2025 SIN Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of SIN

Sinverse (SIN) is a blockchain-based metaverse multiplayer game that enables users to purchase digital real estate in controversial cities worldwide and build their empires within a highly social platform. Since its launch in October 2021, the project has established itself in the gaming and metaverse sector. As of January 2026, SIN has a market capitalization of $262,434.36, with a circulating supply of approximately 855.95 million tokens, currently trading at $0.0003066.

This asset, which operates as a social-oriented gaming platform where players can establish clubs, organize online events, and participate in in-game activities to earn rewards, is playing an increasingly important role in the blockchain gaming ecosystem.

This article will provide a comprehensive analysis of SIN's price trends and market dynamics, combining historical performance, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for 2026 and beyond.

Sinverse (SIN) Market Analysis Report

I. SIN Price History Review and Current Market Status

SIN Historical Price Evolution Trajectory

-

2021: SIN reached its all-time high of $0.710213 on November 28, 2021, during the peak of the metaverse gaming trend as the project gained market attention.

-

2021-2026: Significant downtrend period, with the token experiencing substantial depreciation from its peak valuation, entering a prolonged bear market phase.

-

2025-2026: Continued decline, with SIN reaching its all-time low of $0.0003024 on December 27, 2025, representing a 99.9% loss from the historical high.

SIN Current Market Situation

As of January 1, 2026, SIN is trading at $0.0003066, reflecting a -0.22% change in the last 24 hours. The token maintains a market capitalization of $262,434.36 USD with a fully diluted valuation of $306,600 USD, ranking at #3,849 across the cryptocurrency market.

The 24-hour trading volume stands at $19,986.49, with a circulating supply of 855,950,292.13 SIN tokens out of a total supply of 1,000,000,000 tokens, representing an 85.59% circulation ratio. The market dominance of SIN remains minimal at 0.0000097%, indicating extremely limited market share relative to the broader cryptocurrency ecosystem.

Recent price action shows modest volatility, with the 1-hour change at +0.29% and the high/low range for the 24-hour period between $0.0003066 and $0.0003163. However, the medium to long-term trend remains severely negative, with the token declining -3.59% over 7 days, -35.92% over 30 days, and -91.09% over the past year.

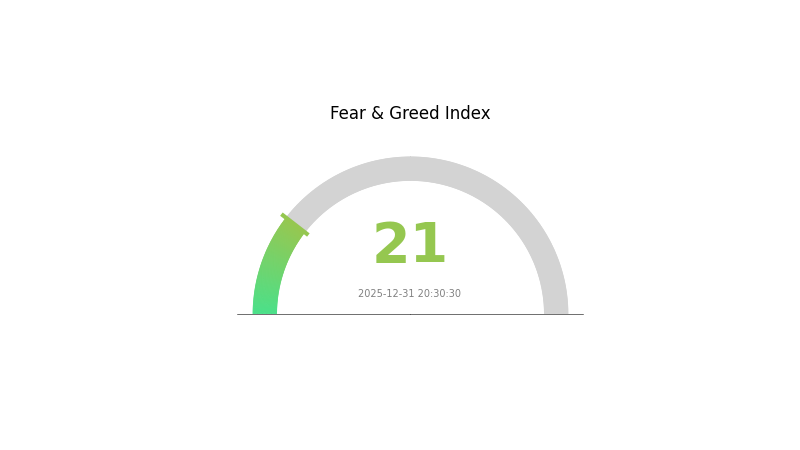

The token currently maintains 22,660 token holders across supported blockchain networks, with SIN deployed on the Binance Smart Chain (BSC) network. Market sentiment data as of December 31, 2025, indicates "Extreme Fear" conditions (VIX: 21), reflecting prevailing market pessimism.

Click to view current SIN market price

SIN Market Sentiment Index

2025-12-31 Fear and Greed Index: 21 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index at 21. This reading suggests investors are highly pessimistic about market conditions, presenting potential buying opportunities for contrarian traders. When fear reaches such extremes, it often signals oversold conditions. However, exercise caution and conduct thorough research before making investment decisions. Consider using Gate.com's market analysis tools to monitor sentiment trends and identify entry points aligned with your investment strategy.

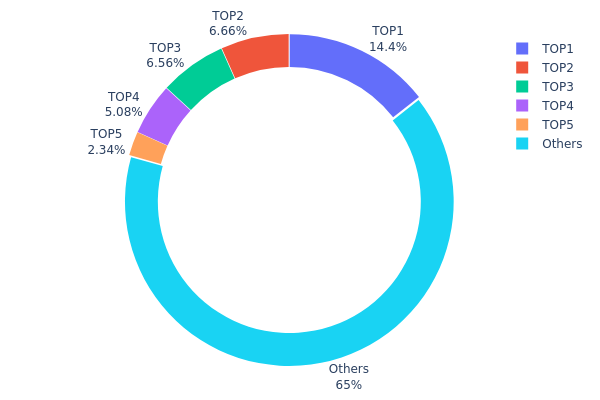

SIN Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, providing critical insights into the decentralization structure and market concentration dynamics of SIN. By analyzing the top holders and their proportional stakes, this metric reveals potential centralization risks, market stability factors, and the overall health of the token's ecosystem distribution.

Current data demonstrates moderate concentration characteristics within the SIN network. The top five addresses collectively hold 34.02% of total supply, with the leading address (0xdecd...606979) commanding 14.40% of all tokens. This concentration level, while notable, does not constitute extreme centralization typical of newly launched or highly speculative projects. The remaining 64.98% distributed among other addresses suggests a relatively diversified holder base, indicating that no single entity has dominant control sufficient to unilaterally manipulate market dynamics. The graduated decline from the top holder (14.40%) through the fifth-largest position (2.33%) reflects a reasonably distributed wealth curve rather than a cliff-like concentration pattern.

From a market structure perspective, this distribution profile presents balanced risk characteristics. The substantial non-top-five holder percentage (64.98%) suggests resilient decentralization and reduced vulnerability to coordinated selling pressure from major stakeholders. However, the cumulative stake of top holders remains significant enough to warrant monitoring for potential price impact during large liquidation events. The current holdings architecture supports moderate market stability while maintaining sufficient concentration among informed early investors to provide some price stability mechanisms inherent to established projects with committed stakeholder bases.

Click to view current SIN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdecd...606979 | 144049.71K | 14.40% |

| 2 | 0x916a...5740a6 | 66645.76K | 6.66% |

| 3 | 0x4982...6e89cb | 65601.46K | 6.56% |

| 4 | 0x69be...6ee5e0 | 50793.79K | 5.07% |

| 5 | 0x0d07...b492fe | 23379.47K | 2.33% |

| - | Others | 649529.80K | 64.98% |

II. Core Factors Affecting SIN's Future Price

Supply Mechanism

-

Token Scarcity: SIN's limited supply directly impacts its price and investment value, serving as a fundamental determinant of long-term price appreciation potential.

-

Current Impact: The scarcity characteristic of SIN positions it as a deflationary asset within the metaverse gaming ecosystem, potentially supporting price stability and growth as adoption increases.

Technology Development and Ecosystem Construction

-

Blockchain Gaming Infrastructure: SIN operates within the blockchain gaming sector, where technological evolution and market adoption drive token utility and demand.

-

Ecosystem Applications: As a metaverse gaming token, SIN's value is intrinsically linked to the expansion of gaming applications, user adoption rates, and the overall maturation of blockchain-based gaming platforms. Growth in these areas directly correlates with increased token utility and demand.

Market Dynamics and Adoption

-

Technology Innovation: Future development in blockchain gaming technology and metaverse infrastructure will significantly influence SIN's market performance and adoption rates.

-

Market Demand: SIN's price trajectory depends heavily on overall cryptocurrency market trends, investor sentiment toward gaming tokens, and the broader adoption of metaverse technologies.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Cryptocurrency investments carry substantial risks. Please conduct thorough research and consider your risk tolerance before making investment decisions. For real-time SIN market data and professional analysis, visit Gate.com.

III. 2026-2030 SIN Price Forecast

2026 Outlook

- Conservative Forecast: $0.00027 - $0.00034

- Neutral Forecast: $0.00034 (average expected trading range)

- Optimistic Forecast: $0.00042 (requires sustained market recovery and increased adoption)

2027-2028 Mid-term Outlook

- Market Stage Expectation: Accumulation phase with gradual price discovery and growing institutional interest in micro-cap assets

- Price Range Forecast:

- 2027: $0.00027 - $0.00045

- 2028: $0.00033 - $0.00050

- Key Catalysts: Enhanced protocol functionality, expanded liquidity on Gate.com and other major platforms, growing ecosystem partnerships, and positive regulatory developments in major markets

2029-2030 Long-term Outlook

- Base Case: $0.00040 - $0.00056 (assumes moderate adoption growth and stable macroeconomic conditions)

- Optimistic Case: $0.00065 - $0.00082 (assumes breakthrough in mainstream adoption and significant ecosystem expansion)

- Transformational Case: $0.00082+ (extreme favorable conditions including major institutional adoption, technological breakthroughs, and sustained bull market cycle)

- 2030-12-31: SIN achieving 81% cumulative appreciation from 2025 levels (reflecting sustained upward momentum and ecosystem maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00038 | 0.00031 | 0.00027 | 0 |

| 2026 | 0.00042 | 0.00034 | 0.00027 | 11 |

| 2027 | 0.00045 | 0.00038 | 0.00027 | 24 |

| 2028 | 0.0005 | 0.00042 | 0.00033 | 35 |

| 2029 | 0.00065 | 0.00046 | 0.0004 | 50 |

| 2030 | 0.00082 | 0.00056 | 0.00032 | 81 |

Sinverse (SIN) Professional Investment Strategy and Risk Management Report

IV. SIN Professional Investment Strategy and Risk Management

SIN Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Metaverse and blockchain gaming enthusiasts with high risk tolerance and extended investment horizons

- Operation Recommendations:

- Accumulate during market downturns when SIN trades near support levels, given the token's significant historical decline of 91.09% over the past year

- Set clear entry and exit targets based on resistance levels identified through historical price analysis

- Maintain positions through market volatility cycles, focusing on the platform's social gaming features and digital real estate ecosystem development

(2) Active Trading Strategy

- Price Trend Analysis:

- 1-Hour Performance: Monitor micro-trend movements showing +0.29% gains for short-term entry/exit opportunities

- 7-Day to 30-Day Trends: Track the -3.59% (7D) and -35.92% (30D) declines to identify reversal patterns and support zones

- Year-over-Year Context: Consider the -91.09% annual decline as context for potential recovery scenarios

- Wave Trading Key Points:

- Identify support levels near the recent all-time low of $0.0003024 (recorded December 27, 2025) for bounce trading opportunities

- Establish resistance zones based on historical price action between the current price of $0.0003066 and previous recovery attempts

- Execute scaled entries during oversold conditions with strict stop-loss discipline

SIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation (for specialized gaming and metaverse-focused portfolios)

(2) Risk Mitigation Strategies

- Diversification Strategy: Balance SIN holdings with established cryptocurrencies to reduce concentration risk from a token ranked 3,849 by market capitalization

- Position Sizing: Implement strict position limits relative to overall portfolio given the extreme price volatility (from historical high of $0.710213 to current levels)

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate.com Web3 Wallet for active trading and frequent transactions with streamlined interface and security features

- Cold Storage Consideration: For long-term holdings exceeding 30-90 days, consider transferring SIN tokens to hardware-based solutions supporting BSC network

- Security Best Practices:

- Enable two-factor authentication on all exchange accounts

- Never share private keys or recovery phrases

- Verify contract addresses before token transfers (Current BSC Contract: 0x6397de0F9aEDc0F7A8Fa8B438DDE883B9c201010)

- Conduct regular security audits of wallet access permissions

V. SIN Potential Risks and Challenges

SIN Market Risk

- Extreme Price Volatility: The token has experienced a catastrophic 91.09% decline over 12 months, with current price ($0.0003066) near historical lows, indicating severe market stress and potential further downside

- Severe Liquidity Constraints: 24-hour trading volume of only $19,986.49 against market capitalization of $262,434 suggests extremely limited liquidity, creating significant slippage risk for position entry and exit

- Low Market Adoption: Only 22,660 token holders and $262,434 circulating market value indicate minimal market penetration and community engagement compared to established gaming tokens

SIN Regulatory Risk

- Gaming and Metaverse Classification Uncertainty: Regulatory frameworks governing blockchain-based gaming and digital real estate remain undefined in most jurisdictions, creating potential compliance challenges

- Jurisdictional Concerns: The game's premise involving "controversial cities" and "underworld activities" may face regulatory scrutiny in certain regions regarding content appropriateness and gambling mechanics

- Exchange Delisting Risk: Limited presence on only 2 major exchanges increases vulnerability to delisting decisions, which could eliminate primary trading venues

SIN Technical Risk

- Smart Contract Vulnerability: As a BSC-based token without published audit reports in the available documentation, the underlying smart contract security status remains unverified

- Platform Development Uncertainty: Lack of active GitHub repositories or published technical roadmaps in the data suggests potential challenges in ongoing development and maintenance

- Blockchain Network Dependency: Reliance on Binance Smart Chain creates exposure to BSC network congestion, security incidents, or operational disruptions

VI. Conclusions and Action Recommendations

SIN Investment Value Assessment

Sinverse presents an extremely high-risk investment opportunity positioned in the intersection of blockchain gaming and metaverse platforms. The token's catastrophic 91.09% annual decline, coupled with minimal liquidity, negligible market share (0.0000097%), and a circulating supply representing 85.6% of total supply, indicates a highly speculative asset with limited institutional interest. The project's gaming premise centered on digital real estate and social experiences contains conceptual merit, yet the stark divergence between historical all-time high ($0.710213) and current valuation ($0.0003066) reflects severe market skepticism regarding execution capability and community sustainability. Investment in SIN should be approached exclusively as a speculative venture with capital allocation not exceeding individual risk tolerance thresholds.

SIN Investment Recommendations

✅ Beginners: Avoid direct SIN investment until establishing foundational knowledge of blockchain gaming tokenomics and metaverse economics. If interested in gaming tokens, start with more established projects possessing greater liquidity and community validation.

✅ Experienced Investors: Consider SIN only as a micro-allocation (1-2% of portfolio) within dedicated gaming/metaverse sector exposure, implementing strict stop-loss orders and predetermined exit strategies. Conduct comprehensive due diligence on project team credentials and development timelines before commitment.

✅ Institutional Investors: SIN lacks sufficient market capitalization, liquidity depth, and institutional infrastructure to warrant portfolio consideration. Focus capital allocation on gaming tokens with established user bases, audited smart contracts, and transparent governance structures.

SIN Trading Participation Methods

- Direct Exchange Trading: Purchase SIN through Gate.com's spot trading market using BSC network, ensuring verification of the correct contract address (0x6397de0F9aEDc0F7A8Fa8B438DDE883B9c201010) before executing transactions

- Limit Order Strategy: Implement limit buy orders at identified support levels to accumulate positions during downtrends, avoiding market orders that could experience extreme slippage given minimal trading volume

- Gradual Scaling: For interested investors, employ dollar-cost averaging across multiple entry points rather than lump-sum purchases to mitigate timing risk in illiquid markets

Cryptocurrency investment carries extreme risk, and this report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and circumstances. Consultation with professional financial advisors is strongly recommended. Never invest capital exceeding your capacity to absorb total loss.

FAQ

What is SIN? What are its basic characteristics and application scenarios?

SIN is a decentralized cryptocurrency token designed for Web3 ecosystem participation. Its key characteristics include smart contract functionality, decentralized governance, and cross-chain interoperability. Primary applications include DeFi protocol integration, NFT marketplace utilities, and blockchain-based payment solutions for next-generation digital commerce.

How to conduct technical analysis and price prediction for SIN?

Analyze SIN's price using technical indicators such as moving averages, RSI, and MACD. Study support and resistance levels, trading volume trends, and market sentiment. Combine these factors with chart pattern analysis to identify potential price movements and forecast future trends.

What are the main factors affecting SIN price fluctuations?

SIN price is mainly influenced by market demand and supply, macroeconomic conditions, interest rate changes, overall crypto market sentiment, project development progress, and trading volume fluctuations.

How can SIN price prediction accuracy be assessed? What are the main risks?

SIN price accuracy depends on analyzing market trends, trading volume, and historical volatility patterns. Key risks include high price fluctuations, limited market liquidity causing slippage on large trades, and competitive pressure from similar projects.

What are the advantages and disadvantages of SIN compared to similar assets?

SIN offers high liquidity and low trading fees, but exhibits significant price volatility and higher risk. Compared to mainstream cryptocurrencies, SIN has lower market recognition and potentially smaller trading volume, limiting accessibility for some investors.

What is the price expectation for SIN from professional institutions and analysts?

Professional institutions predict SIN will reach approximately $0.0003097 per token by end of 2025, based on a 5% annualized growth rate projection. This forecast reflects current market analysis and technical indicators.

2025 ZENT Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Cryptocurrency Landscape

2025 MAK Price Prediction: Navigating Crypto Volatility and Market Trends

2025 WILDPrice Prediction: Analyzing Market Trends and Growth Potential for the WILD Token Ecosystem

2025 ENJ Price Prediction: Analyzing Blockchain Gaming Token's Potential Growth and Market Drivers

ESE vs SAND: Comparing Two Novel Approaches to Efficient Data Processing in Cloud Computing

Is Sovrun (SOVRN) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?