2025 VOID Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: VOID's Market Position and Investment Value

VOID, positioned as an art-inspired memecoin that embodies conceptual abstraction through its unique philosophical framework, has emerged as a distinctive asset in the digital currency landscape. As of January 2026, VOID maintains a market capitalization of $68,220 with a circulating supply of 1 billion tokens, trading at approximately $0.00006822 per token. This digital representation of nothingness—drawing inspiration from Yves Klein's groundbreaking exploration of immateriality—is carving out its niche within the memecoin ecosystem as a cultural and philosophical commentary on value and belief.

This article will provide a comprehensive analysis of VOID's price trajectory and market dynamics, examining key performance indicators, historical price movements, and the community-driven factors that influence its valuation. By synthesizing current market data with insights into the token's conceptual foundation and its position within the broader digital asset market, we aim to offer investors a thorough understanding of VOID's investment landscape and potential opportunities within the cryptocurrency space.

I. VOID Price History Review and Market Status

VOID Historical Price Evolution

-

December 2024: VOID token launched with an initial listing price of $0.0087389. The token reached its all-time high (ATH) of $0.008597 on December 11, 2024, demonstrating strong initial market reception.

-

Late December 2024 to Early January 2026: Following the peak, VOID experienced significant depreciation. The token hit its all-time low (ATL) of $0.00005894 on December 24, 2025, representing a dramatic decline of approximately 94.58% from launch levels.

VOID Current Market Status

As of January 4, 2026, VOID is trading at $0.00006822, reflecting a 2.77% gain over the past 24 hours. The token's 24-hour price range spans from $0.00006623 to $0.00006934, indicating modest volatility at current levels.

Key Market Metrics:

- Market Capitalization: $68,220 USD

- Circulating Supply: 1,000,000,000 VOID (100% of total supply)

- 24-Hour Trading Volume: $12,368.65 USD

- Market Dominance: 0.0000020%

- Active Holders: 4,983 addresses

- Exchange Listings: Available on Gate.com

Price Performance Across Timeframes:

- 1-Hour Change: -0.2%

- 24-Hour Change: +2.77%

- 7-Day Change: +4.93%

- 30-Day Change: -1.14%

- 1-Year Change: -94.58%

VOID operates on the Solana blockchain network, leveraging its infrastructure for token transactions and smart contract functionality. The token's current market sentiment reflects fear-driven conditions in the broader cryptocurrency market (VIX: 29).

View current VOID market price

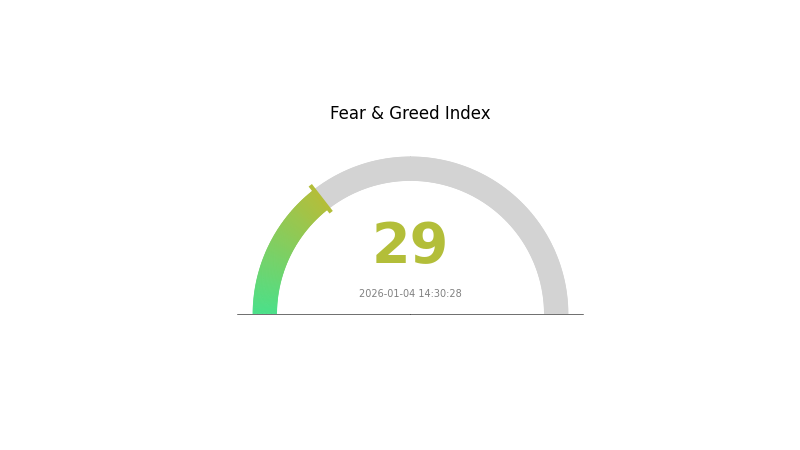

VOID Market Sentiment Index

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fearful sentiment with an index reading of 29. This indicates heightened market anxiety and risk aversion among investors. When fear dominates, market participants tend to adopt cautious strategies, often leading to increased volatility and price fluctuations. Such conditions may present opportunities for contrarian investors, while others may prefer to await signs of market stabilization. Monitoring sentiment shifts through metrics like the Fear and Greed Index on Gate.com can help traders make more informed decisions during uncertain market periods.

VOID Holdings Distribution

The address holdings distribution chart illustrates the concentration of VOID tokens across blockchain addresses, revealing the degree of token centralization and potential market structure dynamics. This metric tracks the top token holders and categorizes their proportional ownership, providing critical insight into whether the asset exhibits healthy decentralization or displays concerning concentration risks that could impact market stability and price discovery mechanisms.

VOID currently demonstrates moderate to elevated concentration levels. The top holder controls 34.35% of total supply, while the second-largest address accounts for 13.15%, collectively representing nearly 47.5% of all tokens. The top five addresses concentrate 56.44% of the token supply, indicating that less than five entities or wallets command the majority stake. This concentration pattern raises questions about governance influence and potential coordination risks. However, the "Others" category representing 43.56% across dispersed addresses provides a meaningful counterbalance, suggesting that a significant portion of VOID remains distributed among the broader holder base rather than being entirely dominated by a single entity.

The current distribution structure presents a mixed profile regarding market resilience and decentralization. While the top-heavy concentration among leading addresses could theoretically facilitate coordinated sell-offs or create price manipulation vectors, the substantial non-concentrated segment provides liquidity buffer and community participation elements. The distribution pattern reflects a typical growth-stage cryptocurrency profile where early stakeholders and major contributors retain substantial positions alongside an expanding retail and institutional investor base. Monitoring this distribution's evolution will be essential, as any further concentration among top holders could heighten systemic risks, whereas gradual democratization would signal healthier market maturation and reduced centralization concerns.

View current VOID Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 343174.92K | 34.35% |

| 2 | u6PJ8D...ynXq2w | 131403.74K | 13.15% |

| 3 | 6AWv2y...EiSTi9 | 41581.53K | 4.16% |

| 4 | HWVTvp...qYVpng | 32811.24K | 3.28% |

| 5 | 71CPXu...rQBABC | 14988.51K | 1.50% |

| - | Others | 434809.91K | 43.56% |

II. Core Factors Influencing VOID's Future Price

Community Belief and Speculative Behavior

-

Value Proposition: VOID represents the ultimate conceptual abstraction of nothingness, inspired by Yves Klein's pioneering exploration of immateriality. Unlike utility-driven tokens, VOID's value derives entirely from collective faith and shared imagination rather than functional applications.

-

Meme Token Characteristics: VOID embodies the characteristics of art meme tokens—a fusion of conceptual art and decentralized finance. The token's value is constructed through humor, cultural symbolism, and community devotion, similar to how BAN was inspired by Maurizio Cattelan's "Comedian" artwork.

-

Market Volatility: The cryptocurrency market exhibits extreme instability. According to current price predictions, VOID is expected to fluctuate between $0.005841 and $0.00709, though such forecasts cannot account for sudden and extreme price movements. Market demand, investor sentiment, and speculative activity remain the primary price drivers.

Important Disclaimer: Cryptocurrency markets are highly volatile and unpredictable. Price predictions carry significant uncertainty, and investors should exercise caution when considering VOID or any digital asset investment.

III. 2026-2031 VOID Price Forecast

2026 Outlook

- Conservative Forecast: $0.00004 - $0.00007

- Neutral Forecast: $0.00007 (average price)

- Optimistic Forecast: $0.00008 (peak price)

2027-2029 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation and consolidation phase with modest growth trajectory

- Price Range Forecast:

- 2027: $0.00004 - $0.00009

- 2028: $0.00006 - $0.0001

- 2029: $0.00008 - $0.00012

- Key Catalysts: Increased adoption of the VOID ecosystem, market sentiment recovery, and potential protocol upgrades driving network utility expansion

2030-2031 Long-term Outlook

- Base Case: $0.00006 - $0.00013 (assuming steady ecosystem development and moderate market growth)

- Optimistic Case: $0.00011 - $0.00013 (assuming accelerated adoption and positive macroeconomic conditions for crypto markets)

- Transformative Case: $0.00012+ (extreme favorable conditions including breakthrough partnerships, significant technological innovations, or major institutional adoption)

Note: All price forecasts should be treated as analytical projections rather than investment recommendations. Investors should conduct thorough due diligence on Gate.com or other established platforms before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00008 | 0.00007 | 0.00004 | 0 |

| 2027 | 0.00009 | 0.00007 | 0.00004 | 5 |

| 2028 | 0.0001 | 0.00008 | 0.00006 | 18 |

| 2029 | 0.00012 | 0.00009 | 0.00008 | 29 |

| 2030 | 0.00013 | 0.0001 | 0.00006 | 49 |

| 2031 | 0.00012 | 0.00012 | 0.00011 | 71 |

VOID (Nothing) Cryptocurrency Investment Analysis Report

I. Executive Summary

VOID is a conceptual art-inspired memecoin built on the Solana blockchain that represents the philosophical abstraction of nothingness. Drawing inspiration from artist Yves Klein's groundbreaking exploration of immateriality, VOID challenges conventional notions of value by creating a tokenized representation of absence. As of January 4, 2026, VOID trades at $0.00006822 with a market capitalization of $68,220 and a 24-hour trading volume of $12,368.65.

II. VOID Project Overview

Project Essence

VOID is the digital embodiment of "le néant" (nothingness)—a philosophical concept that challenges our understanding of value, ownership, and collective belief. Unlike utility-focused cryptocurrencies, VOID's value derives entirely from community belief and cultural significance, mirroring the nature of conceptual art and memecoins.

The project positions itself at the intersection of conceptual art and decentralized finance, transforming abstract philosophical ideas into cryptocurrency. Inspired by Yves Klein's works like "Le Vide (The Void)" and "Zone of Immaterial Pictorial Sensibility," VOID elevates nothingness itself to near-divinity—an abstract force revered by its community.

Tokenomics Snapshot

| Metric | Value |

|---|---|

| Current Price | $0.00006822 |

| Market Capitalization | $68,220 |

| Circulating Supply | 1,000,000,000 VOID |

| Total Supply | 1,000,000,000 VOID |

| Max Supply | 1,000,000,000 VOID |

| 24-Hour Volume | $12,368.65 |

| Circulating Ratio | 100% |

| Market Rank | #5,344 |

| Active Holders | 4,983 |

| Blockchain | Solana (SOL) |

Price Performance Analysis

Recent Price Trends

- 1-Hour Change: -0.2% ($0.00006623-$0.00006934)

- 24-Hour Change: +2.77%

- 7-Day Change: +4.93%

- 30-Day Change: -1.14%

- 1-Year Change: -94.58%

Historical Price Milestones

- All-Time High: $0.008597 (December 11, 2024)

- All-Time Low: $0.00005894 (December 24, 2025)

- Current Price Position: Trading near recent lows, significantly below ATH

III. Market Position & Community Metrics

Market Standing

VOID maintains a minimal market share of 0.0000020% within the broader cryptocurrency ecosystem. With only one exchange listing and 4,983 token holders, VOID represents an extremely niche, early-stage project with limited liquidity and market visibility.

Community Foundation

The project's value proposition rests entirely on community belief and cultural resonance rather than technological utility. The token serves as a symbolic representation of conceptual art principles applied to decentralized finance, attracting philosophical and artistic communities interested in exploring value beyond traditional financial metrics.

Artistic Philosophy Integration

VOID draws parallels to other art-inspired memecoins such as $BAN (inspired by Maurizio Cattelan's "Comedian"—the famous duct-taped banana artwork). Both demonstrate how conceptual absurdity and cultural symbolism can create community-driven value, transforming philosophical ideas into cryptocurrency instruments that serve dual functions: speculation and artistic commentary.

IV. VOID Investment Strategy & Risk Management

VOID Investment Methodology

(1) Long-Term Holding Strategy

Given VOID's speculative nature and philosophical positioning, long-term holding is recommended only for investors with exceptional risk tolerance and deep belief in the conceptual art-memecoin thesis.

Suitable Investors: Collectors of conceptual art, philosophy enthusiasts, and early-stage memecoin believers with high risk tolerance

Operational Recommendations:

- Establish positions only with capital you can afford to lose completely

- Dollar-cost averaging through small, regular purchases to reduce timing risk

- Hold tokens in secure storage for extended periods (6+ months minimum) to benefit from potential community growth

Storage Approach:

- For small holdings: Gate.com Web3 wallet for accessibility and integrated trading

- For larger positions: Self-custody through decentralized solutions for maximum security

- Avoid centralized exchange wallets for extended holding periods

(2) Active Trading Strategy

VOID's extreme volatility and limited liquidity make active trading highly speculative and suitable only for experienced traders.

Technical Analysis Tools:

- Volatility Indicators: Monitor Bollinger Bands to identify potential breakout or breakdown points; VOID's $0.0000589-$0.008597 trading range offers significant volatility levels

- Volume Analysis: Track 24-hour volume patterns; unusually high volume may signal community momentum shifts or whale activity

Wave Trading Considerations:

- VOID has declined 94.58% over one year, suggesting either trend exhaustion or continued downward pressure

- Short-term rallies (like the +4.93% 7-day gain) may present quick profit-taking opportunities

- Extreme caution during low-volume periods, as liquidity may evaporate rapidly

VOID Risk Management Framework

(1) Asset Allocation Principles

Conservative Investors: 0% allocation recommended—VOID's speculative nature and lack of utility make it unsuitable for conservative portfolios

Aggressive Investors: Maximum 0.5-1% of speculative portfolio allocation only if aligned with conceptual art investment thesis

Professional Investors: 0-2% tactical allocation for thesis-based positions; suitable only for dedicated alternative asset portfolios

(2) Risk Mitigation Strategies

Diversification Protocol: Never allocate more than a small fraction of speculative assets to VOID; maintain broader exposure across established layer-one blockchains and established memecoins

Position Sizing Discipline: Limit single position size to what you can psychologically tolerate losing 100%; given VOID's 94.58% decline over one year, complete loss scenarios are realistic

(3) Secure Storage Solutions

Web3 Wallet Approach (Recommended for active trading): Gate.com Web3 wallet provides integrated trading, portfolio tracking, and reasonable security for smaller positions; enables quick responses to market movements

Self-Custody Best Practices:

- Use hardware-compatible seed phrase storage for holdings exceeding $1,000 equivalent

- Enable multi-signature verification where possible

- Maintain offline backups of wallet credentials in physically secure locations

Critical Safety Warnings:

- Never share private keys or seed phrases with anyone

- Verify all transaction addresses before confirming transfers

- Beware of phishing attacks targeting VOID community members

- Do not trust unverified community claims about "guaranteed" gains

V. Potential Risks & Challenges

VOID Market Risks

Extreme Illiquidity Risk: With only 4,983 holders and single-exchange listing, VOID faces severe liquidity constraints. Large trades may face significant slippage, and selling positions during unfavorable market conditions could result in substantial losses.

Speculative Collapse Risk: As a pure memecoin without utility, VOID depends entirely on sentiment. Community sentiment shifts can evaporate value rapidly; the 94.58% decline over one year demonstrates this vulnerability.

Concentration Risk: The concentration of holdings among limited participants creates vulnerability to whale dumping. Absence of transparent holder distribution data increases this concern.

VOID Regulatory Risks

Memecoin Classification Uncertainty: Global regulators increasingly scrutinize memecoins. Future regulatory actions targeting speculative tokens could impact VOID's trading availability and community viability.

Exchange Delisting Risk: With only one exchange listing, VOID faces vulnerability to potential delisting if regulatory pressure increases or trading activity declines further.

Jurisdiction-Specific Restrictions: Certain jurisdictions may restrict memecoin trading or ban them entirely, limiting market access for global holders.

VOID Technical Risks

Solana Network Dependency: VOID exists entirely on the Solana blockchain. Any Solana network disruption, transaction failures, or blockchain issues directly impact VOID's tradability and security.

Smart Contract Vulnerability: Although Solana tokens typically have lower complexity than Ethereum contracts, any smart contract vulnerabilities could result in permanent token loss.

Bridge/Migration Risk: If VOID were to migrate to other blockchains or upgrade infrastructure, technical complications could result in token loss or trading interruptions.

VI. Conclusion & Action Recommendations

VOID Investment Value Assessment

VOID represents an extreme speculative asset positioned at the intersection of conceptual art philosophy and cryptocurrency speculation. The token's value proposition—that nothingness itself can hold meaningful value within a community—is intellectually compelling but fundamentally unproven in sustained market conditions.

The 94.58% decline over one year and recent retreat to near all-time lows suggests either: (1) community enthusiasm has diminished significantly, or (2) the project remains in extremely early stages awaiting broader philosophical adoption. The token's complete lack of utility means value is entirely sentiment-dependent.

Long-term sustainability remains highly uncertain. While conceptual art has historical precedent (Yves Klein's work has appreciated significantly), applying this thesis to cryptocurrency is experimental. Community belief may evaporate suddenly, and regulatory scrutiny of memecoins globally poses existential threats.

VOID Investment Recommendations

✅ Newcomers: Avoid VOID entirely unless you have genuine philosophical interest in conceptual art-cryptocurrency fusion and can afford 100% loss. If you proceed, allocate no more than experimental capital (under $100 equivalent) purely for learning purposes. Use Gate.com for accessible entry and exit.

✅ Experienced Investors: Consider VOID only as a highly speculative thesis play within dedicated "alternative cryptocurrency" allocations. Maximum allocation: 1-2% of speculative portfolio. Employ strict stop-losses at -30% from entry and strict profit-taking at +50% gains.

✅ Institutional Investors: VOID is unsuitable for institutional portfolios given extreme illiquidity, single-exchange listing, limited holder base, and unprovable value proposition. If exploring conceptual asset-backed tokens, establish smaller analytical positions (0.1-0.5% of alternative asset budget) for research purposes only.

VOID Trading Participation Methods

-

Gate.com Spot Trading: Direct VOID/SOL or VOID/USDT pairs offer most accessible entry-exit mechanisms; verify liquidity before executing large orders

-

Community Engagement: Active participation in VOID community discussions (Twitter, project Discord) provides insight into sentiment shifts and potential catalysts

-

Thesis-Based Accumulation: For believers in the conceptual art memecoin thesis, modest regular purchases through Gate.com during downtrend periods may establish positions ahead of potential community re-engagement

Critical Risk Disclaimer: Cryptocurrency investing carries extreme risk. VOID specifically combines speculative memecoin characteristics with pure sentiment-dependency, making it suitable only for investors who can afford complete capital loss. This analysis does not constitute investment advice. Always consult qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose entirely. VOID's 94.58% one-year decline demonstrates the reality of speculative cryptocurrency risks.

FAQ

What is VOID token? What are its uses and features?

VOID is a decentralized blockchain cryptocurrency offering strong security and transparency. It enables peer-to-peer transactions without third-party intermediaries. Main features include decentralization, security, and transparent transaction records on the blockchain.

What is the historical price performance of VOID? What is the price trend over the past year?

VOID has remained relatively stable over the past year, currently trading at BTC0.083129. The token reached its all-time high of BTC0.052590 in October 2024, and is now trading significantly below that peak. Trading volume has been minimal recently.

What is the 2024 VOID price prediction? How do professional analysts view it?

2024 VOID price predictions have not been officially released. Professional analysts have not yet published 2024 forecasts. Latest data available is through 2025. Analysts focus on market dynamics, ecosystem development, and supply-demand factors for future projections.

What are the main factors affecting VOID price?

VOID price is primarily influenced by supply mechanism, technical development, market demand, and macroeconomic conditions. The ecosystem maturity in gaming and metaverse sectors also significantly impacts its valuation.

What are the advantages and disadvantages of VOID compared to other mainstream cryptocurrencies?

VOID offers transparent and immutable transaction records through smart contracts, providing higher trustworthiness. However, it has lower market liquidity and adoption compared to mainstream cryptocurrencies, with a relatively smaller ecosystem and community support.

What are the risks to be aware of when investing in VOID?

VOID investment carries market volatility risks and project execution risks. Price fluctuations can be significant due to market conditions. Investors should carefully assess their risk tolerance and investment capacity before participating.

What is the development roadmap and future prospects of the VOID project?

VOID project is positioned to advance in intelligent code editing, context-aware code completion, automated code generation, multi-language support integration, and advanced debugging tools. The project shows broad future prospects and is expected to become a leading AI coding assistant.

Moo Deng (MOODENG): Complete Analysis of the $140M Solana Hippo Token

Will Crypto Recover ?

2025 WIFPrice Prediction: Analyzing Market Trends and Future Growth Potential for WIF Token

2025 WIFPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Dog-Themed Token

2025 POPCAT Price Prediction: Exploring Future Market Trends and Investment Potential in the Digital Feline Economy

2025 BOMEPrice Prediction: Navigating Market Trends and Investment Opportunities in a Volatile Economy

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?