current price Market Price

- View APT current price Market Price

II. Core Factors Affecting AURA vs APT Investment Value

Supply Mechanism Comparison (Tokenomics)

- AURA: Fixed maximum supply of 1 billion tokens, with 75% of tokens allocated for community distribution

- APT: Maximum supply of 1 billion tokens, with gradual token release schedule over time

- 📌 Historical pattern: Supply mechanisms with fixed caps tend to create scarcity value over time, potentially supporting price appreciation during periods of increased demand.

Institutional Adoption and Market Applications

- Institutional holdings: APT has attracted more institutional interest with backing from major venture capital firms including a16z, FTX Ventures, and Multicoin Capital

- Enterprise adoption: APT's Move programming language offers security advantages for enterprises building financial applications, while AURA focuses on gaming and NFT applications

- Regulatory attitudes: Both tokens operate in evolving regulatory environments with no specific country-level policies targeting either token directly

Technical Development and Ecosystem Building

- AURA technical upgrades: Integration of the Aura network with gaming platforms and NFT marketplaces

- APT technical development: Move VM implementation providing enhanced security features and formal verification capabilities

- Ecosystem comparison: APT has a more developed DeFi ecosystem with higher TVL (Total Value Locked), while AURA is gaining traction in gaming and NFT sectors

Macroeconomic and Market Cycles

- Performance in inflationary environments: Neither token has sufficient historical data to conclusively demonstrate inflation-resistant properties

- Macroeconomic monetary policy: Both tokens show correlation with broader crypto market movements in response to interest rate changes

- Geopolitical factors: APT's technical infrastructure may provide advantages for cross-border settlement use cases

III. 2025-2030 Price Prediction: AURA vs APT

Short-term Prediction (2025)

- AURA: Conservative $0.00500 - $0.00521 | Optimistic $0.00521 - $0.00599

- APT: Conservative $1.85 - $2.31 | Optimistic $2.31 - $2.72

Mid-term Prediction (2027)

- AURA may enter a growth phase, with expected prices $0.00632 - $0.00849

- APT may enter a consolidation phase, with expected prices $1.78 - $3.00

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- AURA: Base scenario $0.00954 - $0.01374 | Optimistic scenario $0.01374+

- APT: Base scenario $3.71 - $5.19 | Optimistic scenario $5.19+

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

AURA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00599495 | 0.005213 | 0.00500448 | 0 |

| 2026 | 0.00756536625 | 0.005603975 | 0.0048194185 | 7 |

| 2027 | 0.00849422510625 | 0.006584670625 | 0.0063212838 | 26 |

| 2028 | 0.009575098789343 | 0.007539447865625 | 0.005051430069968 | 44 |

| 2029 | 0.010525446192805 | 0.008557273327484 | 0.006931391395262 | 63 |

| 2030 | 0.013739558054608 | 0.009541359760145 | 0.008491810186529 | 82 |

APT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.72462 | 2.309 | 1.8472 | 0 |

| 2026 | 3.1460125 | 2.51681 | 1.4345817 | 8 |

| 2027 | 3.001295925 | 2.83141125 | 1.7837890875 | 22 |

| 2028 | 3.237152482125 | 2.9163535875 | 1.80813922425 | 26 |

| 2029 | 4.338221779085625 | 3.0767530348125 | 1.938354411931875 | 33 |

| 2030 | 5.190482369728687 | 3.707487406949062 | 2.96598992555925 | 60 |

IV. Investment Strategy Comparison: AURA vs APT

Long-term vs Short-term Investment Strategies

- AURA: Suitable for investors focused on gaming and NFT ecosystems

- APT: Suitable for investors looking for Layer 1 blockchain potential and enterprise adoption

Risk Management and Asset Allocation

- Conservative investors: AURA: 20% vs APT: 80%

- Aggressive investors: AURA: 40% vs APT: 60%

- Hedging tools: Stablecoin allocation, options, cross-token portfolios

V. Potential Risk Comparison

Market Risks

- AURA: Higher volatility due to smaller market cap and lower liquidity

- APT: Susceptible to broader Layer 1 competition and market sentiment shifts

Technical Risks

- AURA: Scalability, network stability

- APT: Centralization concerns, potential security vulnerabilities in Move VM

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with APT potentially facing more scrutiny due to its broader financial applications

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- AURA advantages: Focus on NFT and gaming sectors, fixed supply cap

- APT advantages: Institutional backing, more developed ecosystem, potential for enterprise adoption

✅ Investment Advice:

- New investors: Consider a small allocation to APT as part of a diversified portfolio

- Experienced investors: Balanced approach with both AURA and APT, aligning with risk tolerance

- Institutional investors: Deeper research into APT's technology and adoption potential

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between AURA and APT? A: AURA focuses on NFTs and gaming, with a fixed supply cap of 1 billion tokens. APT is a Layer 1 blockchain with a gradual token release schedule, targeting enterprise adoption and DeFi applications. APT has attracted more institutional interest and has a more developed ecosystem, while AURA is gaining traction in specific niche markets.

Q2: Which token has performed better in terms of price history? A: As of November 24, 2025, AURA has fallen from its all-time high of $0.06798 to $0.00522, while APT has declined from its all-time high of $19.92 to $2.31. Both tokens have experienced significant drops, but APT has maintained a higher market cap and trading volume.

Q3: What are the long-term price predictions for AURA and APT? A: For 2030, AURA's base scenario predicts a price range of $0.00954 - $0.01374, with an optimistic scenario above $0.01374. APT's base scenario for 2030 predicts a range of $3.71 - $5.19, with an optimistic scenario above $5.19. These predictions are subject to market conditions and should not be considered financial advice.

Q4: How do the supply mechanisms of AURA and APT differ? A: AURA has a fixed maximum supply of 1 billion tokens, with 75% allocated for community distribution. APT also has a maximum supply of 1 billion tokens but implements a gradual token release schedule over time. Fixed supply caps tend to create scarcity value, potentially supporting price appreciation during increased demand.

Q5: What are the main risks associated with investing in AURA and APT? A: AURA faces higher volatility due to its smaller market cap and lower liquidity, as well as potential scalability and network stability issues. APT is susceptible to broader Layer 1 competition, centralization concerns, and potential security vulnerabilities in its Move VM. Both tokens are subject to regulatory risks, with APT potentially facing more scrutiny due to its broader financial applications.

Q6: How should different types of investors approach AURA and APT? A: New investors might consider a small allocation to APT as part of a diversified portfolio. Experienced investors could take a balanced approach with both AURA and APT, aligning with their risk tolerance. Institutional investors should conduct deeper research into APT's technology and adoption potential. Conservative investors might allocate 20% to AURA and 80% to APT, while aggressive investors could consider 40% AURA and 60% APT.

Share

Content