2025 SUN Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Asset

Introduction: SUN's Market Position and Investment Value

SUN (SUN), as a pioneering integrated platform for stable coin exchange, token mining, and autonomous governance on the TRON network, has made significant strides since its inception in 2021. As of 2025, SUN's market capitalization has reached $449,549,028, with a circulating supply of approximately 19,170,534,274 tokens, and a price hovering around $0.02345. This asset, often referred to as the "DeFi Powerhouse on TRON," is playing an increasingly crucial role in decentralized finance and community-driven governance.

This article will provide a comprehensive analysis of SUN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SUN Price History Review and Current Market Status

SUN Historical Price Evolution

- 2020: SUN launched, price reached all-time high of $66.45 on September 11

- 2021: Token split implemented on May 26, 1 SUNOLD = 1000 SUN

- 2022: Bear market, price dropped to all-time low of $0.00462303 on November 14

SUN Current Market Situation

As of October 17, 2025, SUN is trading at $0.02345, ranking 170th by market capitalization. The token has seen a 24-hour decline of 2%, with a trading volume of $400,349. SUN's market cap stands at $449,549,028, representing 0.011% of the total crypto market. The circulating supply is 19,170,534,274 SUN, which is 96.33% of the total supply. Over the past year, SUN has shown resilience with a 24.9% price increase, despite recent short-term volatility.

Click to view the current SUN market price

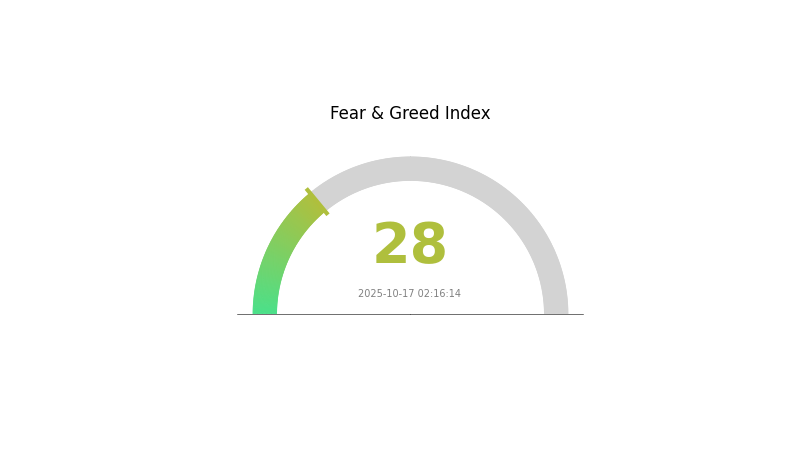

SUN Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is showing signs of apprehension today, with the Fear and Greed Index registering at 28, indicating a state of Fear. This suggests investors are becoming more cautious and risk-averse. During such periods, some traders may see it as a potential buying opportunity, adhering to the contrarian approach of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions.

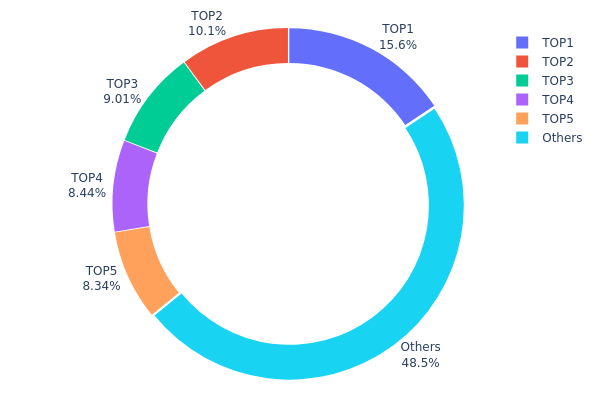

SUN Holdings Distribution

The address holdings distribution data for SUN reveals a significant concentration of tokens among a small number of addresses. The top 5 addresses collectively hold 51.5% of the total SUN supply, with the largest single address controlling 15.63%. This level of concentration indicates a relatively centralized ownership structure, which could have implications for market dynamics and token governance.

Such a concentrated distribution may lead to increased price volatility and susceptibility to large-scale market movements initiated by these major holders. The presence of a few dominant addresses also raises concerns about potential market manipulation or coordinated actions that could significantly impact SUN's price and liquidity. However, it's worth noting that 48.5% of the supply is distributed among other addresses, suggesting some level of broader participation in the SUN ecosystem.

This holdings structure reflects a market with a mix of large institutional or early investors and a more diverse base of smaller holders. While this configuration may provide some stability through the commitment of major stakeholders, it also underscores the importance of monitoring these large addresses for any significant changes in their holdings, as such movements could serve as leading indicators for market trends or shifts in SUN's underlying fundamentals.

Click to view the current SUN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | TScVwV...NbzmUL | 3111713.86K | 15.63% |

| 2 | TT2T17...EWkU9N | 2009954.75K | 10.09% |

| 3 | TXomXp...amFX9t | 1793482.38K | 9.01% |

| 4 | TWadTq...hue7uE | 1679832.85K | 8.44% |

| 5 | TQiXPT...MLrxnM | 1659259.31K | 8.33% |

| - | Others | 9646486.85K | 48.5% |

II. Key Factors Affecting SUN's Future Price

Supply Mechanism

- Permanent Buyback Program: Justin Sun announced a permanent buyback agreement for SUN, which could potentially reduce the circulating supply over time.

- Current Impact: The announcement of the buyback program led to a significant price surge of over 22% in a single day, demonstrating its immediate impact on market sentiment.

Institutional and Whale Dynamics

- Market Sentiment: Gate.com's market sentiment indicator currently rates SUN as "neutral," reflecting a cautious short-term outlook following significant price volatility.

Macroeconomic Environment

- Inflation Hedging Properties: As with many cryptocurrencies, SUN's performance in inflationary environments may be a factor for investors to consider.

- Geopolitical Factors: International trade agreements and tariff negotiations could indirectly affect the cryptocurrency market, including SUN.

Technical Development and Ecosystem Building

- Ecosystem Applications: The growth and development of DApps and ecosystem projects within the SUN network could influence its future price trajectory.

III. SUN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01595 - $0.02345

- Neutral prediction: $0.02345 - $0.02509

- Optimistic prediction: $0.02509 - $0.03000 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.01464 - $0.02984

- 2028: $0.01479 - $0.04321

- Key catalysts: Technological advancements, wider cryptocurrency adoption, and favorable regulatory environment

2029-2030 Long-term Outlook

- Base scenario: $0.03610 - $0.04423 (assuming steady market growth and adoption)

- Optimistic scenario: $0.05235 - $0.06015 (assuming strong market performance and increased utility)

- Transformative scenario: $0.06500 - $0.07500 (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: SUN $0.06015 (potential peak price for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02509 | 0.02345 | 0.01595 | 0 |

| 2026 | 0.03204 | 0.02427 | 0.01869 | 3 |

| 2027 | 0.02984 | 0.02815 | 0.01464 | 19 |

| 2028 | 0.04321 | 0.029 | 0.01479 | 23 |

| 2029 | 0.05235 | 0.0361 | 0.03358 | 53 |

| 2030 | 0.06015 | 0.04423 | 0.02875 | 88 |

IV. Professional Investment Strategies and Risk Management for SUN

SUN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate SUN tokens during market dips

- Stake SUN tokens for additional yield

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend identification

- RSI: Use overbought/oversold levels for entry and exit points

- Key points for swing trading:

- Set strict stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

SUN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Use of stablecoins: Partially convert to stablecoins during high volatility periods

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Transfer to a hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SUN

SUN Market Risks

- High volatility: SUN price can experience significant fluctuations

- Liquidity risk: Potential difficulties in large-volume trades

- Competition: Emerging DeFi platforms may impact SUN's market share

SUN Regulatory Risks

- Uncertain regulatory environment: Potential for stricter DeFi regulations

- Cross-border compliance: Varying legal status across different jurisdictions

- Tax implications: Evolving tax laws for DeFi transactions and yields

SUN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability challenges: Network congestion during high-demand periods

- Interoperability issues: Compatibility with other blockchain networks

VI. Conclusion and Action Recommendations

SUN Investment Value Assessment

SUN offers potential in the growing DeFi sector but carries significant risks due to market volatility and regulatory uncertainties. Long-term value depends on continued platform development and user adoption.

SUN Investment Recommendations

✅ Beginners: Start with small, manageable investments; focus on learning the platform ✅ Experienced investors: Consider a balanced approach with both staking and trading ✅ Institutional investors: Conduct thorough due diligence; consider SUN as part of a diversified DeFi portfolio

SUN Trading Participation Methods

- Spot trading: Buy and sell SUN tokens on Gate.com

- Staking: Participate in SUN's staking programs for passive income

- Liquidity provision: Contribute to liquidity pools for additional yields

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the sun prediction for 2025?

Based on astrological forecasts, the sun in 2025 may bring significant career opportunities and positive changes in love life for many zodiac signs. Specific predictions vary by sign.

What is the price prediction for Sun crypto in 2030?

Based on technical analysis, the price prediction for Sun crypto in 2030 is $0.018083. This forecast suggests potential growth for Sun in the long term.

What is the price prediction for Sol 2025?

Based on current trends and expert forecasts, Solana (SOL) is predicted to reach around $482 by 2025, driven by its growing adoption and technological advancements in the blockchain space.

What is the price prediction for Sun stock?

By 2030, SUN stock is predicted to reach $0.03186. Forecasts for 2025-2029 are not available.

2025 JST Price Prediction: Analyzing Future Market Trends and Growth Potential for JUST Token

STRIKE vs TRX: Which Resistance Training System Offers Better Results for Home Workouts?

Is Just (JST) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is SUN (SUN) a good investment?: Analyzing the potential and risks of this cryptocurrency in the current market

LEMD vs TRX: Comparing Effectiveness of Two Popular Core Strengthening Systems

Is JackPool (JFI) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?