2025 SNIFT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SNIFT's Market Position and Investment Value

StarryNift (SNIFT), a premier AI-powered co-creation platform that transforms virtual experiences through AI SDK infrastructure, has established itself as an innovative player in the digital asset ecosystem. As of January 2026, SNIFT boasts a market capitalization of $52,019.70 with a circulating supply of approximately 127.81 million tokens, currently trading at $0.000407. This emerging digital asset is playing an increasingly significant role in the virtual experience and decentralized identity development sectors, enabling users to play games, create content, engage in social interactions, develop DIDs, and earn rewards immersively.

This article will provide a comprehensive analysis of SNIFT's price trajectory through 2026-2031, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

SNIFT (StarryNift) Market Analysis Report

I. SNIFT Price History Review and Current Market Status

SNIFT Historical Price Evolution Trajectory

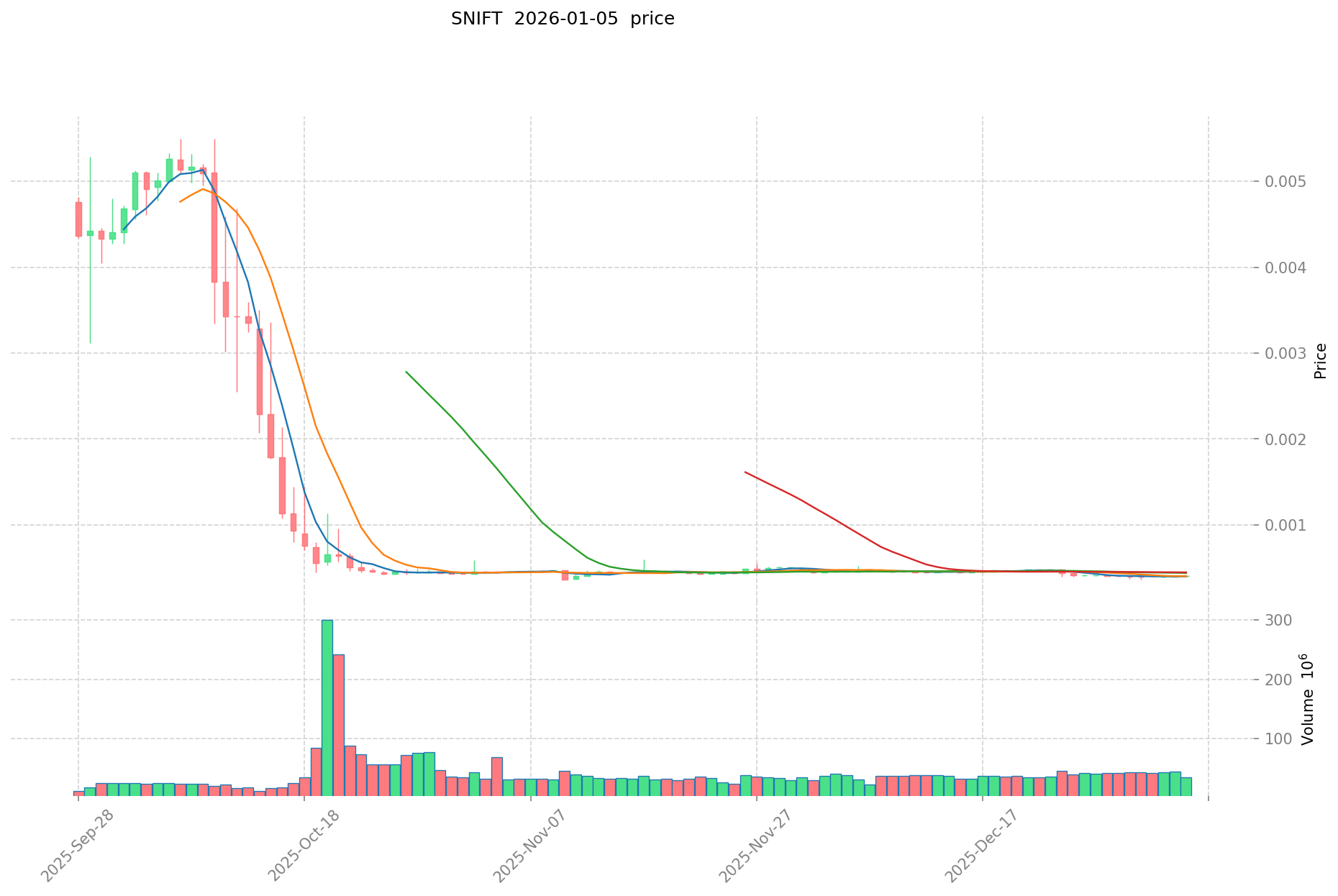

- September 2024: Project launch with initial momentum, reaching an all-time high of $0.13 on September 26, 2024.

- October 2024 - January 2026: Extended downtrend period, with the token experiencing significant depreciation from its peak, declining approximately 99.09% over the one-year period.

- November 2025: Price reached an all-time low of $0.0003608 on November 11, 2025, marking the lowest point in the token's trading history.

SNIFT Current Market Status

As of January 5, 2026, SNIFT is trading at $0.000407 with a 24-hour trading volume of $14,029.94. The token demonstrates modest short-term volatility, with a 24-hour price increase of 1.44%, while maintaining slight downward pressure over longer timeframes (7-day: -0.37%, 30-day: -10.78%).

The token's market capitalization stands at approximately $52,019.70, with a fully diluted valuation of $407,000.00, reflecting a circulating supply of 127,812,520 SNIFT out of a total supply of 1,000,000,000 tokens. The token maintains a market share of 0.000012% within the broader cryptocurrency market. With 82,177 active holders, SNIFT demonstrates a distributed holder base across the Binance Smart Chain (BSC) network.

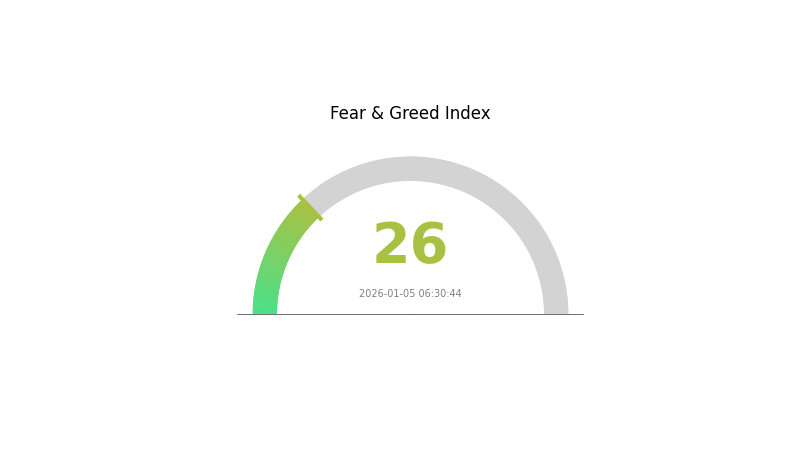

Current market sentiment reflects heightened fear conditions (VIX: 26), contributing to broader market caution and uncertainty.

Click to view current SNIFT market price

SNIFT Market Sentiment Index

2026-01-05 Fear and Greed Index: 26 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fearful sentiment with an index reading of 26. This indicates elevated market anxiety and risk aversion among investors. During such periods, market volatility typically increases as participants adopt more cautious positions. This environment may present both challenges and opportunities - conservative investors might wait for clearer signals, while contrarian traders could identify potential buying opportunities at depressed prices. Monitoring the Fear and Greed Index on Gate.com helps traders better understand market psychology and make more informed decisions aligned with their risk tolerance and investment strategy.

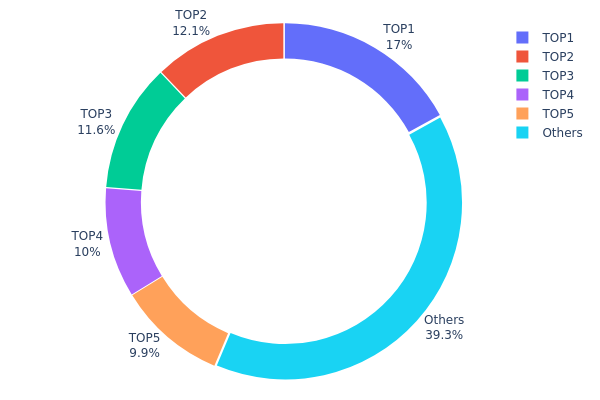

SNIFT Holding Distribution

The holding distribution chart illustrates the concentration of SNIFT tokens across blockchain addresses, revealing the decentralization level and potential market structure risks. By analyzing the top holders and their proportional stakes, we can assess token ownership concentration and its implications for market stability and governance dynamics.

The current distribution data indicates moderate concentration characteristics within the SNIFT ecosystem. The top five addresses collectively hold approximately 60.66% of circulating tokens, with the leading address commanding 17.00% of total holdings. While this level of concentration does suggest a degree of centralization risk, it remains distributed across multiple entities rather than concentrated in a single dominant wallet. The presence of a significant "dead" address holding 10.00% of tokens effectively removes this portion from active circulation, slightly reducing the practical concentration among active participants. The remaining 39.34% dispersed across other addresses demonstrates a reasonably fragmented distribution pattern, which provides some safeguard against extreme market manipulation scenarios.

The existing address distribution structure reveals important implications for market microstructure and price discovery mechanisms. With the top holder representing approximately one-sixth of total supply, there exists meaningful potential for substantial single-entity influence over price movements and market sentiment. However, the diversification across the top five addresses and the substantial tail of smaller holders suggests that coordinated manipulation would require consensus among multiple stakeholders. This fragmented ownership structure generally enhances market resilience by distributing decision-making power, though ongoing monitoring of address accumulation patterns remains essential for identifying potential consolidation trends that could elevate systemic risks.

Click to view current SNIFT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4982...6e89cb | 170085.66K | 17.00% |

| 2 | 0x710b...7abe33 | 121222.00K | 12.12% |

| 3 | 0xeabb...388281 | 116462.50K | 11.64% |

| 4 | 0x0000...00dead | 100000.01K | 10.00% |

| 5 | 0x798e...a97b68 | 99000.00K | 9.90% |

| - | Others | 393229.83K | 39.34% |

II. Core Factors Influencing SNIFT's Future Price

Macroeconomic Environment

-

Federal Reserve Monetary Policy Impact: Market expectations anticipate the Federal Reserve will continue its rate-cutting cycle through 2025. The current easing cycle remains in its early stages, which could increase investment demand and support asset prices including cryptocurrencies. However, in the second half of 2025, if U.S. economic expectations rise, real interest rates on Treasury bonds may increase, potentially creating downward pressure on risk assets.

-

Geopolitical Factors: Global geopolitical complexity, including tensions in the Middle East and East Asia, has heightened risk aversion sentiment among investors. While near-term geopolitical tensions support safe-haven demand, potential easing of conflicts under new policy directions could create medium-term headwinds for risk assets. Additionally, the incoming U.S. administration's "America First" policy may create trade friction and currency system challenges, affecting global market dynamics.

-

Market Sentiment and Risk Appetite: SNIFT's price movements are significantly influenced by market sentiment dynamics. Optimistic sentiment and "greed" can drive bullish predictions, while fear or negative news can trigger bearish outlooks. Market sentiment analysis combined with on-chain indicators provides crucial insight into price trajectory. Cryptocurrency prices are subject to dramatic volatility influenced by market sentiment, macroeconomic conditions, news events, and regulatory developments.

III. 2026-2031 SNIFT Price Forecast

2026 Outlook

- Conservative Forecast: $0.00030 - $0.00041

- Neutral Forecast: $0.00041

- Bullish Forecast: $0.00056 (requiring sustained market interest and ecosystem development)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual upward momentum, characterized by volatility stabilization and increased institutional attention.

- Price Range Forecast:

- 2027: $0.00045 - $0.00055 (19% potential upside)

- 2028: $0.00044 - $0.00070 (27% potential upside)

- 2029: $0.00050 - $0.00081 (50% potential upside)

- Key Catalysts: Enhanced protocol functionality, expanded partnership ecosystem, increased adoption on Gate.com and other platforms, and improved market sentiment within the altcoin segment.

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00042 - $0.00106 (75% upside by 2030, based on moderate adoption acceleration and stable macroeconomic conditions)

- Bullish Scenario: $0.00082 - $0.00128 (117% upside by 2031, assuming significant utility expansion and mainstream recognition)

- Transformative Scenario: $0.00128+ (substantial outperformance contingent on breakthrough technological innovation, major institutional adoption, and favorable regulatory environment)

- 2031-12-31: SNIFT trading near $0.00128 (peak forecast value achieved under favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00056 | 0.00041 | 0.0003 | 0 |

| 2027 | 0.00055 | 0.00048 | 0.00045 | 19 |

| 2028 | 0.0007 | 0.00052 | 0.00044 | 27 |

| 2029 | 0.00081 | 0.00061 | 0.0005 | 50 |

| 2030 | 0.00106 | 0.00071 | 0.00042 | 75 |

| 2031 | 0.00128 | 0.00089 | 0.00082 | 117 |

StarryNift (SNIFT) Investment Strategy and Risk Management Report

IV. SNIFT Professional Investment Strategy and Risk Management

SNIFT Investment Methodology

(1) Long-Term Holding Strategy

- Suitable For: Conservative investors seeking exposure to AI-powered virtual experience platforms with long-term growth potential

- Operation Recommendations:

- Establish a core position during market corrections when SNIFT trades below $0.0005, given its current price of $0.000407

- Implement dollar-cost averaging (DCA) over 6-12 months to reduce timing risk and volatility impact

- Hold positions for a minimum of 12-24 months to capture potential platform adoption cycles and ecosystem development

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Use 50-day and 200-day MAs to identify trend direction; buy when price is above both MAs, sell when price breaks below

- Relative Strength Index (RSI): Monitor RSI levels; consider accumulation when RSI falls below 30 (oversold), take profits when RSI exceeds 70 (overbought)

- Wave Operation Key Points:

- Monitor the $0.0003956-$0.0004144 trading range established in the past 24 hours for intraday opportunities

- Set profit targets at 15-25% above entry points given SNIFT's volatility profile

- Place stop losses at 8-10% below entry to manage downside risk in this volatile asset class

SNIFT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio

- Active Investors: 1-3% of portfolio

- Professional Investors: 3-5% of portfolio

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SNIFT holdings with stablecoin positions (USDT, USDC) to reduce overall portfolio volatility

- Partial Profit Taking: Sell 20-30% of holdings at 50% gains and reinvest proceeds into lower-risk assets

(3) Secure Storage Solutions

- Hot Wallet Strategy: For frequent trading, use Gate.com's built-in wallet for accessibility and quick execution

- Cold Storage Plan: For long-term holdings exceeding 12 months, transfer SNIFT to a secure hardware wallet to minimize smart contract and exchange risks

- Security Best Practices: Never share private keys or seed phrases; enable two-factor authentication (2FA) on all exchange accounts; regularly verify contract addresses on BSCscan before transactions

V. SNIFT Potential Risks and Challenges

SNIFT Market Risks

- Extreme Volatility: SNIFT has experienced a -99.09% decline over the past year, indicating severe price instability and potential for significant losses

- Liquidity Risk: With a 24-hour trading volume of only $14,029.94 against a market cap of $52,019.70, liquidity is extremely limited, making it difficult to execute large trades without significant slippage

- Low Trading Interest: Listed on only 4 exchanges with limited mainstream adoption, reducing accessibility and market depth

SNIFT Regulatory Risks

- Regulatory Uncertainty: AI-powered platforms operating in virtual spaces face evolving regulatory frameworks across different jurisdictions that could impact platform operations

- Decentralized Identity (DID) Compliance: Regulatory requirements for identity services vary by region and could create compliance challenges for cross-border users

- Gaming and Content Monetization Rules: Regulations governing virtual economies, NFTs, and content creator compensation remain in flux globally

SNIFT Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, the platform is exposed to potential smart contract bugs or security exploits

- Infrastructure Dependency: The platform's AI SDK infrastructure could face scalability challenges or technical failures that disrupt user experience

- AI Model Risks: Reliance on AI for core platform functions introduces risks from model bias, hallucinations, or unexpected behavior

VI. Conclusions and Action Recommendations

SNIFT Investment Value Assessment

StarryNift positions itself as an innovative AI-driven co-creation platform targeting virtual experiences, gaming, content creation, and decentralized identity development. However, the token presents significant challenges: a devastating -99.09% annual decline from its $0.13 all-time high, minimal market capitalization of $52,019.70, and extremely thin liquidity. While the underlying platform concept has merit in the growing Web3 entertainment space, SNIFT remains a highly speculative, micro-cap asset with substantial downside risk and unproven market adoption.

SNIFT Investment Recommendations

✅ Beginners: Start with minimal allocation (0.1-0.5% of portfolio) only if you can afford to lose the entire investment; focus on understanding the platform's roadmap and user adoption metrics before increasing exposure

✅ Experienced Investors: Consider 1-2% portfolio allocation using DCA strategies during significant drawdowns; actively monitor technical indicators and platform development milestones; maintain strict stop-loss disciplines

✅ Institutional Investors: Conduct thorough due diligence on the development team, technology audits, and competitive positioning before any meaningful allocation; require transparent governance structures and clear tokenomics implementation

SNIFT Trading Participation Methods

- Direct Purchase on Gate.com: Trade SNIFT directly against USDT pairs with full liquidity management tools available on the platform

- DCA Investment Programs: Set up recurring purchases on Gate.com to systematically accumulate positions over time and reduce timing risk

- Spot Trading and Leverage: Advanced users may utilize Gate.com's spot trading features for active management; leverage trading should only be used by experienced traders with strict risk controls

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Always consult with a professional financial advisor before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

What is SNIFT? What are its uses and characteristics?

SNIFT is the functional token within the StarryNift ecosystem, designed for governance, trading, and rewards. Users can earn SNIFT by completing tasks and participating in community activities, enabling decentralized governance and ecosystem incentives.

What are the main factors that affect the price trend of SNIFT tokens?

SNIFT token price is primarily influenced by market demand, regulatory policy changes, global economic conditions, trading volume, and market adoption rates. Regulatory developments and institutional interest significantly impact price movements.

How to conduct SNIFT price prediction? What are the analysis methods?

SNIFT price prediction uses technical analysis methods including RSI and Stoch RSI indicators, combined with market trend analysis. Based on current analysis, SNIFT may reach $0.009681 by 2032, with predictions ranging from $0.000249 to $0.001553.

What are the risks of SNIFT price prediction? How should I mitigate them?

SNIFT price predictions face market volatility and regulatory changes. Mitigate risks through thorough research, diversified investments, and monitoring policy developments closely for informed decision-making.

SNIFT与其他类似代币相比,投资前景如何?

SNIFT具有独特的市场定位和创新机制。相比同类代币,其交易额增长势头强劲,生态应用场景不断扩展,社区活跃度高。2026年有望成为加密资产重要选手,投资前景看好。

Where can I check SNIFT's real-time price and historical data?

You can view SNIFT's real-time price and historical data on Bitget, CoinMarketCap, and CoinGecko. These platforms provide comprehensive price charts, trading volume, and market trend information for tracking SNIFT performance.

2025 FAR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 DUEL Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 VIRTUAL Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 SKAI Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 NRN Price Prediction: Analyzing Market Trends and Potential Growth Factors

How Does Competitor Analysis Impact Crypto Market Share in 2025?

Is Bitcoin Dead? The Truth About Bitcoin's Survival

Bull and Bear Markets: What They Are and How They Differ

What is cross margin

The Difference Between the 2025 and 2021 Crypto Bull Runs

How to get free bitcoins