2025 SHARDS Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: SHARDS' Market Position and Investment Value

WorldShards (SHARDS) is a Web3 MMORPG token that combines traditional MMORPG gameplay with blockchain-based NFT ownership benefits across PC, mobile, and console platforms. As a fair-launch token with no allocation to team or investors, SHARDS has established itself as a community-driven asset within the gaming and blockchain ecosystem. As of January 2026, SHARDS maintains a market capitalization of approximately $117,812.68, with a circulating supply of 413,377,839 tokens and a price hovering around $0.000285.

This token, recognized for its "fair community-driven" distribution model, is playing an increasingly significant role in the Web3 gaming economy. With over 400,000 community members, more than $8.9 million in NFT sales, and users spending over 3.1 million hours engaging with the platform, SHARDS represents a meaningful footprint in the decentralized gaming sector.

This article will provide a comprehensive analysis of SHARDS' price trajectory through 2026 and beyond, incorporating historical performance data, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for crypto asset investors.

SHARDS Token Market Analysis Report

I. SHARDS Price History Review and Current Market Status

SHARDS Historical Price Evolution

-

September 2025: Token reached its all-time high of $0.062, marking the peak of market enthusiasm following the token generation event (TGE) and initial community adoption phase.

-

January 2026: Price declined to $0.0002572, representing the all-time low as of the report date, reflecting a significant correction from historical peaks.

SHARDS Current Market Position

As of January 3, 2026, SHARDS is trading at $0.000285, with a 24-hour trading volume of $17,583.49. The token has experienced substantial downward pressure across multiple timeframes:

- 1-hour change: -0.70%

- 24-hour change: -4.74%

- 7-day change: -23.16%

- 30-day change: -89.09%

- 1-year change: -99.13%

The token currently holds a market capitalization of $117,812.68 with a fully diluted valuation of $1,425,000.00. With 413,377,839 circulating tokens out of a total supply of 5,000,000,000, SHARDS represents 8.27% of the fully diluted supply circulation. The token ranks 4,726th by market capitalization and maintains a market dominance of 0.000043%.

Trading activity remains limited, with the token available on 8 exchanges. The current holder base consists of 199 addresses, indicating a concentrated distribution pattern.

Click to view current SHARDS market price

SHARDS Market Sentiment Indicator

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index standing at 29. This reading indicates heightened anxiety among investors, reflecting concerns about market volatility and potential downside risks. During such fearful conditions, experienced traders often view this as a potential buying opportunity, as excessive pessimism can create attractive entry points for quality assets. However, caution is advised, and investors should conduct thorough research before making investment decisions on the Gate.com platform.

SHARDS Holdings Distribution

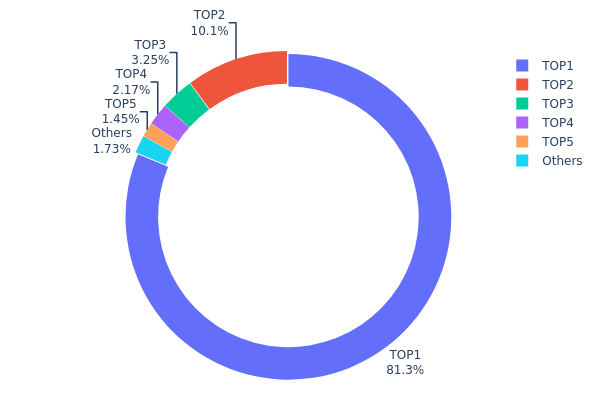

The address holdings distribution map represents a snapshot of token concentration across blockchain addresses, revealing the ownership structure and decentralization characteristics of the SHARDS ecosystem. This metric serves as a critical indicator for assessing market concentration risk, potential manipulation vulnerabilities, and the overall health of the token's decentralized structure.

The current holdings distribution of SHARDS exhibits pronounced concentration characteristics. The top address holds 81.28% of total token supply, while the top two addresses collectively control 91.39% of circulating tokens. This extreme concentration is further compounded by the top five addresses accounting for 98.25% of all holdings, leaving only 1.75% distributed among remaining market participants. Such a centralized distribution structure raises significant concerns regarding the token's decentralization posture and market maturity.

The dominance of a single address controlling over four-fifths of the token supply introduces substantial systemic risks. This concentration creates a potential single point of failure and amplifies vulnerability to coordinated selling pressure or market manipulation. Large holders of this magnitude possess the capacity to materially influence price discovery mechanisms and market sentiment. The severely limited float available to other market participants constrains organic price formation and liquidity conditions. Additionally, the stark disparity between the largest holder and the rest of the ecosystem suggests underdeveloped distribution mechanisms and potentially concentrated initial allocation structures that remain unresolved through market mechanisms or community engagement initiatives.

Click to view current SHARDS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3de3...8f62f6 | 2500000.00K | 81.28% |

| 2 | 0xf89d...5eaa40 | 311243.04K | 10.11% |

| 3 | 0xa957...fcd7af | 100000.00K | 3.25% |

| 4 | 0x4695...fd7d37 | 66633.52K | 2.16% |

| 5 | 0x0d07...b492fe | 44695.65K | 1.45% |

| - | Others | 53080.88K | 1.75% |

II. Core Factors Affecting SHARDS Future Price

Market Sentiment and Investment Environment

-

Market Psychology Impact: SHARDS price movements are highly sensitive to overall market trends. Investor confidence and market sentiment directly influence price trajectories. Bullish sentiment can drive significant price appreciation, while negative sentiment can accelerate declines.

-

External Events Influence: Cryptocurrency and NFT prices are vulnerable to financial, regulatory, and political events. These external shocks can cause substantial price volatility in short periods.

-

Correlation with Broader Market: SHARDS, as a cryptocurrency asset, tends to move in correlation with major market trends. Overall cryptocurrency market conditions significantly impact individual token valuations.

Regulatory and Policy Environment

-

Regulatory Changes: Regulatory shifts and policy updates directly affect cryptocurrency valuations. Changes in government stance toward digital assets or gaming tokens can have material impacts on SHARDS price outlook.

-

Compliance Requirements: Evolution in compliance frameworks across jurisdictions may influence investor participation and market liquidity for SHARDS trading.

Technology and Project Development

-

Game Updates and Features: Project development progress, including planned game updates and new feature releases, affects market expectations and investor confidence in long-term viability.

-

Operational Stability: Core team retention and operational risk management are critical. Technical team departures or project execution delays can negatively impact price performance and community confidence.

Three、2026-2031 SHARDS Price Forecast

2026 Outlook

- Conservative Forecast: $0.0002 - $0.00027

- Neutral Forecast: $0.00027 (average expectation)

- Optimistic Forecast: $0.00033 (requires sustained market sentiment and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Forecast:

- 2027: $0.00022 - $0.00033

- 2028: $0.00027 - $0.00036

- 2029: $0.0003 - $0.00049

- Key Catalysts: Enhanced protocol functionality, increased adoption metrics, improved market liquidity on platforms like Gate.com, and positive regulatory developments in major markets

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00026 - $0.00058 (assuming steady ecosystem development and moderate market expansion)

- Optimistic Scenario: $0.00035 - $0.00054 (contingent upon breakthrough adoption milestones and institutional participation)

- Transformative Scenario: $0.0005+ (extreme favorable conditions including major partnership announcements, technological breakthroughs, and widespread mainstream adoption)

- 2031-12-31: SHARDS $0.00054 (peak year projection with 73% cumulative growth from 2026 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00033 | 0.00027 | 0.0002 | -4 |

| 2027 | 0.00033 | 0.0003 | 0.00022 | 5 |

| 2028 | 0.00036 | 0.00031 | 0.00027 | 10 |

| 2029 | 0.00049 | 0.00034 | 0.0003 | 18 |

| 2030 | 0.00058 | 0.00041 | 0.00026 | 44 |

| 2031 | 0.00054 | 0.0005 | 0.00035 | 73 |

WORLDSHARDS (SHARDS) Professional Investment Strategy and Risk Management Report

IV. SHARDS Professional Investment Strategy and Risk Management

SHARDS Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Community-driven enthusiasts and GameFi believers with high risk tolerance

- Operation suggestions:

- Participate in early-stage Web3 MMORPG ecosystem growth potential, targeting long-term value appreciation as the game expands its player base and NFT ecosystem

- Accumulate during market downturns, particularly given the current 89.09% decline over 30 days which may present entry opportunities for contrarian investors

- Hold through game development milestones and community expansion phases

(2) Active Trading Strategy

- Technical analysis considerations:

- Price volatility monitoring: Track the 24-hour trading volume of $17,583.49 against the current price of $0.000285 to identify liquidity conditions

- Support and resistance levels: Current all-time low of $0.0002572 (January 3, 2026) and all-time high of $0.062 (September 5, 2025) provide critical reference points

- Swing trading key points:

- Monitor NFT sales velocity and community engagement metrics as leading indicators for price momentum

- Execute positions during high-volume trading sessions to ensure adequate liquidity given the token's current market depth

SHARDS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio

- Aggressive investors: 3-5% of portfolio

- Professional investors: Up to 5% with active monitoring and hedging mechanisms

(2) Risk Hedging Solutions

- Portfolio diversification: Maintain SHARDS position as a small allocation within a broader Web3 gaming and blockchain technology portfolio to mitigate single-asset risk

- Dollar-cost averaging: Execute purchases at regular intervals regardless of price movement to reduce timing risk and entry point volatility

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for active trading and participation in ecosystem features

- Cold storage approach: Transfer holdings to self-custody solutions for long-term security of significant positions

- Security considerations: Never share private keys or seed phrases; enable two-factor authentication on trading accounts; verify contract addresses (0x6efe65c2426b51e9aa0427b96c313e5d8715fd06 on Ethereum) before transactions

V. SHARDS Potential Risks and Challenges

SHARDS Market Risk

- Extreme price volatility: The token has declined 99.13% over one year and 89.09% over 30 days, indicating severe market pressure and potential for further downside

- Liquidity constraints: With only 8 exchange listings and 199 holders, the token faces limited trading depth and significant slippage risk during large transactions

- Market capitalization erosion: The current fully diluted valuation of $1,425,000 with only 8.27% circulating supply ratio suggests substantial dilution pressure as tokens enter circulation

SHARDS Regulatory Risk

- Gaming regulation uncertainty: Web3 gaming projects face increasing regulatory scrutiny across multiple jurisdictions regarding NFT sales, token mechanics, and play-to-earn economics

- Token classification ambiguity: SHARDS may face reclassification as a security in certain jurisdictions, potentially impacting trading availability and compliance requirements

- Cross-border compliance: The project's multi-platform (PC/Mobile/Console) distribution expands regulatory exposure across different regional requirements

SHARDS Technology Risk

- Smart contract vulnerability: New gaming protocols may contain undiscovered vulnerabilities affecting token mechanics or NFT ownership

- Game development execution: Delays in PC, mobile, and console launches could impact community engagement and token utility

- Network dependency: The ERC-20 token operates on Ethereum, exposing holdings to network congestion and transaction fee volatility

VI. Conclusion and Action Recommendations

SHARDS Investment Value Assessment

SHARDS represents a speculative investment opportunity in the Web3 MMORPG sector with significant execution risks balanced against potential ecosystem growth. The project demonstrates community traction with 400,000+ participants and $8.9 million in NFT sales, yet faces substantial headwinds including 99.13% annual decline, severe market concentration (199 holders), and technological execution uncertainty. The fair-launch model and zero team allocation may support long-term community alignment, but current market conditions reflect broader skepticism about gaming tokenomics sustainability.

SHARDS Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio maximum) through Gate.com to understand Web3 gaming dynamics; prioritize learning over profit expectations

✅ Experienced investors: Consider 2-4% allocation as a speculative position only within a diversified portfolio; implement strict stop-loss discipline given extreme volatility and use technical analysis to identify higher-probability entry points

✅ Institutional investors: Conduct comprehensive due diligence on development roadmap and team execution capacity; limit exposure to risk capital designated for experimental blockchain gaming ventures

SHARDS Trading Participation Methods

- Direct token purchase: Access SHARDS on Gate.com for spot trading using the official contract address (0x6efe65c2426b51e9aa0427b96c313e5d8715fd06)

- In-game acquisition: Participate in free token drops and gameplay to accumulate SHARDS through the gaming ecosystem

- NFT marketplace participation: Engage with the $8.9 million+ NFT ecosystem to understand project tokenomics and obtain tokens through secondary market sales

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is SHARDS token and what is its purpose?

SHARDS is a utility token within the SolChicks ecosystem, primarily used for gameplay mechanics, breeding new NFTs, and in-game transactions. It serves as the essential currency for upgrading and participating in the SolChicks gaming activities.

What is the historical price performance of SHARDS?

SHARDS experienced significant volatility in 2025, with a 40.34% surge in the past 24 hours, reflecting renewed market interest. However, the current price remains 80.19% below its year-start peak, indicating substantial pullback from earlier highs.

What is the SHARDS price prediction for 2024-2025?

SHARDS price prediction for 2024-2025 ranges between $0.000742 and $0.000951. Based on 2025 forecasts, the average price is expected to fluctuate within this range. Actual prices may vary depending on market conditions and adoption trends.

What are the main factors affecting SHARDS price?

Key factors influencing SHARDS price include supply and demand dynamics, market sentiment driven by news and social media, investor confidence, regulatory developments such as ETF approvals, government policies, and overall cryptocurrency market trends.

What advantages does SHARDS have compared to other fragmented tokens?

SHARDS offers superior liquidity, lower fragmentation risk, and enhanced utility within its ecosystem. It features optimized smart contracts, faster transaction speeds, and stronger community governance compared to traditional sharded tokens, positioning it for significant growth potential.

What risks should be considered when investing in SHARDS?

SHARDS investment involves unlock pressure from large locked amounts potentially exceeding demand, and cross-chain bridge risks requiring careful review of bridge design and trust assumptions. Investors should carefully assess these factors.

Is ALICE (ALICE) a good investment?: Analyzing the Potential and Risks of This Gaming Token in Today's Crypto Market

2025 RON Price Prediction: Analyzing Potential Growth and Market Factors for Ronin Network's Native Token

2025 GEMS Price Prediction: Will This Gaming Token Surge to New Heights?

2025 PYRPrice Prediction: Analyzing Market Trends and Key Factors Influencing Vulcan Forged's Native Token

Is Vulcan Forged (PYR) a Good Investment?: Analyzing the Potential of This Gaming Cryptocurrency in Today's Market

2025 MBXPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for MBX Token

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?