2025 SKAI Price Prediction: Expert Analysis and Market Outlook for the Emerging Cryptocurrency Token

Introduction: Market Position and Investment Value of SKAI

Skillful AI (SKAI) represents a pioneering platform transitioning from basic chatbots to advanced virtual assistants and customized AI solutions. Since its launch in 2024, the project has established itself as an innovative ecosystem empowering individuals through personalized AI technology. As of January 2026, SKAI maintains a market capitalization of approximately $874,500 with a circulating supply of around 113.37 million tokens, currently trading at $0.0008745. This blockchain-powered AI assistant ecosystem is gaining recognition as a gateway to harnessing AI benefits while maintaining decentralized governance and developer-friendly monetization opportunities.

This article will provide a comprehensive analysis of SKAI's price trajectories and market dynamics, examining historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment guidance for the 2026-2031 period.

Skillful AI (SKAI) Market Analysis Report

I. SKAI Price History Review and Current Market Status

SKAI Historical Price Evolution

-

June 2024: SKAI reached its all-time high of $0.25 on June 9, 2024, marking the peak of the token's price performance since launch.

-

December 2024 - January 2026: SKAI experienced a significant downturn, declining approximately 98.01% from its historical peak, reaching an all-time low of $0.000784 on December 25, 2025.

SKAI Current Market Conditions

As of January 3, 2026, SKAI is trading at $0.0008745, reflecting a 24-hour price change of +5.18%. The token demonstrates modest short-term recovery momentum, with a 1-hour change of +0.22% and a 7-day change of +3.15%. However, the 30-day performance shows a decline of -28.81%, indicating ongoing downward pressure in the medium term.

Key Market Metrics:

- Market Capitalization: $99,142.20

- Fully Diluted Valuation (FDV): $874,500.00

- 24-Hour Trading Volume: $11,936.20

- Circulating Supply: 113,370,157.66 SKAI (11.34% of total supply)

- Total Supply: 1,000,000,000 SKAI

- Market Dominance: 0.000026%

- Token Holders: 4,725

The token's 24-hour trading range spans from $0.0008297 to $0.0008893. With a market cap to FDV ratio of 11.34%, SKAI remains in early accumulation stages relative to its maximum valuation potential. The modest trading volume relative to market cap suggests limited liquidity conditions.

View current SKAI market price

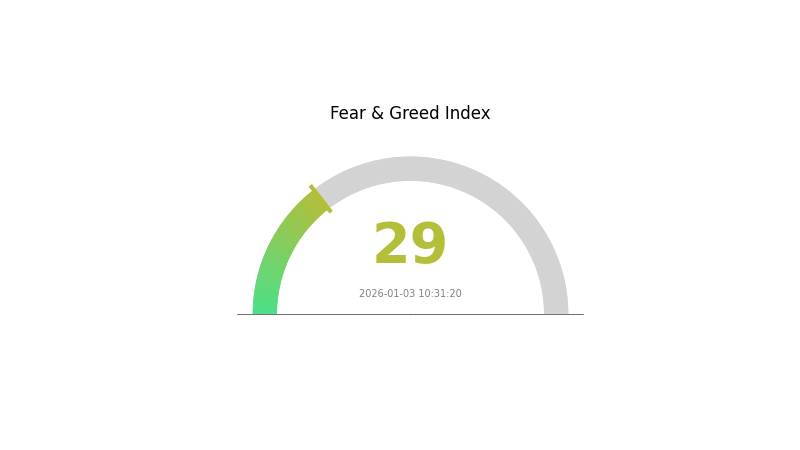

SKAI Market Sentiment Index

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This indicates heightened market anxiety and risk aversion among investors. During such periods, market volatility tends to increase as participants adopt a defensive stance. For traders and investors, this environment presents both challenges and opportunities. Conservative investors may consider waiting for clearer market signals, while opportunistic traders might view this as a potential buying opportunity for long-term positions. It's essential to conduct thorough due diligence and risk management strategies when navigating fearful market conditions.

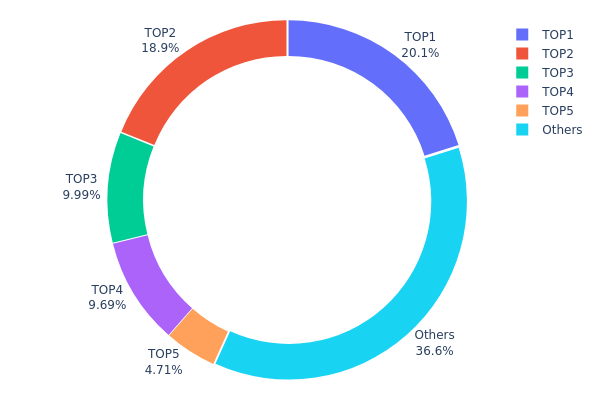

SKAI Holdings Distribution

The address holdings distribution reveals the concentration pattern of token ownership across the SKAI network. By analyzing the top holders and their respective stake percentages, we can assess the degree of decentralization and potential market dynamics. Currently, SKAI exhibits moderate concentration characteristics, with the top four addresses collectively controlling approximately 58.68% of total supply. The leading address (0x1dde...82beee) holds 20.14%, followed closely by the second address (0x1b81...1a8e20) with 18.88%, while the third and fourth addresses maintain positions of 9.98% and 9.68% respectively. This distribution pattern indicates a meaningful presence of large stakeholders, though the remaining addresses account for 36.62% of circulating tokens, suggesting a relatively distributed tail structure.

The concentration dynamics present both structural considerations and market implications. While the top two addresses represent approximately 39.02% of total holdings, the subsequent dispersion across smaller holders provides some resilience against extreme price manipulation by individual entities. The fifth-ranked address holds 4.70%, marking a significant drop-off from the top tier, which suggests a natural clustering of major stakeholders rather than a single dominant actor. The substantial proportion held by "Others" (36.62%) indicates that approximately two-thirds of holders maintain relatively smaller positions, contributing to a more balanced market foundation and reducing the likelihood of unilateral supply-side pressure.

Click to view current SKAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1dde...82beee | 201443.61K | 20.14% |

| 2 | 0x1b81...1a8e20 | 188800.00K | 18.88% |

| 3 | 0x8a69...e56b06 | 99870.90K | 9.98% |

| 4 | 0x8791...cb1540 | 96863.86K | 9.68% |

| 5 | 0xa988...99edd0 | 47068.80K | 4.70% |

| - | Others | 365952.82K | 36.62% |

II. Core Factors Influencing SKAI's Future Price

Supply Mechanism

-

Token Supply Structure: As of November 29, 2025, SKAI has a circulating supply of 113,370,157.66374785 tokens out of a total issued supply of 1,000,000,000 tokens, representing approximately 11.34% circulation rate.

-

Historical Price Performance: SKAI reached an all-time high of $0.25 on June 9, 2024, and hit a historical low of $0.00111 on July 11, 2025, demonstrating significant price volatility influenced by supply dynamics and market sentiment.

-

Current Impact: The relatively low circulating supply percentage suggests potential for future dilution as more tokens enter circulation, which could exert downward pressure on price unless demand significantly increases.

Investor Sentiment and Market Dynamics

-

Community Engagement: As of 2025, Skillful AI has attracted 4,736 active token holder addresses with a highly engaged developer community, indicating growing ecosystem participation and network effects.

-

Market Sentiment Factors: Investor psychology and price expectations directly influence SKAI market volatility. Technical indicators such as MACD and divergences from actual prices provide potential signals for market directional shifts.

Technology Development and Ecosystem

-

Decentralized Architecture: Skillful AI operates through a globally distributed node network with no single entity in control. All interactions are recorded on an immutable blockchain ledger, ensuring transparency and system resilience while preserving user autonomy.

-

Consensus Mechanism: The protocol likely employs consensus mechanisms to verify transactions and prevent fraud, with network participants earning SKAI rewards based on their contributions to system security and maintenance.

-

AI-Powered Ecosystem: Skillful AI facilitates the creation of personalized AI assistants with specialized knowledge, advancing AI technology from basic chatbots to sophisticated virtual advisors and customized solutions across various sectors.

III. 2026-2031 SKAI Price Forecast

2026 Outlook

- Conservative Forecast: $0.00045 - $0.00088

- Base Case Forecast: $0.00088

- Optimistic Forecast: $0.00111 (requiring sustained market sentiment and positive ecosystem developments)

2027-2029 Mid-term Outlook

- Market Stage Expectations: Gradual accumulation and early growth phase with increasing institutional interest

- Price Range Predictions:

- 2027: $0.00051 - $0.00127 (13% upside potential)

- 2028: $0.00098 - $0.00141 (29% upside potential)

- 2029: $0.00107 - $0.00170 (45% upside potential)

- Key Catalysts: Project milestone achievements, expanded partnership announcements, market cycle recovery, and improved token utility implementation

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00089 - $0.00205 (69% appreciation by 2030, assuming continued ecosystem development and moderate market conditions)

- Optimistic Scenario: $0.00145 - $0.00260 (102% appreciation by 2031, assuming strong mainstream adoption and positive macroeconomic conditions)

- Transformational Scenario: Exceeding $0.00260 (contingent on breakthrough technological innovations, major institutional adoption waves, and favorable regulatory environment globally)

Note: These forecasts are based on historical trend analysis and market modeling. Investors should conduct thorough due diligence on Gate.com and other reputable platforms before making investment decisions. Actual results may vary significantly from these projections.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00111 | 0.00088 | 0.00045 | 0 |

| 2027 | 0.00127 | 0.00099 | 0.00051 | 13 |

| 2028 | 0.00141 | 0.00113 | 0.00098 | 29 |

| 2029 | 0.0017 | 0.00127 | 0.00107 | 45 |

| 2030 | 0.00205 | 0.00149 | 0.00089 | 69 |

| 2031 | 0.0026 | 0.00177 | 0.00145 | 102 |

Skillful AI (SKAI) Professional Investment Strategy and Risk Management Report

IV. SKAI Professional Investment Strategy and Risk Management

SKAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with conviction in AI and blockchain technology integration, those seeking exposure to the evolving virtual assistant ecosystem, and participants with a 1-3 year investment horizon

- Operational Recommendations:

- Establish a core position during market downturns when price volatility creates opportunities, as SKAI has experienced significant downside (-98.0099% over 1 year) that may represent accumulation zones for long-term believers

- Dollar-cost averaging (DCA) to mitigate timing risk, purchasing fixed amounts at regular intervals regardless of short-term price movements

- Secure storage of tokens in a personal wallet to maintain full control and reduce counterparty risk from exchange holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 1H (+0.22%), 24H (+5.18%), and 7D (+3.15%) price changes to identify short-term momentum reversal points and entry/exit signals

- Volume Analysis: Observe the 24H trading volume of $11,936.20 relative to market capitalization to assess liquidity conditions and confirm trend validity

- Wave Operation Key Points:

- Identify support and resistance levels around the recent 24H range ($0.0008297 to $0.0008893) for tactical entry and exit positions

- Watch for volume spikes above the average to confirm breakout movements and validate directional conviction

SKAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.0% of total portfolio allocation

- Active Investors: 1.0-3.0% of total portfolio allocation

- Professional Investors: 2.0-5.0% of total portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing: Limit individual SKAI positions to a defined percentage of total crypto holdings to prevent catastrophic losses, particularly given the asset's extreme volatility and historical 98% annual decline

- Profit-Taking Strategy: Establish predetermined price targets to lock in gains during favorable market conditions, reducing exposure as the position appreciates

(3) Secure Storage Solutions

- Self-Custody Recommendation: Use Gate Web3 wallet for secure token management with full private key control, enabling direct participation in the Skillful AI ecosystem while maintaining security standards

- Exchange Storage Approach: Maintain a portion of holdings on Gate.com for active trading and liquidity management, balancing convenience with security considerations

- Security Precautions: Enable two-factor authentication on all exchange accounts, never share private keys, verify contract addresses before token transfers (0xcf078da6e85389de507ceede0e3d217e457b9d49 on Ethereum), and regularly audit wallet permissions

V. SKAI Potential Risks and Challenges

SKAI Market Risk

- Extreme Volatility: SKAI has experienced catastrophic price declines, falling 98.01% over the past year from approximately $0.025 (launch price) to current levels, indicating severe market instability and sentiment fluctuations

- Liquidity Constraints: With a 24H trading volume of only $11,936.20 against a total market cap of $99,142.20, the token exhibits limited liquidity that could result in significant slippage for larger trades

- Low Market Capitalization: At $99,142.20 in circulating market cap, SKAI ranks 4,919th globally, suggesting limited institutional adoption and higher susceptibility to manipulation and abandonment

SKAI Regulatory Risk

- Evolving AI Governance Framework: Increased regulatory scrutiny on AI-related projects globally could impose compliance burdens on the Skillful AI platform, potentially affecting token utility and value

- Cryptocurrency Market Regulation: Heightened regulatory pressure on digital assets, particularly in major jurisdictions, could restrict trading venues and investor access to SKAI tokens

- Token Classification Uncertainty: Regulatory authorities may reassess SKAI's classification as a security versus utility token, triggering compliance obligations or trading restrictions

SKAI Technical Risk

- Smart Contract Vulnerability: As an ERC-20 token on Ethereum, SKAI remains exposed to potential smart contract bugs, exploits, or vulnerabilities that could compromise token security and user funds

- Platform Development Execution: The success of Skillful AI depends on timely development of promised features for customized virtual assistants and developer monetization tools; delays or failures could erode user confidence

- Blockchain Network Risk: Ethereum network congestion, high gas fees, or technical failures could impair the functionality and user experience of Skillful AI ecosystem services

VI. Conclusion and Action Recommendations

SKAI Investment Value Assessment

Skillful AI represents a speculative opportunity at the intersection of artificial intelligence and blockchain technology. The platform's vision of personalized AI ecosystems and developer-enabled monetization addresses emerging market demands. However, the project faces significant headwinds: extreme historical volatility (-98% annually), minimal trading liquidity ($11,936.20 daily volume), minuscule market capitalization ($99,142.20), and limited market adoption (4,725 token holders). The current price of $0.0008745 reflects severe market pessimism, creating both opportunity and risk. The token's value depends critically on execution of the Skillful AI platform roadmap and achieving meaningful ecosystem adoption.

SKAI Investment Recommendations

✅ Beginners: Limit exposure to this highly speculative asset, allocating only 0.5% or less of total portfolio if participating at all; consider waiting for signs of platform traction and ecosystem development before investing ✅ Experienced Investors: Conduct thorough due diligence on the Skillful AI platform development progress, team credentials, and partnership announcements; if comfortable with extreme volatility, consider small positions (1-2%) as high-risk/high-reward exposure to AI innovation ✅ Institutional Investors: Evaluate Skillful AI through the lens of emerging AI + blockchain infrastructure; assess team qualifications, roadmap credibility, and competitive positioning before considering allocation; liquidity constraints may limit institutional participation viability

SKAI Trading Participation Methods

- Gate.com Spot Trading: Purchase SKAI directly through Gate.com's spot trading interface using ETH, USDT, or other supported trading pairs, accessing real-time price discovery and order execution

- Direct Wallet Acquisition: Obtain SKAI through decentralized protocols or peer-to-peer transfers, then store securely in Gate Web3 Wallet or personal Ethereum wallets for long-term custody

- Platform Integration: Participate in the Skillful AI ecosystem directly through the platform's website (https://www.skillfulai.io) if developer tools or user benefits become available, earning or utilizing SKAI tokens within the application environment

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must evaluate their personal risk tolerance and make informed decisions independently. Consulting with a qualified financial advisor is strongly recommended. Never invest more than you can afford to lose completely.

FAQ

What is SKAI? What are its uses and value?

SKAI is an AI system leveraging blockchain for healthcare diagnostics. It provides personalized AI assistants through a decentralized platform, ensuring transparency and security. SKAI aims to revolutionize healthcare with advanced AI technology while enabling users greater autonomy and control over their data.

What are the main factors affecting SKAI price?

SKAI price is primarily influenced by market sentiment, adoption rate, regulatory policies, and technological developments. Trading volume and investor confidence also play significant roles in price movements.

How to analyze and predict future price trends of SKAI?

Analyze SKAI price trends by monitoring trading volume, market sentiment, and historical price patterns. Track key support and resistance levels, evaluate project fundamentals and adoption metrics. Combine technical analysis with on-chain data to forecast potential price movements.

SKAI价格预测有哪些常用的技术分析方法?

Common technical analysis methods for SKAI price prediction include moving averages, RSI (Relative Strength Index), and Bollinger Bands. These tools help analyze price trends and momentum by examining historical price data and trading volume patterns.

What risks should be considered when investing in SKAI for price prediction?

SKAI price prediction involves market volatility, liquidity risks, and regulatory uncertainty. Monitor trading volume closely, diversify your portfolio, and only invest capital you can afford to lose. Stay informed about market trends and project developments.

How is SKAI's price potential compared to similar tokens?

SKAI features innovative technology and unique applications with strong market potential. Its distinctive characteristics attract niche interest, potentially driving significant value growth. Current market trends suggest promising price appreciation ahead.

Is AVA (AVAAI) a good investment?: Analyzing the Potential Returns and Risks of the Emerging AI Token

AIV vs CRO: A Comparative Analysis of AI-Driven Value and Conversion Rate Optimization Strategies

Is ai16z (AI16Z) a good investment?: Analyzing the potential and risks of this emerging AI fund

Is Holoworld AI (HOLO) a good investment?: Analyzing the potential and risks of this emerging AI cryptocurrency

Is VaderAI by Virtuals (VADER) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token in Today's Crypto Market

Is Wisdomise AI (WSDM) a good investment?: Analyzing the Potential and Risks of this Emerging AI Stock

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?