2025 SLC Price Prediction: Analyzing Market Trends and Expert Forecasts for the Future of Solana

Introduction: SLC's Market Position and Investment Value

Silencio Network (SLC), as a pioneering platform in noise intelligence, has made significant strides since its inception. As of 2025, SLC's market capitalization has reached $1,459,689.56, with a circulating supply of approximately 13,082,000,000 tokens, and a price hovering around $0.00011158. This asset, dubbed the "Noise Intelligence Token," is playing an increasingly crucial role in real estate, travel, and urban planning sectors.

This article will comprehensively analyze SLC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SLC Price History Review and Current Market Status

SLC Historical Price Evolution Trajectory

- 2025: SLC reached its all-time high of $0.000916 on January 24, marking a significant milestone for the project

- 2025: The token experienced a sharp decline, hitting its all-time low of $0.00007979 on May 6

- 2025: Market volatility continued throughout the year, with the price fluctuating between these extremes

SLC Current Market Situation

As of November 25, 2025, SLC is trading at $0.00011158. The token has seen a slight decrease of 0.41% in the last 24 hours, with a trading volume of $10,684.20. SLC's market capitalization stands at $1,459,689.56, ranking it at 2373 in the global cryptocurrency market.

The token is currently experiencing a bearish trend across various timeframes. While it has shown a marginal increase of 0.027% in the past hour, it has declined by 10.31% over the last week and a substantial 53.26% over the past month. The most significant drop is observed in the yearly performance, with a 90.10% decrease from its price a year ago.

The current circulating supply of SLC is 13,082,000,000 tokens, which represents 13.08% of its total supply of 100,000,000,000. The fully diluted valuation of the project is $11,158,000.

Click to view the current SLC market price

SLC Market Sentiment Index

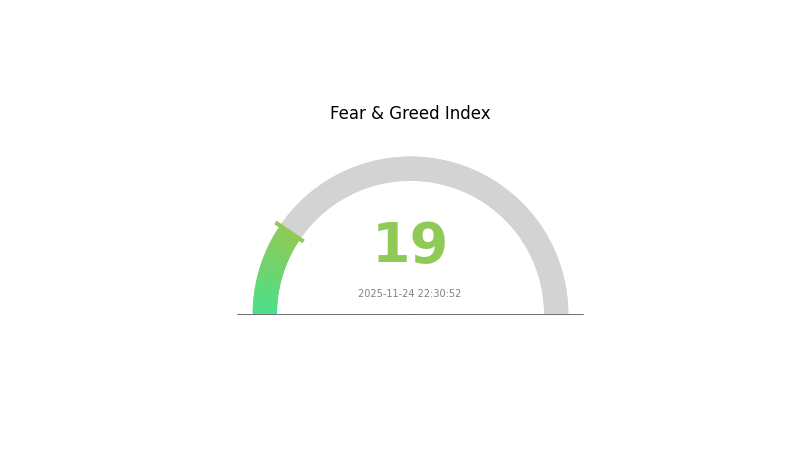

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 19. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider dollar-cost averaging and thorough research before making any decisions. Remember, market sentiment can shift rapidly, and it's crucial to stay informed and manage risk carefully in these uncertain times.

SLC Holdings Distribution

The address holdings distribution chart provides crucial insights into the concentration of SLC tokens among different addresses. Based on the provided data, it appears that the SLC token distribution is currently unavailable or incomplete, as no specific address holdings are listed.

Without detailed information on address holdings, it's challenging to assess the concentration characteristics of SLC accurately. A healthy distribution typically shows a balance between large holders and a diverse base of smaller holders. The absence of data could indicate various scenarios, such as a very new token, a highly decentralized distribution, or potential data collection issues.

This lack of visible concentration data makes it difficult to evaluate the potential impact on market structure, price volatility, or manipulation risks. It also limits our ability to draw conclusions about the token's decentralization level or on-chain structural stability. Further investigation and data collection would be necessary to provide a comprehensive analysis of SLC's market characteristics and holder distribution.

Click to view the current SLC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing Future SLC Prices

Supply Mechanism

- Market Supply and Demand: SLC NAND prices are heavily influenced by market supply and demand dynamics. Oversupply can lead to price drops, affecting company revenues and profits.

- Historical Patterns: The SLC NAND market has experienced complete cycles of upward and downward trends. From 2020 onwards, the industry has gone through a full cycle, with prices and profit margins potentially bottoming out in the current phase.

- Current Impact: After several quarters of price stability, the market now expects relatively flat pricing in the near future.

Macroeconomic Environment

- Industry Recovery: The storage industry is benefiting from a sector-wide recovery, driven by advanced technologies and emerging market applications.

- Market Growth Projections: Forecasts suggest the storage market size will increase by at least 42% in 2024. NAND Flash production is expected to exceed 800 billion GB equivalents, growing 20% year-over-year.

Technological Developments and Ecosystem Building

- AI-Driven Demand: The rapid development of AI is transforming data centers, driving new trends in power management and data protection solutions.

- Edge AI Applications: There's a growing trend towards edge AI applications, driven by the need for low-latency responses in areas like autonomous driving and industrial control, as well as privacy and data security considerations.

- Emerging Players: New entrants in the domestic storage sector, such as power management chip companies expanding into storage power solutions, are shaping the ecosystem.

III. SLC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00007 - $0.00009

- Neutral forecast: $0.00009 - $0.00013

- Optimistic forecast: $0.00013 - $0.00015 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.0001 - $0.00019

- 2028: $0.0001 - $0.0002

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00017 - $0.00019 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00019 - $0.00021 (with favorable market conditions and increased utility)

- Transformative scenario: $0.00021 - $0.00025 (with breakthrough developments and mass adoption)

- 2030-12-31: SLC $0.00021 (potential peak price for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00015 | 0.00011 | 0.00007 | 2 |

| 2026 | 0.00016 | 0.00013 | 0.00011 | 19 |

| 2027 | 0.00019 | 0.00015 | 0.0001 | 30 |

| 2028 | 0.0002 | 0.00017 | 0.0001 | 50 |

| 2029 | 0.0002 | 0.00018 | 0.00017 | 64 |

| 2030 | 0.00021 | 0.00019 | 0.00013 | 70 |

IV. Professional Investment Strategies and Risk Management for SLC

SLC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in the long-term potential of noise intelligence technology

- Operational suggestions:

- Accumulate SLC tokens during market dips

- Set price targets and stick to them

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor news and developments in the noise intelligence sector

- Set stop-loss orders to manage downside risk

SLC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, store private keys securely

V. Potential Risks and Challenges for SLC

SLC Market Risks

- High volatility: SLC price may experience significant fluctuations

- Limited liquidity: May face challenges in buying or selling large amounts

- Competition: Other projects may enter the noise intelligence space

SLC Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting crypto assets

- Data privacy concerns: Noise data collection may face scrutiny from regulators

- Cross-border compliance: Different regulations in various jurisdictions

SLC Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: May face issues as the network grows

- Dependency on smartphone technology: Reliance on user adoption and smartphone capabilities

VI. Conclusion and Action Recommendations

SLC Investment Value Assessment

SLC presents an innovative approach to noise pollution management with potential long-term value. However, it faces short-term risks due to market volatility and regulatory uncertainties.

SLC Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the project ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

SLC Trading Participation Methods

- Spot trading: Buy and sell SLC tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- Community engagement: Contribute to the Silencio network to earn rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for SLC token in 2025?

Based on long-term analysis, SLC token is predicted to trade between $0.0001170 and $0.0001675 in 2025.

What crypto will 1000x prediction?

Potential 1000x cryptos include Best Wallet Token ($BEST) and SUBBD Token ($SUBBD). These projects focus on market growth and development, with presales offering early investment opportunities for maximum gains.

Can smooth love potion reach $1?

While possible, it's unlikely in the near term. SLP's all-time high was $0.4191 in 2023, and it remains below that in 2025.

Can Solana reach $1000 in 2025?

Yes, Solana reached $1000 in 2025. Strong adoption, significant investments, and network growth fueled its price surge during the bull run.

Share

Content