2025 ZORO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ZORO's Market Position and Investment Value

ZoRobotics (ZORO) stands as the first Web3-native platform designed to power AI robotics at scale, combining zero-knowledge proofs, machine learning, and blockchain technology. Since its launch, ZORO has established itself as a pioneering infrastructure for decentralized AI automation. As of January 2026, ZORO boasts a market capitalization of $51,584, with a circulating supply of 10.4 million tokens trading at approximately $0.00496 per token. This innovative asset, recognized as a "decentralized AI robotics infrastructure" pioneer, is playing an increasingly critical role in enabling millions of contributors to train artificial intelligence through gamified tasks while maintaining on-chain verification and rewards.

The platform currently supports over 6 million connected wallets, 57,000 monthly active contributors across 100+ countries, and has completed more than 6 million annotation tasks. With backing from major partners including Hacken, Phala Network, ElizaOS (AI16Z), and IQ AI, along with support from over 80 global KOLs commanding a combined reach of 10 million followers, ZORO is establishing itself as a benchmark for decentralized AI automation infrastructure.

This comprehensive analysis will examine ZORO's price trajectory through 2031, integrating historical market patterns, supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for discerning investors evaluating positions through Gate.com and other trading platforms.

ZoRobotics (ZORO) Market Analysis Report

I. ZORO Price History Review and Current Market Status

ZORO Historical Price Evolution

- 2025: Project launch and initial market entry, with the token reaching its all-time high (ATH) of $0.48961 on June 10, 2025.

- 2025: Significant market correction phase, with the token declining from its peak to its all-time low (ATL) of $0.004828 on November 25, 2025.

- Current Period: Continued downward pressure, with the token currently trading at $0.00496 as of January 5, 2026.

ZORO Current Market Status

ZORO is currently trading at $0.00496, reflecting significant volatility since its launch in 2025. The token has experienced a steep decline of 96.56% over the past year, falling from its ATH to its current price levels.

24-Hour Performance:

- Price: $0.00496

- 24-Hour Change: -7.25%

- 24-Hour High: $0.006523

- 24-Hour Low: $0.004863

- 24-Hour Trading Volume: $16,687.62

Medium-Term Performance Metrics:

- 1-Hour Change: -4.24%

- 7-Day Change: -8.77%

- 30-Day Change: -5.45%

Market Capitalization and Supply Metrics:

- Market Cap: $51,584.00

- Fully Diluted Valuation (FDV): $496,000.00

- Circulating Supply: 10,400,000 ZORO (10.4% of total supply)

- Total Supply: 100,000,000 ZORO

- Market Share: 0.000014%

- Token Holders: 239,516

Blockchain and Technical Details:

- Blockchain: BEP-20 (Binance Smart Chain)

- Contract Address: 0x0d4d3c739e2fdf82c7ce2a9e450e208e5330a237

- Listed Exchanges: 1 exchange (Gate.com)

Market Sentiment: Current market sentiment indicates fear, with a VIX reading of 26, reflecting broader market uncertainty and risk aversion among investors.

Click to view current ZORO market price

ZORO Market Sentiment Index

2026-01-05 Fear and Greed Index: 26 (Fear)

Click to view current Fear & Greed Index

Today's cryptocurrency market is dominated by fear sentiment with an index reading of 26. This low reading indicates heightened market anxiety and pessimistic investor outlook. During such periods, market volatility tends to increase as participants adopt cautious trading strategies. Fear-driven markets often present contrarian opportunities for long-term investors, though short-term traders should exercise heightened risk management. Monitor key support levels closely and consider portfolio diversification to navigate through this uncertain period effectively.

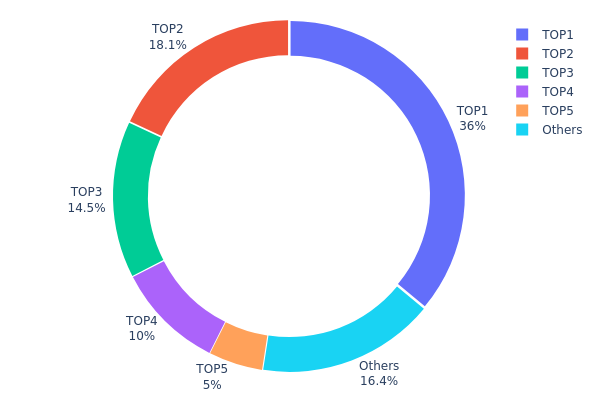

ZORO Holdings Distribution

The address holdings distribution map illustrates the concentration of ZORO tokens across blockchain addresses, providing critical insights into token ownership patterns and decentralization metrics. This data reveals how the total token supply is distributed among the top holders and the broader community, serving as a key indicator of network health and potential market manipulation risks.

ZORO demonstrates a moderate degree of concentration within its top holders. The leading address controls 36.00% of the total supply, while the top five addresses collectively account for 83.57% of all tokens in circulation. This concentration pattern indicates a significant reliance on major stakeholders, though the presence of a substantial "Others" category representing 16.43% suggests meaningful distribution beyond the primary holders. The second and third largest addresses hold 18.09% and 14.48% respectively, creating a relatively steep distribution curve that warrants attention.

The current address distribution presents mixed implications for market structure stability. While such concentration levels are not uncommon in emerging tokens during early development phases, the presence of three addresses exceeding 10% each creates potential systemic risks regarding price volatility and liquidity fluctuations. Large holder movements or coordinated actions could significantly impact market dynamics. However, the diversification beyond the top five addresses provides some resistance to extreme centralization scenarios. This structural composition suggests ZORO maintains a moderate decentralization profile, balancing institutional participation with community ownership, though continued monitoring of large holder behavior remains essential for assessing long-term market health.

Click to view current ZORO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8fdc...876188 | 36000.00K | 36.00% |

| 2 | 0xa29e...e82f1c | 18097.12K | 18.09% |

| 3 | 0x5c49...fbfd92 | 14480.00K | 14.48% |

| 4 | 0xea97...6e98cc | 10000.00K | 10.00% |

| 5 | 0xbaeb...ff1e2b | 5000.00K | 5.00% |

| - | Others | 16422.88K | 16.43% |

Core Factors Influencing ZORO's Future Price

Market Sentiment and External Factors

-

Current Market Outlook: Market sentiment toward ZORO remains pessimistic as of January 2026. Most ZORO investors have experienced certain levels of losses, with the market holding a bearish perspective on ZORO's price trajectory.

-

Price Volatility Pattern: ZORO's price is highly susceptible to external financial events and broader cryptocurrency market trends. Historical patterns demonstrate significant price fluctuations driven by market demand and investor sentiment shifts.

-

Trading Activity: Recent data shows ZORO trading at approximately $0.21 USD with a circulating supply of around 25 million tokens. Trading volumes have been recorded in the $5-6 million range over 24-hour periods, with the token experiencing price movements exceeding 60% within short timeframes.

III. 2026-2031 ZORO Price Forecast

2026 Outlook

- Conservative Forecast: $0.00346 - $0.00501

- Neutral Forecast: $0.00501 - $0.00587

- Bullish Forecast: $0.00672 (requires sustained market recovery and increased adoption)

2027-2029 Medium-term Outlook

- Market Stage Expectations: Progressive accumulation phase transitioning into early expansion cycle with growing institutional interest and ecosystem development

- Price Range Forecast:

- 2027: $0.0034 - $0.00675

- 2028: $0.00334 - $0.0087

- 2029: $0.00698 - $0.01036

- Key Catalysts: Enhanced protocol functionality, strategic partnerships, expansion of use cases, improved market liquidity on platforms like Gate.com, and growing developer ecosystem participation

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00795 - $0.01241 (assumes steady ecosystem growth and moderate market sentiment improvement)

- Bullish Scenario: $0.01036 - $0.01241 (assumes accelerated adoption, successful major upgrades, and positive regulatory environment)

- Transformational Scenario: $0.01195 - $0.01241+ (requires breakthrough network adoption, transformative use case emergence, and significant market cycle acceleration)

- 2031-01-05: ZORO anticipated trading in the $0.01067 range (approaching medium-term consolidation phase with 115% cumulative gains from 2026 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00672 | 0.00501 | 0.00346 | 1 |

| 2027 | 0.00675 | 0.00587 | 0.0034 | 18 |

| 2028 | 0.0087 | 0.00631 | 0.00334 | 27 |

| 2029 | 0.01036 | 0.0075 | 0.00698 | 51 |

| 2030 | 0.01241 | 0.00893 | 0.00795 | 80 |

| 2031 | 0.01195 | 0.01067 | 0.00822 | 115 |

ZORO Investment Strategy and Risk Management Report

IV. ZORO Professional Investment Strategy and Risk Management

ZORO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance who believe in the long-term potential of decentralized AI infrastructure and blockchain-based machine learning platforms

- Operational Recommendations:

- Accumulate ZORO tokens during market downturns, leveraging dollar-cost averaging to reduce average entry prices

- Hold tokens for 12-24 months to participate in the platform's growth as user adoption increases and the AI training ecosystem expands

- Monitor platform metrics such as monthly active contributors, completed annotation tasks, and connected wallets to assess fundamental growth

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average (MA): Use 7-day and 30-day moving averages to identify trend direction and support/resistance levels

- Relative Strength Index (RSI): Monitor oversold conditions (RSI < 30) for potential buying opportunities and overbought conditions (RSI > 70) for taking profits

- Wave Trading Key Points:

- Execute buy orders when ZORO rebounds from technical support levels, particularly during market-wide corrections

- Take partial profits when price reaches resistance levels or when 24-hour volume spikes significantly above average

ZORO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Aggressive Investors: 5-10% of total portfolio allocation

- Professional Investors: 10-15% of total portfolio allocation with active rebalancing quarterly

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance ZORO holdings with established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Limit individual trade size to no more than 2% of total trading capital to manage drawdown exposure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and active participation in the Zoro platform's gamified tasks

- Cold Storage Method: Transfer long-term holdings to hardware-secured solutions to protect against exchange hacks and cyber threats

- Security Considerations: Enable two-factor authentication on all exchange accounts, use hardware security keys where available, and never share private keys or seed phrases with third parties

V. ZORO Potential Risks and Challenges

ZORO Market Risks

- Extreme Price Volatility: ZORO has declined 96.56% over the past year (from historical high of $0.48961 to current $0.00496), indicating severe market sentiment deterioration and liquidity challenges

- Low Trading Volume and Liquidity: With 24-hour volume of only $16,687.62, the token faces significant liquidity constraints that could result in large slippage during substantial buy or sell orders

- Market Sentiment Deterioration: The token has experienced consistent negative price action over multiple timeframes (1H: -4.24%, 24H: -7.25%, 7D: -8.77%, 30D: -5.45%), suggesting weakening investor confidence

ZORO Regulatory Risks

- Evolving AI and Blockchain Regulation: Jurisdictions worldwide are implementing stricter regulations on artificial intelligence systems and cryptocurrency platforms, which could impact Zoro's operational model and token utility

- Compliance Requirements for Data Privacy: The platform's annotation task system involving data collection from millions of contributors may face challenges under emerging data protection regulations (GDPR, CCPA) in different regions

- Classification Uncertainty: Regulatory authorities may classify ZORO tokens differently across jurisdictions, potentially affecting their legal status and trading availability in certain markets

ZORO Technical Risks

- Scalability Challenges: The platform must maintain reliable performance while processing millions of annotation tasks and managing 6+ million connected wallets, which could create bottlenecks

- Zero-Knowledge Proof Implementation: While ZK technology enhances privacy, implementation vulnerabilities could expose user data or compromise task verification integrity

- Smart Contract Vulnerabilities: The BEP-20 token contract on BSC network could contain security flaws, despite being deployed on an established blockchain network

VI. Conclusion and Action Recommendations

ZORO Investment Value Assessment

Zoro presents an innovative approach to decentralized AI infrastructure by leveraging gamified task distribution and zero-knowledge proof verification. The platform demonstrates substantial user engagement with 6+ million connected wallets and 57,000 monthly active contributors across 100+ countries. However, the token faces significant headwinds, with a 96.56% decline over one year, minimal trading liquidity, and uncertain regulatory frameworks for AI-based platforms. The long-term value proposition depends heavily on successful platform scaling, broader adoption of decentralized AI training, and sustaining user engagement through the incentive structure. Near-term price recovery appears challenging given current market sentiment and trading volume constraints.

ZORO Investment Recommendations

✅ Beginners: Allocate only 1-2% of portfolio to ZORO as a speculative holding; focus on understanding the platform's fundamentals before increasing exposure, and use Gate.com for secure token storage and trading ✅ Experienced Investors: Consider contrarian accumulation during extreme weakness, with strict stop-losses at 20-30% below entry price; actively participate in platform metrics monitoring to validate growth narratives ✅ Institutional Investors: Conduct deep technical due diligence on smart contracts and zero-knowledge proof implementation; establish position limits below 5% of daily trading volume to ensure exit liquidity

ZORO Trading Participation Methods

- Exchange Trading: Execute spot purchases on Gate.com with limit orders to minimize slippage given the thin order book

- Direct Platform Participation: Engage with gamified AI training tasks to earn ZORO tokens while supporting the ecosystem, though token generation rates and vesting schedules should be carefully reviewed

- Grid Trading: Implement automated trading strategies within 2-3% price bands to capture volatility while managing risk exposure

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. It is strongly recommended to consult with professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is ZORO token and what are its practical uses?

ZORO token is used for staking on the blockchain network to share block rewards. Token holders can become nodes or delegate tokens to other nodes. If a node commits an error, stakers may lose their tokens.

What is the ZORO price prediction for 2024?

Based on long-term analysis, ZORO was projected to reach approximately $0.005448 in 2025 and $0.005720 in 2026. However, specific 2024 prediction data is limited. Current market dynamics may differ from earlier forecasts.

What is the historical price trend of ZORO?

ZORO has experienced fluctuations in its price history. Currently trading at ¥0.037617 with a market cap of ¥466,700, the token saw a 24-hour decline of 1.23%. Historical data shows price ranges between ¥0.036720 and ¥0.038205, with consistent trading volume of approximately 2.21 million units daily.

What are the main factors affecting ZORO price?

ZORO price is primarily influenced by Bitcoin trends, cryptocurrency market sentiment, and technical breakthrough signals. Under favorable market conditions, the price could potentially reach $0.45.

What are ZORO's advantages compared to similar projects?

ZORO excels through innovative tokenomics, robust blockchain security, and exceptional community governance. Superior transaction efficiency, lower fees, and sustainable ecosystem growth differentiate ZORO from competitors, positioning it for significant long-term value appreciation.

What are the main risks of investing in ZORO?

Main risks include market volatility, technical risks, and regulatory changes. Due to ZORO's smaller market size, price fluctuations are more pronounced. Additionally, regulatory policy shifts may significantly impact its performance.

How is ZORO's market liquidity and trading volume?

As of January 2026, ZORO maintains solid market liquidity with 24-hour trading volume between $5-6 million. The token trades around $0.21 with a circulating supply of approximately $25 million, indicating healthy market activity and accessibility for traders.

What is the background of the ZORO team and how is the project progressing?

ZORO team has launched on Gate Alpha with triple rewards. The project is built on BNB Chain, integrating zero-knowledge technology and AI mechanisms. As of January 5, 2026, the project is progressing smoothly with strong momentum in development.

Quantum Financial System: 2025 Launch Date and Market Impact

QFS System Explained: What the Quantum Financial System Means

COAI Crypto: What It Is and How It Works

2025 ASM Price Prediction: Future Trajectory Analysis and Key Factors Influencing Market Value

WhiteBridge Network (WBAI): AI-Powered Trust Layer for People-Data Intelligence

Aster CEO Leonard: Shaping Web3's Future Through Blockchain Innovation

Is Bitcoin Dead? The Truth About Bitcoin's Survival

Bull and Bear Markets: What They Are and How They Differ

What is cross margin

The Difference Between the 2025 and 2021 Crypto Bull Runs

How to get free bitcoins