2025 SDN Price Prediction: Navigating the Future of Software-Defined Networking Markets

Introduction: SDN's Market Position and Investment Value

ShidenNetwork (SDN), as a multi-chain decentralized application layer on the Kusama network, has been building bridges for various blockchains since its inception in 2021. As of 2025, SDN's market capitalization has reached $1,378,224, with a circulating supply of approximately 67,959,766 tokens, and a price hovering around $0.02028. This asset, often referred to as the "Kusama's smart contract layer," is playing an increasingly crucial role in supporting DeFi, NFTs, and other decentralized applications.

This article will provide a comprehensive analysis of SDN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SDN Price History Review and Current Market Status

SDN Historical Price Evolution

- 2021: Initial launch, price reached all-time high of $8.36 on September 12

- 2023: Market downturn, price declined significantly

- 2025: Continued bearish trend, price dropped to all-time low of $0.01801155 on November 23

SDN Current Market Situation

As of November 25, 2025, SDN is trading at $0.02028. The token has seen a 2.94% increase in the last 24 hours, with a trading volume of $7,206.47. However, SDN has experienced significant losses over longer time frames, with a 7-day decline of 7.9%, a 30-day drop of 39.51%, and a staggering 88.2% decrease over the past year.

The current market capitalization of SDN stands at $1,378,224, ranking it 2406th among all cryptocurrencies. With a circulating supply of 67,959,766 SDN tokens, representing 77.93% of the total supply, the fully diluted market cap is $1,768,455.

Despite the recent 24-hour gain, the overall market sentiment remains bearish, as indicated by the token's performance across various timeframes. The current price is significantly below its all-time high, reflecting the challenging market conditions faced by SDN.

Click to view the current SDN market price

SDN Market Sentiment Indicator

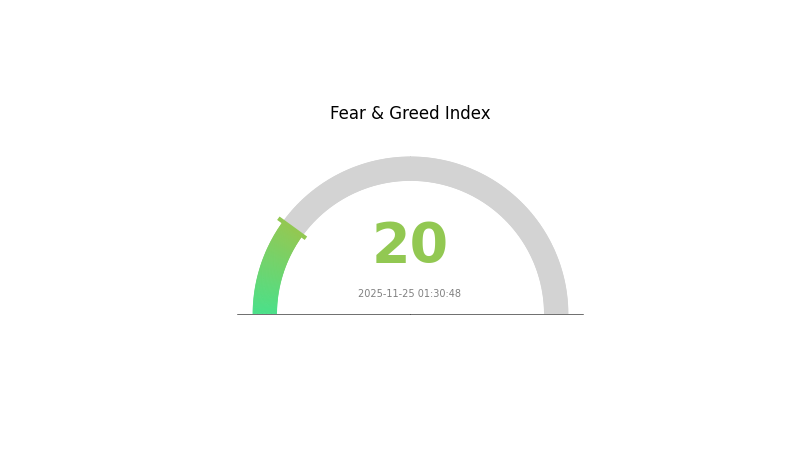

2025-11-25 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the sentiment index plummeting to 20. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed, diversify your portfolio, and consider dollar-cost averaging to navigate these uncertain times. As always, only invest what you can afford to lose in the volatile crypto space.

SDN Holdings Distribution

The address holdings distribution data for SDN reveals a notable absence of significant token concentration among top addresses. This lack of data suggests a highly decentralized ownership structure, where no single address holds a disproportionate amount of tokens.

Such a distribution pattern is generally indicative of a healthy market structure with reduced risk of price manipulation by large holders. The absence of whale addresses could potentially lead to more stable price movements, as there are no major holders capable of causing significant market impact through large trades.

This decentralized structure may contribute to enhanced on-chain stability and could be viewed favorably in terms of the project's commitment to decentralization principles. However, it's important to note that a complete lack of major holders might also indicate limited institutional interest or strategic investments in the token.

Click to view the current SDN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting SDN's Future Price

Supply Mechanism

- Technological Innovation: SDN's core technology OpenFlow enables flexible control of network traffic by separating the control plane from the data plane of network devices.

- Current Impact: The innovative architecture of SDN is providing a good platform for core network and application innovation, which may positively influence its value.

Institutional and Major Player Dynamics

- Enterprise Adoption: Companies like Huawei, China Telecom, and China Construction are among the domestic and international industry-leading enterprises adopting SDN technology.

Macroeconomic Environment

- Geopolitical Factors: The development of SDN technology in different regions, including Asia, North America, and Europe, may impact its global adoption and value.

Technological Development and Ecosystem Building

- Data Center Transformation: The emergence of SDN is driving data center transformation.

- WAN Modernization: Software-Defined Wide Area Network (SD-WAN) is promoting the modernization of wide area networks.

- Edge Access Innovation: There's a need for innovation in edge access networks, which have remained largely unchanged for decades.

- IoT Integration: The mainstream adoption of Internet of Things (IoT) is increasing the importance of network edge, where SDN can play a crucial role.

- Cloud Migration: With the prediction that 74% of business applications will reside in public or private clouds within three years, the value of SDN in managing network edges is likely to increase.

- Wi-Fi Advancements: The advent of Wi-Fi 5 and Wi-Fi 6 standards has made wireless connections comparable to wired ones in speed, potentially increasing the relevance of SDN in managing these networks.

- Security Shift: As security protection is moving towards the access edge due to the proliferation of mobile devices, IoT endpoints, and cloud computing, SDN's role in network security may become more significant.

III. SDN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01055 - $0.02028

- Neutral prediction: $0.02028 - $0.02322

- Optimistic prediction: $0.02322 - $0.02616 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01616 - $0.03232

- 2028: $0.01655 - $0.04454

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.03732 - $0.04123 (assuming steady market growth)

- Optimistic scenario: $0.04123 - $0.04536 (assuming strong market conditions)

- Transformative scenario: $0.04515 - $0.04536 (assuming exceptional market performance and widespread adoption)

- 2030-12-31: SDN $0.04536 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02616 | 0.02028 | 0.01055 | 0 |

| 2026 | 0.03251 | 0.02322 | 0.02252 | 14 |

| 2027 | 0.03232 | 0.02786 | 0.01616 | 37 |

| 2028 | 0.04454 | 0.03009 | 0.01655 | 48 |

| 2029 | 0.04515 | 0.03732 | 0.0347 | 84 |

| 2030 | 0.04536 | 0.04123 | 0.02227 | 103 |

IV. SDN Professional Investment Strategies and Risk Management

SDN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate SDN during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit downside risk

- Take profits at predetermined price targets

SDN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Software wallet option: Official Shiden Network wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SDN

SDN Market Risks

- High volatility: SDN price can experience significant fluctuations

- Low liquidity: Limited trading volume may lead to slippage

- Competitive landscape: Other smart contract platforms may outperform Shiden

SDN Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on DeFi and smart contract platforms

- Cross-border compliance: Varying regulations across jurisdictions may impact adoption

SDN Technical Risks

- Smart contract vulnerabilities: Potential for bugs or exploits in the network's code

- Scalability challenges: Possible network congestion during high usage periods

- Interoperability issues: Difficulties in seamless integration with other blockchain networks

VI. Conclusion and Action Recommendations

SDN Investment Value Assessment

SDN presents a high-risk, high-reward opportunity within the evolving DeFi and smart contract ecosystem. While it offers potential for significant growth, investors should be prepared for extreme volatility and regulatory uncertainties.

SDN Investment Recommendations

✅ Beginners: Allocate a small portion (1-3%) of your crypto portfolio to SDN as a speculative investment ✅ Experienced investors: Consider a 5-10% allocation, actively managing positions based on market trends ✅ Institutional investors: Explore SDN as part of a diversified DeFi portfolio, with up to 15% allocation for high-risk strategies

SDN Trading Participation Methods

- Spot trading: Buy and hold SDN on Gate.com

- DeFi staking: Participate in yield farming opportunities on the Shiden Network

- Liquidity provision: Contribute to SDN liquidity pools for potential rewards

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

DeepSnitch AI is predicted to give 1000x returns. It's developing AI tools for crypto trading and is a standout candidate for 2026.

Can Chain Link hit $100?

Yes, Chainlink (LINK) has reached $100 by late 2025, driven by bullish crypto market trends and increased adoption of its oracle technology.

Can Sol reach $1000 USD?

Yes, Solana (SOL) has the potential to reach $1000 USD. Market trends and Solana's technological advancements suggest this is possible in the long term.

Would hamster kombat coin reach $1?

Hamster Kombat coin has potential to reach $1 by 2028, based on current market trends and blockchain gaming growth. However, this remains speculative as of 2025.

Share

Content