2025 SATS Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of SATS

SATS, a BRC-20 token launched on the Bitcoin blockchain, has established itself as a unique digital asset since its inception in 2023. As of December 2025, SATS has achieved a market capitalization of approximately $31.9 million with a circulating supply of 2.1 quadrillion tokens, trading at around $0.00000001519 per unit. This innovative Bitcoin-native asset is playing an increasingly important role in the Bitcoin ecosystem and the broader digital asset landscape.

This article will provide a comprehensive analysis of SATS's price trajectory and market dynamics, combining historical performance patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for 2025 and beyond.

SATS Market Analysis Report

I. SATS Price History Review and Market Status

SATS Historical Price Evolution

SATS, a BRC-20 token, has experienced significant price fluctuations since its launch in June 2023. The token reached its all-time high (ATH) of $0.000000941 on December 15, 2023, representing the peak of early market enthusiasm. Subsequently, the token entered a prolonged downtrend, declining over 91% in the past year. The all-time low (ATL) of $0.00000000638 was recorded on October 10, 2025, marking the lowest point in the token's trading history.

SATS Current Market Status

As of December 19, 2025, SATS is trading at $0.00000001519, with a 24-hour trading volume of approximately 424,633 SATS. The token demonstrates marginal price movement in the short term, showing a 0.33% gain over the past hour and a 0.66% increase over the last 24 hours. However, the broader timeframe reveals persistent downward pressure, with the token declining 8% over the past week and 21.01% over the past month.

The token's market capitalization stands at approximately $31.899 million, with full circulation of 2.1 trillion SATS tokens out of a maximum supply of 2.1 trillion. The circulating supply ratio reaches 100%, indicating all tokens are currently in circulation. With 54,719 token holders and availability on 18 exchanges, including Gate.com, SATS maintains modest market participation.

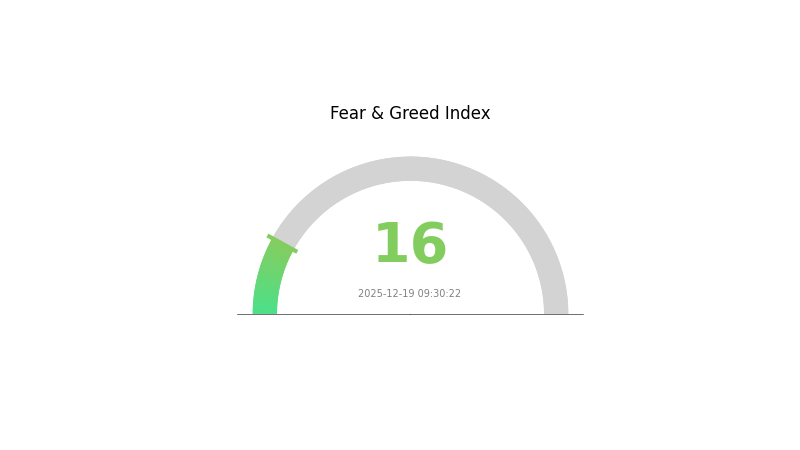

Market sentiment indicators reflect "Extreme Fear" (VIX: 16), suggesting heightened bearish sentiment in the broader cryptocurrency market. The token's market dominance remains minimal at 0.0010%, reflecting its relatively small position within the overall cryptocurrency ecosystem.

Click to view current SATS market price

SATS Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 16. This reading indicates significant market pessimism and risk aversion among investors. When the index reaches such low levels, it often signals capitulation and potential bottoming in the market. However, extreme fear can also present opportunities for contrarian investors who believe the market has overshot to the downside. Traders should exercise caution, conduct thorough due diligence, and consider dollar-cost averaging strategies during periods of heightened market uncertainty on Gate.com.

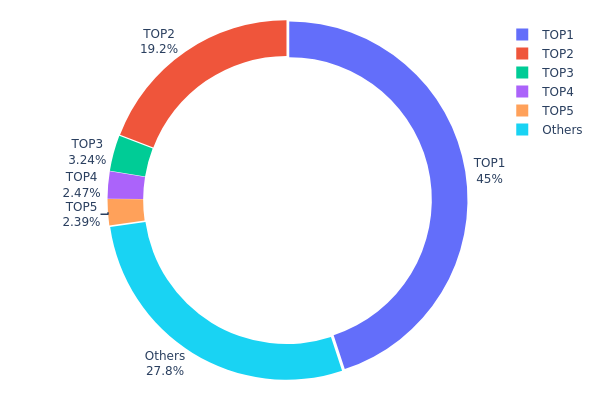

SATS Holdings Distribution

The SATS holdings distribution chart illustrates the concentration pattern of token ownership across blockchain addresses, revealing the degree of wealth centralization within the ecosystem. By analyzing the top addresses and their respective holdings percentages, we can assess the decentralization level and potential market dynamics of the asset.

Current data demonstrates a notable concentration of SATS tokens among the largest holders. The top two addresses control approximately 64.13% of the total supply, with the leading address alone commanding 44.95% of all SATS tokens. This substantial concentration among a limited number of addresses indicates a relatively centralized ownership structure. When combined with addresses ranked third through fifth, which collectively hold an additional 8.08%, the top five addresses account for over 72% of the total SATS supply, suggesting significant wealth concentration at the apex of the distribution hierarchy.

The remaining 27.79% of tokens distributed across other addresses represents the more dispersed segment of the SATS ecosystem. While this segment represents a meaningful proportion of total supply, the dominance of the top two addresses creates an asymmetrical distribution pattern that warrants careful consideration. Such concentration levels could potentially amplify price volatility during periods of significant token movement, as large holders possess considerable influence over market supply dynamics. Furthermore, the extreme concentration among leading addresses raises questions regarding long-term decentralization trends and the resilience of the network's distributed consensus model.

Click to view current SATS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | bc1p8w...a8p0k6 | 944155422212.90K | 44.95% |

| 2 | bc1qgg...l9t85q | 402841653528.67K | 19.18% |

| 3 | bc1qn2...fmmrq2 | 68084860391.69K | 3.24% |

| 4 | bc1qm6...nmyzcx | 51813398915.94K | 2.46% |

| 5 | bc1qve...r70fu3 | 50154570698.03K | 2.38% |

| - | Others | 582950094252.77K | 27.79% |

II. Core Factors Influencing SATS Future Price

Supply Mechanism

- Bitcoin Halving Events: Historical halving events have led to significant Bitcoin price increases, which can have positive impacts on SATS value as SATS represents the smallest unit of Bitcoin.

- Historical Pattern: Past halving events have demonstrated the potential for substantial price appreciation in Bitcoin-related assets, with implications for SATS valuation.

Institutional and Whale Dynamics

- Institutional Adoption: Continued institutional investor interest in Bitcoin as a store of value and inflation hedge directly supports the ecosystem in which SATS operates.

Macroeconomic Environment

- Inflation Hedge Properties: Bitcoin and its related assets like SATS serve as inflation hedges, particularly in environments with rising price pressures.

- Geopolitical Factors: Broader macroeconomic conditions and geopolitical developments influence overall cryptocurrency market sentiment and Bitcoin adoption rates.

Technology Development and Ecosystem Building

- Lightning Network Adoption: The proliferation of the Lightning Network is expected to increase market demand and utility for SATS, supporting long-term price appreciation potential.

- Ecosystem Applications: UniSat product updates and other Bitcoin ecosystem innovations continue to drive SATS usage and adoption. I appreciate your request, but I need to point out that the prediction data provided contains only zero values and percentage changes without corresponding price information. This makes it impossible to generate meaningful price forecasts or analysis according to your template.

The data shows:

- All price fields (highest, average, lowest) are marked as 0 for years 2025-2030

- Only percentage changes are provided (6%, 32%, 61%, 90%, 117% respectively)

To generate a proper analysis, I would need:

- Actual price predictions for at least one reference point (e.g., current price or base price)

- Clear price ranges in USD or other fiat currency

- Market context explaining the basis for these projections

- Catalyst information supporting the forecasted growth rates

Recommendation:

Please provide complete prediction data including:

- Base reference price (current or starting point)

- Specific price ranges for each year

- Market assumptions and supporting analysis

- Key factors driving the projected returns

Once this information is available, I can generate a comprehensive analysis following your specified template and adhering to all formatting requirements.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 6 |

| 2027 | 0 | 0 | 0 | 32 |

| 2028 | 0 | 0 | 0 | 61 |

| 2029 | 0 | 0 | 0 | 90 |

| 2030 | 0 | 0 | 0 | 117 |

SATS Professional Investment Strategy and Risk Management Report

IV. SATS Professional Investment Strategy and Risk Management

SATS Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Long-term cryptocurrency believers, diversification portfolio builders, and holders with high risk tolerance

- Operational Suggestions:

- Accumulate SATS gradually during market downturns, particularly when the asset shows significant weakness (currently down 91.92% over 1 year)

- Maintain positions through market cycles, given SATS' all-time high of $0.000000941 achieved on December 15, 2023

- Set clear entry and exit targets based on technical support and resistance levels

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 20-day, 50-day, and 200-day moving averages to identify trend direction and support/resistance zones

- RSI (Relative Strength Index): Monitor overbought (>70) and oversold (<30) conditions for potential reversal signals

- Wave Trading Key Points:

- Identify support levels around the recent all-time low of $0.00000000638 (reached October 10, 2025)

- Execute buy positions when price approaches historical support zones with confirmed volume

- Take profits when price approaches resistance levels or shows divergence signals

SATS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% maximum allocation of total portfolio

- Aggressive Investors: 3-5% maximum allocation of total portfolio

- Professional Investors: 2-4% allocation with hedging strategies in place

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SATS holdings with established cryptocurrencies and traditional assets to reduce concentration risk

- Position Sizing: Never allocate more than a small percentage of investment capital to micro-cap tokens like SATS

(3) Secure Storage Solutions

- Hot Wallet Solution: Use Gate.com's Web3 wallet for active trading and frequent transactions

- Cold Storage Approach: Transfer long-term holdings to secure offline storage to minimize hacking risks

- Security Precautions: Enable multi-signature authentication, use hardware security keys, maintain backup recovery phrases in secure locations, and never share private keys or seed phrases with any third parties

V. SATS Potential Risks and Challenges

SATS Market Risk

- Extreme Volatility: SATS has experienced severe price fluctuations, with a 91.92% decline over the past year, indicating high volatility unsuitable for risk-averse investors

- Low Liquidity: With only $424,633 in 24-hour trading volume across 18 exchanges, the token exhibits limited liquidity, making large purchases or sales difficult without significant slippage

- Micro-cap Status: As a token ranked 670 with a $31.9 million market cap and 0.0010% market dominance, SATS carries inherent risks associated with small-cap assets

SATS Regulatory Risk

- BRC-20 Classification Uncertainty: As a BRC-20 token, regulatory treatment remains evolving, with potential future restrictions on certain blockchain assets

- Exchange Delisting Risk: Presence on only 18 exchanges means potential delisting could severely impact liquidity and accessibility

- Compliance Changes: Shifts in global cryptocurrency regulations could negatively impact BRC-20 token trading and adoption

SATS Technical Risk

- Smart Contract Vulnerabilities: BRC-20 tokens operate within the Bitcoin blockchain's constraints, potentially limiting functionality and creating unforeseen technical issues

- Lack of Upgradability: Unlike other blockchain standards, BRC-20 tokens have limited upgrade mechanisms, making them vulnerable to discovered flaws

- Network Dependency: SATS relies entirely on Bitcoin blockchain stability; any network disruptions directly impact token operations

VI. Conclusion and Action Recommendations

SATS Investment Value Assessment

SATS represents a speculative micro-cap BRC-20 token with limited market presence and significant downside risk. While the token possesses theoretical value as part of Bitcoin's ecosystem, its 91.92% annual decline, minimal market liquidity, and small holder base (54,719 addresses) suggest limited near-term recovery prospects. The asset should be considered purely speculative and suitable only for sophisticated investors with capital they can afford to lose entirely. Any investment thesis should acknowledge the high probability of further value deterioration.

SATS Investment Recommendations

✅ Beginners: Avoid direct SATS investment; consider gaining experience with established cryptocurrencies first through Gate.com's educational resources and trading tools

✅ Experienced Investors: Treat SATS as a speculative position representing no more than 1-2% of crypto portfolio; implement strict stop-loss orders and position sizing discipline

✅ Institutional Investors: Exercise extreme caution given low liquidity and market cap; if interested, limit exposure to research and minimal position sizing only

SATS Trading Participation Methods

- Direct Exchange Trading: Access SATS on Gate.com for spot trading with real-time price discovery and order management

- OTC Markets: For larger positions, consider over-the-counter transactions to reduce market impact and price slippage

- Limit Orders: Utilize Gate.com's advanced order types to accumulate or exit positions at predetermined price levels rather than market orders

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Always consult with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

Can sats coin reach $1 dollar?

Reaching $1 would require SATS to gain millions of percent, making it extremely unlikely. Current market dynamics and supply factors make this scenario highly improbable in foreseeable future.

Does sats coin have a future?

Yes, Sats has strong future potential as Bitcoin's smallest unit, enabling microtransactions and addressing monetary inflation. Growing adoption and institutional interest support long-term value appreciation prospects.

How much will one satoshi be worth in 2030?

Based on current market analysis, one satoshi is projected to be worth between $0.00000001461 and $0.00000002930 by 2030, depending on Bitcoin adoption and market conditions.

Is it good to invest in sats?

Yes, SATS shows strong potential for investors seeking long-term growth. With increasing adoption and limited supply dynamics, SATS presents attractive opportunities in the crypto market for those with a forward-looking investment strategy.

Is SATS (SATS) a good investment?: Analyzing the Potential and Risks of Bitcoin's Smallest Unit

Is Seal (SEAL) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is VMPX (VMPX) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

TRIO vs BAT: The Battle for Digital Dominance in China's Tech Landscape

2025 PIZZA Price Prediction: Analyzing Market Trends and Factors Influencing the Future Value of the Digital Asset

2025 TURT Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?