2025 ZBT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ZBT's Market Position and Investment Value

ZEROBASE (ZBT) serves as a decentralized cryptographic infrastructure network that enables verifiable off-chain computation using zero-knowledge proofs (ZKPs) and trusted execution environments (TEEs). As of December 2025, ZBT has achieved a market capitalization of approximately $79.96 million, with a circulating supply of 220 million tokens and a current price of around $0.07996. This innovative infrastructure asset, which powers products like zkStaking, zkLogin, and ProofYield, is playing an increasingly critical role in bridging institutional DeFi, user privacy, and real-world asset strategies.

This article provides a comprehensive analysis of ZBT's price trends and market dynamics, combining historical performance data, market supply-demand mechanics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment guidance for market participants.

ZEROBASE (ZBT) Market Analysis Report

I. ZBT Price History Review and Market Status

ZBT Current Market Position

As of December 21, 2025, ZEROBASE (ZBT) is trading at $0.07996, reflecting a dynamic market environment characterized by recent volatility. The token has demonstrated notable price movements within a 24-hour range of $0.0751 to $0.08223, representing a 24-hour price increase of 5.03%.

The token has achieved a historical all-time high (ATH) of $0.88999 on October 17, 2025, while the all-time low (ATL) stands at $0.06891, recorded on December 18, 2025. This significant price range illustrates the inherent volatility characteristic of ZBT's market trajectory since its market inception.

ZBT Performance Metrics

Market Capitalization and Supply Metrics:

- Current Market Cap: $17,591,200

- Fully Diluted Valuation (FDV): $79,960,000

- Circulating Supply: 220,000,000 ZBT (22% of total supply)

- Total Supply: 1,000,000,000 ZBT

- Market Cap to FDV Ratio: 22%

Price Performance Analysis:

- 1-Hour Change: -0.04%

- 24-Hour Change: +5.03%

- 7-Day Change: -19.64%

- 30-Day Change: -34.28%

The token has experienced significant downward pressure over the medium term, with a 30-day decline of 34.28%, suggesting recent market headwinds. However, the positive 24-hour performance indicates potential short-term stabilization or recovery attempts.

Trading Activity:

- 24-Hour Volume: $777,292.13

- Token Holders: 139,605

- Market Dominance: 0.0024%

- Current Market Ranking: #918

ZBT Market Dynamics

ZBT operates on the BSC (Binance Smart Chain) network with the contract address 0xfab99fcf605fd8f4593edb70a43ba56542777777. The token maintains active trading on Gate.com, demonstrating consistent exchange presence across the cryptocurrency landscape.

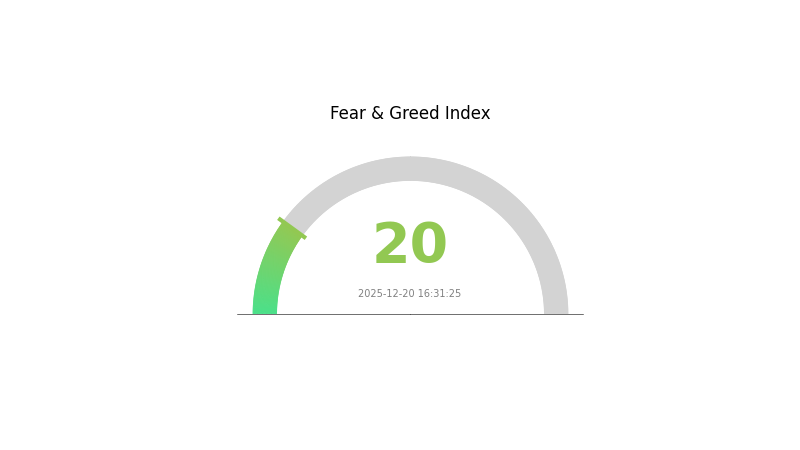

The current market sentiment reflects cautious positioning, as indicated by the broader market's "Extreme Fear" sentiment (VIX: 20 as of December 20, 2025). Despite this challenging sentiment environment, ZBT has maintained trading activity with approximately 139,605 token holders demonstrating continued community engagement.

Access current ZBT market pricing on Gate.com

ZBT Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at 20. This indicates heightened market pessimism and risk aversion among investors. During such periods, market volatility typically increases as participants become cautious about their positions. However, extreme fear often presents opportunities for long-term investors to accumulate assets at lower prices. It's advisable to monitor market developments closely and consider your risk tolerance before making investment decisions. Remember to conduct thorough research and only invest what you can afford to lose.

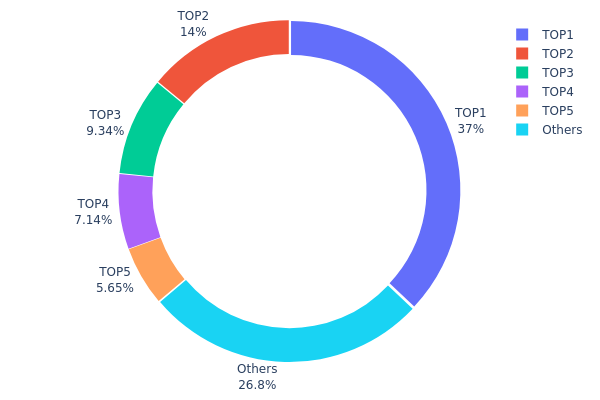

ZBT Holdings Distribution

The address holdings distribution chart presents a comprehensive view of how ZBT tokens are distributed across blockchain addresses, serving as a critical indicator of token concentration and market decentralization. By analyzing the proportion of tokens held by top addresses relative to total supply, this metric reveals the ownership structure and potential systemic risks associated with token concentration.

Current data demonstrates notable concentration characteristics within the ZBT ecosystem. The top holder (0xdeca...93824a) commands 37.03% of total supply, while the top five addresses collectively control 73.17% of all tokens in circulation. This level of concentration indicates a relatively centralized distribution pattern. The second-largest holder maintains 14.03% of tokens, followed by decreasing proportions among subsequent addresses. The remaining 26.83% dispersed across other addresses suggests that while a significant minority of holdings exists outside the top five, the overall distribution remains skewed toward a small number of entities.

The concentration profile of ZBT presents both structural considerations and market implications. With more than one-third of the token supply concentrated in a single address, and nearly three-quarters held by the five largest holders, the token exhibits heightened sensitivity to the decisions and activities of these major stakeholders. This distribution pattern could potentially influence price volatility and market dynamics, as large holders possess substantial liquidity control. However, the existence of a meaningful "Others" category holding over one-quarter of tokens provides some degree of decentralized participation, moderating the degree of extreme concentration that would characterize a critically centralized asset structure.

Click to view current ZBT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdeca...93824a | 30653.71K | 37.03% |

| 2 | 0x8894...e2d4e3 | 11613.78K | 14.03% |

| 3 | 0x3cee...777777 | 7729.74K | 9.33% |

| 4 | 0x359a...777777 | 5908.83K | 7.13% |

| 5 | 0x4368...26f042 | 4679.75K | 5.65% |

| - | Others | 22186.94K | 26.83% |

II. Core Factors Impacting ZBT's Future Price

Supply Mechanism

- Locking Mechanism: On-chain data shows that 65% of ZBT's circulating supply is in a locked state, which effectively reduces the available supply in the market.

- Current Impact: The locking mechanism helps support price stability by constraining market liquidity and reducing sell pressure.

Technology Development and Ecosystem Building

- Zero-Knowledge Proof Technology: The commercialization and application of zero-knowledge proof technology is a key driver for ZBT's price trajectory. The price movement is largely dependent on the progress of technology implementation and expansion of the ecosystem system.

Market Sentiment and Capital Flows

- Market Sentiment Impact: Overall market sentiment, particularly the price movements of mainstream cryptocurrencies like Bitcoin, tends to influence altcoin performance, including ZBT.

- Large Capital Inflows: The entry of large-scale capital, such as institutional investors, plays a crucial role in supporting price movements.

- Trading Volume: 24-hour trading volume is a key indicator of ZBT's market activity and liquidity. Higher trading volumes typically mean greater price resilience and easier entry/exit for traders, while low trading volumes may result in significant price volatility during minor market movements.

III. ZBT Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.05082 - $0.07941

- Neutral Forecast: $0.07941

- Optimistic Forecast: $0.08735 (requiring sustained market stability and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation, featuring periodic volatility and price discovery mechanisms as the asset establishes its market position.

- Price Range Forecast:

- 2026: $0.04669 - $0.11173

- 2027: $0.06439 - $0.10634

- 2028: $0.07646 - $0.12233

- Key Catalysts: Ecosystem development initiatives, increased institutional adoption through platforms like Gate.com, technological upgrades, and broader market recovery cycles.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.09083 - $0.16597 (assuming moderate adoption growth and stable macroeconomic conditions)

- Optimistic Scenario: $0.11214 - $0.15018 (contingent on accelerated mainstream adoption and positive regulatory developments)

- Transformative Scenario: $0.13905+ (assuming breakthrough technological achievements and significant institutional capital inflow)

- 2030-12-31: ZBT projected at average $0.13905 (representing 73% cumulative growth from baseline, reflecting sustained positive momentum)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08735 | 0.07941 | 0.05082 | 0 |

| 2026 | 0.11173 | 0.08338 | 0.04669 | 4 |

| 2027 | 0.10634 | 0.09756 | 0.06439 | 22 |

| 2028 | 0.12233 | 0.10195 | 0.07646 | 27 |

| 2029 | 0.16597 | 0.11214 | 0.09083 | 40 |

| 2030 | 0.15018 | 0.13905 | 0.09038 | 73 |

ZEROBASE (ZBT) Professional Investment Strategy and Risk Management Report

IV. ZBT Professional Investment Strategy and Risk Management

ZBT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for investors: Those seeking exposure to zero-knowledge proof infrastructure with extended time horizons (2+ years)

- Operational recommendations:

- Accumulate ZBT during price consolidation phases, particularly when prices approach historical support levels

- Maintain position through market volatility cycles, focusing on the fundamental value proposition of zkStaking, zkLogin, and ProofYield products

- Reinvest any rewards or gains back into the position to compound returns over time

(2) Active Trading Strategy

- Technical analysis tools:

- Price action analysis: Monitor the 24-hour trading range ($0.0751 - $0.08223) and weekly resistance/support levels formed during the -19.64% 7-day decline

- Volume analysis: Track the $777,292.13 daily volume to identify breakout opportunities when volume increases above this average

- Wave trading key points:

- Identify oversold conditions during sharp declines (current 30-day drop of -34.28%) as potential entry opportunities

- Execute partial profit-taking at previous resistance levels, using the historical high of $0.88999 as a long-term reference point

ZBT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 2-3% of total crypto portfolio allocation

- Active investors: 5-8% of total crypto portfolio allocation

- Professional investors: 8-15% of total crypto portfolio allocation (with corresponding hedging strategies)

(2) Risk Hedging Solutions

- Dollar-cost averaging (DCA): Execute purchases over 4-12 week periods rather than lump sum investments to reduce timing risk exposure

- Portfolio diversification: Combine ZBT holdings with established infrastructure tokens to balance risk and create uncorrelated asset exposure

(3) Secure Storage Solutions

- Hot wallet approach: Use Gate.com Web3 Wallet for active trading and frequent transactions, with fund allocation limited to 30% of total holdings

- Cold storage approach: Transfer 70% of holdings to secure offline storage for long-term preservation

- Security considerations: Enable two-factor authentication on all exchange accounts, use hardware authentication methods, maintain private key backups in geographically dispersed secure locations, and never share seed phrases or private keys

V. ZBT Potential Risks and Challenges

ZBT Market Risks

- High volatility exposure: ZBT has declined 34.28% over the past 30 days and 19.64% over 7 days, indicating significant price instability that could result in substantial losses for short-term holders

- Limited market liquidity: With only $777,292 in 24-hour trading volume across a market cap of $17.59 million, large trades could experience significant slippage and price impact

- Market cap concentration risk: The project ranks 918th globally with only 0.0024% market dominance, indicating limited institutional adoption and potential for rapid price movements based on news cycles

ZBT Regulatory Risks

- Cryptocurrency regulatory uncertainty: Ongoing global regulatory developments could impact token classification, trading availability, and compliance requirements for staking and privacy-focused features

- Jurisdiction-specific restrictions: Zero-knowledge proof technologies and privacy features may face regulatory scrutiny in certain jurisdictions, potentially limiting the addressable market

- Compliance implementation challenges: The integration of compliance-aligned staking mechanisms may require continuous adaptation to evolving regulatory frameworks across different regions

ZBT Technology Risks

- Zero-knowledge proof complexity: Reliance on cutting-edge ZKP and trusted execution environment (TEE) technologies introduces implementation risks, potential security vulnerabilities, and ongoing maintenance requirements

- Smart contract vulnerabilities: As with all blockchain protocols, potential bugs or exploits in smart contracts supporting zkStaking, zkLogin, and ProofYield could result in loss of user funds

- Scalability and adoption uncertainty: The technology must achieve sufficient network effects and developer adoption to validate its long-term viability in the competitive infrastructure layer

VI. Conclusion and Action Recommendations

ZBT Investment Value Assessment

ZEROBASE presents a compelling infrastructure play focused on zero-knowledge proofs and privacy-preserving computation, addressing genuine institutional DeFi and real-world asset (RWA) integration needs. The zkStaking, zkLogin, and ProofYield product suite offers practical utility for both privacy-conscious users and compliance-requiring institutions. However, the significant market volatility (-34.28% over 30 days), modest trading volume, and early-stage adoption status indicate this is a higher-risk, speculative investment suitable primarily for experienced cryptocurrency investors with high risk tolerance. The technology is innovative but unproven at scale, and the project must demonstrate meaningful commercial traction to justify current valuations.

ZBT Investment Recommendations

✅ Newcomers: Begin with minimal allocation (1-2% of crypto portfolio) through periodic dollar-cost averaging on Gate.com, while dedicating time to understand zero-knowledge proof technology and the competitive landscape before increasing exposure.

✅ Experienced investors: Consider 5-8% portfolio allocation using a combination of long-term core holding and tactical trading around technical support/resistance levels, while actively monitoring product development milestones and institutional adoption signals.

✅ Institutional investors: Evaluate 8-15% allocations with comprehensive due diligence on technology audits, regulatory compliance frameworks, and strategic partnership development; consider phased entry with hedging strategies.

ZBT Trading Participation Methods

- Direct token acquisition: Purchase ZBT on Gate.com using spot trading for long-term position building or active trading based on technical analysis

- Staking participation: Engage with zkStaking products once sufficient ecosystem maturity is demonstrated, to generate additional yield while supporting network validation

- Risk-managed entry: Establish positions during oversold conditions (using the current -34.28% monthly decline as a reference for potential accumulation) with predetermined stop-loss levels and profit-taking targets

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is ZBT and what is its current market value?

ZBT is a blockchain-based cryptocurrency token. Its current market value is approximately 0.07232 USD, reflecting recent market movements. The token's price fluctuates based on market demand and trading activity.

What factors could influence ZBT's price in the next 1-2 years?

ZBT's price could be influenced by platform development progress,market adoption rates,regulatory environment changes,overall cryptocurrency market trends,and technological advancements in the blockchain ecosystem.

What is the price prediction for ZBT by 2025/2026?

Based on current market sentiment and user consensus, ZBT is predicted to reach approximately $0.11195 by 2026. This forecast reflects market analysis as of December 2025.

What are the main risks and opportunities for ZBT investment?

ZBT investment risks include market volatility and regulatory changes. Opportunities encompass high return potential and emerging market growth driven by increasing adoption and technological development.

How does ZBT compare to similar cryptocurrencies in terms of potential?

ZBT stands out with superior scalability, enhanced security features, and growing ecosystem adoption. Its innovative technology and strong development team position it competitively, offering significant upside potential compared to similar projects in the market.

AVNT vs NEAR: Comparing Two Innovative Blockchain Platforms for Decentralized Applications

ROOST vs AVAX: Comparing Two Innovative Blockchain Platforms for Decentralized Applications

Is Orochi Network (ON) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

Viction's Whitepaper Logic: Driving 75.6% Growth with Zero-Gas Innovations in 2025

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Prove coin

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?