2025 SCARCITY Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: SCARCITY's Market Position and Investment Value

SCARCITY (SCARCITY) as a decentralized social media platform, has been solving problems inherent in centralized social applications since its inception in 2023. As of 2025, SCARCITY's market capitalization has reached $66,287,373, with a circulating supply of approximately 889,166,650 tokens, and a price hovering around $0.07455. This asset, dubbed the "Web3 Social Media Pioneer," is playing an increasingly crucial role in revolutionizing online social interactions.

This article will comprehensively analyze SCARCITY's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SCARCITY Price History Review and Current Market Status

SCARCITY Historical Price Evolution

- 2025 April: SCARCITY reached its all-time high of $0.68

- 2025 June: The price hit its all-time low of $0.06001

- 2025 October: Current price stabilized around $0.07455

SCARCITY Current Market Situation

SCARCITY is currently trading at $0.07455, with a 24-hour trading volume of $58,330.69. The token has experienced a slight decrease of 0.32% in the last 24 hours. Its market cap stands at $66,287,373.76, ranking 521st in the cryptocurrency market.

The token's circulating supply is 889,166,650 SCARCITY, which represents 8.89% of its total supply of 10,000,000,000. SCARCITY has shown mixed performance across different timeframes, with a 2.77% increase over the past 30 days, but a significant 72.39% decrease over the past year.

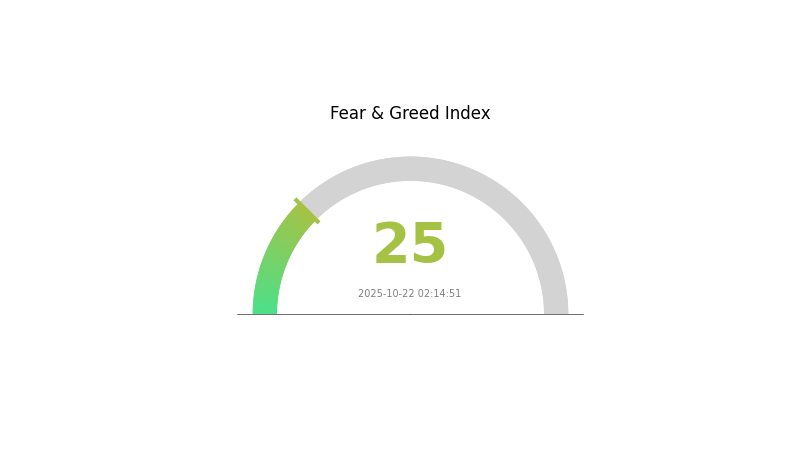

The current market sentiment for cryptocurrencies is characterized as "Extreme Fear" with a VIX of 25, indicating a cautious and uncertain environment for digital assets.

Click to view the current SCARCITY market price

SCARCITY Market Sentiment Indicator

2025-10-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of extreme fear, with the Fear and Greed Index registering a low score of 25. This sentiment reflects heightened investor anxiety and risk aversion in the market. During such times, it's crucial for traders to remain cautious and avoid making impulsive decisions based on emotions. However, contrarian investors might view this as a potential buying opportunity, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." As always, thorough research and risk management are essential in navigating these market conditions.

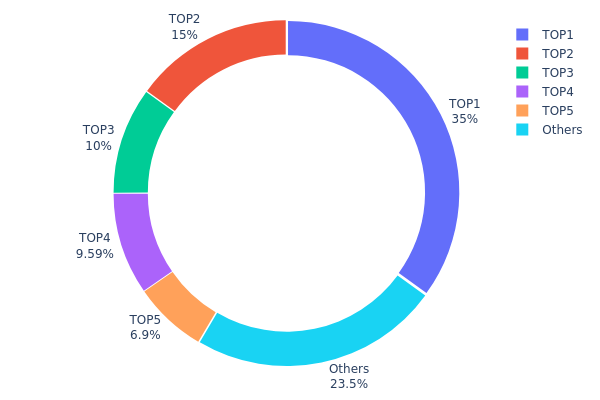

SCARCITY Holdings Distribution

The address holdings distribution chart for SCARCITY reveals a highly concentrated token ownership structure. The top address, likely a burn or contract address (0x0000...00dead), holds 35.02% of the total supply. The subsequent four largest addresses control an additional 41.49% combined. This means that just five addresses account for 76.51% of all SCARCITY tokens, with the remaining 23.49% distributed among other holders.

Such a concentrated distribution raises concerns about centralization and potential market manipulation. With over three-quarters of the supply in the hands of a few entities, there's a significant risk of price volatility should any of these major holders decide to sell. This concentration also implies that the token's governance and decision-making processes may be heavily influenced by a small group of stakeholders, potentially compromising the project's decentralization ethos.

The current distribution suggests a relatively young or tightly controlled token ecosystem. While this might provide stability in the short term, it could pose challenges for long-term sustainability and widespread adoption. Investors and users should be aware of these dynamics when considering their involvement with SCARCITY.

Click to view the current SCARCITY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 3500000.00K | 35.02% |

| 2 | 0xf6ef...ccdfec | 1500000.00K | 15.01% |

| 3 | 0xd78b...d41190 | 1000000.00K | 10.00% |

| 4 | 0xddee...f7d48d | 958333.34K | 9.58% |

| 5 | 0x6d41...d5f1fd | 690000.00K | 6.90% |

| - | Others | 2344791.95K | 23.49% |

II. Key Factors Affecting SCARCITY's Future Price

Supply Mechanism

- Historical patterns: Past supply changes have shown to impact SCARCITY's price.

- Current impact: The expected supply changes are likely to influence the future price of SCARCITY.

Technical Development and Ecosystem Building

- 200-day Moving Average: This technical indicator serves as a crucial support/resistance level for SCARCITY. Historically, 78% of encounters with this level have led to significant price movements.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's aggressive interest rate hikes have led to a continuous tightening of global liquidity, which may affect SCARCITY's price.

- Geopolitical Factors: International situations, such as the Russia-Ukraine conflict, have led to significant increases in commodity prices, potentially impacting SCARCITY's value.

III. SCARCITY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.06926 - $0.07447

- Neutral prediction: $0.07447 - $0.08825

- Optimistic prediction: $0.08825 - $0.10202 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.06814 - $0.15074

- 2028: $0.08255 - $0.14478

- Key catalysts: Increased adoption and technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.13589 - $0.16035 (assuming steady market growth)

- Optimistic scenario: $0.16035 - $0.18480 (assuming strong market performance)

- Transformative scenario: $0.18480+ (extremely favorable market conditions)

- 2030-12-31: SCARCITY $0.18279 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10202 | 0.07447 | 0.06926 | 0 |

| 2026 | 0.11825 | 0.08825 | 0.04942 | 18 |

| 2027 | 0.15074 | 0.10325 | 0.06814 | 38 |

| 2028 | 0.14478 | 0.127 | 0.08255 | 70 |

| 2029 | 0.1848 | 0.13589 | 0.10463 | 82 |

| 2030 | 0.18279 | 0.16035 | 0.11224 | 115 |

IV. SCARCITY Professional Investment Strategies and Risk Management

SCARCITY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate SCARCITY tokens during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend direction and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

SCARCITY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official SCARCITY wallet (if available)

- Security precautions: Use two-factor authentication, keep private keys offline, and regularly update wallet software

V. SCARCITY Potential Risks and Challenges

SCARCITY Market Risks

- High volatility: SCARCITY's price may experience significant fluctuations

- Limited adoption: Slow user growth could impact token value

- Competition: Other decentralized social media projects may gain market share

SCARCITY Regulatory Risks

- Uncertain regulations: Changing cryptocurrency regulations could affect SCARCITY's operations

- Content moderation: Challenges in moderating decentralized content may attract regulatory scrutiny

- Privacy concerns: Data protection regulations may impact SCARCITY's operational model

SCARCITY Technical Risks

- Smart contract vulnerabilities: Potential bugs in the underlying code could lead to security breaches

- Scalability issues: The platform may face challenges in handling increased user activity

- Network congestion: High transaction volumes could result in slower processing times and higher fees

VI. Conclusion and Action Recommendations

SCARCITY Investment Value Assessment

SCARCITY presents a novel approach to decentralized social media with long-term potential. However, it faces significant short-term risks due to market volatility, regulatory uncertainty, and technical challenges.

SCARCITY Investment Recommendations

✅ Beginners: Consider a small allocation (1-2%) as part of a diversified crypto portfolio

✅ Experienced investors: Implement a dollar-cost averaging strategy with a 3-5% allocation

✅ Institutional investors: Conduct thorough due diligence and consider a 5-10% allocation in a crypto-focused fund

SCARCITY Trading Participation Methods

- Spot trading: Buy and sell SCARCITY tokens on Gate.com

- Staking: Participate in staking programs if offered by the SCARCITY platform

- Liquidity provision: Contribute to liquidity pools on decentralized exchanges (if available)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would hamster kombat coin reach $1?

It's possible for Hamster Kombat to reach $1, given its growing popularity and play-to-earn model. Like other meme coins, it could see significant price growth, but market conditions will ultimately determine its future value.

Does scarcity lead to higher prices?

Yes, scarcity often leads to higher prices. When a resource or asset is limited in supply, demand typically increases, driving up its value and price in the market.

What is the Powerledger price prediction for 2030?

Based on current market trends and expert analysis, the Powerledger price prediction for 2030 is estimated to be between $0.1224 and $0.1248.

Which coin will reach 1 rupee prediction?

PEPE is not expected to reach 1 rupee soon. Current predictions suggest it will stay below this value, based on market trends and expert analysis.

Share

Content