2025 STORM Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Introduction: STORM's Market Position and Investment Value

Storm Trade (STORM), as a social-first derivatives platform on Telegram, has made significant strides since its inception. As of 2025, STORM's market capitalization has reached $594,024, with a circulating supply of approximately 46,619,408 tokens, and a price hovering around $0.012742. This asset, known as the "Telegram-integrated trading token," is playing an increasingly crucial role in facilitating cryptocurrency, forex, equity, and commodity trading on the TON blockchain.

This article will comprehensively analyze STORM's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. STORM Price History Review and Current Market Status

STORM Historical Price Evolution

- 2024: Project launched, price reached all-time high of $0.056522 on December 5th

- 2025: Market correction, price dropped to all-time low of $0.008165 on October 10th

STORM Current Market Situation

As of October 30, 2025, STORM is trading at $0.012742. The token has experienced a 17.73% increase over the past week, suggesting a short-term bullish trend. However, the broader picture remains bearish, with a 23.86% decline over the past month and a significant 56.81% drop over the past year.

The current price represents a 77.47% decrease from its all-time high and a 56.06% increase from its all-time low. With a market capitalization of $594,024, STORM ranks 3295th in the cryptocurrency market. The token's 24-hour trading volume stands at $46,533.81, indicating moderate market activity.

STORM's circulating supply is 46,619,408 tokens, which is only 4.66% of its total supply of 1,000,000,000. This low circulation ratio suggests potential for increased supply in the future, which could impact price dynamics.

The market sentiment for cryptocurrencies is currently cautious, with the VIX index at 34, indicating a "Fear" state in the market. This broader market sentiment may be influencing STORM's price performance.

Click to view current STORM market price

Here's the content in English as requested:

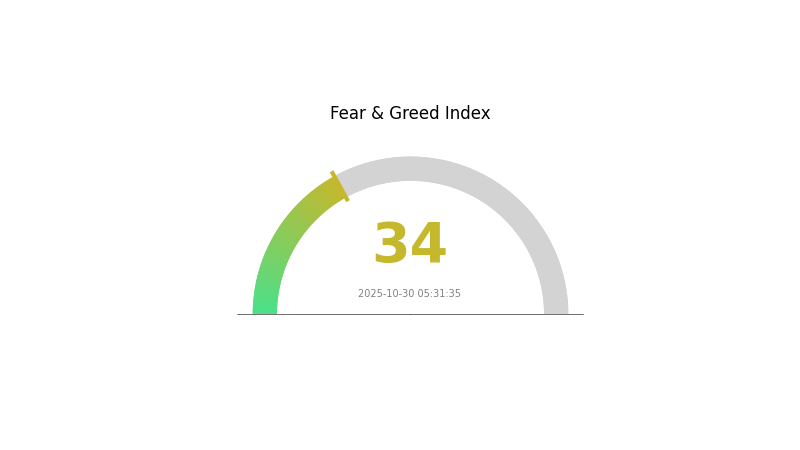

STORM Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a fearful sentiment, with the Fear and Greed Index standing at 34. This indicates a cautious approach among investors, potentially signaling undervalued market conditions. During such periods, savvy traders often view it as an opportunity to accumulate assets, adhering to the principle of "buy when there's blood in the streets." However, it's crucial to conduct thorough research and exercise prudence in investment decisions, as market sentiment can shift rapidly in the volatile crypto landscape.

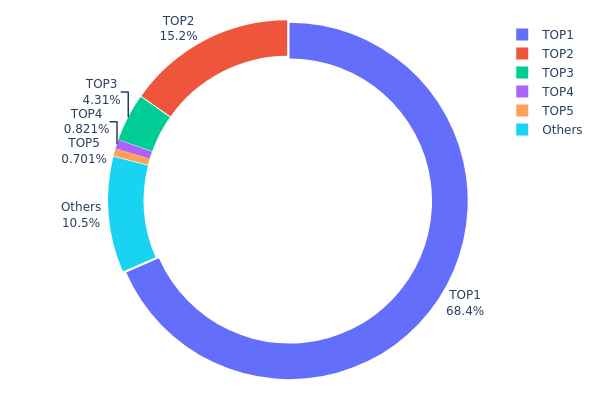

STORM Holdings Distribution

The address holdings distribution data for STORM reveals a highly concentrated ownership structure. The top address holds a staggering 68.43% of the total supply, while the second-largest holder accounts for 15.24%. This extreme concentration raises concerns about potential market manipulation and price volatility.

With the top five addresses controlling 89.5% of STORM tokens, the cryptocurrency exhibits a centralized distribution pattern. This concentration may lead to increased market instability, as large holders have the power to significantly influence price movements through their trading activities. Moreover, such a distribution structure could potentially undermine the principles of decentralization that many cryptocurrencies aim to achieve.

The current address distribution suggests a high risk of market manipulation and reduced liquidity for smaller traders. It also indicates that STORM's on-chain structure may be less stable than desired, potentially impacting its long-term sustainability and adoption as a decentralized asset.

Click to view the current STORM holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQBDMz...0BasXR | 684338.62K | 68.43% |

| 2 | EQDaC-...VNUdik | 152448.79K | 15.24% |

| 3 | EQByAD...JNJGx6 | 43130.69K | 4.31% |

| 4 | UQCmGW...FslyH3 | 8211.38K | 0.82% |

| 5 | UQAbhM...0d1t87 | 7010.74K | 0.70% |

| - | Others | 104859.16K | 10.5% |

II. Key Factors Affecting STORM's Future Price

Supply Mechanism

- Historical patterns: Past supply changes have influenced price movements

- Current impact: Expected effects of the latest supply changes on price

Institutional and Whale Dynamics

- Enterprise adoption: Notable companies adopting STORM

Macroeconomic Environment

- Inflation hedging properties: Performance in inflationary environments

- Geopolitical factors: Impact of international situations

Technical Development and Ecosystem Building

- Ecosystem applications: Major DApps/ecosystem projects

III. STORM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00829 - $0.01256

- Neutral prediction: $0.01256 - $0.01507

- Optimistic prediction: $0.01507 - $0.01758 (requires favorable market conditions)

2026-2028 Outlook

- Market phase expectation: Gradual growth and stabilization

- Price range forecast:

- 2026: $0.00829 - $0.01959

- 2027: $0.013 - $0.02149

- 2028: $0.01048 - $0.02504

- Key catalysts: Increased adoption, technological advancements, and market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.01333 - $0.02745 (assuming steady market growth)

- Optimistic scenario: $0.02745 - $0.0398 (assuming strong market performance)

- Transformative scenario: $0.0398+ (under extremely favorable conditions)

- 2030-12-31: STORM $0.0398 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01758 | 0.01256 | 0.00829 | -1 |

| 2026 | 0.01959 | 0.01507 | 0.00829 | 18 |

| 2027 | 0.02149 | 0.01733 | 0.013 | 36 |

| 2028 | 0.02504 | 0.01941 | 0.01048 | 52 |

| 2029 | 0.03267 | 0.02222 | 0.01333 | 74 |

| 2030 | 0.0398 | 0.02745 | 0.01482 | 115 |

IV. Professional Investment Strategies and Risk Management for STORM

STORM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate STORM during market dips

- Set price alerts for significant price movements

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Swing trading key points:

- Follow the overall market trend of TON ecosystem

- Set stop-loss orders to manage downside risk

STORM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple TON-based projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting TON blockchain

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for STORM

STORM Market Risks

- High volatility: Prices can fluctuate dramatically in short periods

- Limited liquidity: May face challenges in executing large trades

- Correlation with TON: Performance heavily tied to TON ecosystem growth

STORM Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on TON-based projects

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

STORM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Scalability challenges: Dependent on TON blockchain's ability to handle increased adoption

- Integration risks: Reliance on successful integration with Telegram and @wallet

VI. Conclusion and Action Recommendations

STORM Investment Value Assessment

STORM presents a high-risk, high-potential opportunity within the TON ecosystem. Its integration with Telegram offers unique value, but investors should be prepared for significant volatility and regulatory uncertainties.

STORM Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Conduct comprehensive due diligence and consider as part of a diversified crypto portfolio

STORM Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- DeFi participation: Explore liquidity provision or yield farming opportunities if available

- OTC trading: Consider for large volume transactions to minimize slippage

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can StormX reach $1?

Yes, StormX reaching $1 is possible. Market trends and adoption rates suggest this price target is achievable in the future, given favorable conditions and continued growth in the crypto space.

Which crypto boom in 2025 prediction?

In 2025, crypto boom predictions include major IPOs, Coinbase joining S&P 500, $50B in tokenized assets, and crypto integration in 401(k) plans.

Why is STMx pumping?

STMx is pumping due to a breakout from a long-term resistance trendline, signaling strong bullish momentum and attracting new investors.

What crypto has the highest price prediction?

Bitcoin is often predicted to have the highest price due to its market dominance and widespread adoption. Analysts frequently project substantial long-term growth for Bitcoin's value.

GG3 Project Analysis: Whitepaper Logic, Use Cases, and Technical Innovation

How to See What Whales are Buying in Crypto Market

Why Dexscreener Has Become a Must-Have Tool for DeFi Traders

How Will DASH Price Volatility Evolve in 2025?

Spot Wallet Description: How it works and why every trader needs one.

What is MA: Understanding the Basics of Moving Averages in Technical Analysis

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?