2025 USDP Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: USDP'nin Piyasadaki Konumu ve Yatırım Değeri

Paxos (USDP), dünyanın ilk regüle edilen stablecoin'i olarak 2018'den bu yana önemli kilometre taşlarına ulaşmıştır. 2025 yılı itibarıyla USDP'nin piyasa değeri 62.252.108 ABD doları seviyesine çıkmış olup, dolaşımdaki token sayısı yaklaşık 62.264.561'dir ve fiyatı 0,9998 ABD doları dolayındadır. "Nakitin dijital alternatifi" olarak nitelendirilen bu varlık, kripto varlık ticaretinde likidite sağlamada ve tüm varlık sınıflarında anında işlem takasında giderek daha önemli bir rol oynamaktadır.

Bu makalede, 2025-2030 döneminde USDP'nin fiyat trendleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar temel alınarak kapsamlı şekilde analiz edilecek, yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. USDP Fiyat Geçmişi ve Güncel Piyasa Durumu

USDP'nin Tarihsel Fiyat Seyri

- 2018: USDP, PAX adıyla piyasaya sürüldü ve ilk fiyatı 1 ABD doları olarak belirlendi

- 2021: PAX, USDP olarak yeniden markalandı; fiyat 1 ABD doları civarında sabit kaldı

- 2024: 16 Nisan'da 1,502 ABD doları ile zirveye, 3 Ocak'ta ise 0,9824 ABD doları ile dip seviyeye ulaştı

USDP Güncel Piyasa Durumu

22 Ekim 2025 itibarıyla USDP, 0,9998 ABD doları seviyesinden işlem görmektedir ve 24 saatlik işlem hacmi 63.397,31 ABD dolarıdır. Piyasa değeri şu anda 62.252.108 ABD doları olup, kripto para piyasasında 541. sıradadır. USDP, ABD dolarına endeksini koruyarak fiyat dalgalanmasını en düşük seviyede tutmuştur. Dolaşımdaki arz 62.264.561 USDP olup, bu miktar toplam arza eşittir. Son dönemde, USDP'de hafif fiyat hareketleri gözlenmiş; son bir saatte %0,019, son 24 saat ve 7 günde %0,01, son 30 günde ise %0,02 artış yaşanmıştır. Ancak, son bir yılda %0,13 oranında küçük bir düşüş kaydedilmiştir.

Güncel USDP piyasa fiyatını görmek için tıklayın

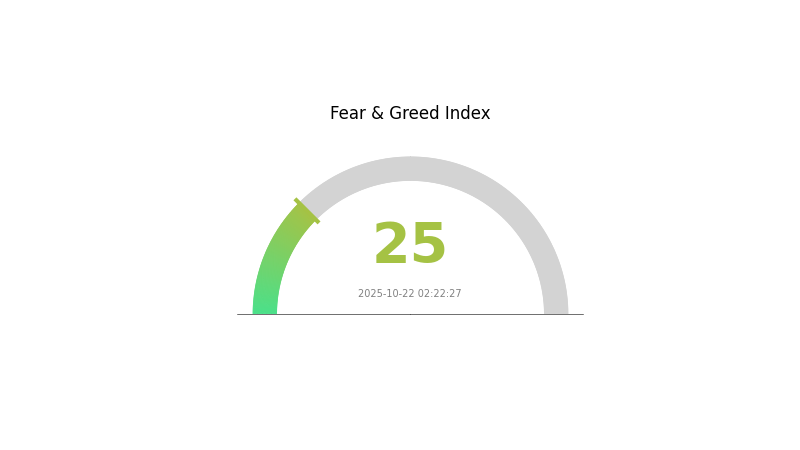

USDP Piyasa Duyarlılığı Göstergesi

22 Ekim 2025 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında şu anda aşırı korku hakim; duyarlılık endeksi 25'e kadar gerilemiş durumda. Bu düzeydeki kötümserlik, karşıt görüşlü yatırımcılar için potansiyel bir alım fırsatı sunabilir. Ancak, piyasa koşulları dalgalı olduğu için dikkatli hareket edilmelidir. Gate.com üzerindeki yatırımcılar, piyasa duyarlılığını değiştirebilecek destek seviyelerini ve potansiyel tetikleyicileri yakından takip etmektedir. Belirsiz dönemlerde kapsamlı araştırma yapmak ve risk yönetimini ön planda tutmak kritik önem taşır.

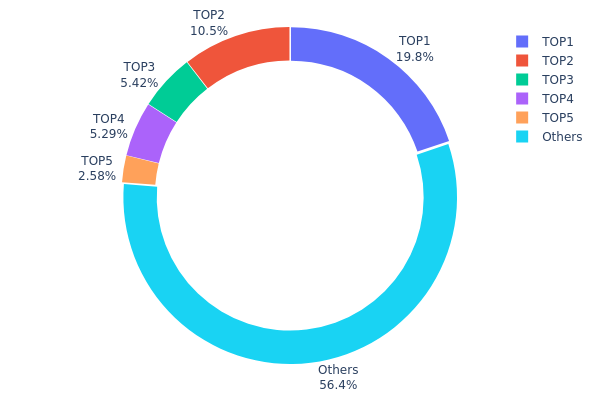

USDP Varlık Dağılımı

USDP'nin adres bazlı varlık dağılımı verileri, orta düzeyde yoğunlaşmış bir piyasa yapısına işaret etmektedir. En büyük adres toplam arzın %19,83'ünü, ilk 5 adres ise USDP tokenlarının toplamda %43,56'sını elinde bulundurmaktadır. Bu yoğunlaşma seviyesi, piyasa dinamikleri üzerinde potansiyel etkiler yaratabilecek bir merkezileşmeye işaret eder.

Böyle bir dağılım, büyük sahiplerin piyasada önemli alım veya satım işlemleriyle fiyat üzerinde belirgin etkiler yaratabilmesini mümkün kılar ve bu durum fiyat oynaklığını artırabilir. Öte yandan, tokenların %56,44'ünün diğer adreslere yayılması, aşırı merkezileşmeden kaynaklanabilecek riskleri azaltan önemli bir dağılım sağlamaktadır.

Mevcut adres dağılımı, merkezileşme ve dağıtık yapı unsurlarını aynı anda barındıran dengeli bir piyasa yapısı göstermektedir. Bu denge, USDP'nin zincir üstü yapısında görece istikrar olduğunu gösterirken, büyük token sahiplerinin olası piyasa manipülasyonlarına karşı da dikkatli olunmasını gerektirir.

Güncel USDP Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf840...61ab62 | 11953,17K | 19,83% |

| 2 | 0x091d...2fb90c | 6306,88K | 10,46% |

| 3 | 0x264b...5997b5 | 3264,14K | 5,41% |

| 4 | 0x28c6...f21d60 | 3189,99K | 5,29% |

| 5 | 0x35a0...2661a4 | 1551,97K | 2,57% |

| - | Diğerleri | 33986,39K | 56,44% |

II. USDP'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Arz Değişimi: Arzda yaşanan düşüşler, USDP fiyatında potansiyel artışlar yaratabilir.

- Tarihsel Modeller: Geçmişteki arz azalmaları, USDP fiyatını olumlu yönde etkilemiştir.

- Güncel Etki: 19 Mart'tan bu yana yaşanan %25,2'lik arz düşüşü, gelecekteki fiyat hareketlerine etki edebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: PayPal gibi büyük şirketlerin kendi stablecoin'i PYUSD'u piyasaya sürerken USDP'yi de desteklemesi, kurumsal talebin arttığını göstermektedir.

Makroekonomik Ortam

- Enflasyona Karşı Korumalı Özellikler: ABD dolarına endeksli bir stablecoin olan USDP, belirli ekonomik koşullarda enflasyona karşı koruma aracı olarak değerlendirilebilir.

- Jeopolitik Faktörler: Büyük ekonomilerde (ör. AB, Hindistan) yaşanan uluslararası gerilimler ve politika değişiklikleri, USDP'nin küresel ölçekte benimsenmesini ve kullanımını etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Regülasyon Uyumu: Circle'ın (USDC ihraççısı) sıkı uyum standartları ve şeffaf rezerv yönetimi, sektörde bir referans noktası oluşturmakta ve USDP'nin pozisyonunu etkileyebilmektedir.

- Ekosistem Uygulamaları: DeFi ekosisteminin büyümesi ve stablecoin'lerin finansal uygulamalarda artan kullanımı, USDP'ye olan talebi artırabilir.

III. 2025-2030 USDP Fiyat Öngörüsü

2025 Görünümü

- Temkinli tahmin: 0,98 - 1,00 ABD doları

- Tarafsız tahmin: 0,99 - 1,01 ABD doları

- İyimser tahmin: 1,00 - 1,02 ABD doları (DeFi platformlarında daha fazla benimsenme senaryosunda)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Hafif dalgalanma potansiyeliyle istikrar

- Fiyat aralığı tahmini:

- 2027: 0,99 - 1,01 ABD doları

- 2028: 0,99 - 1,01 ABD doları

- Temel tetikleyiciler: Regülasyon netliğinin sağlanması ve geleneksel finans sistemleriyle entegrasyonun artması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99 - 1,01 ABD doları (kripto piyasasında istikrarın devamı halinde)

- İyimser senaryo: 1,00 - 1,02 ABD doları (sınır ötesi işlemlerde yaygın kullanım varsayımıyla)

- Dönüştürücü senaryo: 1,00 - 1,03 ABD doları (USDP'nin küresel finansın lider stablecoin'i olması halinde)

- 2030-12-31: USDP 1,01 ABD doları (yüksek talep nedeniyle endekste hafif prim oluşması)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. USDP Profesyonel Yatırım Stratejileri ve Risk Yönetimi

USDP Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Değerini korumak isteyen temkinli yatırımcılar

- Uygulama önerileri:

- Portföyün belirli bir bölümünü USDP'ye ve nakit benzerlerine ayırın

- USDP'nin ABD doları rezerviyle desteklenmesini düzenli olarak kontrol edin

- USDP'yi güvenli donanım cüzdanlarında veya saklama hizmetlerinde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Fiyat grafikleri: USDP/USD fiyat istikrarını izleyin

- Hacim göstergeleri: İşlem hacmini ve likiditeyi takip edin

- Alım-satımda dikkat edilmesi gerekenler:

- Borsalar arası arbitraj fırsatlarını değerlendirin

- USDP'nin statüsünü etkileyebilecek regülasyon haberlerini izleyin

USDP Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Nakit varlıkların %5-10'u

- Orta düzey yatırımcılar: Nakit varlıkların %10-20'si

- Profesyonel yatırımcılar: Nakit varlıkların %20-30'u

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Varlıkları farklı stablecoin'ler arasında dağıtmak

- Sigorta: Kripto varlık sigorta ürünlerini değerlendirmek

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Büyük varlıklar için donanım cüzdanı tercih edin

- Güvenlik önlemleri: Çoklu imza cüzdanları kullanın, 2FA etkinleştirin

V. USDP İçin Potansiyel Riskler ve Zorluklar

USDP Piyasa Riskleri

- Likidite riski: Büyük ölçekli geri ödemelerde yaşanabilecek güçlükler

- Rekabet riski: Diğer stablecoin'lerin artan rekabeti

- Endeks kaybı riski: ABD doları ile 1:1 endeksin geçici olarak bozulması

USDP Regülasyon Riskleri

- Uyum riski: Stablecoin regülasyonlarındaki değişiklikler

- Denetim riski: Rezerv denetimlerinde çıkabilecek olası sorunlar

- Hukuki risk: Paxos'a karşı açılabilecek davalar veya regülasyon işlemleri

USDP Teknik Riskleri

- Akıllı kontrat riski: Token kontratında potansiyel açıklar

- Blokzincir riski: Ethereum ağında tıkanıklık veya teknik problemler

- Siber güvenlik riski: Paxos altyapısına yönelik siber saldırılar

VI. Sonuç ve Eylem Önerileri

USDP Yatırım Değeri Değerlendirmesi

USDP, güçlü teminat ve regülasyon avantajıyla istikrarlı bir stablecoin seçeneği sunar. Ancak, yatırımcılar değişen stablecoin ortamında karşılaşılabilecek regülasyon ve piyasa risklerinin bilincinde olmalıdır.

USDP Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Düşük riskli ve küçük çaplı kripto varlık yatırımı için USDP'yi değerlendirin ✅ Deneyimli yatırımcılar: Portföyünüzde istikrar ve likidite sağlamak için USDP kullanın ✅ Kurumsal yatırımcılar: Hazine yönetimi ve işlem çiftlerinde USDP'nin rolünü değerlendirin

USDP'ye Katılım Yöntemleri

- Doğrudan satın alma: Gate.com üzerinden USDP alabilirsiniz

- İşlem çiftleri: Borsalarda USDP işlem çiftlerini kullanın

- DeFi uygulamaları: Merkeziyetsiz finans protokollerinde USDP kullanın

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi içermez. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermelidir. Profesyonel finansal danışmanlara danışmanız tavsiye edilir. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

USDC her zaman 1 ABD doları olacak mı?

USDC'nin 1 ABD doları değerini koruma hedefi olsa da bu garanti değildir. İstikrarı, ihraççısının finansal sağlığı ve piyasa koşullarına bağlıdır.

XRP, 2025'te 100 ABD dolarına ulaşabilir mi?

Mevcut piyasa analizlerine göre, XRP'nin 2025'te 100 ABD dolarına ulaşması beklenmemektedir. Tahminler, 2,31-2,60 ABD doları arasında daha mütevazı bir fiyat aralığına işaret etmekte olup, bu dönemde XRP için temkinli bir düşüş eğilimi öngörülmektedir.

USDP bir stablecoin midir?

Evet, USDP ABD dolarına endeksli, Paxos tarafından ihraç edilen ve New York Eyaleti Finansal Hizmetler Departmanı tarafından regüle edilen bir stablecoin'dir.

USDT'nin yükselmesi bekleniyor mu?

USDT, önemli piyasa olaylarına bağlı olarak kısa vadede hafif bir artış gösterebilir. Ancak, mevcut veriler sınırlı olduğundan uzun vadeli öngörüler belirsizliğini korumaktadır.

USDC Ne Kadar Sıklıkla Faiz Öder? Bilmeniz Gereken Her Şey

2025 USDC Fiyat Tahmini: Stablecoin İstikrarı ve Piyasa Trendlerinin Analizi

GUSD nasıl alınır: Stablecoin yatırımı için yeni bir seçenek

USDC faizi nasıl işler?

USDCoin (USDC) iyi bir yatırım mı?: Stablecoin yatırımının avantajlarını ve dezavantajlarını değerlendirmek

2025 USDC Fiyat Tahmini: Piyasa Dalgalanmaları Karşısında İstikrar mı, Yoksa Sabitlikten Sapma Riski mi?

Blockchain Node İşlevselliğini Anlamak: Yeni Başlayanlar İçin Rehber

Taproot teknolojisini destekleyen en güvenli Bitcoin cüzdanları

Ethereum İşlem Maliyetlerinin Yapısını Kavramak ve Bunları Azaltma Yöntemleri

Bulut madenciliğinin işleyişini kavramak

Polygon Ağı’nı Kripto Cüzdanınızla Entegre Etme Kılavuzu